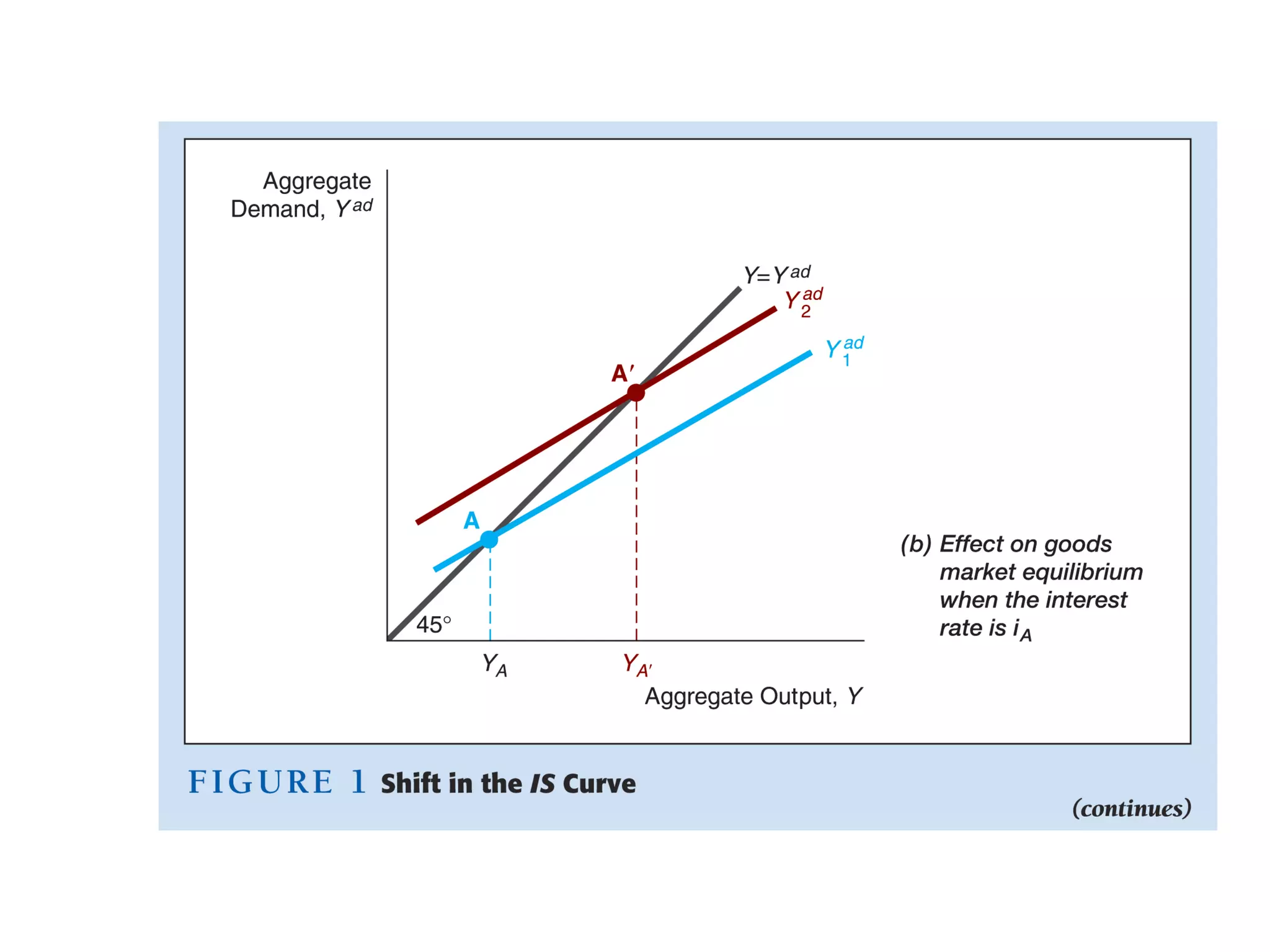

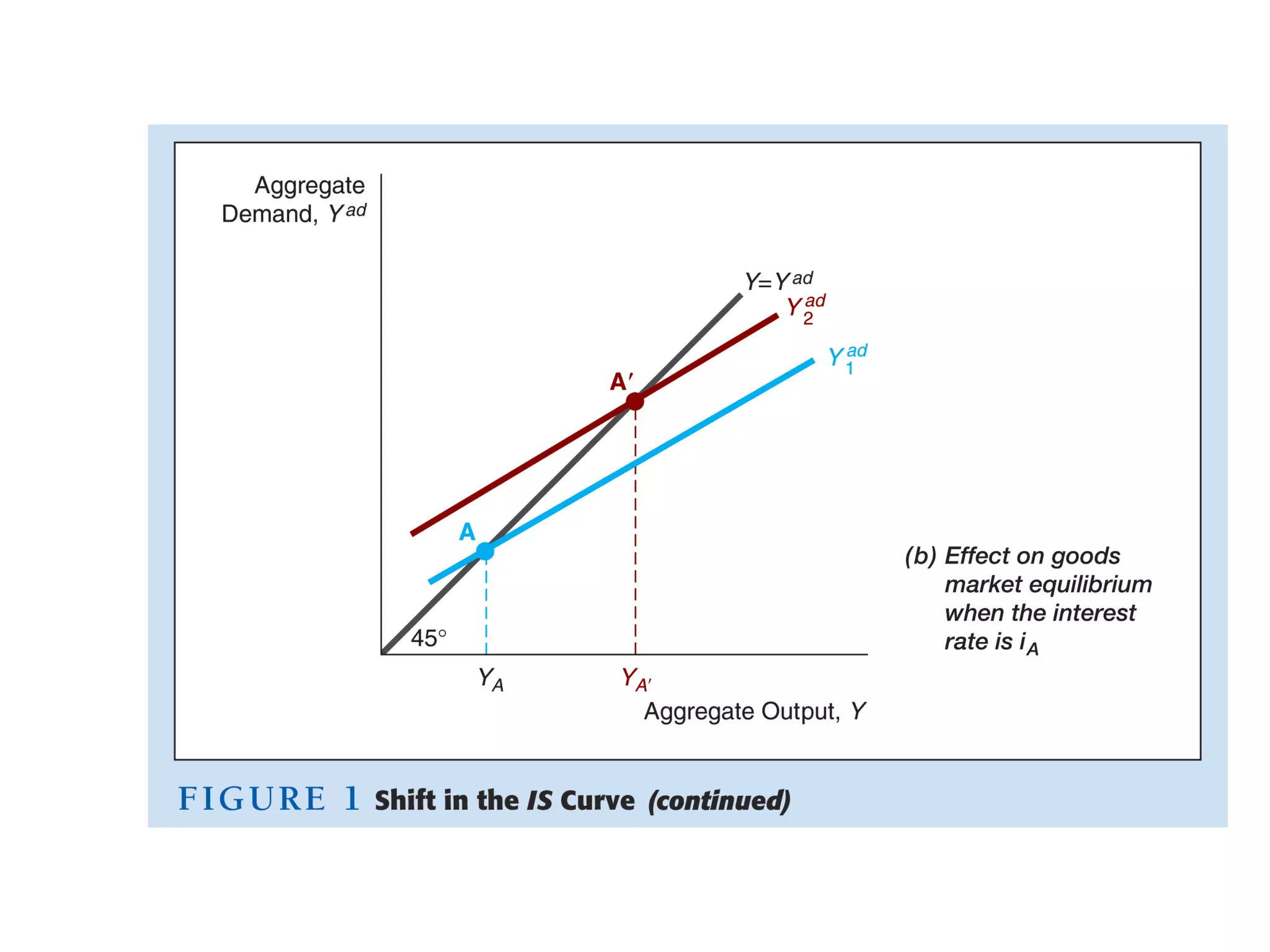

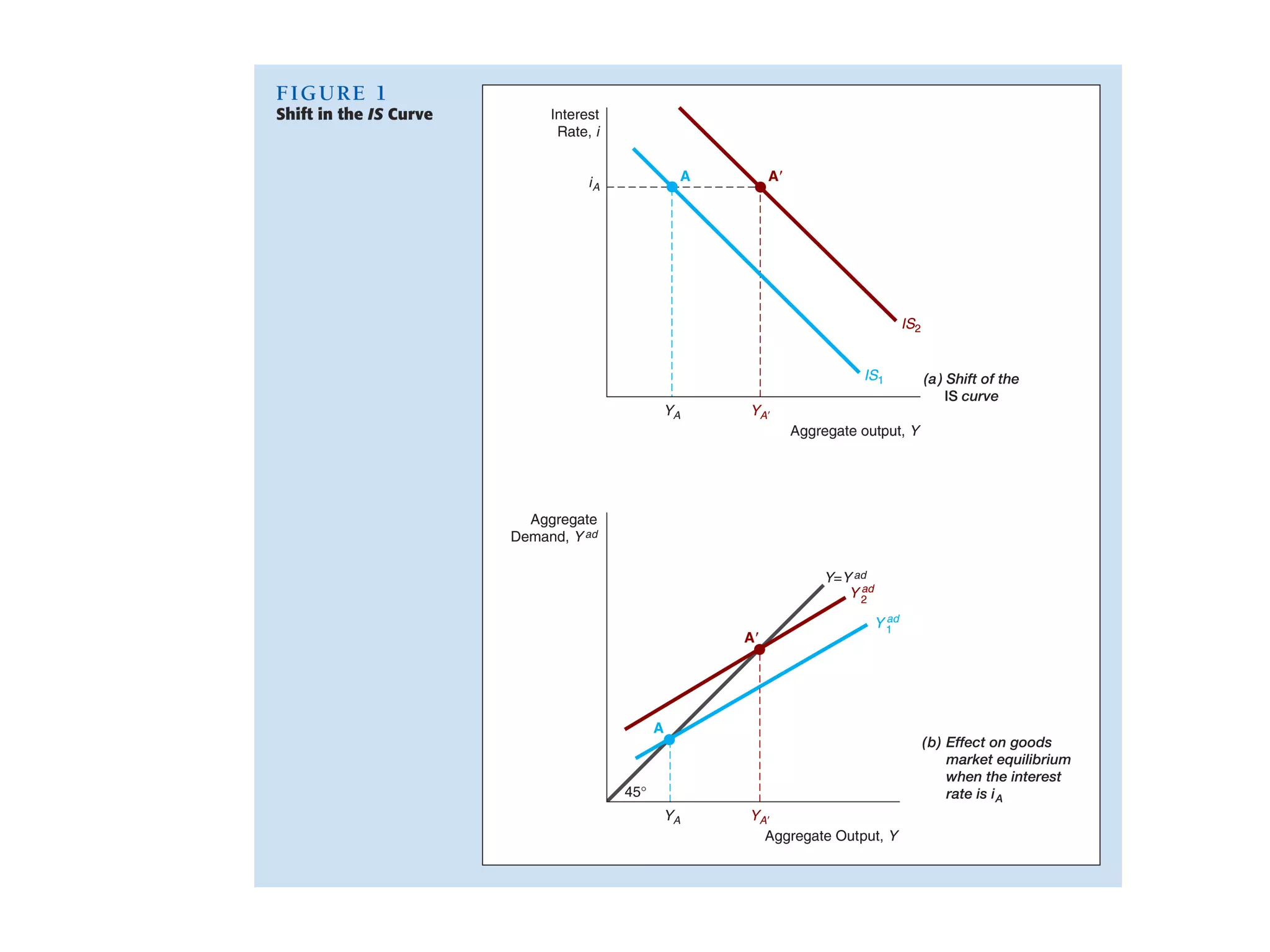

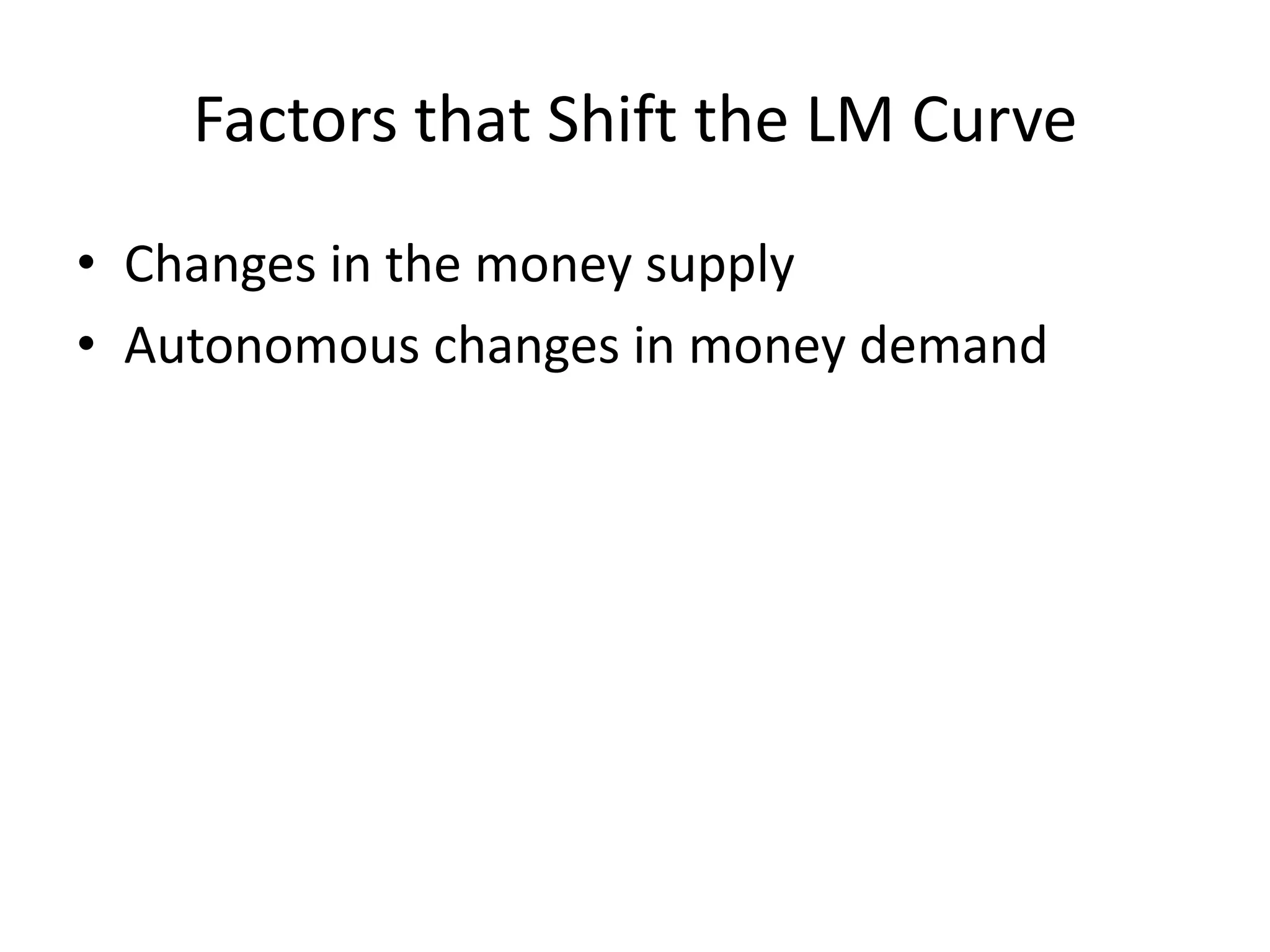

