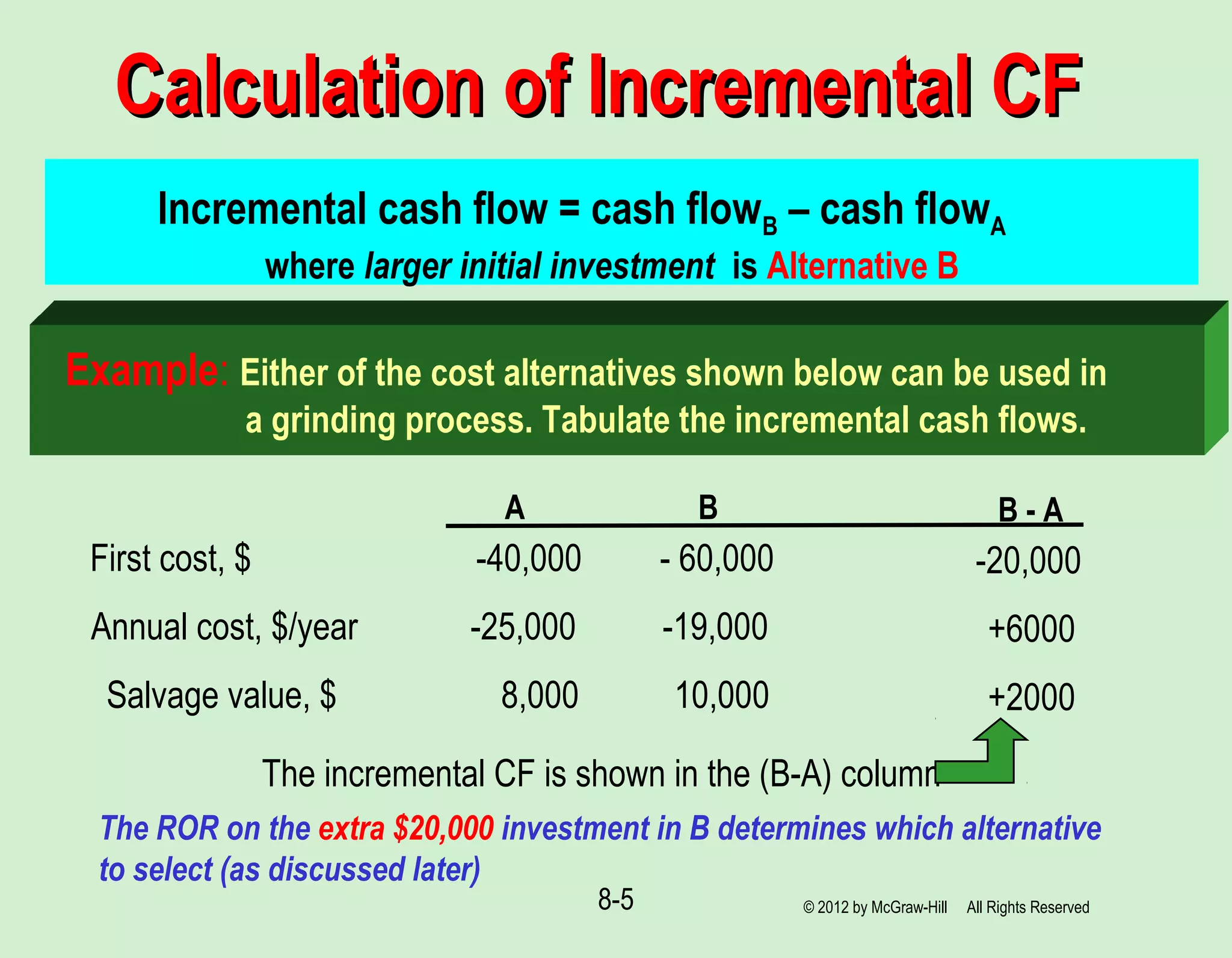

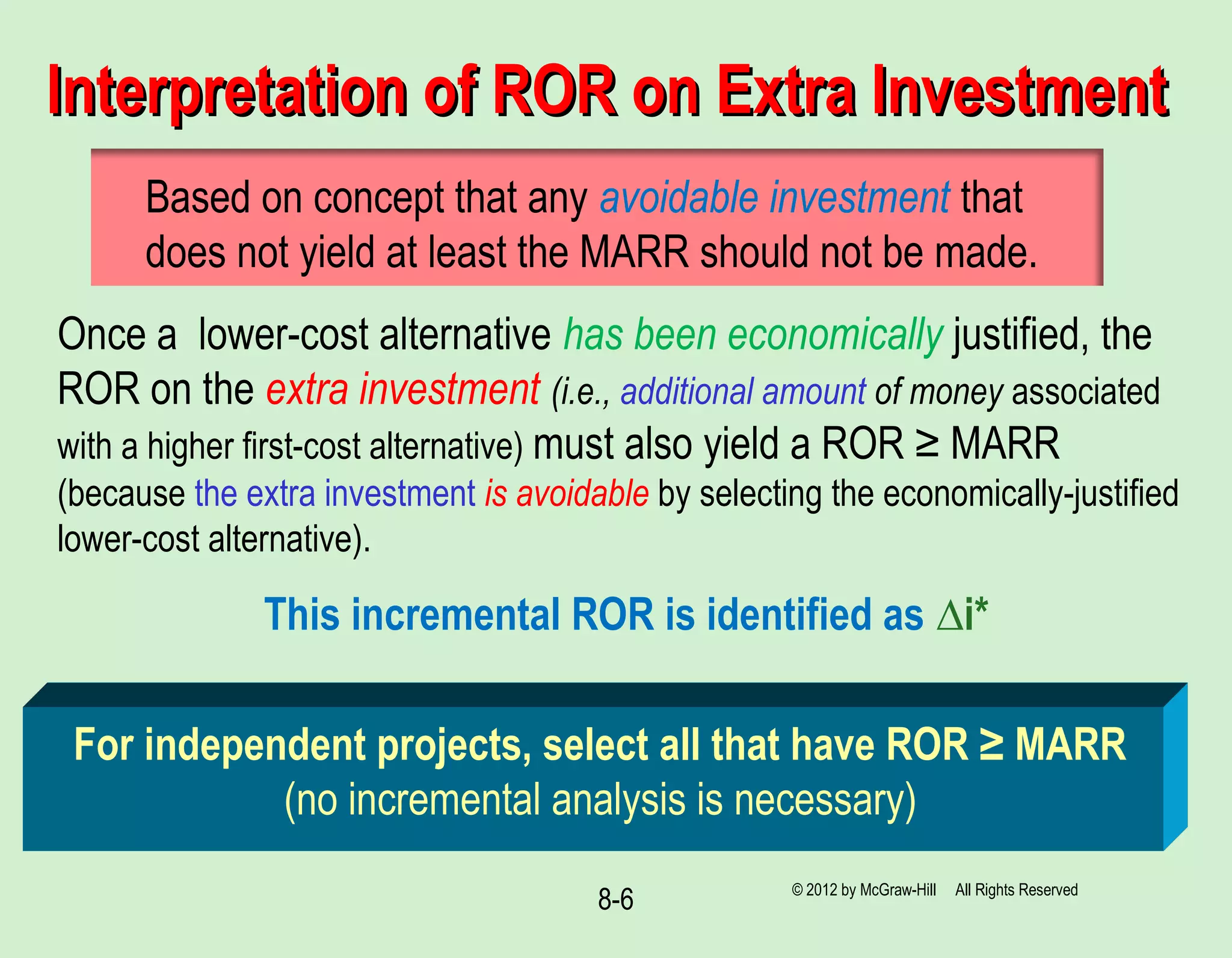

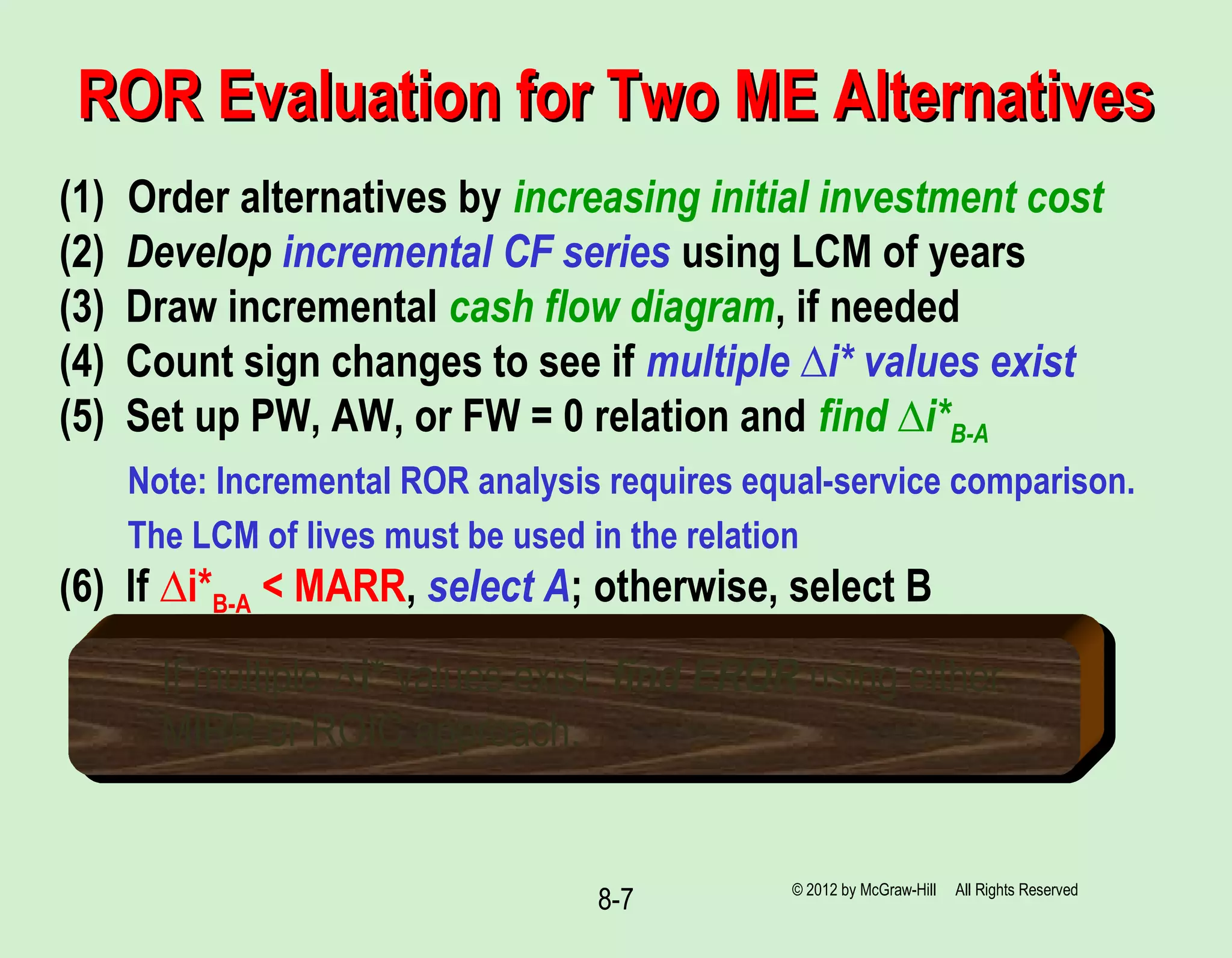

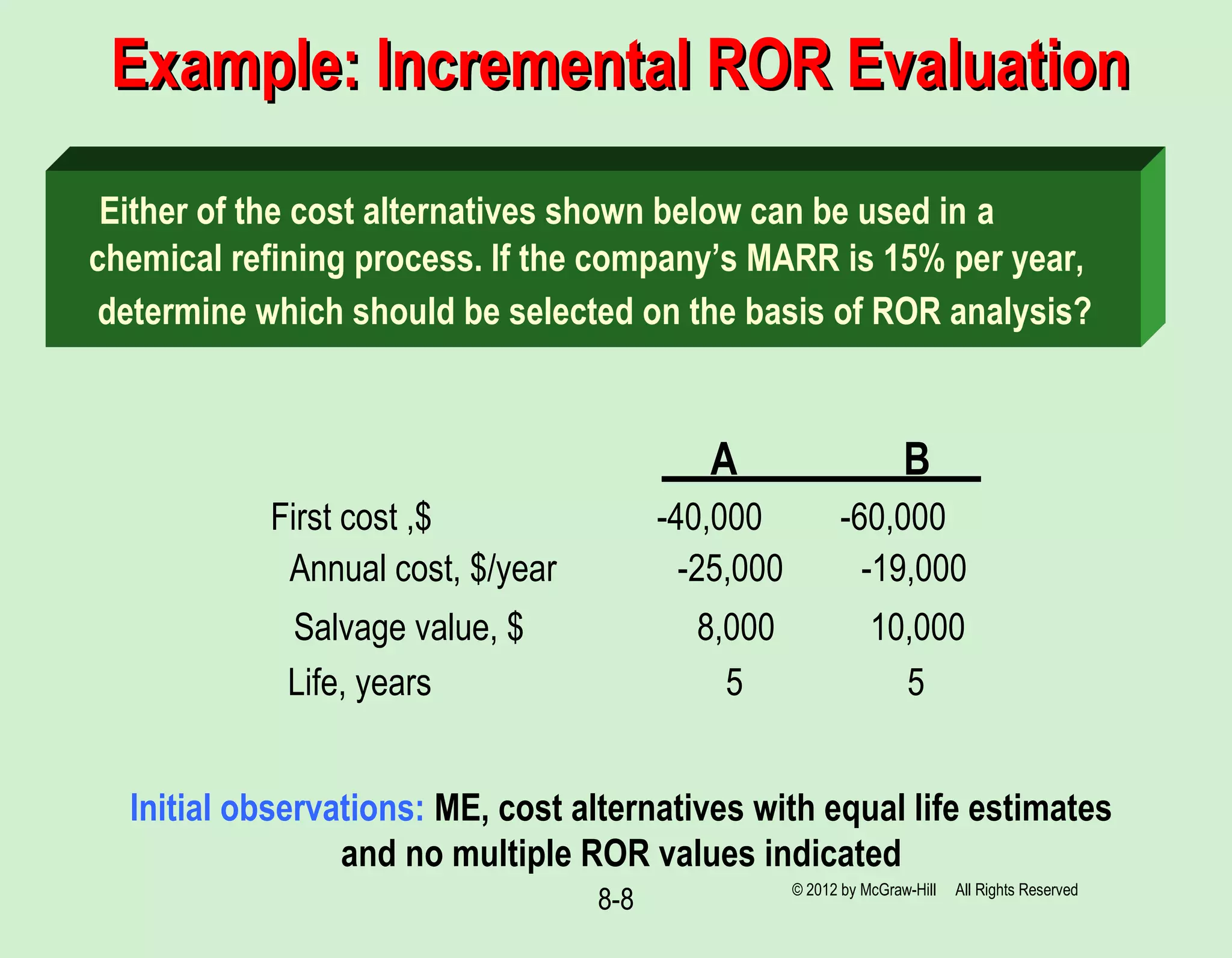

