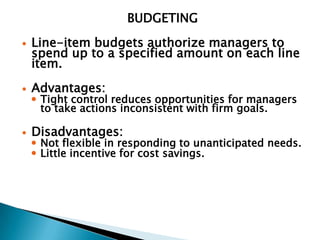

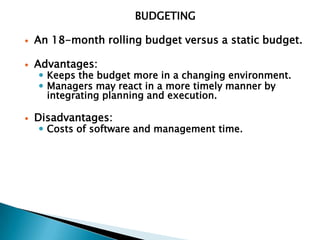

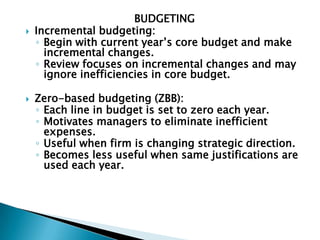

Budgets are management's forecasts of revenues, expenses, and profits used for both decision making and control. They communicate planning assumptions, set resource guidelines, and are used to evaluate performance against targets. The budget process separates decision rights between managers who initiate budgets and directors who ratify and monitor them.