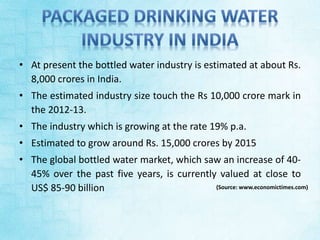

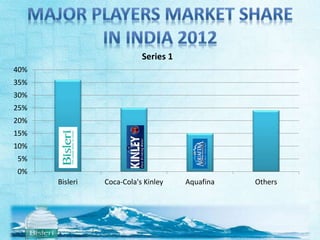

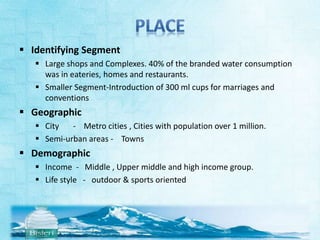

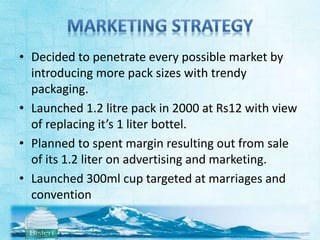

This document discusses the bottled water industry in India, focusing on Bisleri, a leading bottled water brand. It provides details on Bisleri's history starting in 1965 as the first bottled water company in India. It discusses Bisleri's growth over the decades under owners Parle and Ramesh Chauhan. Key points covered include Bisleri's market share, the size and growth of the Indian bottled water industry, Bisleri's product portfolio and pricing, target markets, and marketing campaigns.