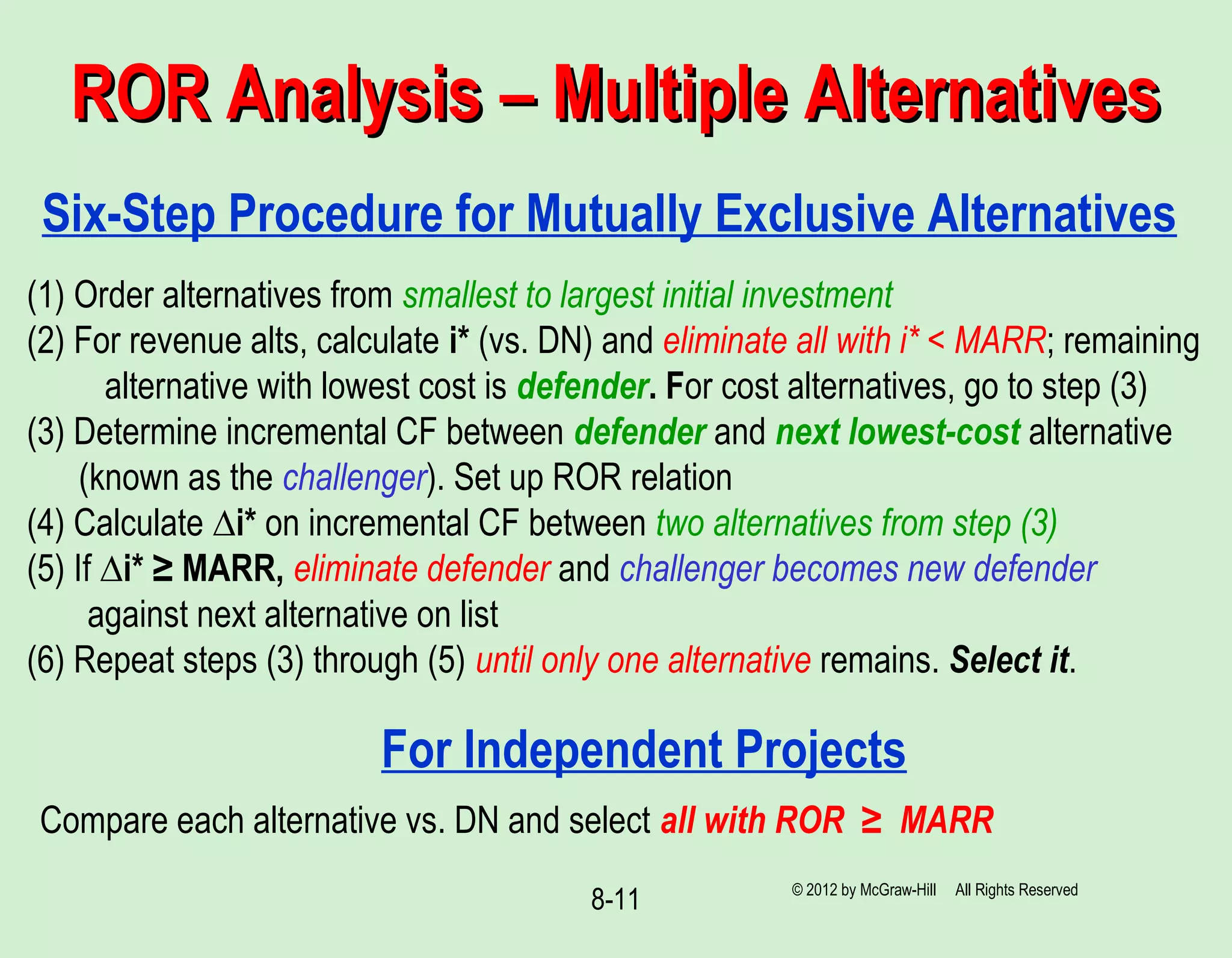

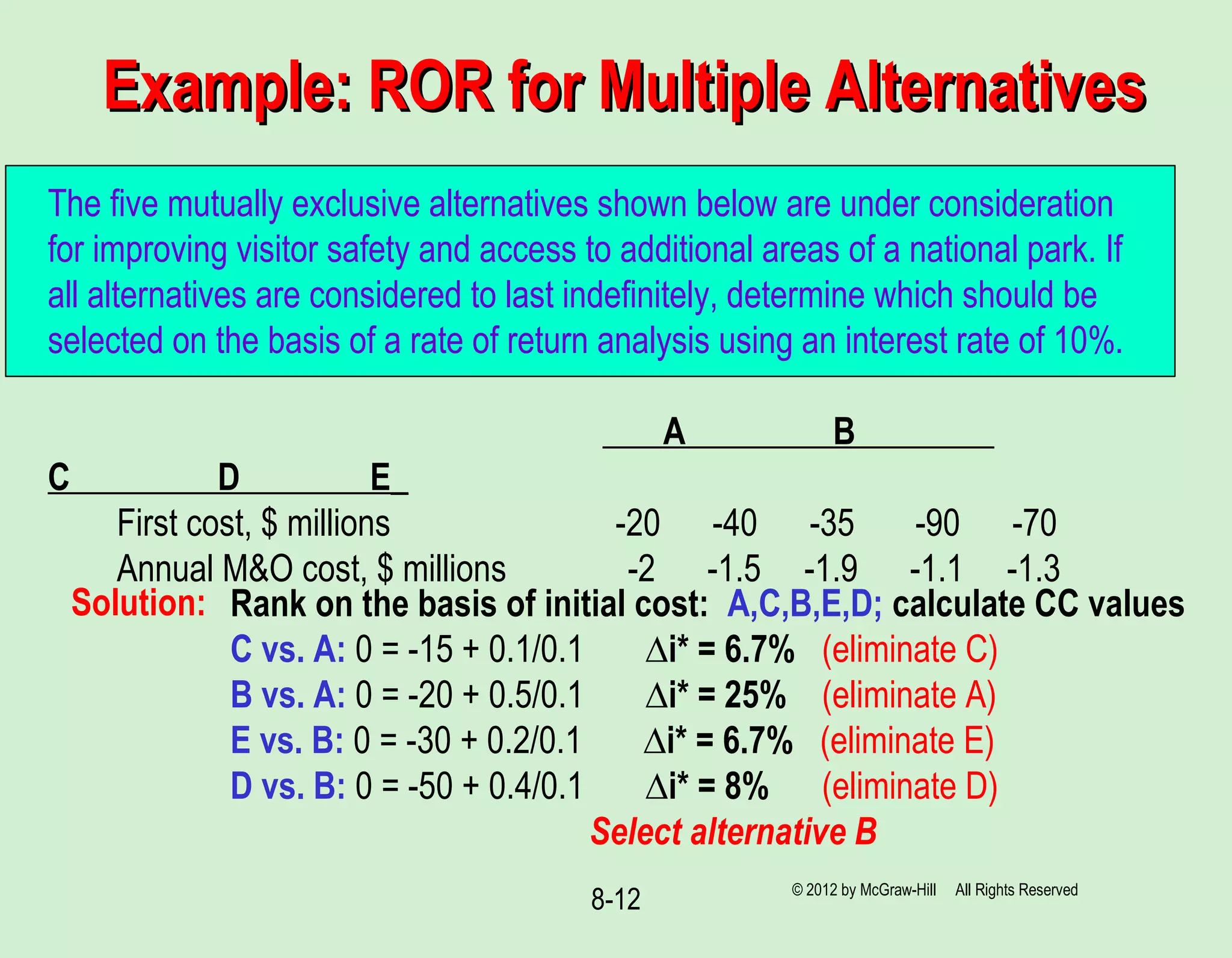

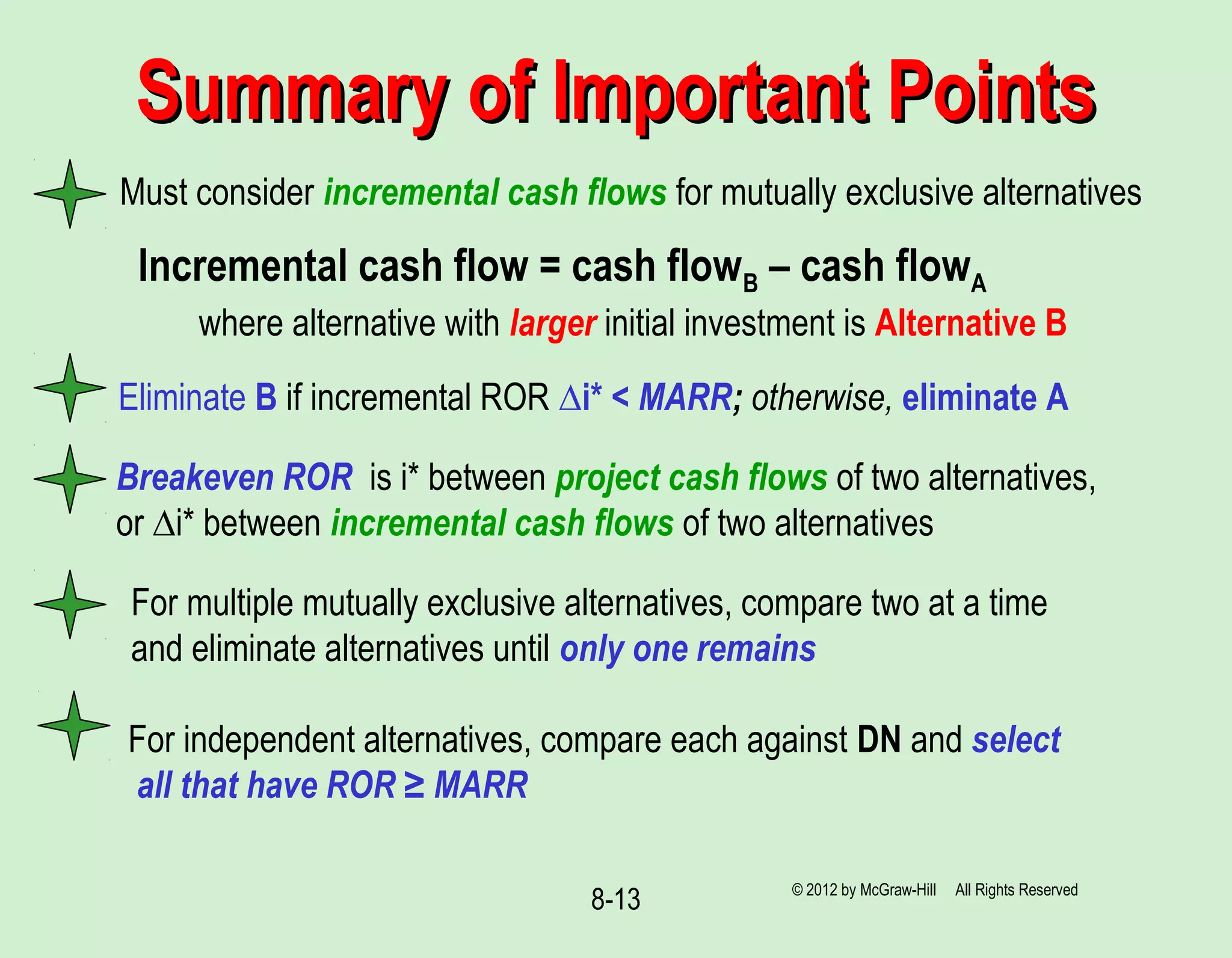