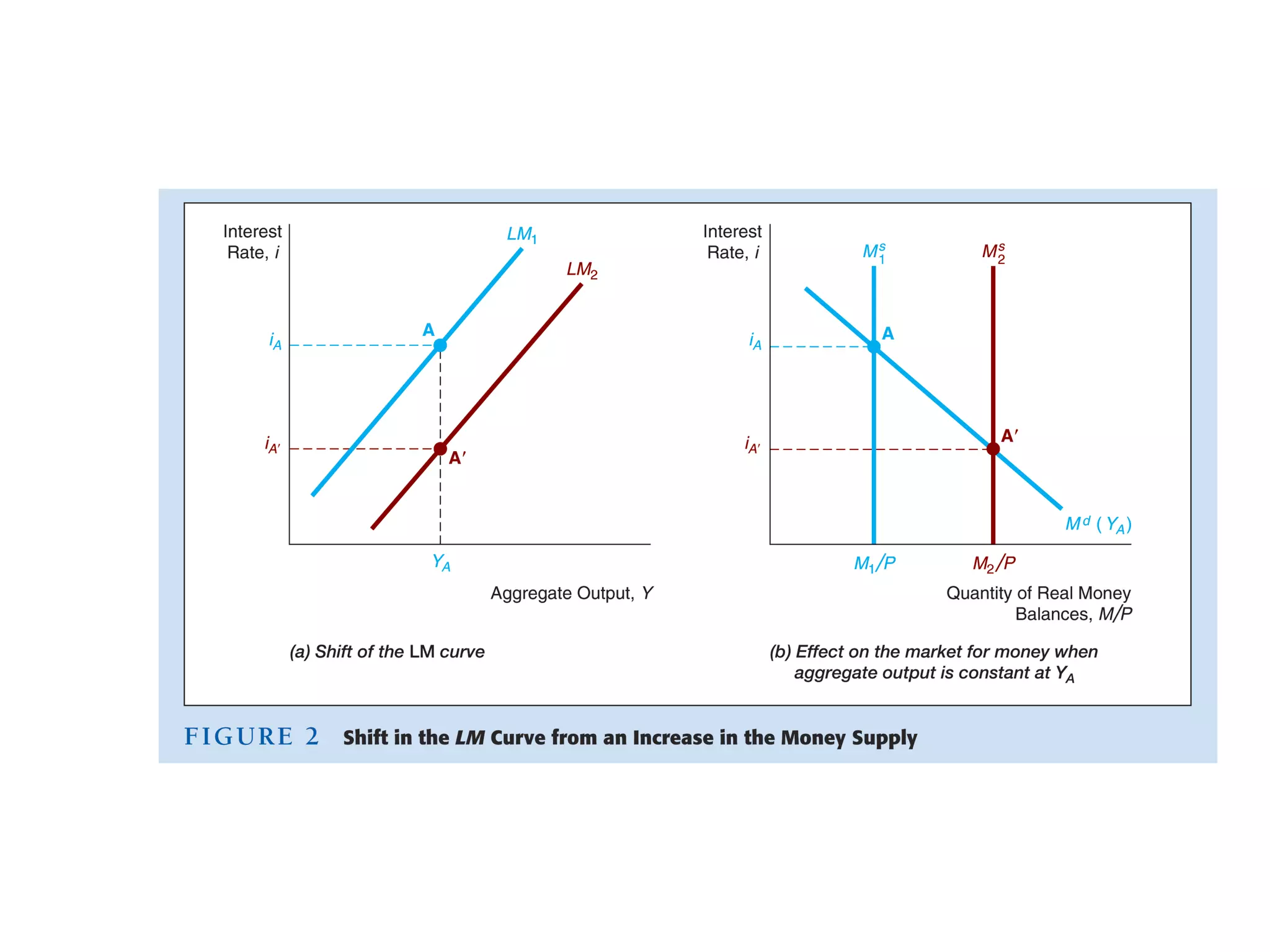

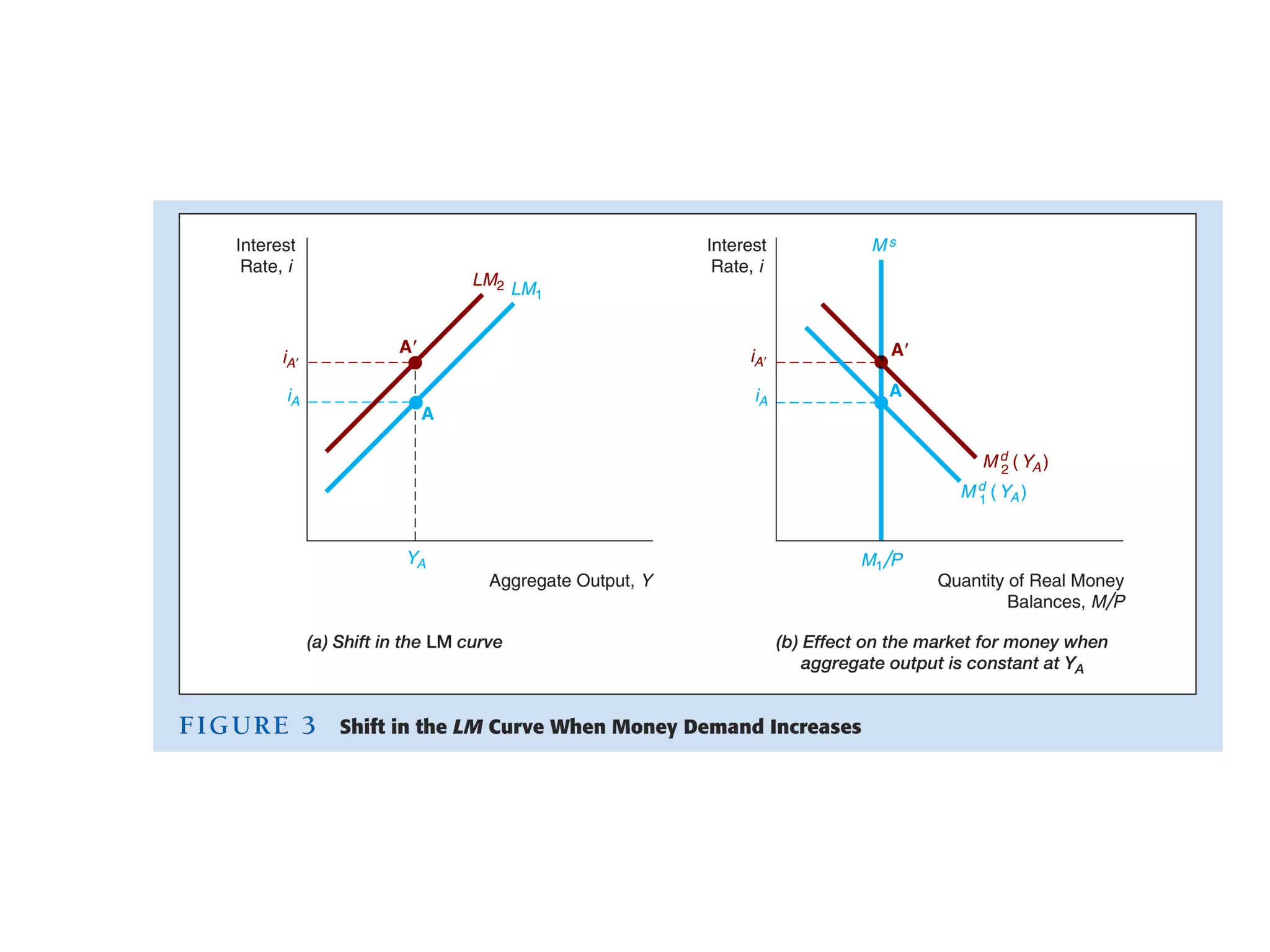

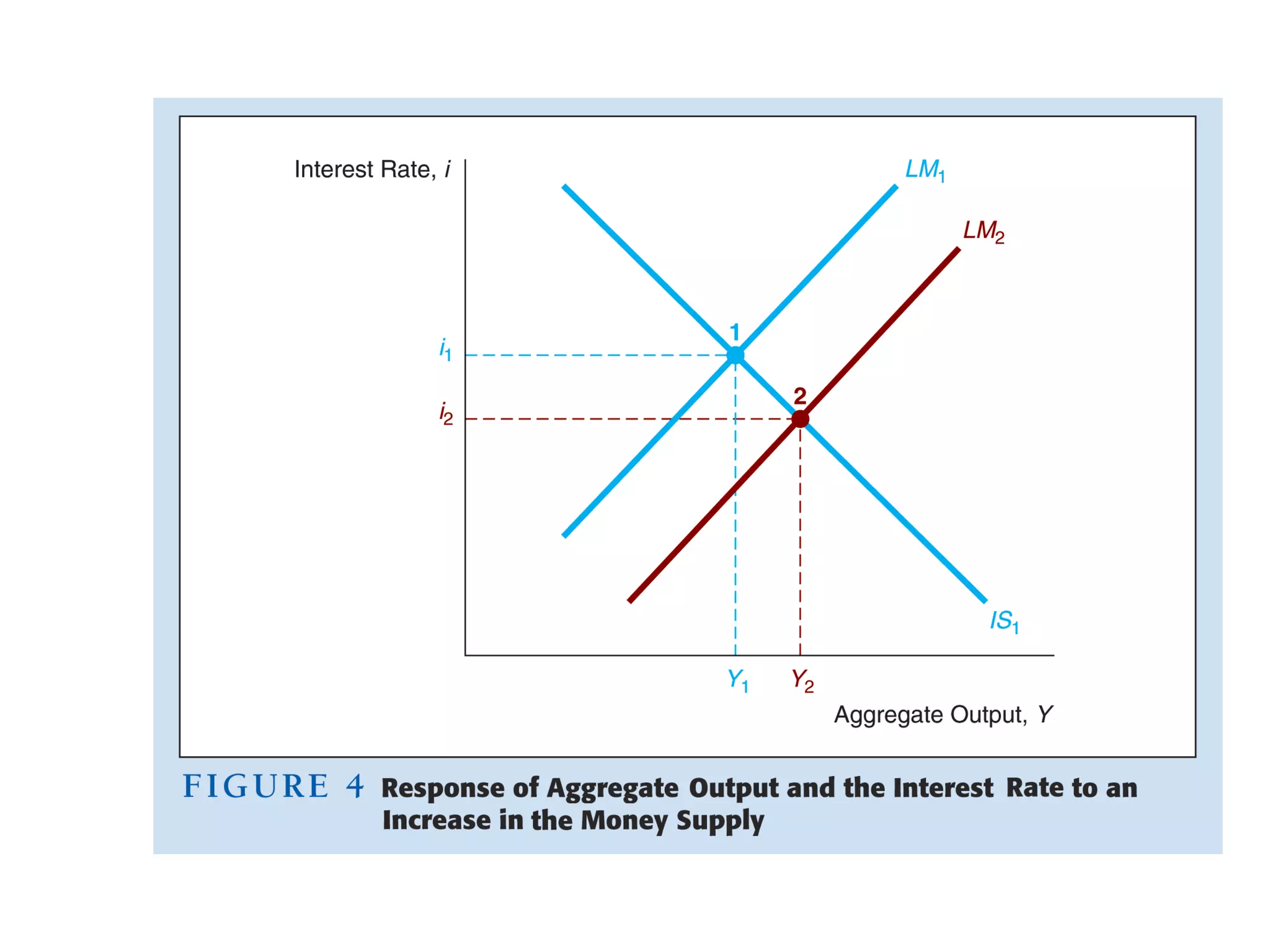

