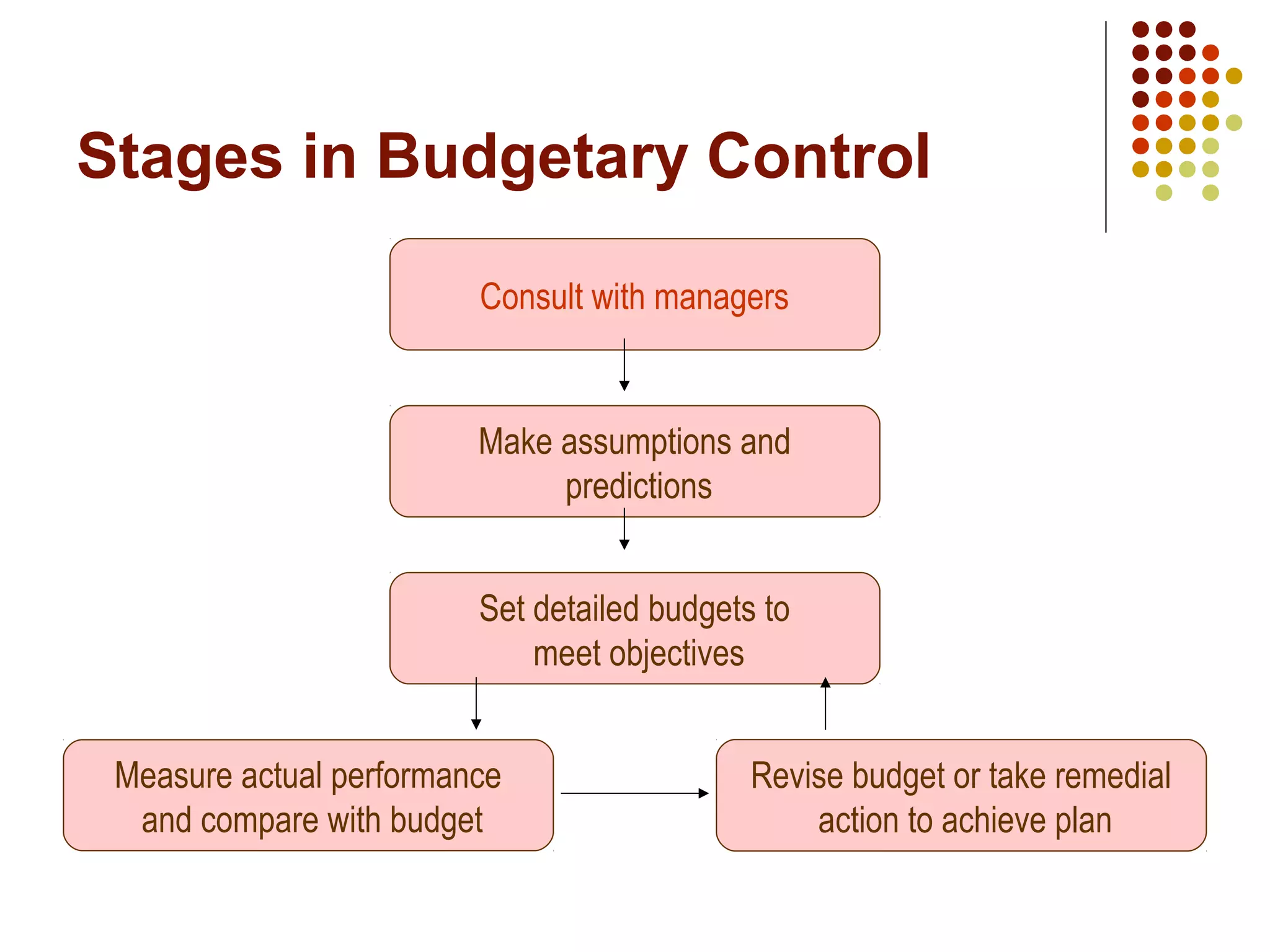

Budgetary control involves companies establishing budgets for revenue, expenses, assets and liabilities in advance of an accounting period. Managers prepare functional budgets for their departments, which are then combined into a master budget. Actual performance is continuously compared to budgets to ensure plans are achieved or provide a basis for revision. Budgetary control coordinates activities, provides responsibility accounting, motivates managers, and establishes a system for planning and control through regular budget reviews.