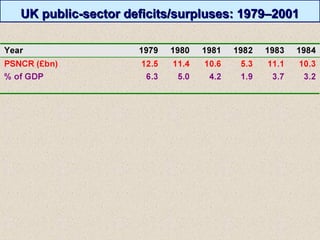

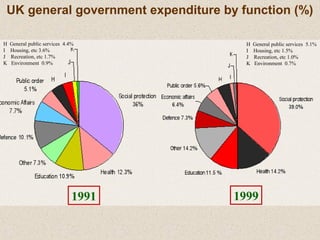

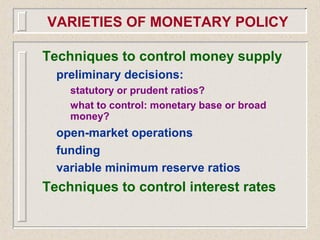

This document discusses fiscal and monetary policy. It covers the nature of fiscal policy including the purpose of fiscal policy, government finances, and public sector deficits/surpluses. It also discusses the effectiveness of fiscal policy including automatic stabilizers and problems with discretionary fiscal policy. The document covers varieties of monetary policy including different policy approaches and techniques to control money supply and interest rates. It concludes by discussing problems with monetary policy implementation including difficulties controlling money supply and interest rates.