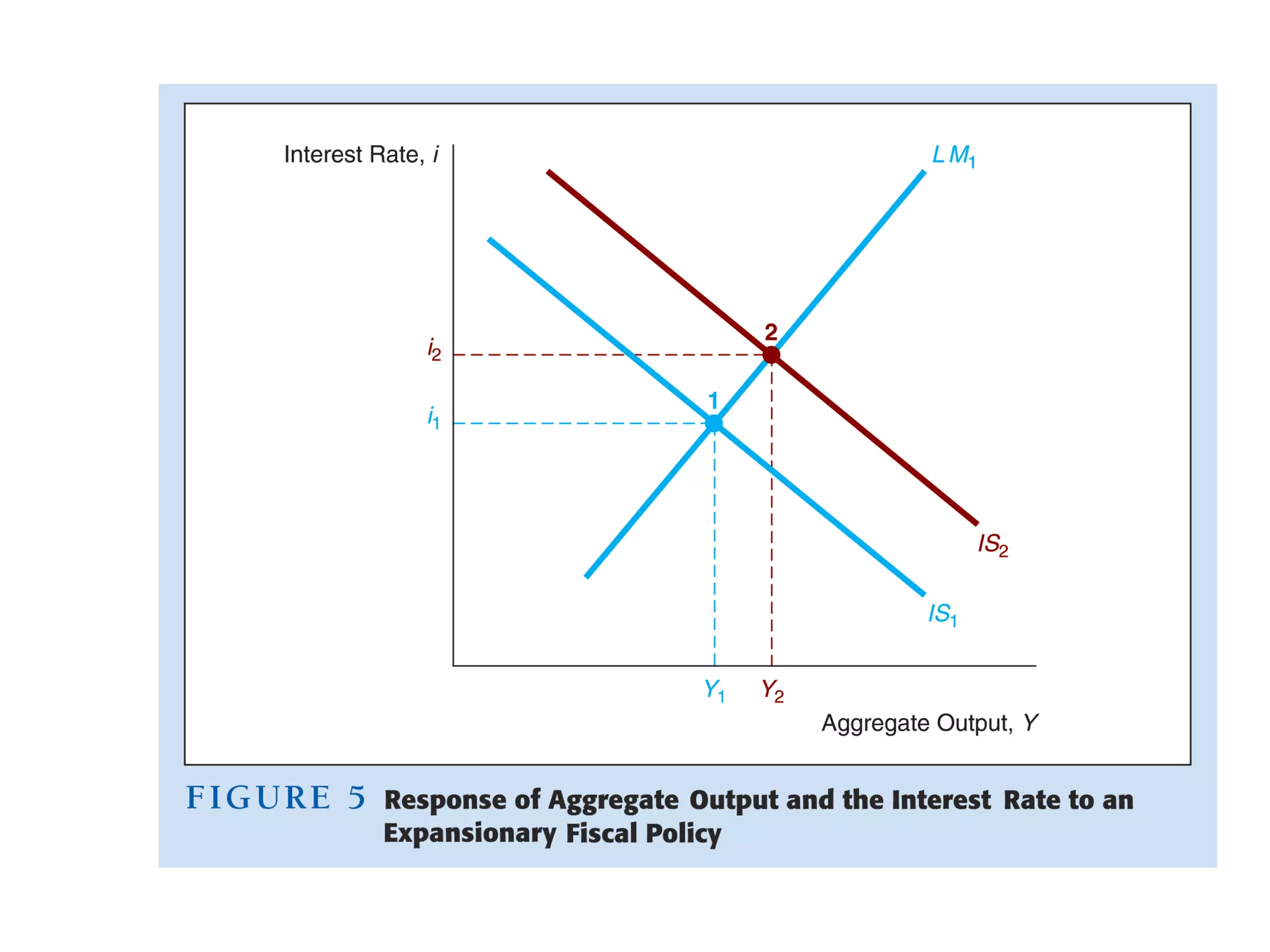

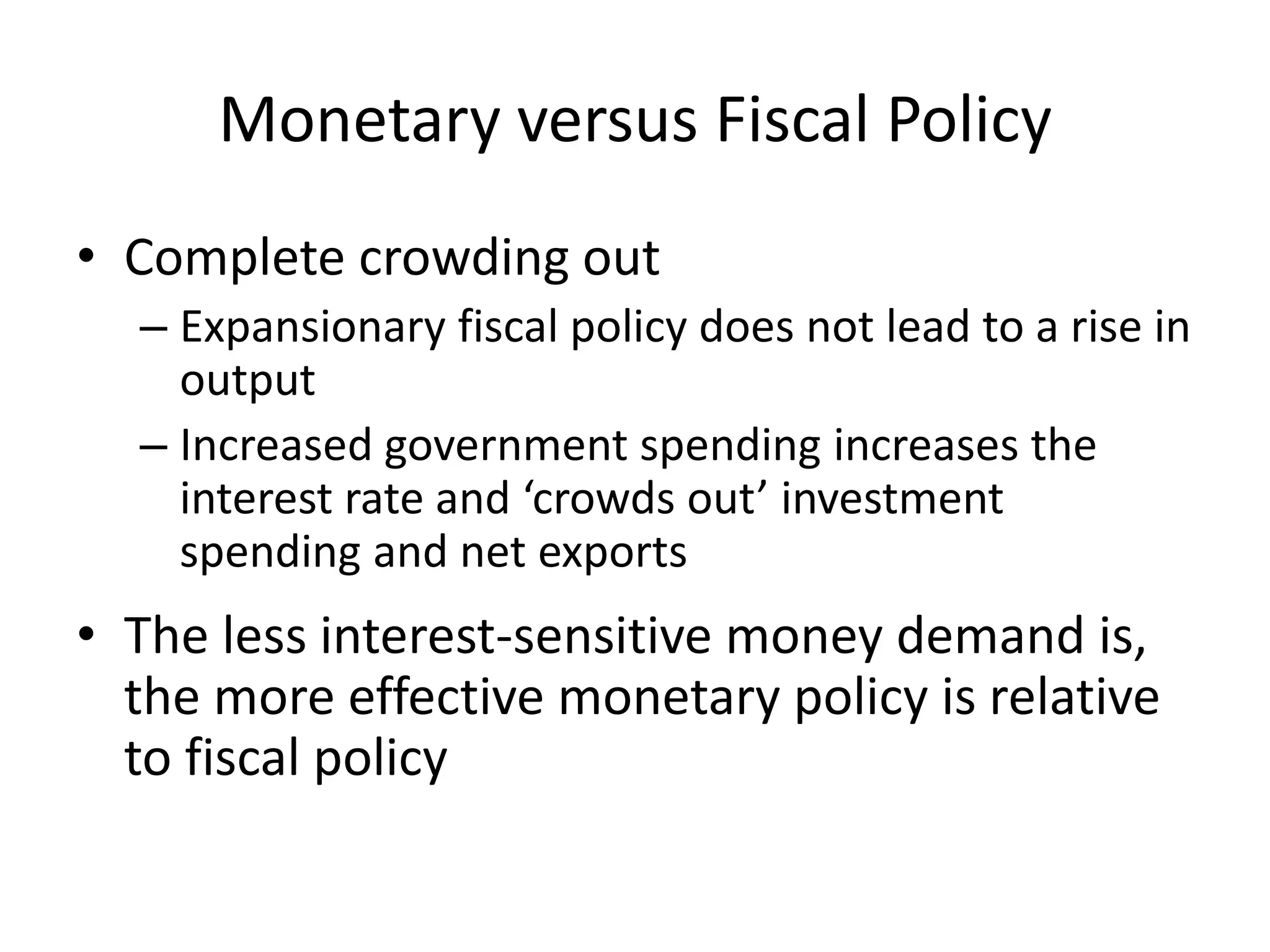

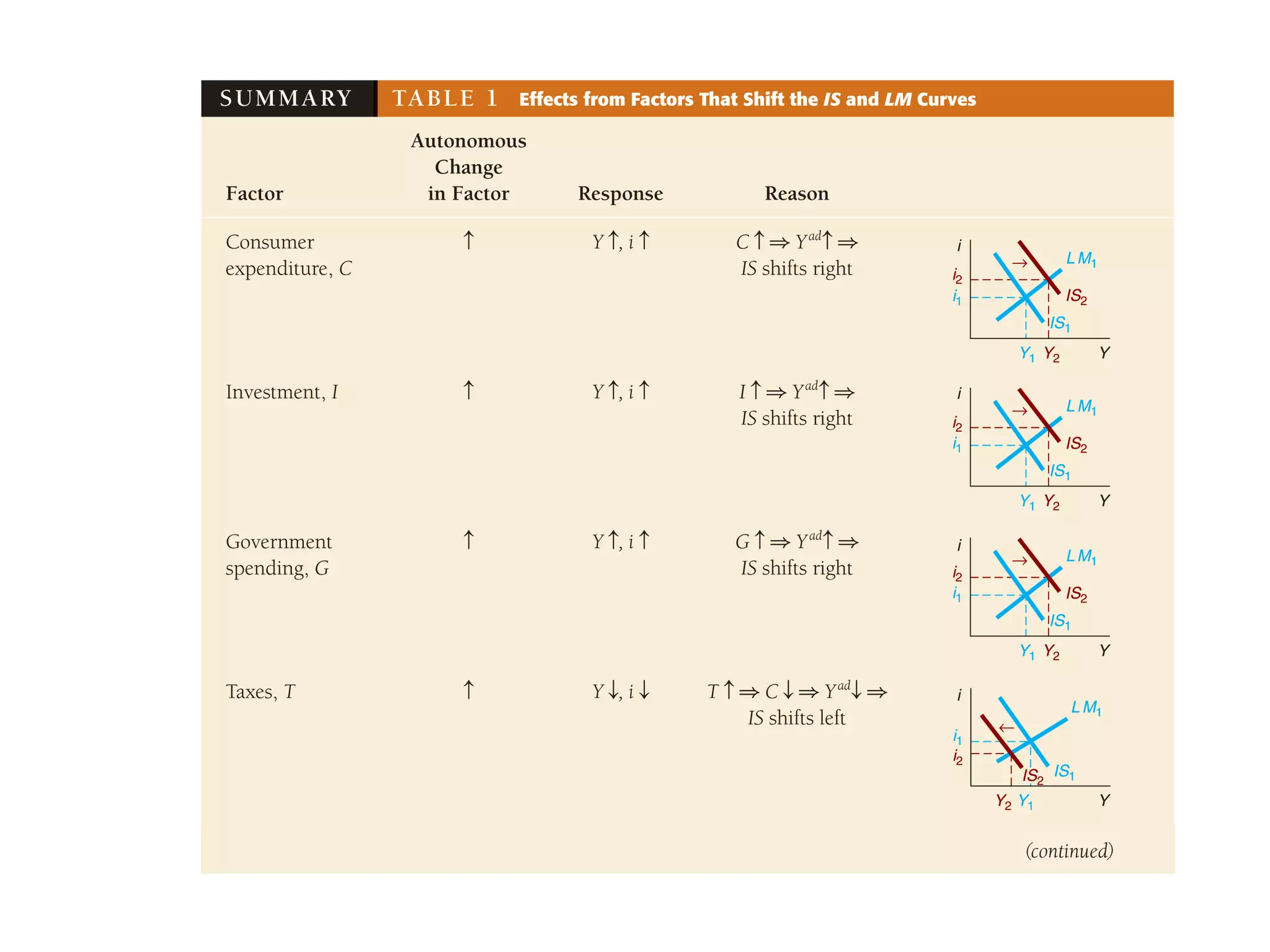

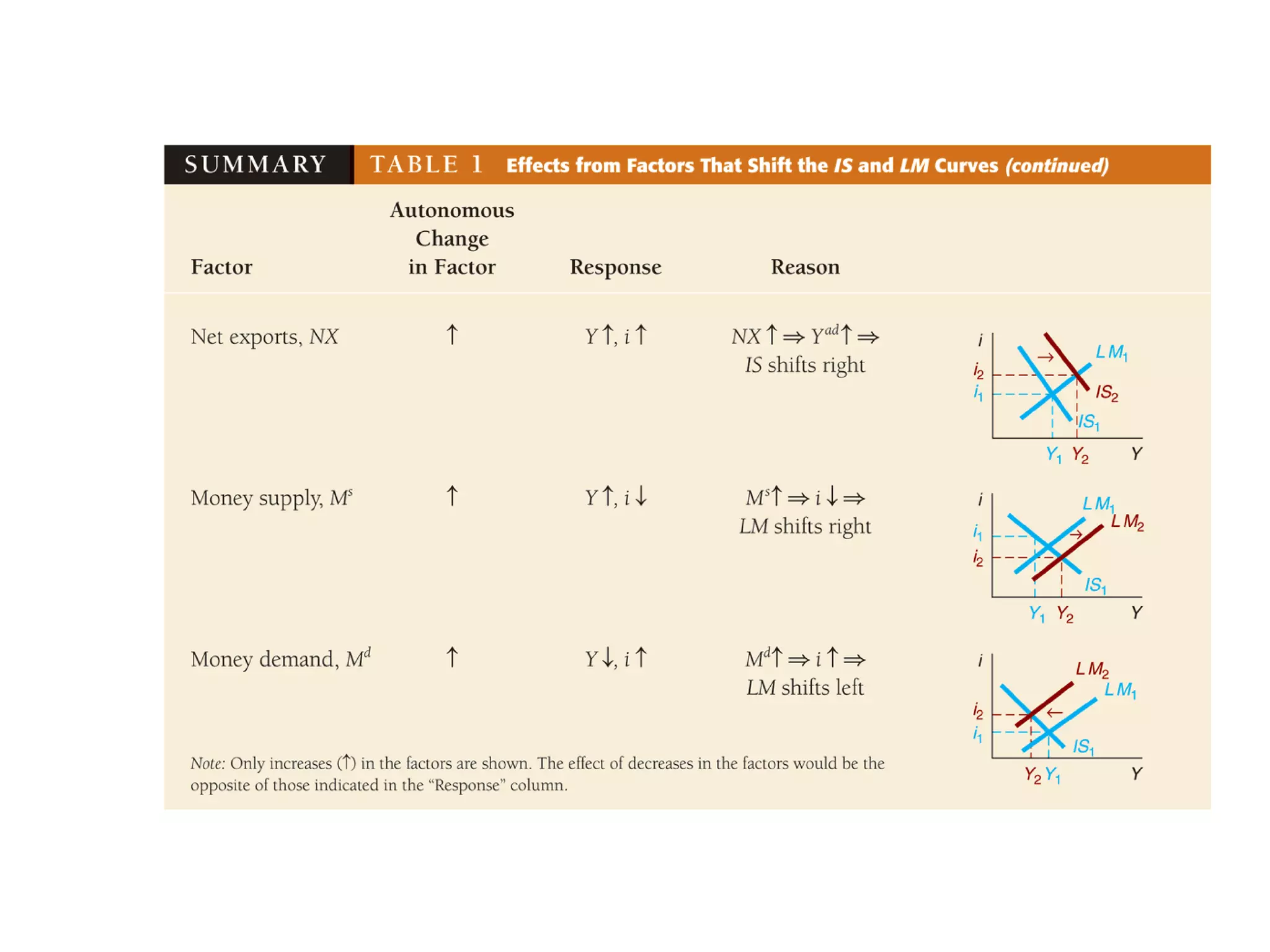

