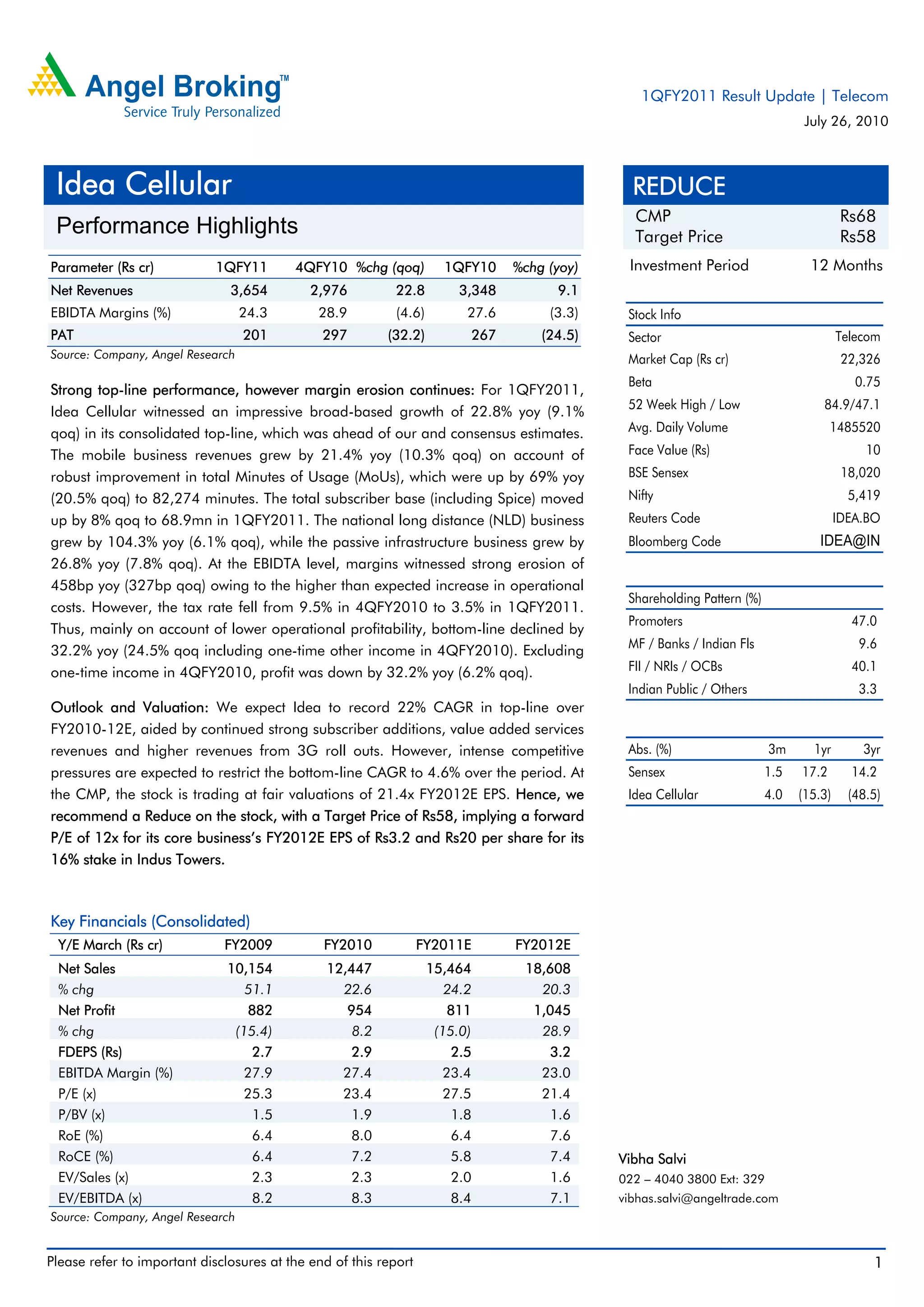

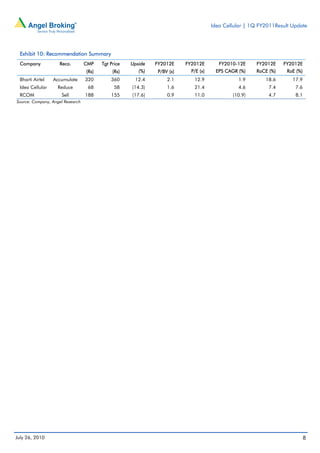

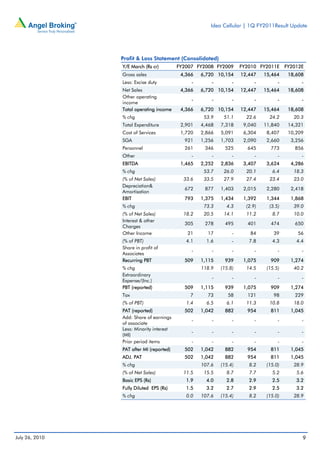

Idea Cellular reported strong revenue growth of 22.8% year-over-year for the first quarter of FY2011, however margins declined. While revenue was ahead of estimates due to increased mobile usage and subscribers, earnings before interest, taxes, depreciation and amortization (EBITDA) margins fell 4.6% from the prior year due to higher operational costs. Net profit declined 32.2% from the prior year and 24.5% sequentially. The analyst maintains a "Reduce" rating on Idea Cellular shares and sets a target price of Rs58.