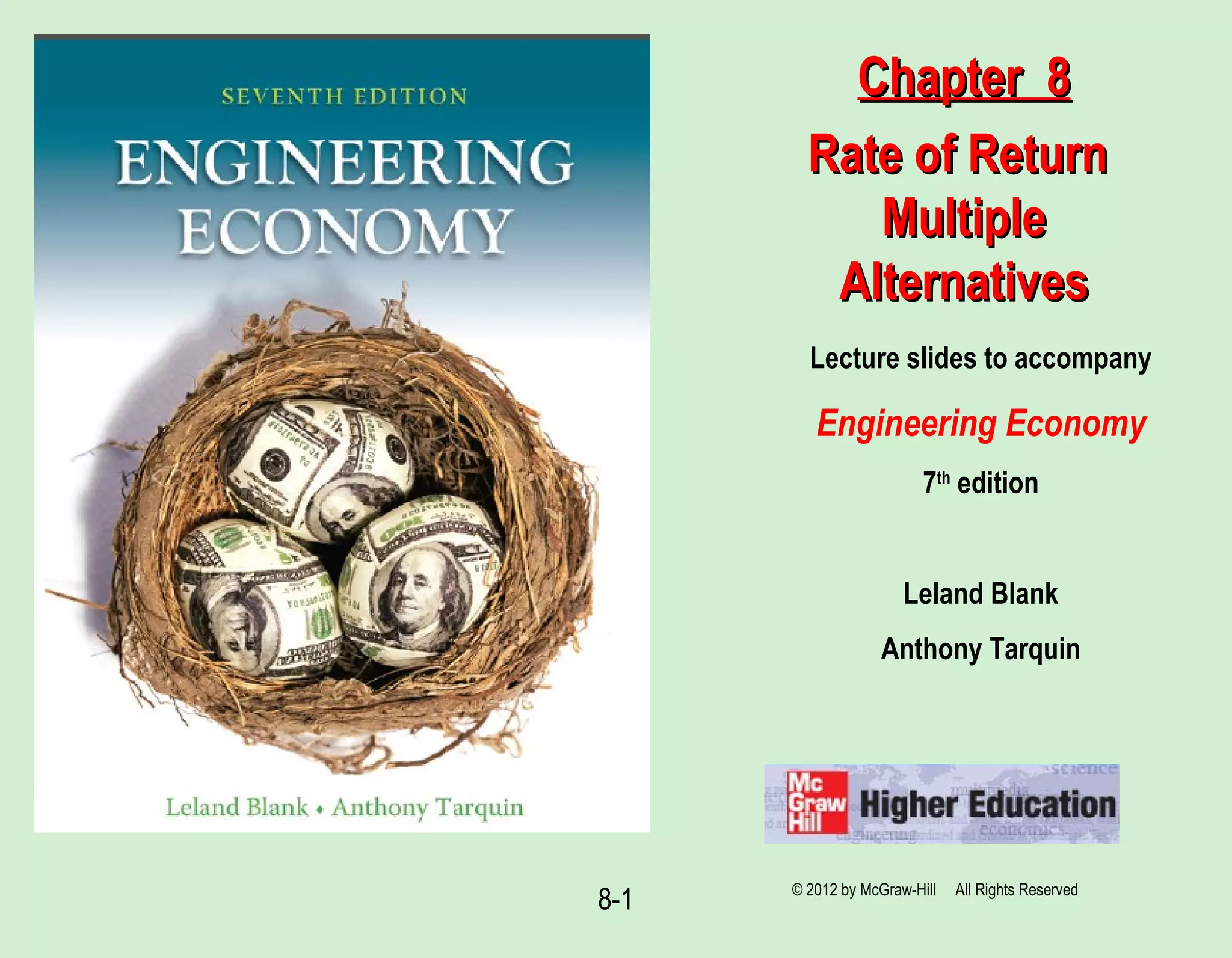

This document discusses rate of return analysis for multiple project alternatives. It introduces the concept of incremental rate of return analysis, which determines the rate of return on the additional investment required for a more expensive alternative. The key steps are: (1) calculate incremental cash flows between two alternatives, (2) determine the incremental rate of return (Δi*) on those cash flows, and (3) eliminate the more expensive alternative if Δi* is less than the minimum acceptable rate of return. This process is repeated to evaluate all alternatives two at a time until only one remains. Incremental analysis ensures the alternative selected maximizes overall return on the total capital available.

