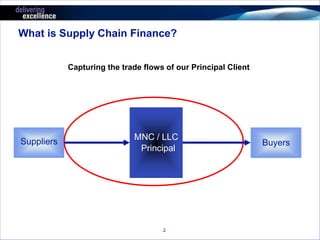

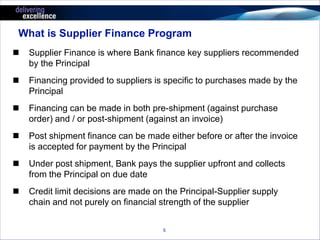

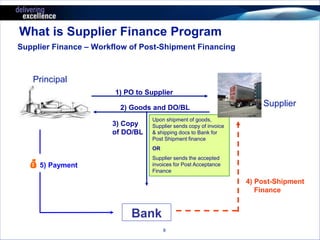

The document outlines the concept of supply chain financing and its benefits, including pre and post-shipment financing options for suppliers. It addresses challenges in procurement, such as liquidity issues and costs related to payment processing, while explaining how a supplier finance program can enhance access to working capital for suppliers. Additionally, it details key workflows and differences between local and regional supplier finance programs.