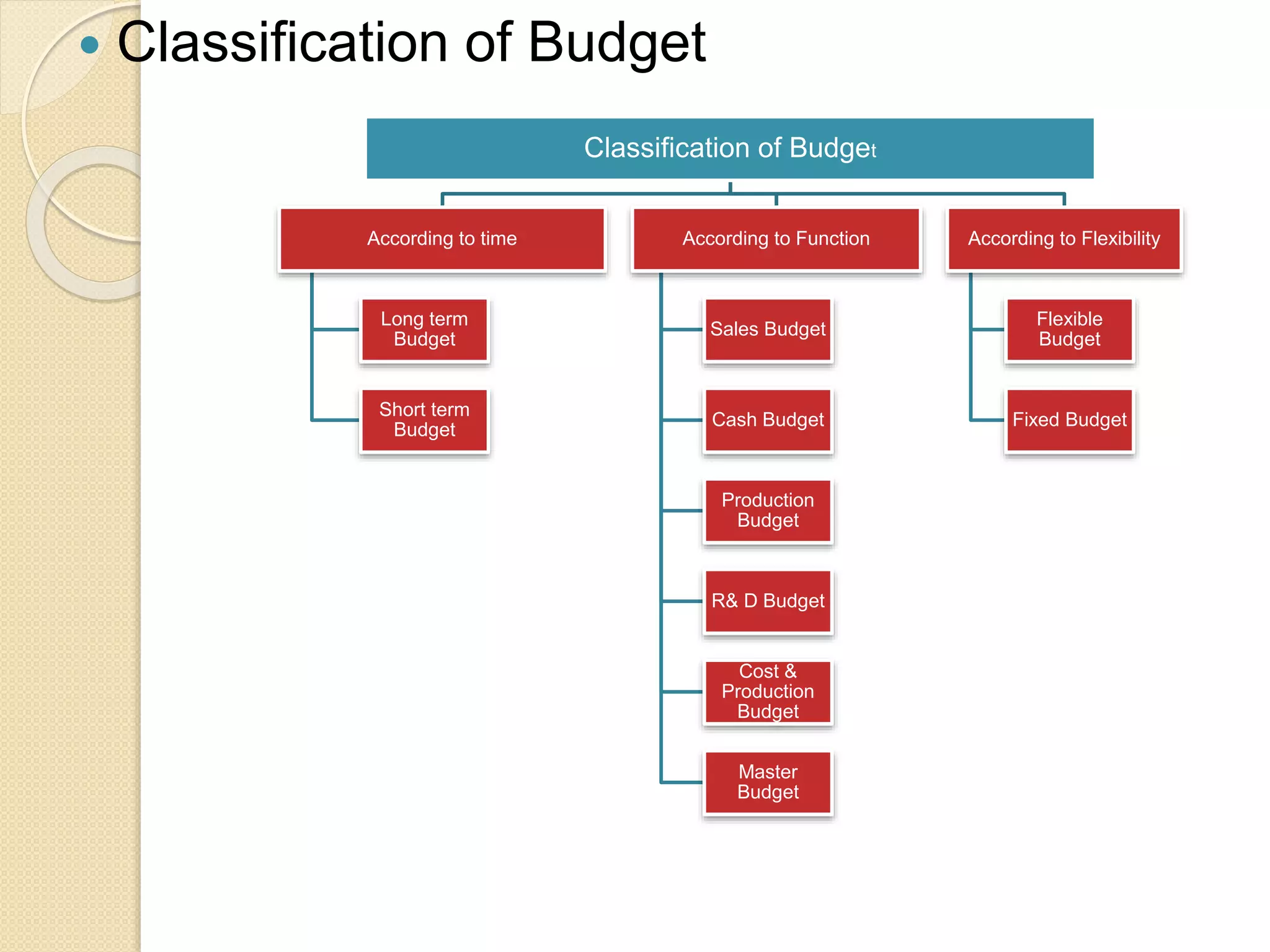

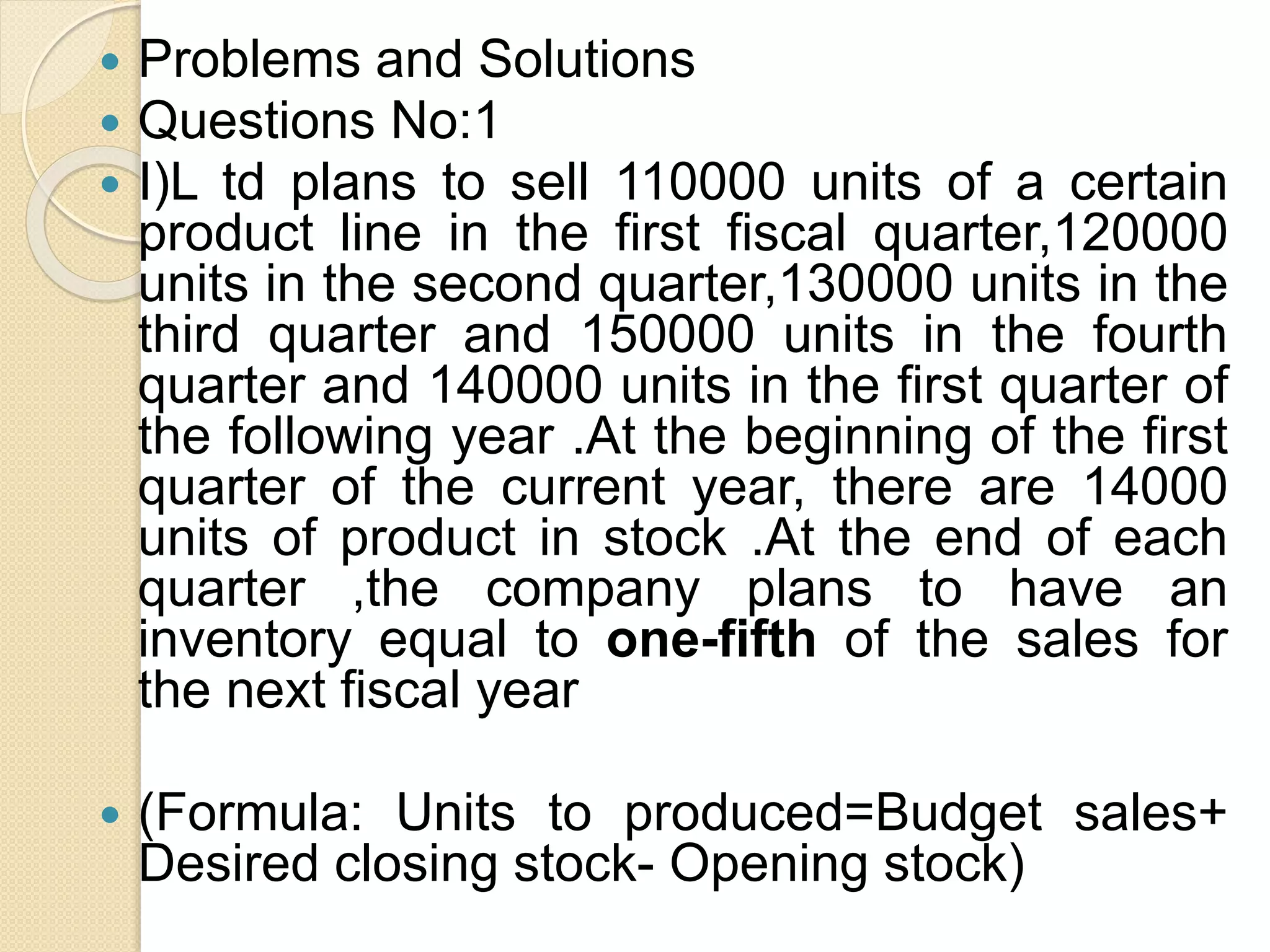

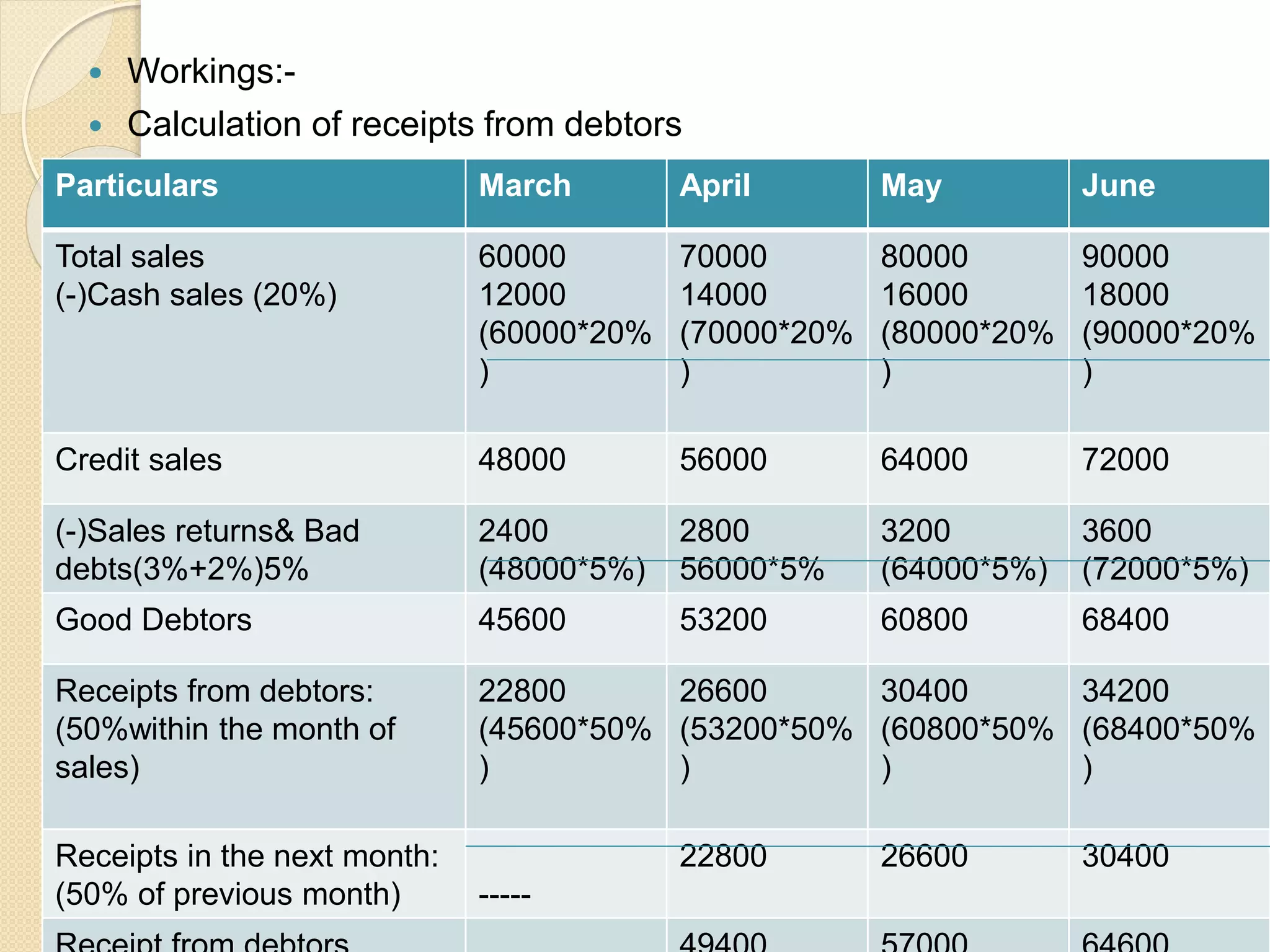

