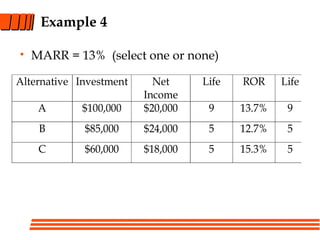

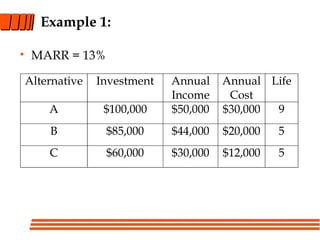

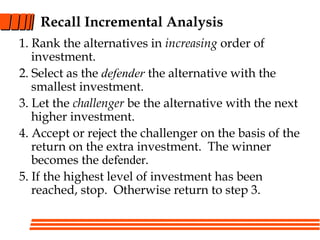

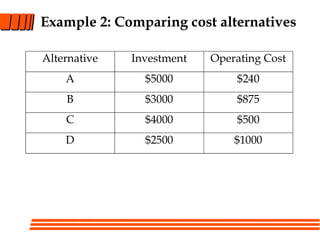

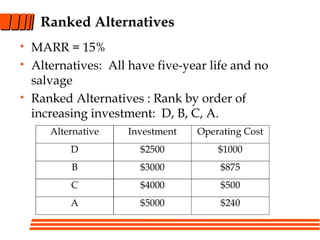

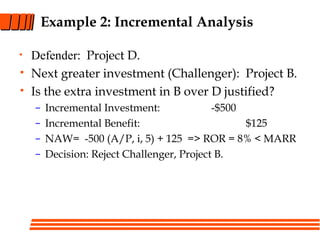

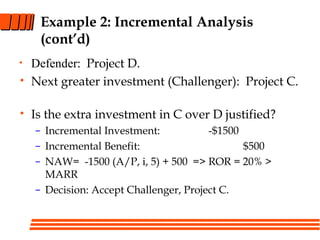

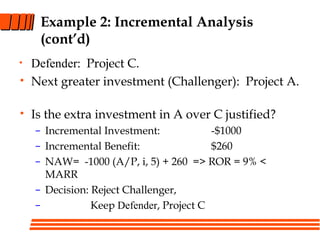

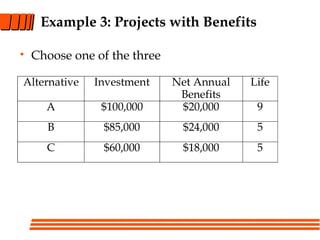

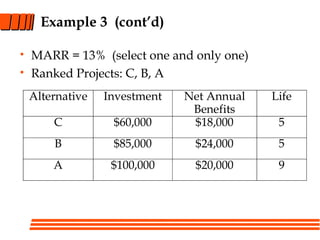

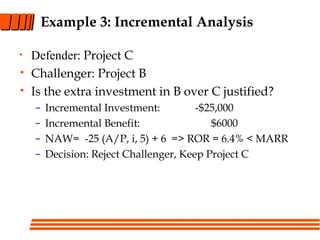

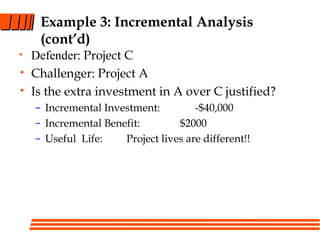

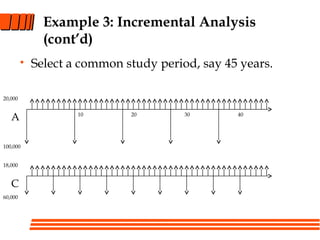

This document discusses methods for evaluating multiple investment alternatives. It defines rate of return (ROR) and discusses how to evaluate non-mutually exclusive and mutually exclusive alternatives. For non-mutually exclusive alternatives, select any project with ROR above the minimum acceptable rate of return (MARR). For mutually exclusive projects, use incremental analysis by ranking projects by cost and sequentially accepting higher cost projects if their incremental ROR exceeds MARR. Examples demonstrate these methods.

![An Easier way for Different Lives

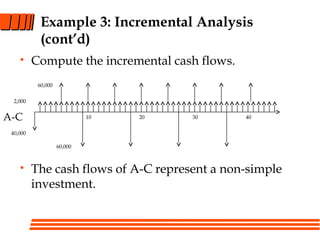

• Find ROR of A - C

• NAW(A - C) = NAW(A) - NAW(C) = 0

• -100(A/P, i, 9) + 20 - [-60(A/P, i, 5) + 18]

• -100(A/P, i, 9) + 60(A/P, i, 5) + 2 = 0

• i NAW(A - C)

• 0% 2889

• 5% 1789

• 10% 463

• 15% -1058

• 12% -123

• ROR of A - C is 11.6%. Reject A - C and choose C](https://image.slidesharecdn.com/05-140427213156-phpapp02/85/05-2comp-ror-22-320.jpg)