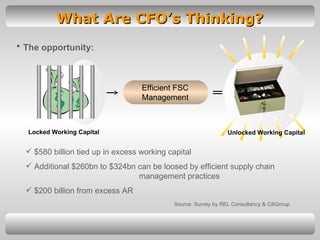

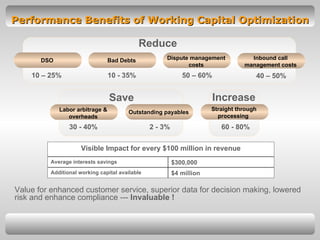

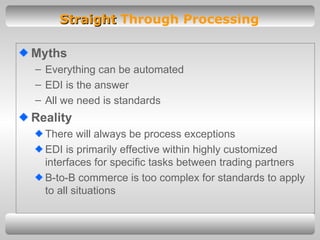

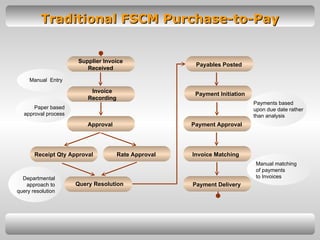

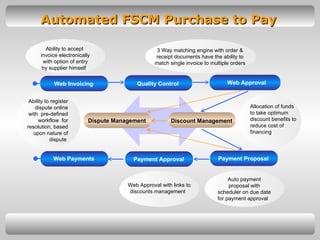

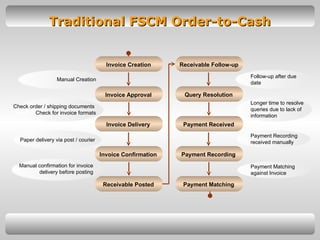

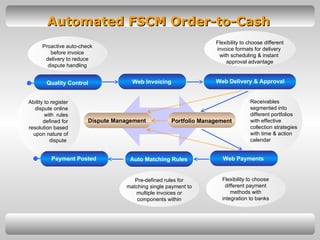

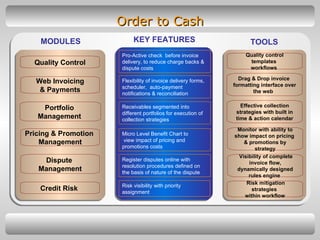

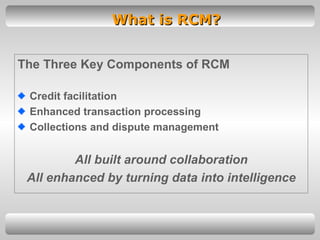

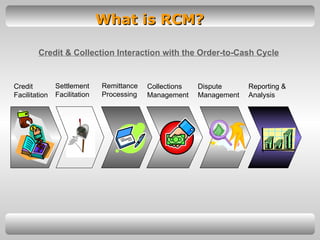

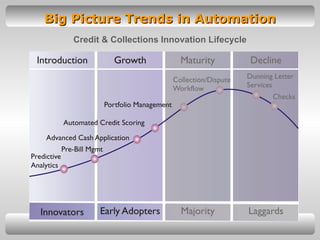

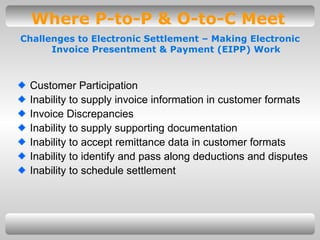

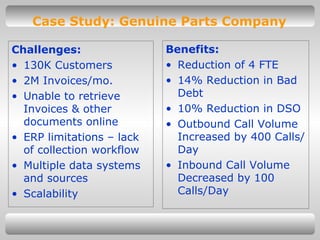

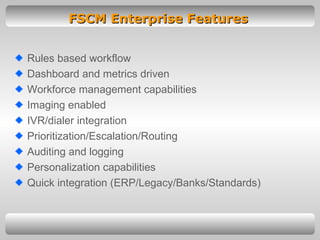

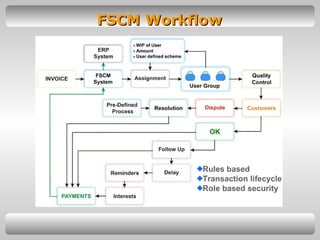

The document discusses challenges with traditional financial supply chain management (FSCM) processes and the benefits of automating FSCM through a rules-based workflow system. It outlines key components of traditional vs automated purchase-to-pay and order-to-cash processes. Automating can provide benefits like reduced DSO, lower dispute costs, and increased productivity by streamlining manual tasks and providing greater visibility into risks and opportunities. However, automating FSCM also faces challenges like overcoming functional silos and gaining management buy-in for new solutions and processes.