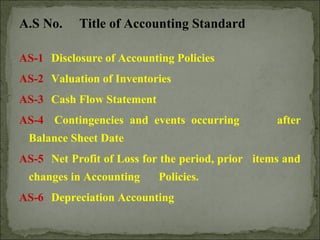

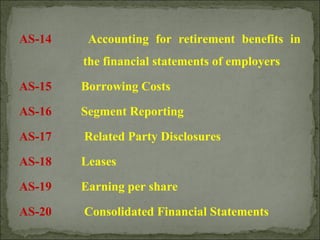

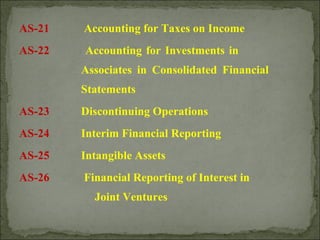

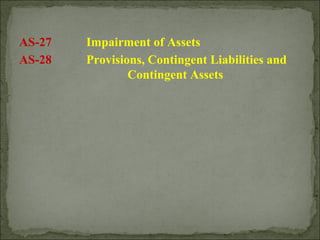

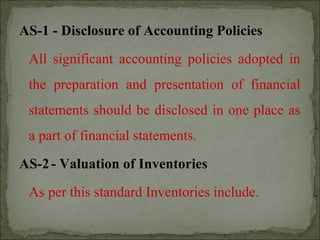

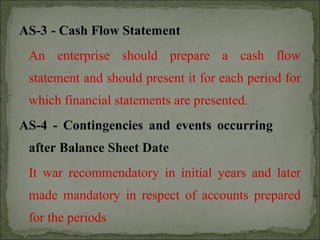

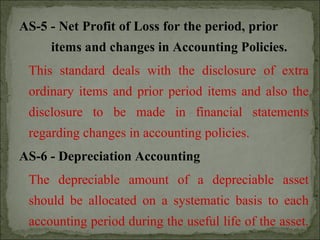

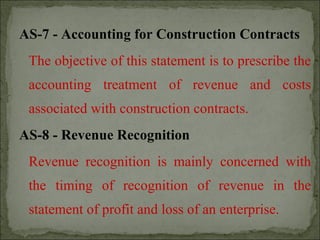

This document lists 28 Indian Accounting Standards (AS) that provide guidance on accounting treatments for various financial transactions and reporting. It includes AS on topics like disclosure of accounting policies, valuation of inventories, cash flow statements, contingencies, revenue recognition, fixed assets, government grants, investments, retirement benefits, taxes, and impairment of assets. The standards are issued by the Institute of Chartered Accountants of India to standardize accounting practices.