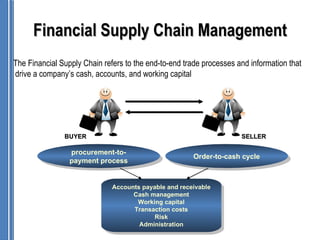

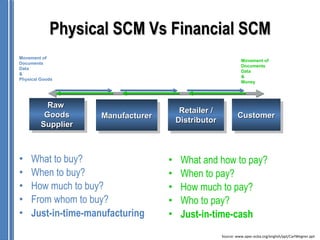

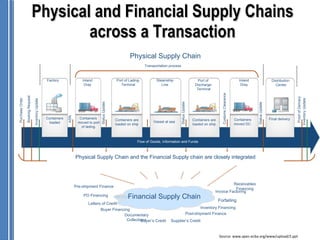

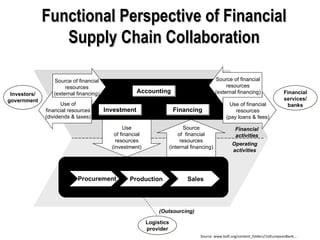

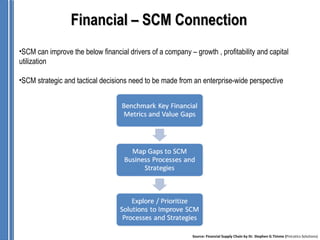

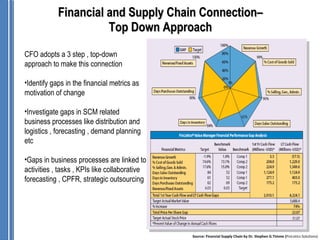

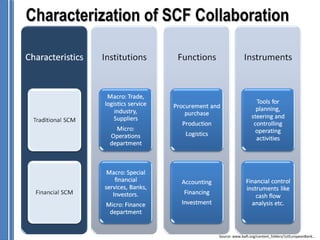

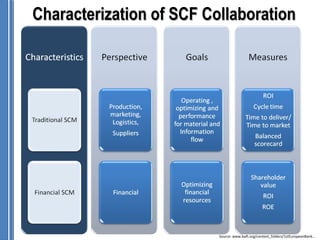

The document discusses financial supply chain management. It summarizes that the financial supply chain refers to the end-to-end trade processes and information that drive a company's cash, accounts, and working capital. It also compares physical supply chain management to financial supply chain management, noting they both involve the movement of documents, data, physical goods, and money. Key aspects of financial supply chain management discussed include order-to-cash cycles, accounts payable and receivable, cash management, working capital, and transaction costs.