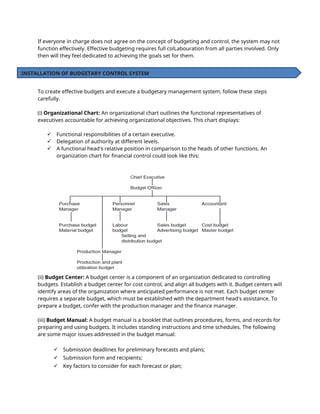

The document discusses the budgeting process, emphasizing its importance in financial planning and control within organizations. It outlines the key features of budgets and budgetary control, distinguishing between forecasting and budgeting, and highlights the objectives and limitations of budgetary control systems. Additionally, it details the roles of budget committees, controllers, and the necessity of collaboration for successful budget implementation and management.