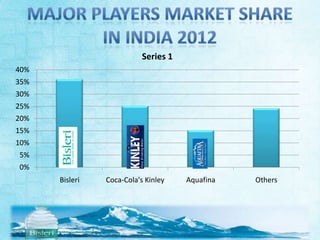

Bisleri is India's largest bottled water company. It was started in 1965 by an Italian entrepreneur who began packaging drinking water in Mumbai. In the late 1960s, Parle took over Bisleri and began bottling operations. Through expansions and ownership changes over the decades, Bisleri has become a leader in the bottled water industry in India, which is now worth an estimated Rs. 15,000 crores. Bisleri focuses on quality, brand image, and wide distribution network to maintain its dominant market share over competitors like Coca-Cola's Kinley and Pepsi's Aquafina.