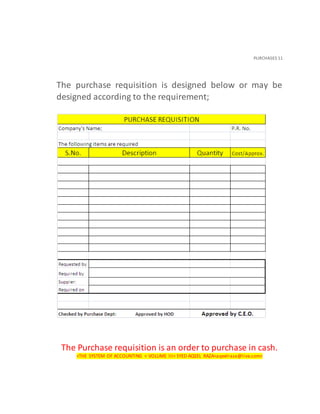

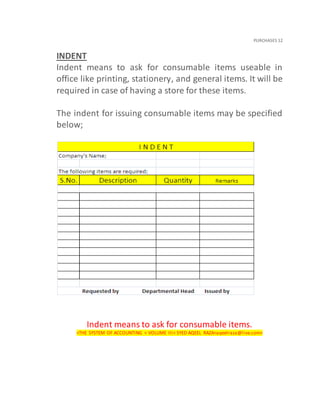

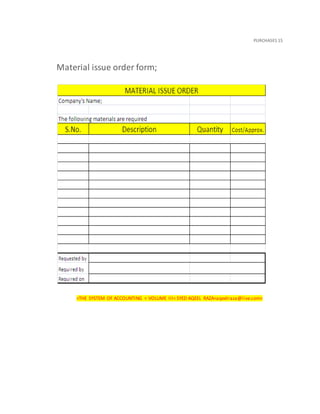

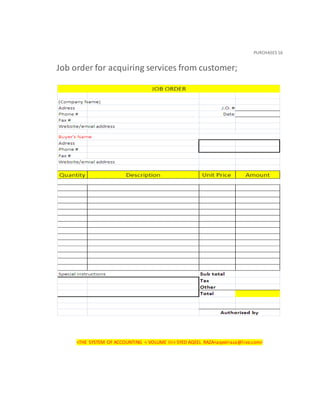

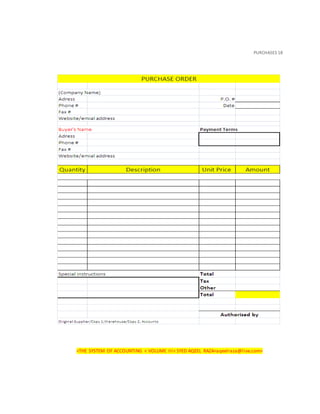

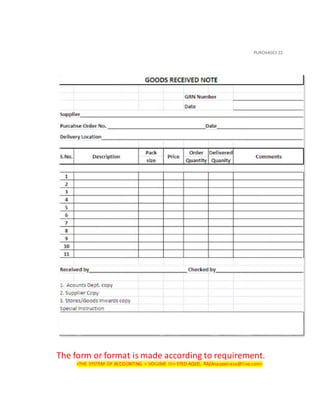

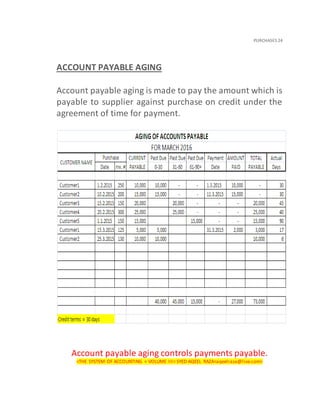

The document discusses various types and aspects of accounting for purchases. It describes three types of businesses that involve purchases and sales: trading, manufacturing, and services. It also discusses the different types of purchases for accounting purposes, including purchases for personal use, purchases for business, and purchases for expenses. Various purchase documents and procedures are also outlined, such as purchase requisitions, purchase orders, and accounts payable aging.