![8-3

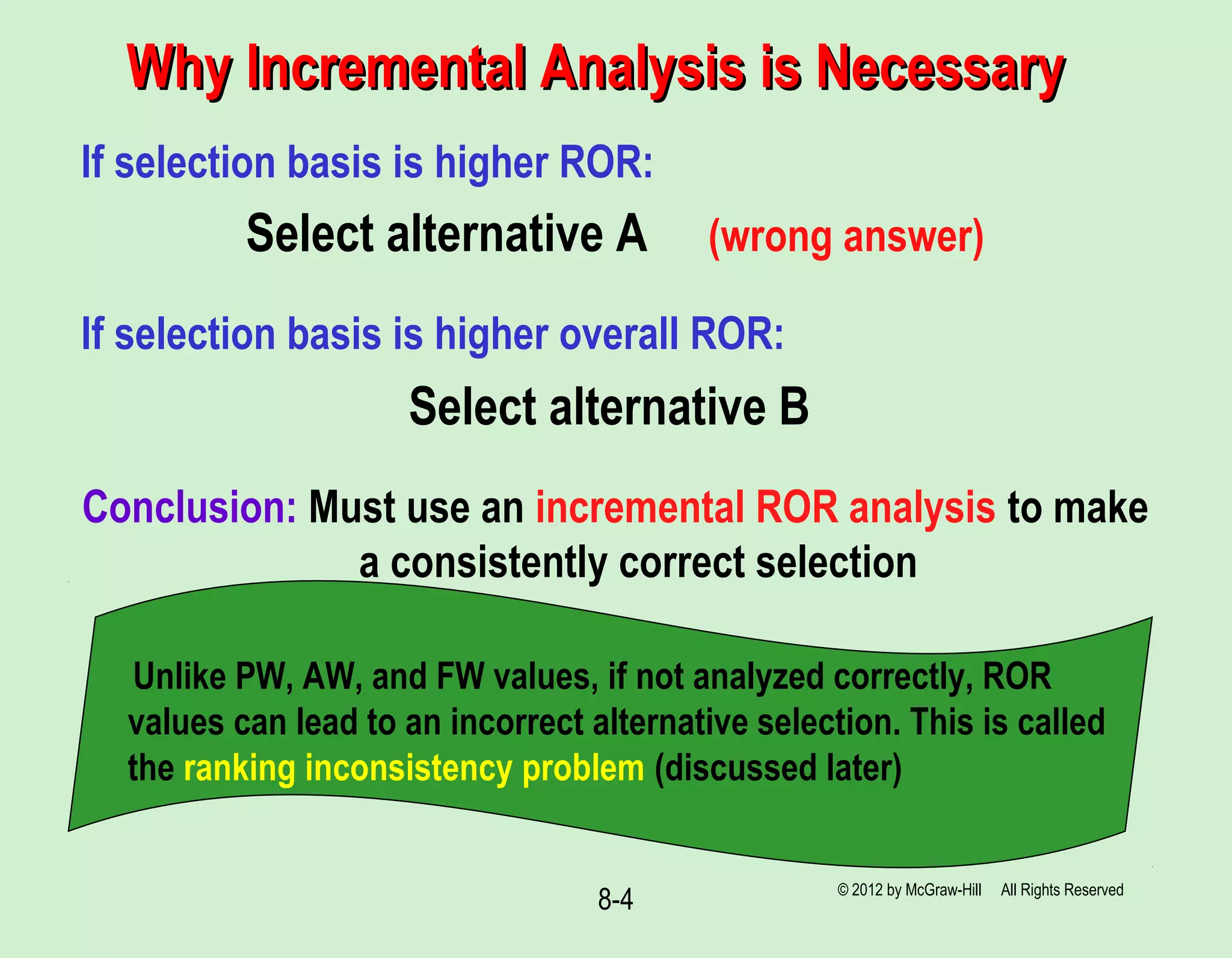

Why Incremental Analysis is NecessaryWhy Incremental Analysis is Necessary

Selecting the alternative with highest ROR may not

yield highest return on available capital

Must consider weighted average of total capital available

Capital not invested in a project is assumed to earn at MARR

Example: Assume $90,000 is available for investment and MARR = 16%

per year. If alternative A would earn 35% per year on investment of $50,000, and

B would earn 29% per year on investment of $85,000, the weighted averages are:

Overall RORA = [50,000(0.35) + 40,000(0.16)]/90,000 = 26.6%

Overall RORB = [85,000(0.29) + 5,000(0.16)]/90,000 = 28.3%

Which investment is better, economically?

© 2012 by McGraw-Hill All Rights Reserved](https://image.slidesharecdn.com/chapter8-roranalysisformultiplealternatives-140315184242-phpapp01/75/Chapter-8-ror-analysis-for-multiple-alternatives-3-2048.jpg)