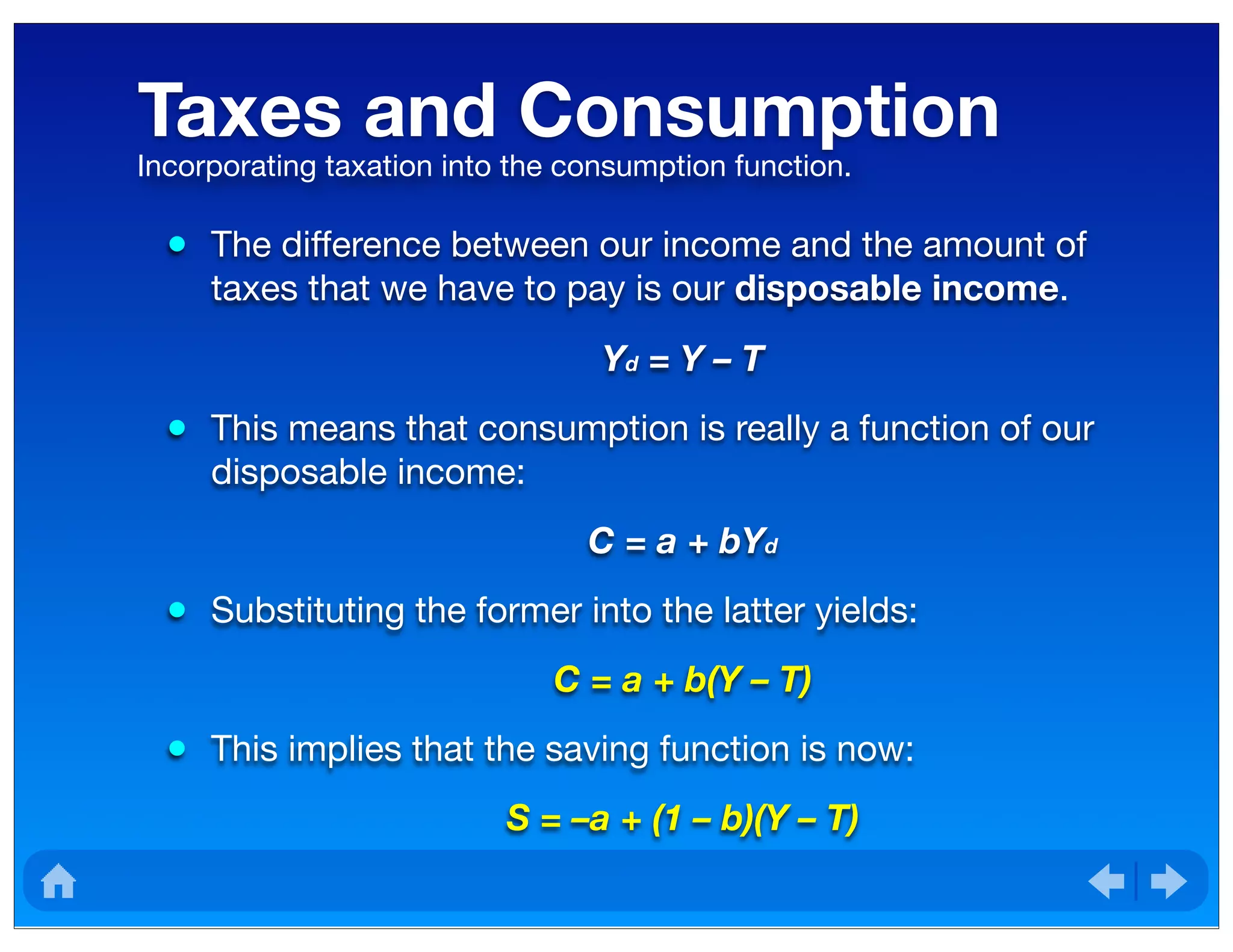

The document analyzes the role of government in the economy, focusing on fiscal policy, which entails taxation and government spending. It outlines how taxes influence disposable income and consumption, and how government spending impacts equilibrium output. Lastly, it discusses the effects of fiscal stimuli during economic downturns and overheating, and examines balanced budget spending.