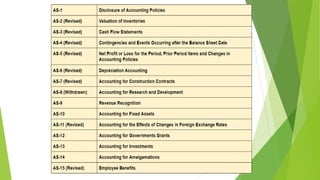

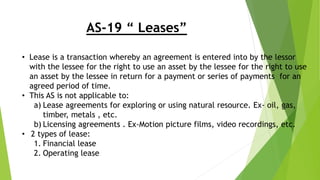

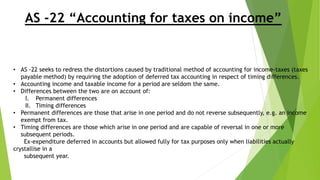

This document provides an overview of Indian Accounting Standards (Ind AS), including their applicability, issuing body, and some of the key standards covered. It notes that Ind AS are converged standards based on International Financial Reporting Standards (IFRS). There are currently 41 notified Ind AS standards issued by the Accounting Standards Board of the Institute of Chartered Accountants of India. Applicability of Ind AS in India is determined by the Ministry of Corporate Affairs and they must be followed when preparing financial statements. Several important Ind AS are mentioned relating to inventories, cash flows, revenue recognition, leases, taxes, and intangible assets.