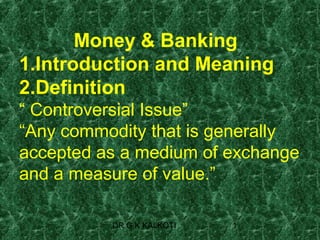

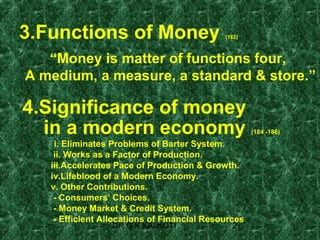

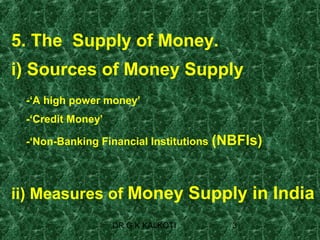

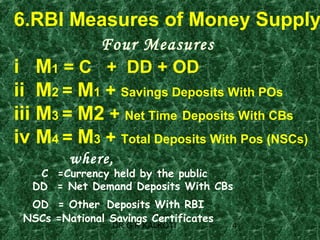

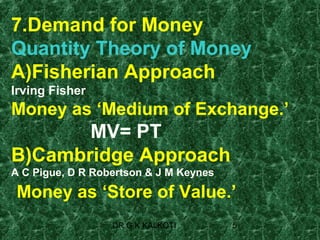

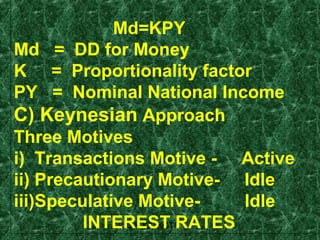

This document discusses money and banking. It defines money as any commodity that is generally accepted as a medium of exchange and a measure of value. Money serves four main functions: a medium of exchange, a measure of value, a standard of deferred payment, and a store of value. The supply of money comes from high powered money, credit money, and non-banking financial institutions. The Reserve Bank of India measures money supply using four measures: M1, M2, M3, and M4. The demand for money can be explained by the quantity theory of money, the Cambridge approach, and the Keynesian approach which identifies three motives for holding money: transactions, precautionary, and speculative.