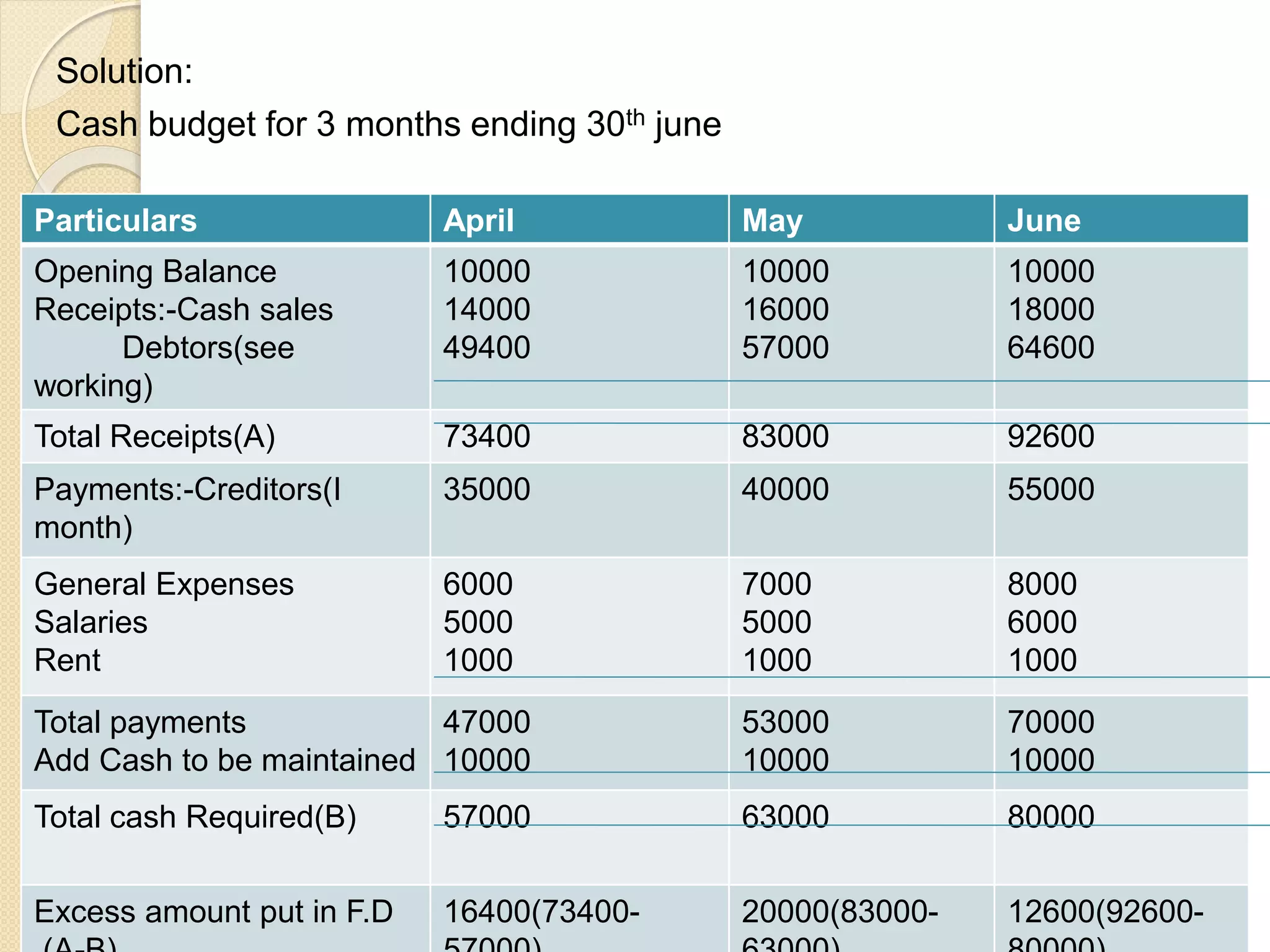

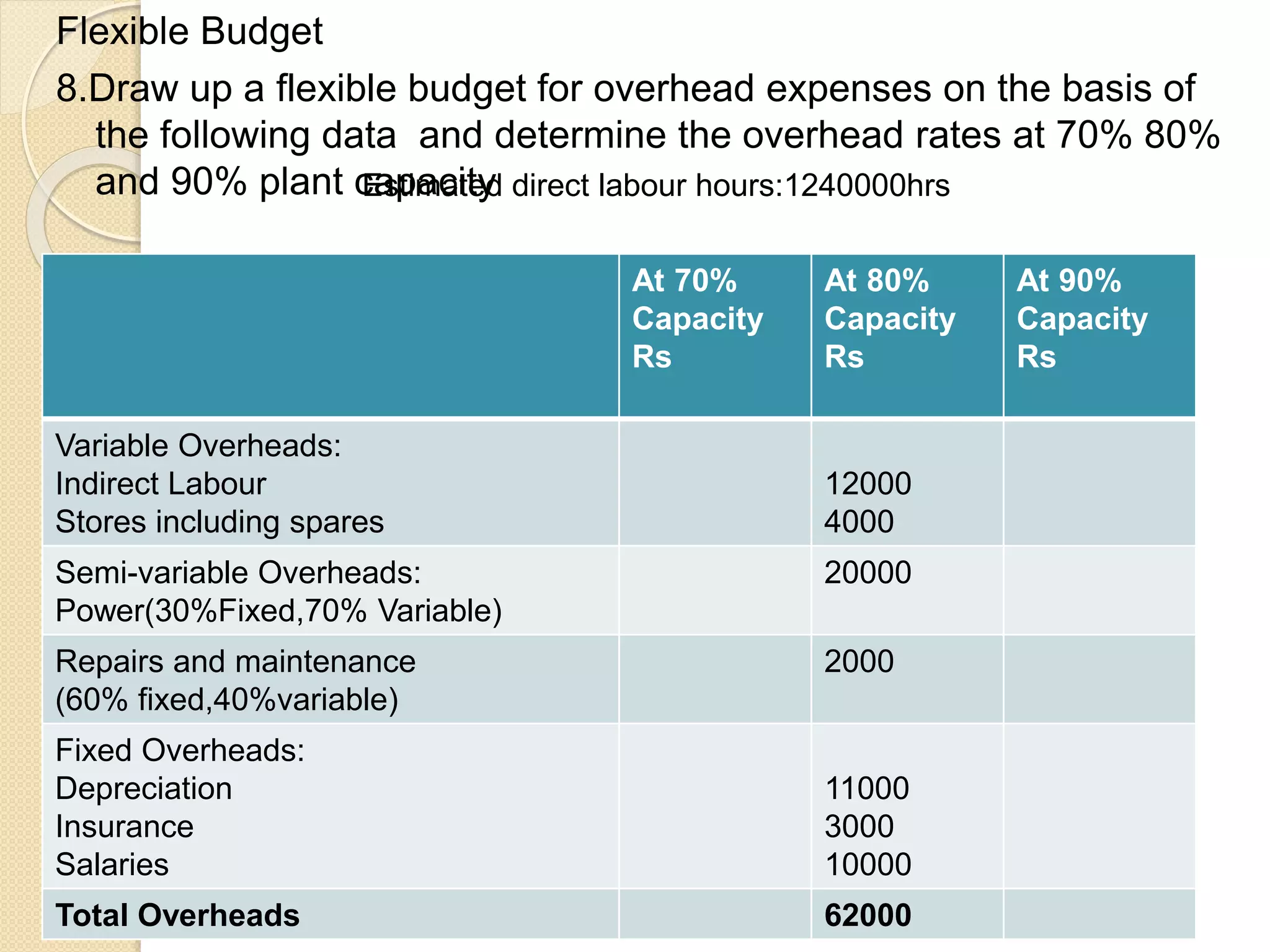

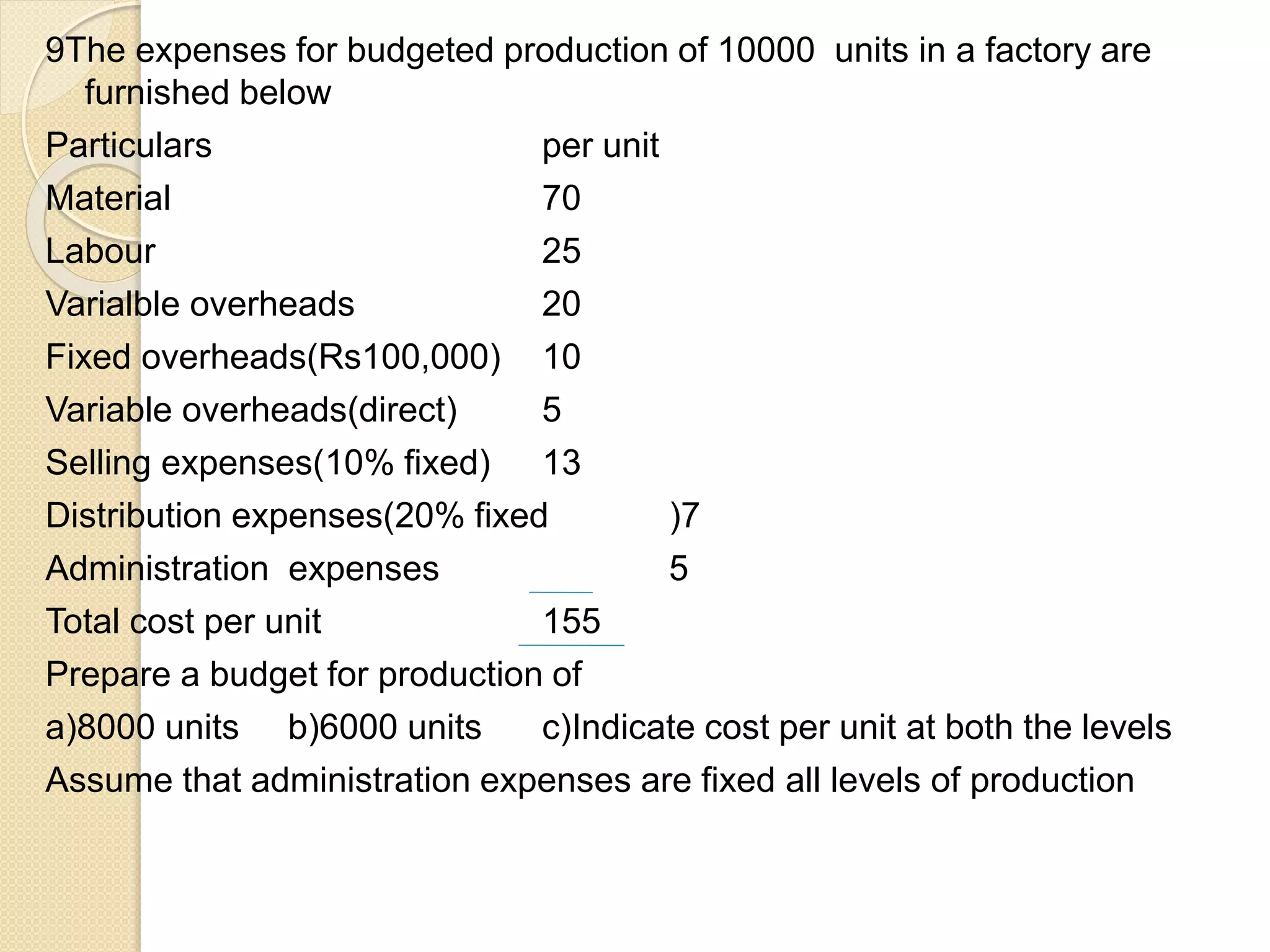

Budgeting involves preparing pre-determined financial statements for a future period. There are different types of budgets such as long term vs short term budgets and master budgets that consolidate other functional budgets like sales, production etc. Budgets can also be fixed or flexible depending on how strictly actual results are compared to them. The document then provides examples of different types of budgets including production, materials purchase, sales and cash budgets. It demonstrates how to prepare these budgets using sample data provided.