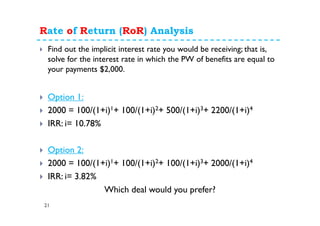

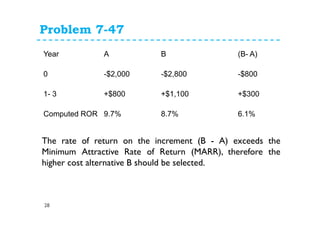

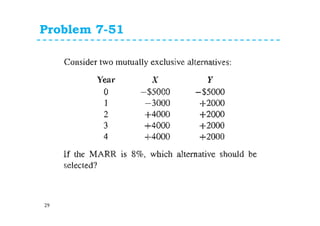

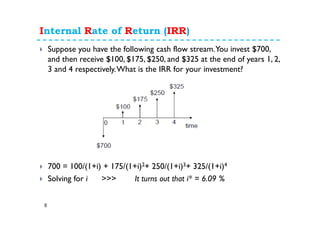

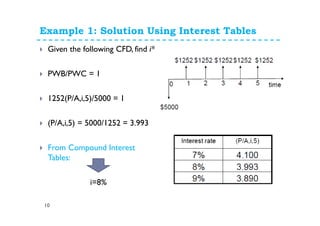

This document provides an overview of rate of return analysis techniques for evaluating engineering projects and investments. It defines internal rate of return as the interest rate that makes the net present value of a project's cash flows equal to zero. It discusses how to calculate IRR using tables, trial and error, or numerical methods. The document also covers incremental rate of return analysis for comparing competing alternatives, and defines the minimum attractive rate of return used for evaluating projects. Several examples are provided to illustrate IRR, incremental analysis, and solving practice problems.

![Problem 7-8

14

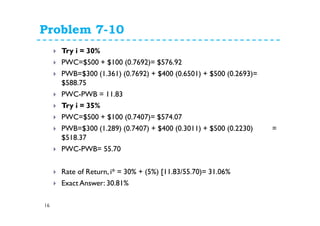

Try i = 7%

PWB=[$200 (3.387) - $50 (4.795)] (0.9346) = 409.03

Try i = 8%

PWB=[$200 (3.312) - $50 (4.650)] (0.9259) = $398.08

i* = 7% + (1%) [($409.03 - $400)/($409.03 - $398.04)]

= 7.82%

PWC=$400

PWB = [$200 (P/A, i%, 4) - $50 (P/G,

i%, 4)] (P/F, i%, 1)

PWC=PWB](https://image.slidesharecdn.com/8-150316005531-conversion-gate01-200618095823/85/8-150316005531-conversion-gate01-14-320.jpg)