The document defines what a budget is according to various sources and provides details about the key components of a government budget. A budget is a financial plan that estimates revenues and expenditures for a set period, usually a year. It includes estimates of taxes, borrowing, expenditures on programs and services. The budget helps allocate resources and implement economic policies.

![BUDGET IS CONCERNED WITH

THREE PERIODS

1. THE ACTUAL REVENUE AND

EXPENDITURE OF THE PREVIOUS YEAR [if

the current year is 2009-10 then 2008-09 will

be the preious year]

2. THE REVISED ESTIMATES OF REVENUE

AND EXPENDITURE OF THE CURRENT

YEAR.

3. ESTIMATES OF REVENUE AND

EXPENDITURE FOR THE NEXT FINANCIAL

YEAR.](https://image.slidesharecdn.com/presentation1-pptonbudget-130128052251-phpapp02/85/Presentation1-ppt-on-budget-10-320.jpg)

![COMPONENTS OF BUDGET

• Revenue receipts

• Capital receipts

• Revenue expenditure

• Capital expenditure

THUS A BUDGET HAS TWO MAIN

COMPONENTS :[A] RECEIPTS ,[B]

EXPENDITURE.](https://image.slidesharecdn.com/presentation1-pptonbudget-130128052251-phpapp02/85/Presentation1-ppt-on-budget-11-320.jpg)

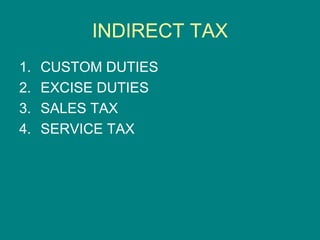

![COMPONERNTS OF BUDGET

• RECEIPTS

• A. REVENUE RECEIPTS [1+2 ]

• 1. TAX REVENUE

• 2. NON –TAX REVENUE

• B. CAPITAL RECEIPTS [3+5]

• 3.RECOVERY LOANS

• 4.OTHER RECEIPTS

• 5.BORROWING & OTHER LIABILITIES

• TOTAL RECEIPTS = A+B](https://image.slidesharecdn.com/presentation1-pptonbudget-130128052251-phpapp02/85/Presentation1-ppt-on-budget-12-320.jpg)

![A.REVENUE RECEIPTS D.REVENUE EXPEND.

A.1.TAX REVENUE 6.ON NON PLAN ACC.

2.NONTAX REV 7.ON PLAN ACCOUNT

B.CAPITAL RECEIPTS. E.CAPITAL EXP.[8+9]

[3+4+5]

3.RECOVERY OF LOAN 8.ON NON PLAN ACC.

4.OTHERB RECEIPTS 9.ON PLAN ACCOUNT

5.BORROWINGS AND F.TOTAL EXP.[D+E]

OTHER LIABILITIES G.BUDGE.DEFI-F-C

H.REV. DEFI D-A

C.TOTAL RECEIPTS-A+B I.FISCAL DEFICIT[F_(A+3+4)]](https://image.slidesharecdn.com/presentation1-pptonbudget-130128052251-phpapp02/85/Presentation1-ppt-on-budget-13-320.jpg)

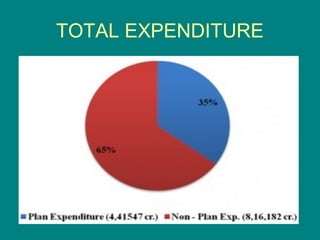

![EXPENDITURE

• EXPENDITURE

• A. REVENUE EXPENDITURE [1+2]

• 1 ON PLAN ACCOUNT

• 2 ON NON PLAN ACCOUNT

• B.CAPITAL EXPENDITURE](https://image.slidesharecdn.com/presentation1-pptonbudget-130128052251-phpapp02/85/Presentation1-ppt-on-budget-14-320.jpg)