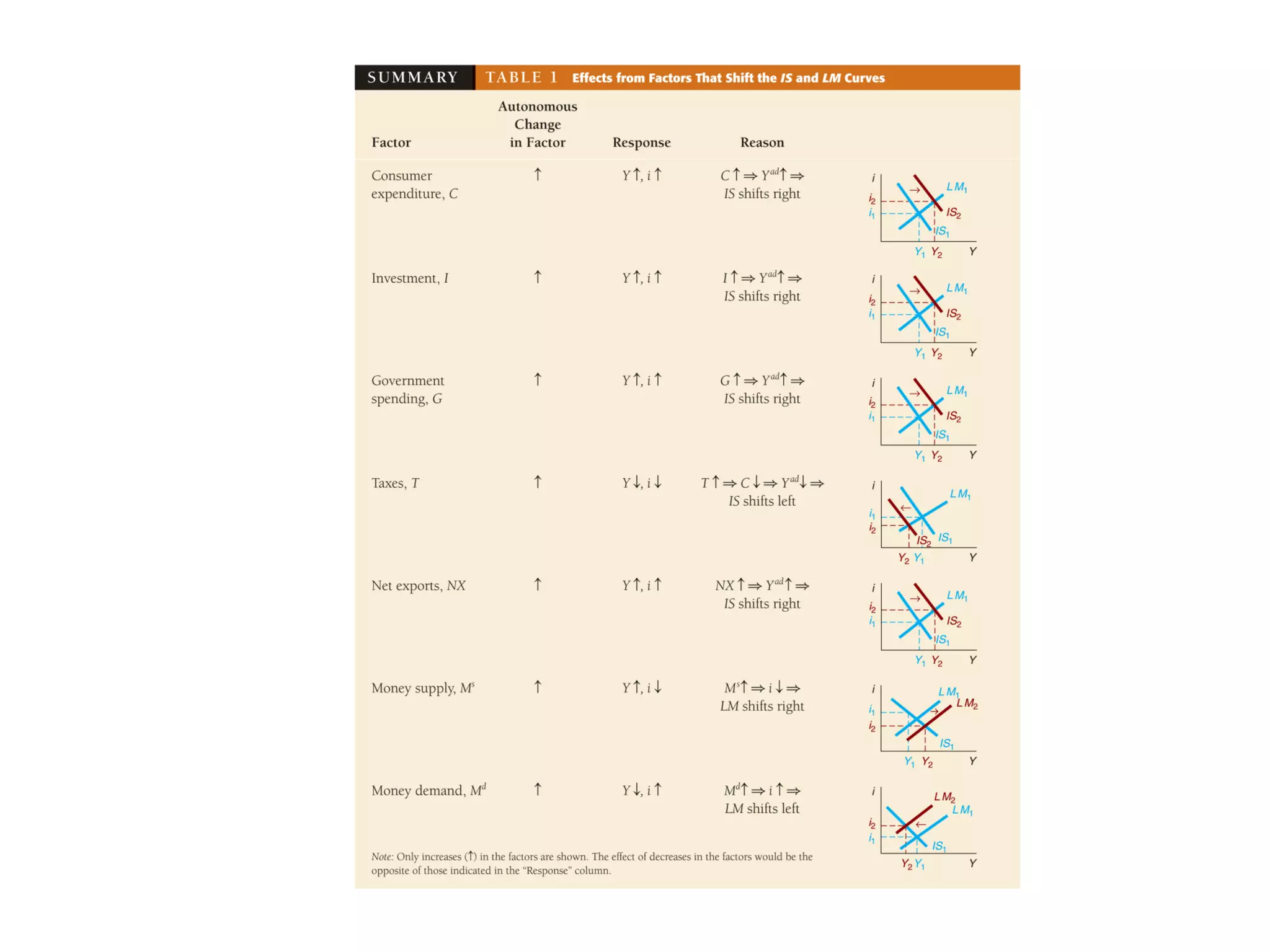

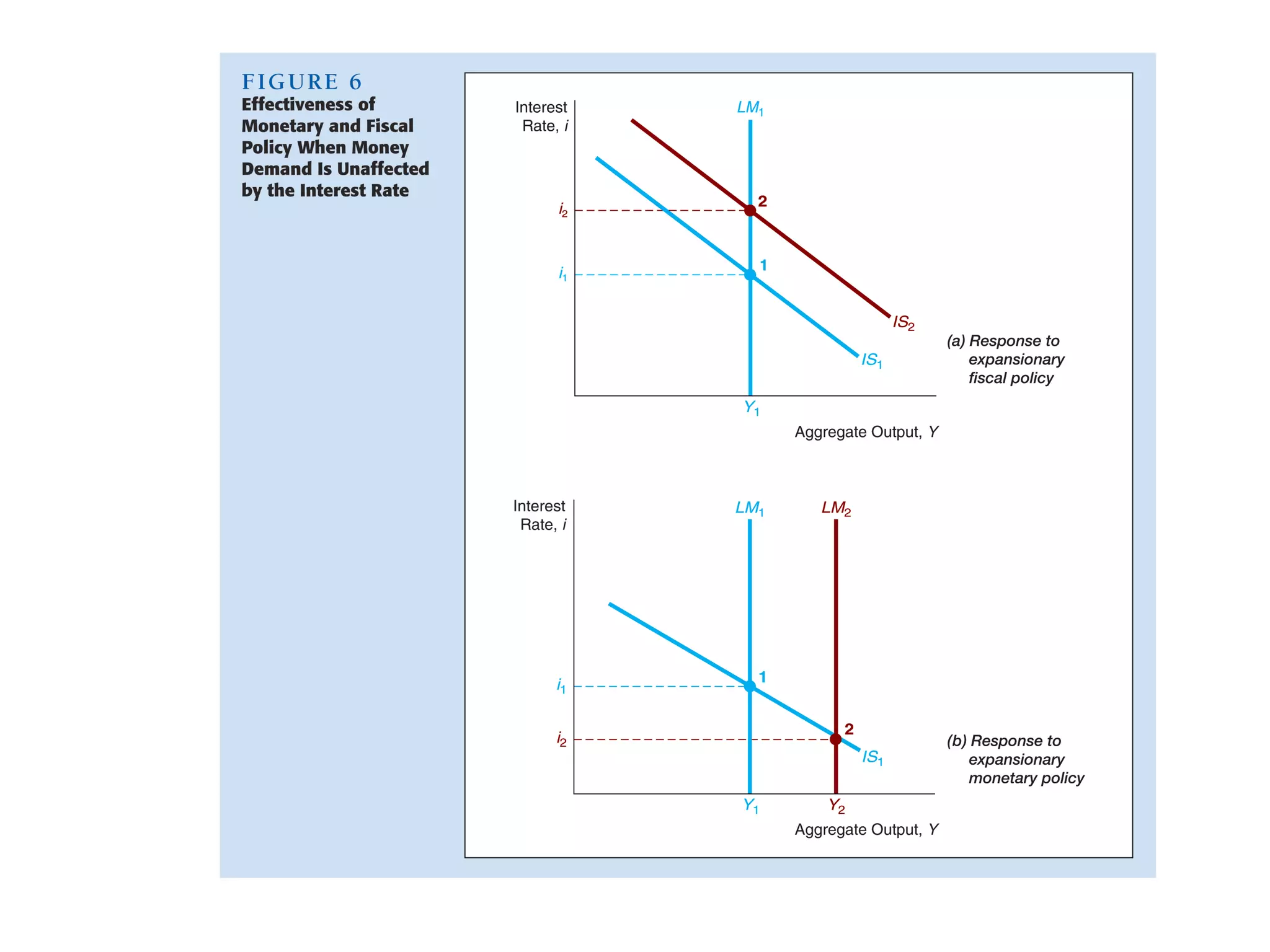

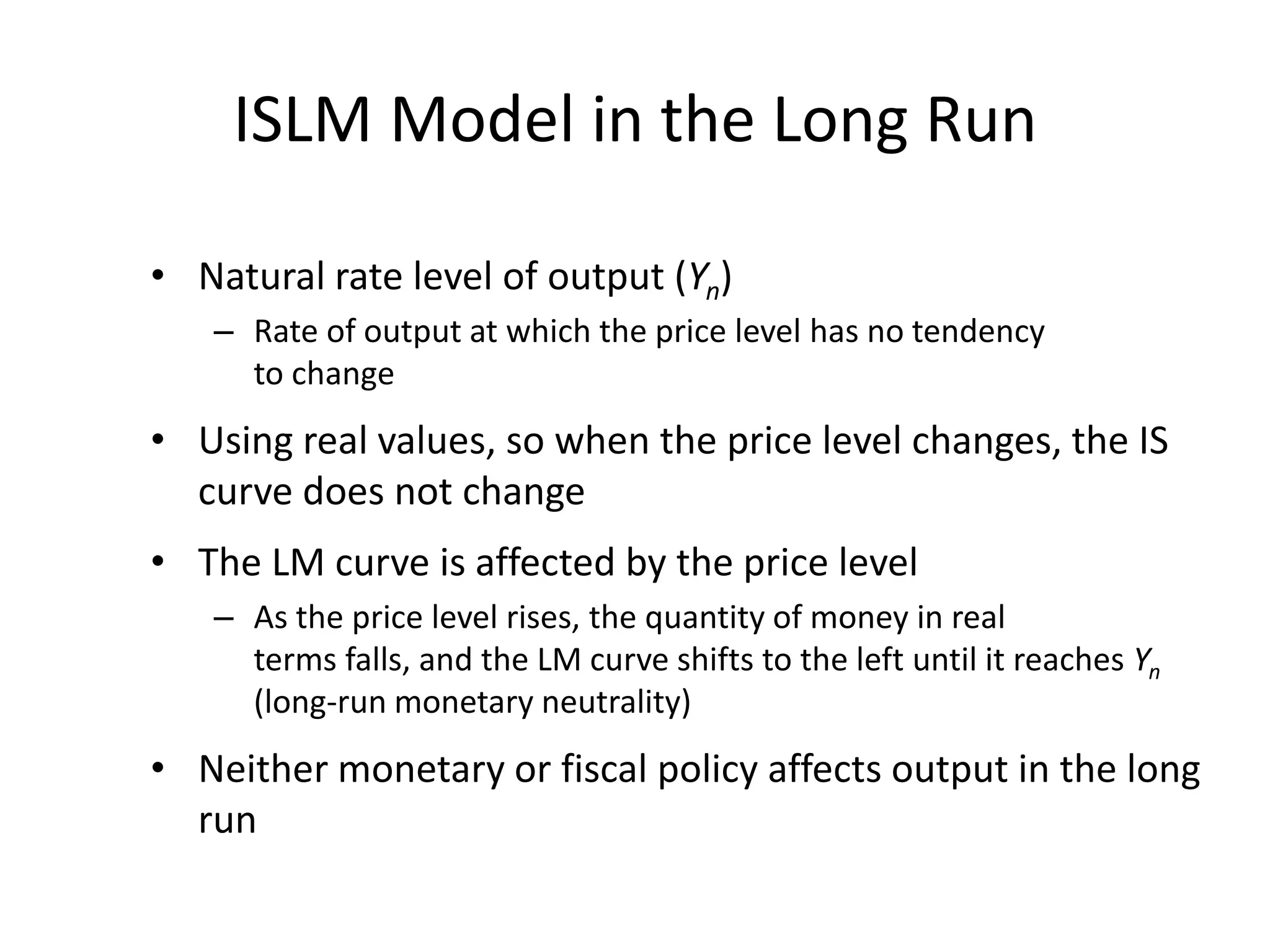

