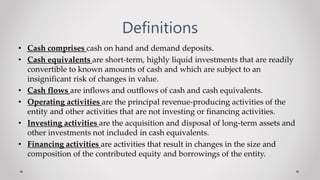

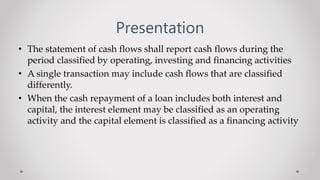

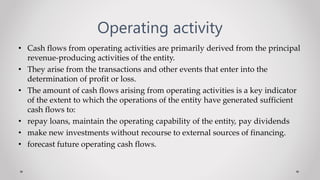

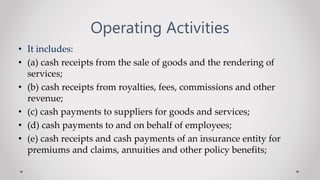

This document outlines the requirements for preparing a statement of cash flows under Indian Accounting Standard 7. It discusses the objective to provide information on an entity's cash generation and usage. The standard requires classification of cash flows as operating, investing or financing activities. It provides definitions for key terms and guidance on treatment of items like foreign currency cash flows, interest and dividends, taxes and non-cash transactions.