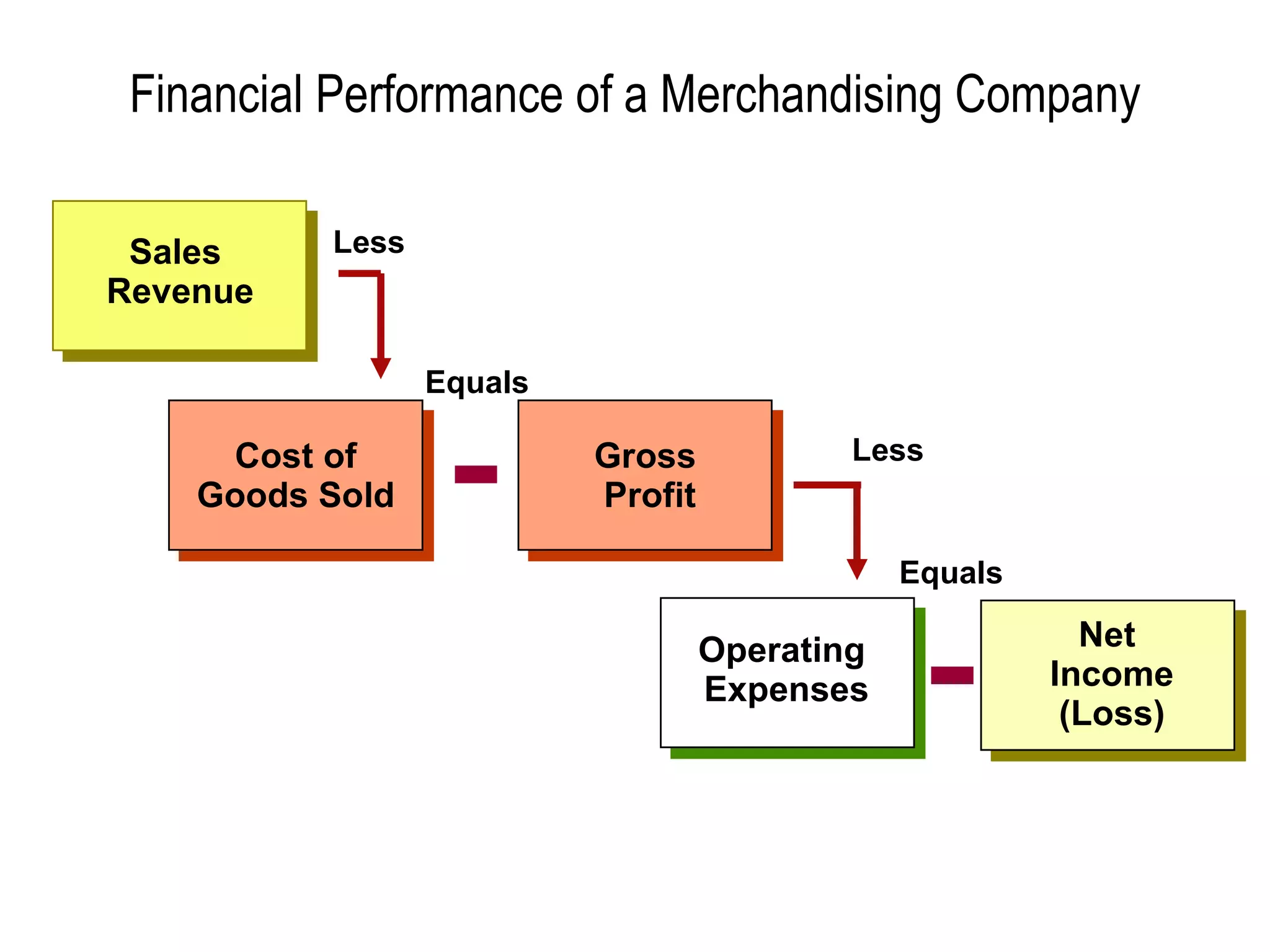

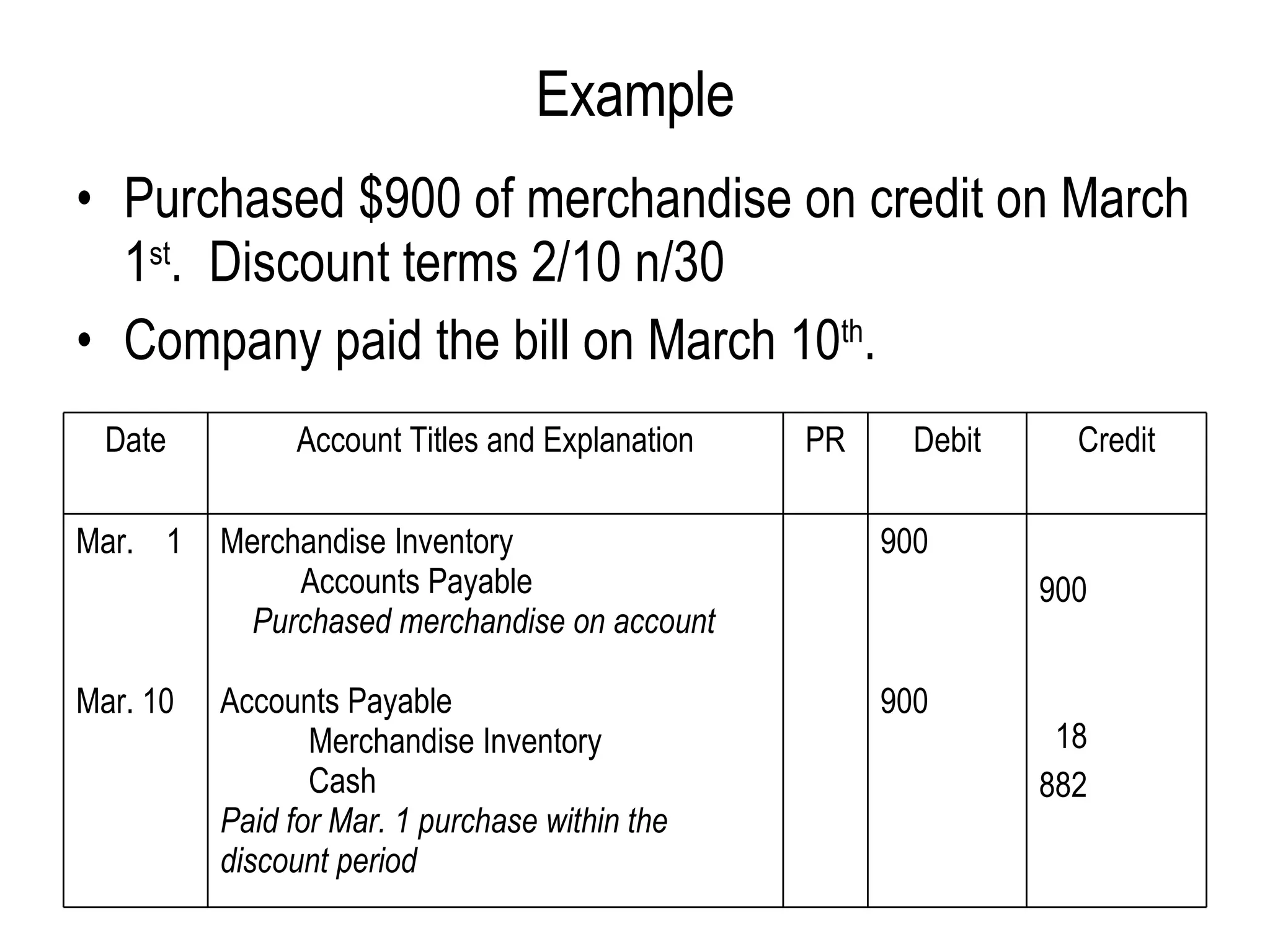

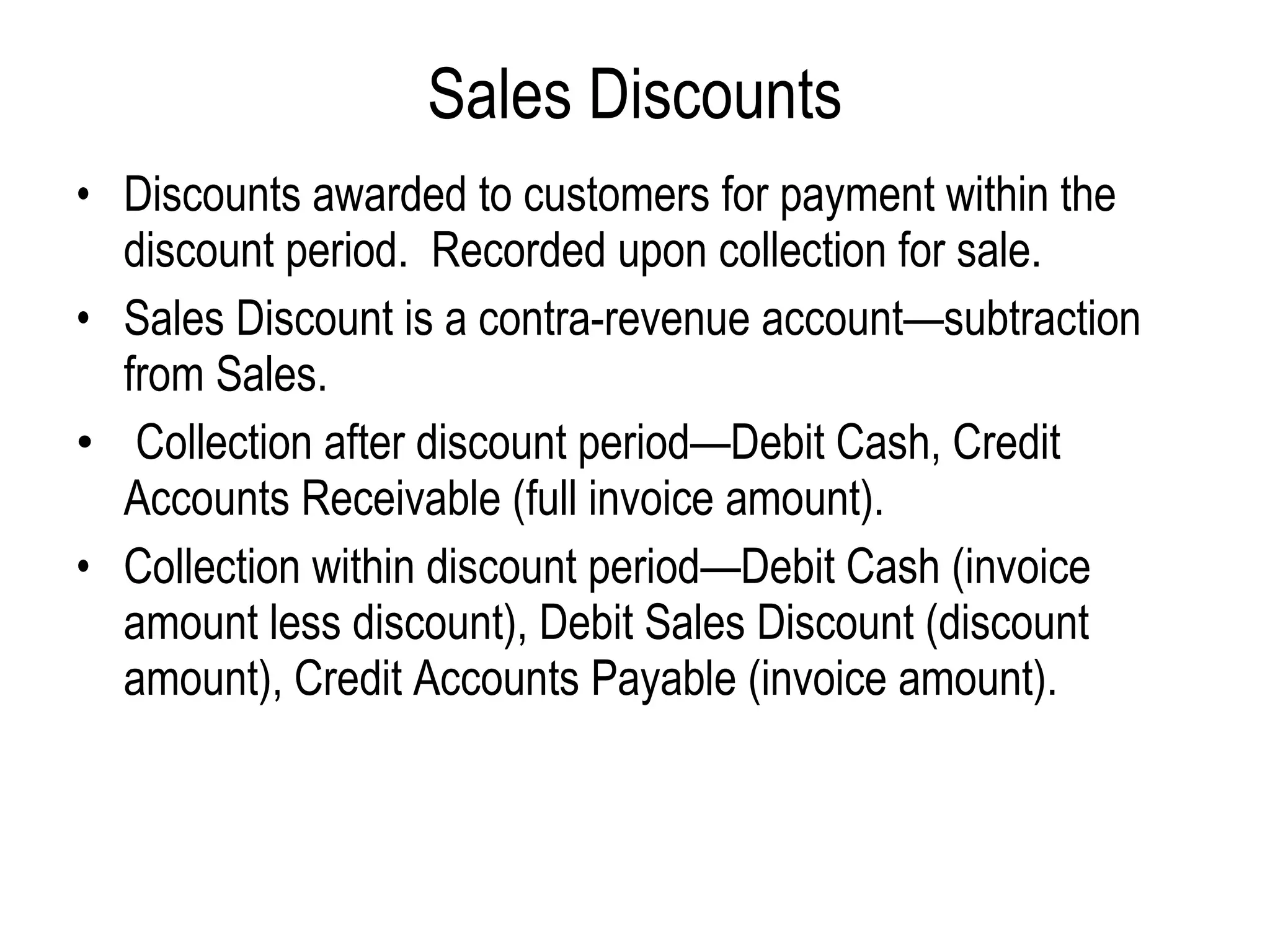

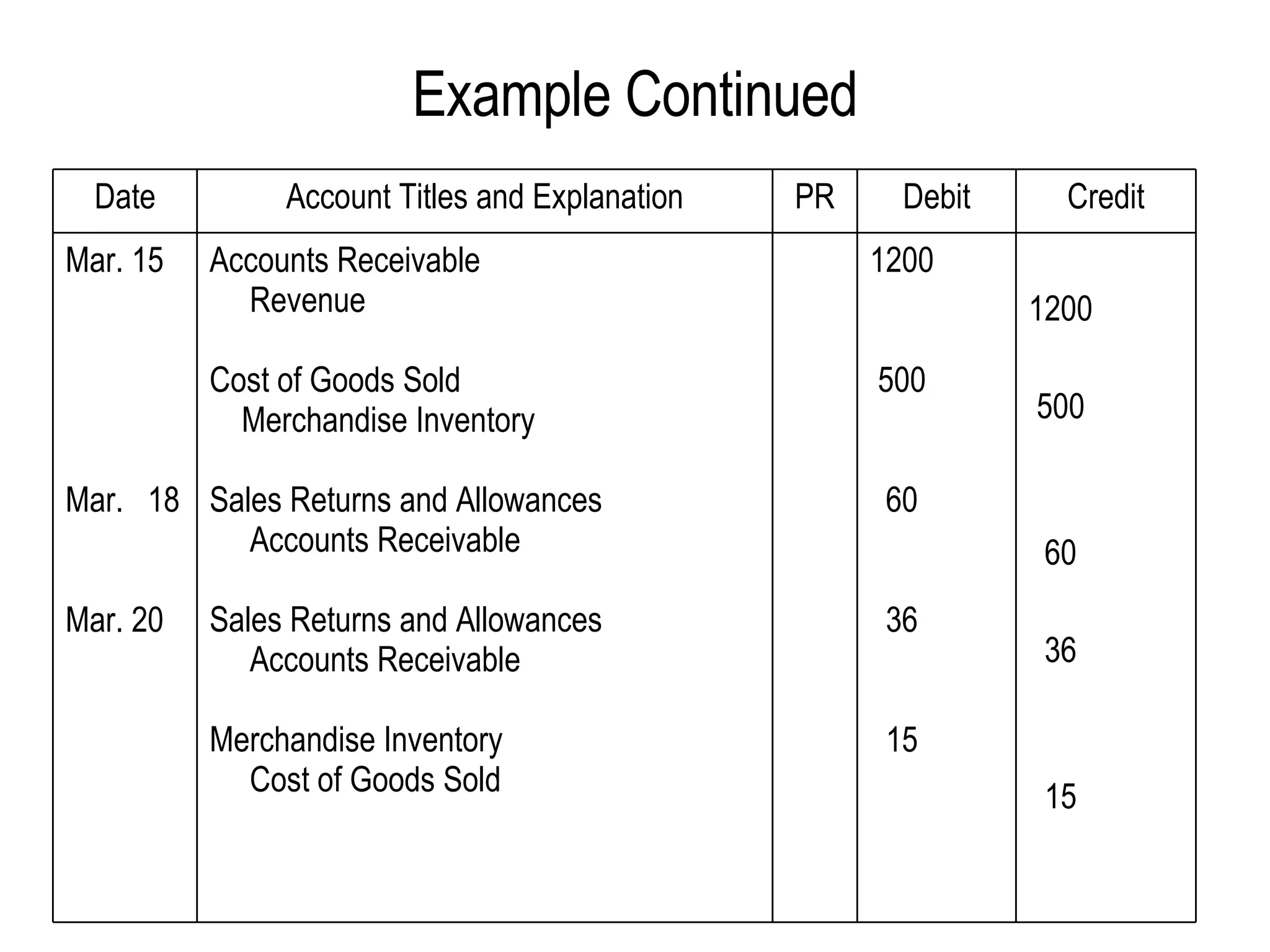

This document summarizes key concepts related to merchandising activities for companies that buy and sell goods. It discusses how merchandisers derive revenue from sales rather than services. It also outlines the basic accounting entries for purchases, sales, returns and allowances. Inventory systems and calculations for cost of goods sold are summarized. Key financial statements for merchandising companies are identified.