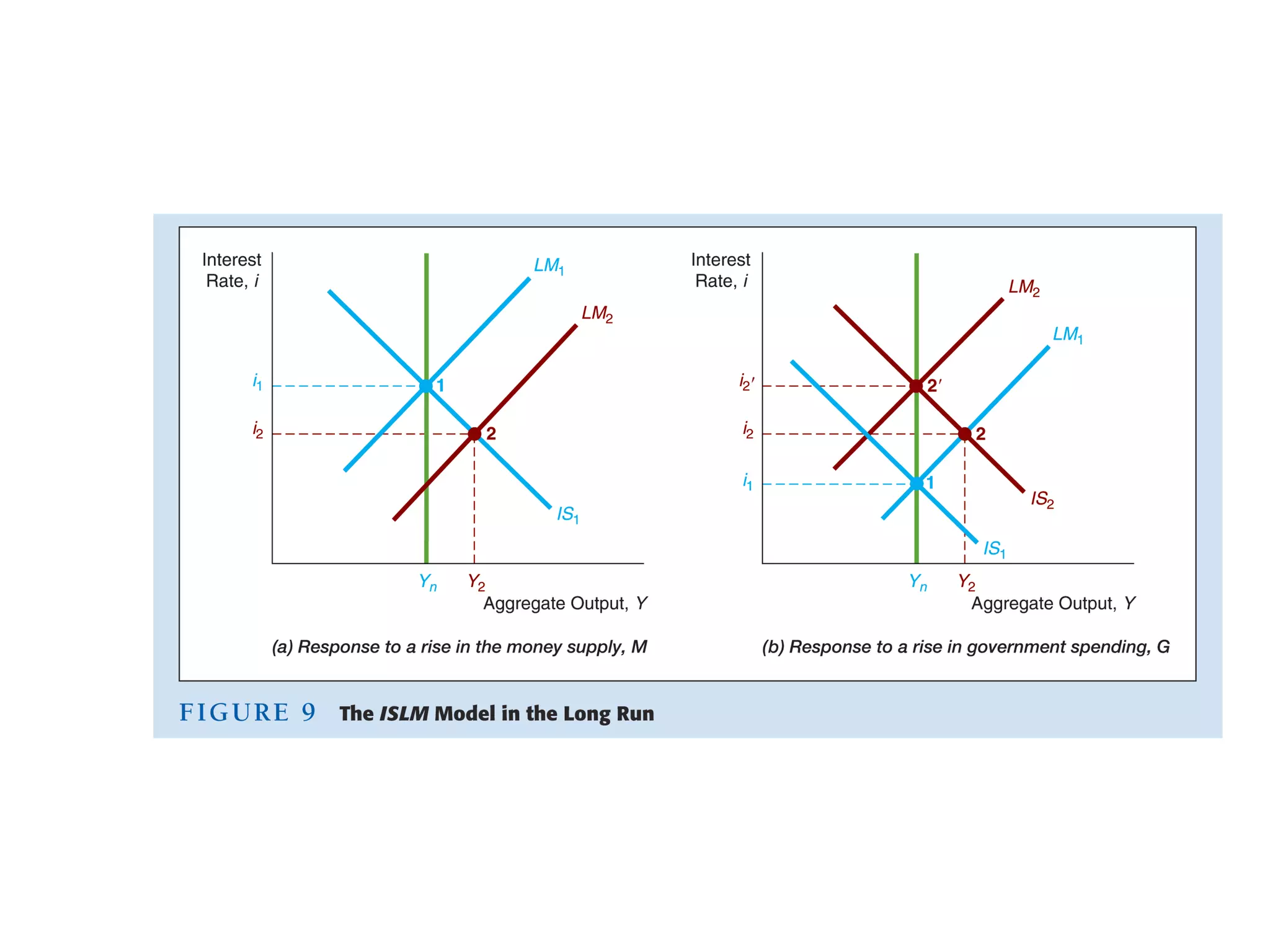

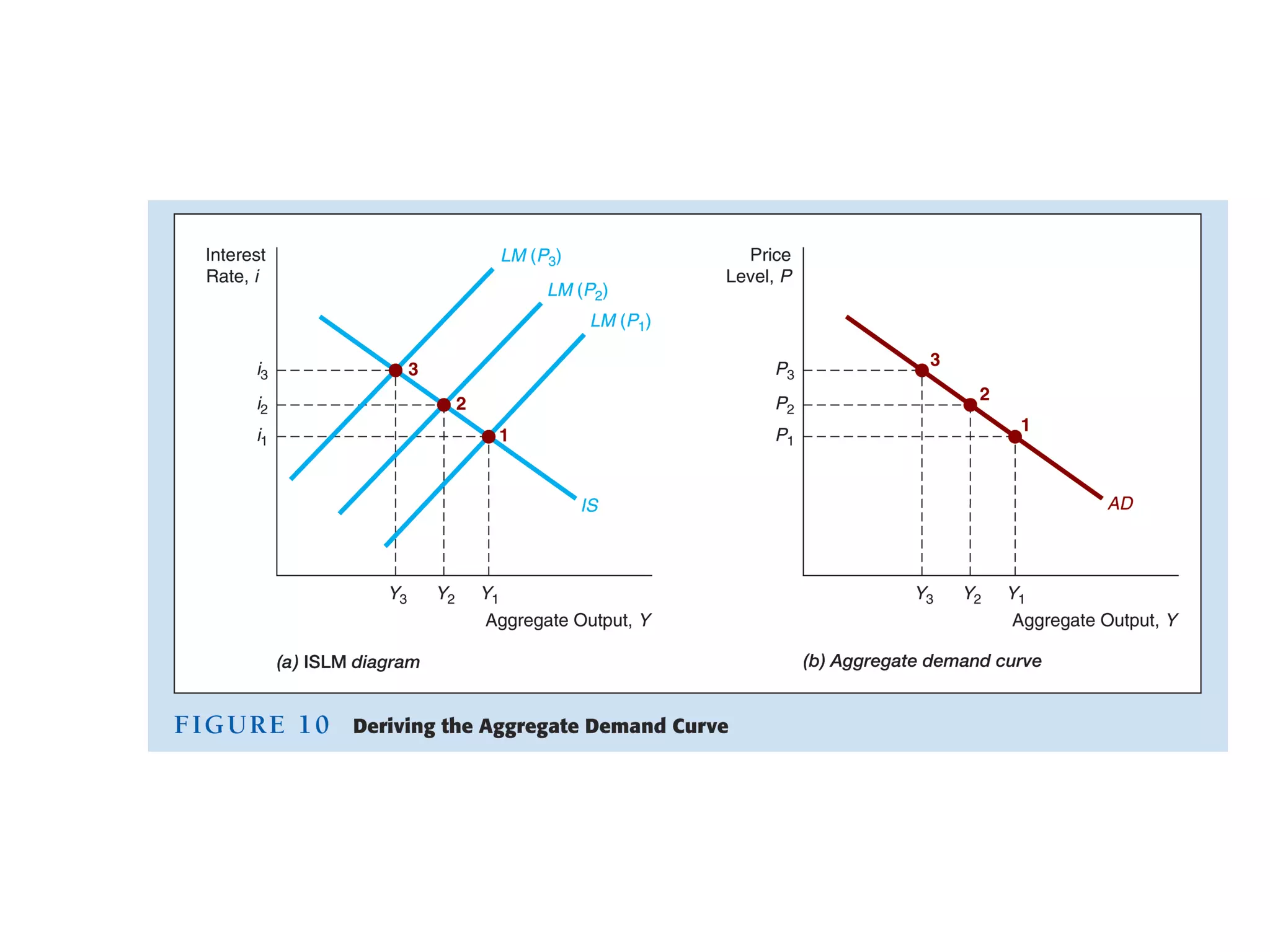

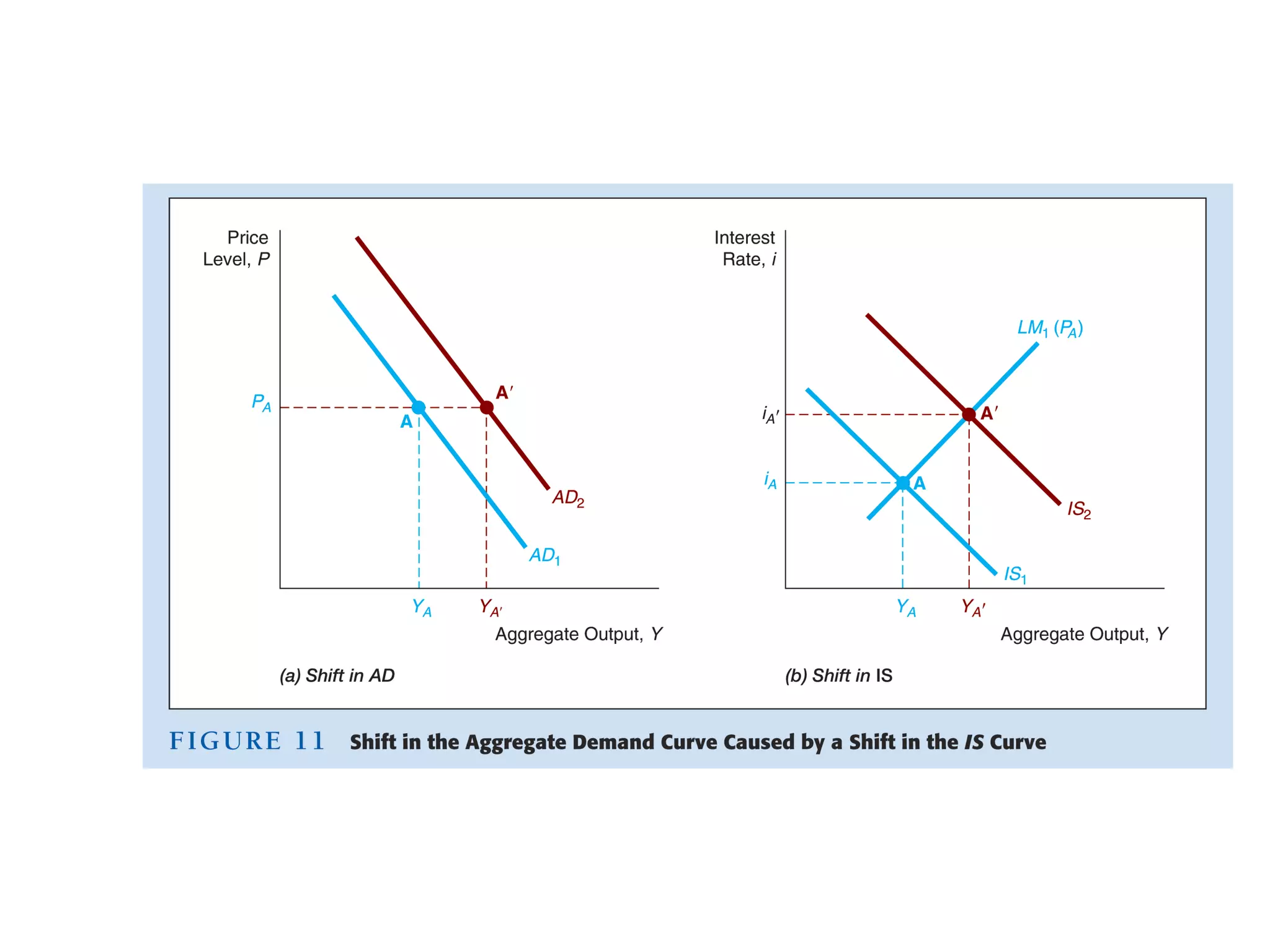

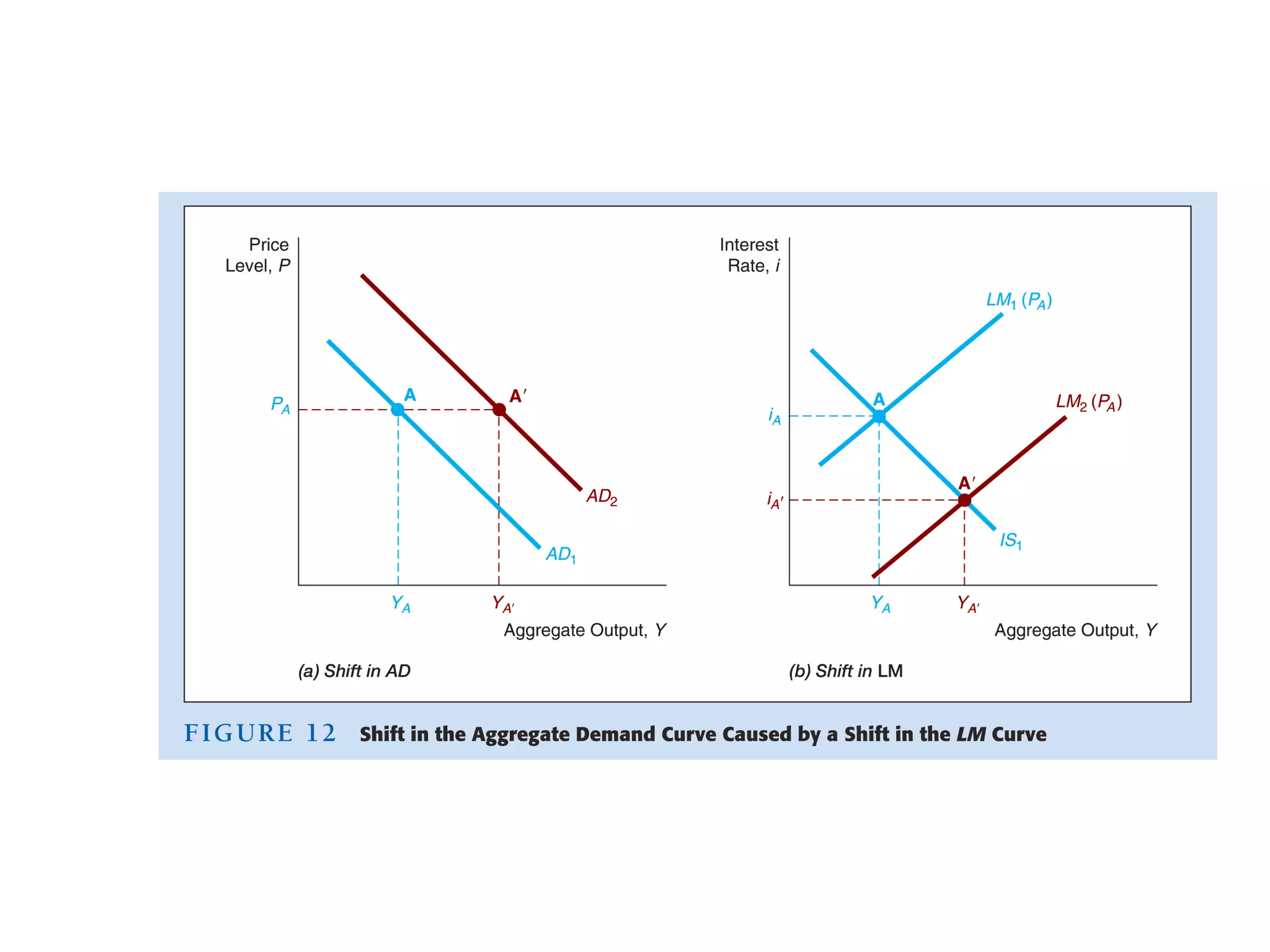

This document discusses the IS-LM model and how it can be used to analyze the effects of monetary and fiscal policy. It explains that monetary policy works by shifting the LM curve, changing interest rates and aggregate demand. Fiscal policy works by shifting the IS curve directly or indirectly through interest rates. In the long run, neither monetary nor fiscal policy can affect output levels, as prices will adjust to the "natural rate of output."