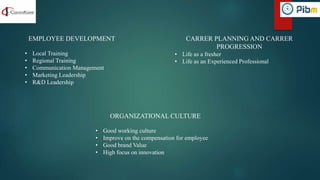

The document provides information on the FMCG sector in India including market size, growth rates, and segment breakdown. It notes that the FMCG market is expected to grow from $672B in FY16 to $1.1T in FY20. Food and personal care make up two-thirds of the sector's revenue. The top FMCG companies like HUL, ITC, and Dabur are analyzed with their sales and growth rates from FY16 to FY17. Porter's five forces model is applied to the industry. SWOT analyses are presented for a hair coloring product and CavinKare company. Financial analysis, organizational structure, recruitment process and employee programs at CavinKare are outlined