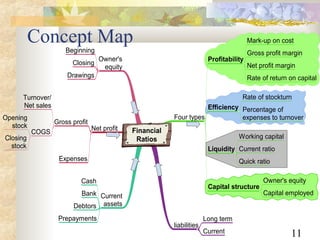

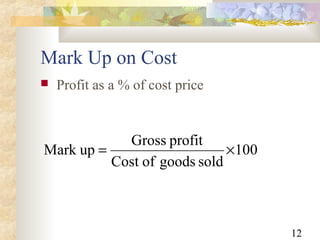

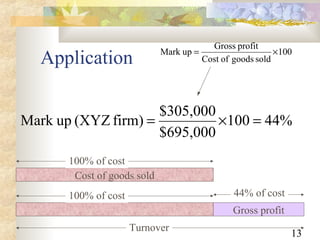

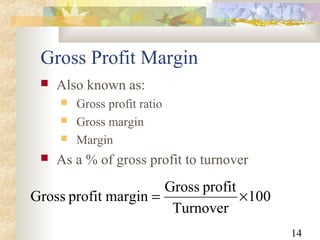

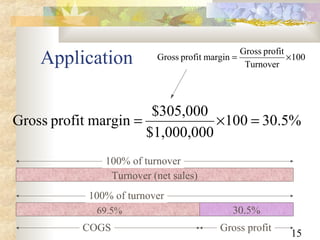

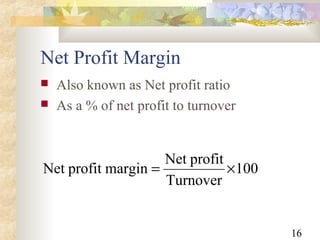

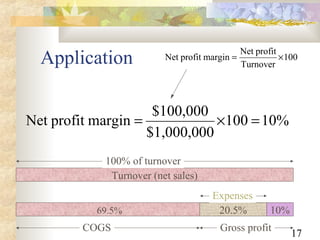

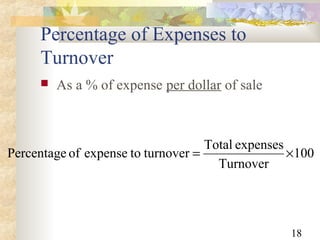

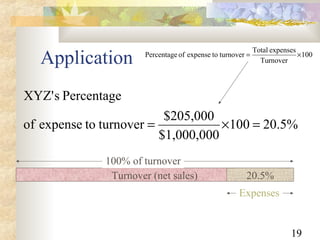

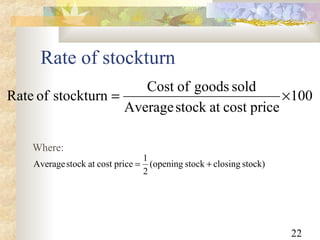

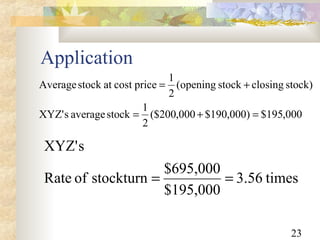

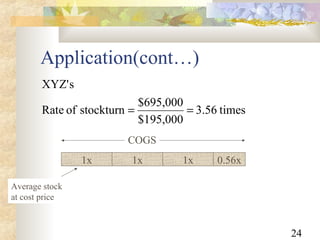

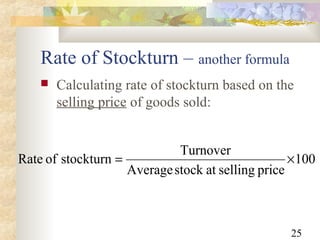

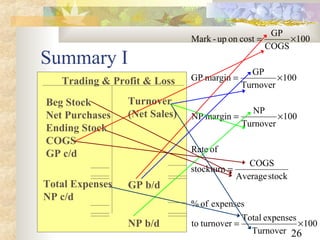

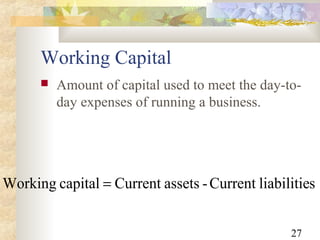

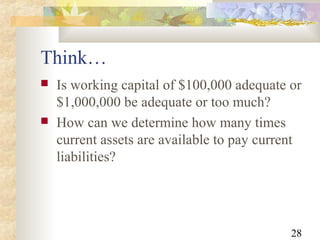

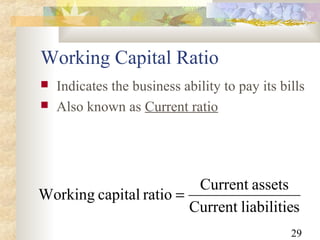

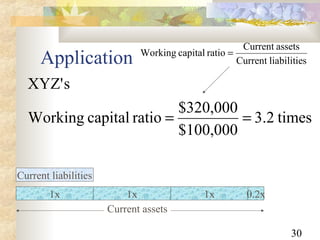

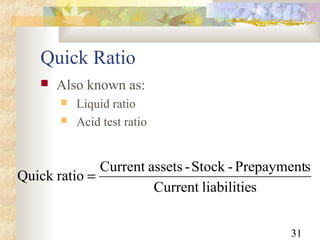

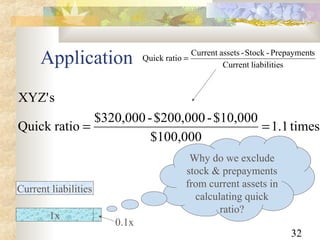

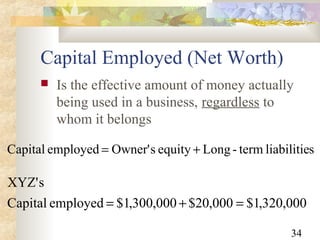

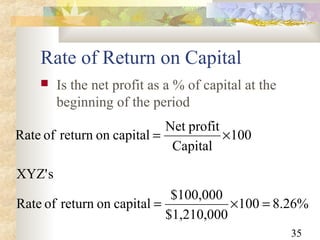

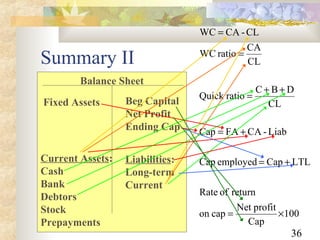

Semmi Chen, a retired singer, is considering investing $100,000 in company XYZ. She asks for help analyzing XYZ's financial statements to determine if it is a good investment. The assistant provides Semmi with an introduction to financial ratios that can be used to evaluate a company's profitability, efficiency, liquidity, and capital structure based on its financial statements. Key ratios discussed include gross profit margin, net profit margin, rate of stock turnover, current ratio, and return on capital. The assistant offers to calculate these ratios from XYZ's financials and make a recommendation about whether Semmi should invest.