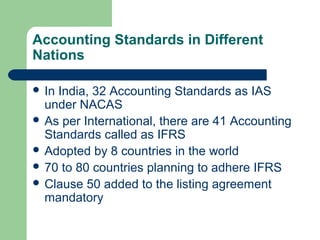

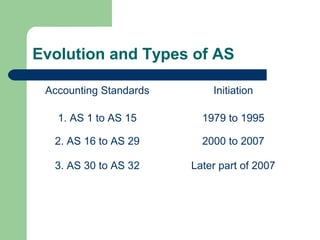

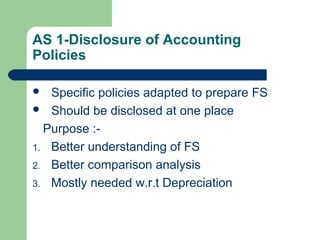

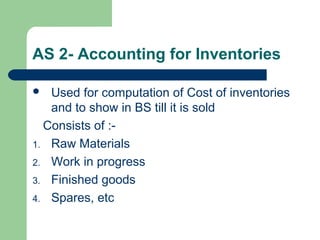

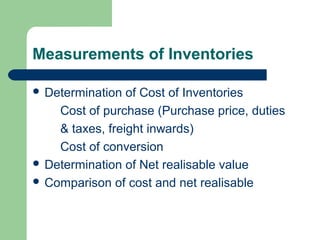

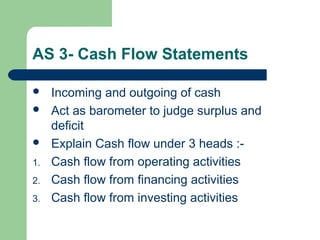

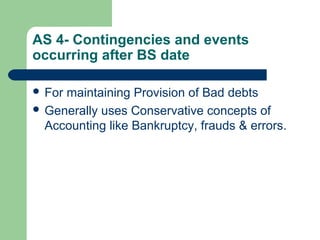

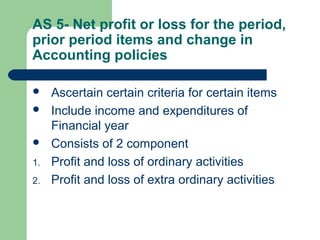

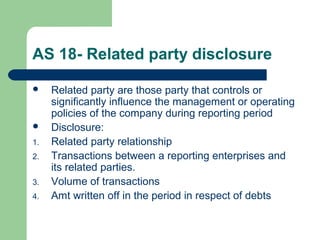

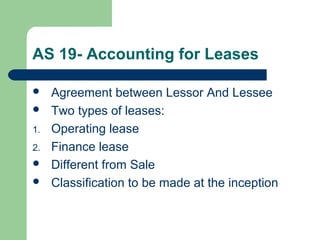

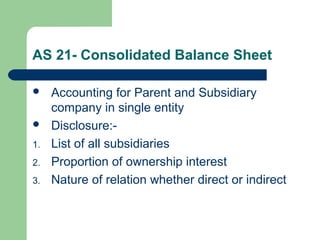

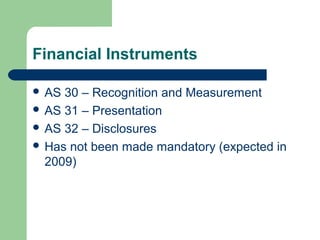

This document provides an overview of accounting standards in India. It begins with introducing accounting standards as written documents issued by regulatory bodies to standardize accounting policies. It then discusses the objectives of accounting standards such as adding reliability to financial statements. The document outlines the different types of accounting standards introduced in India from 1979 to 2007 and provides brief descriptions of several individual standards including those covering cash flow statements, revenue recognition, and financial instruments. It concludes with noting that 32 accounting standards have been adopted in India based on international standards.