Sesa goa 2QFY2011 Result Update

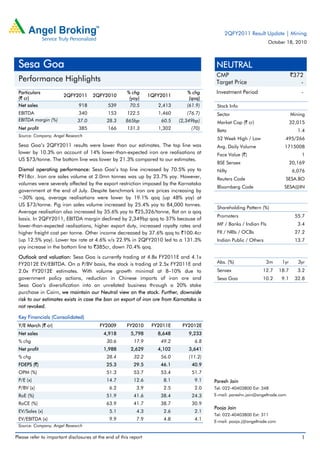

- 1. 2QFY2011 Result Update | Mining October 18, 2010 Sesa Goa NEUTRAL CMP `372 Performance Highlights Target Price - Particulars % chg % chg Investment Period - 2QFY2011 2QFY2010 1QFY2011 (` cr) (yoy) (qoq) Net sales 918 539 70.5 2,413 (61.9) Stock Info EBITDA 340 153 122.5 1,460 (76.7) Sector Mining EBITDA margin (%) 37.0 28.3 865bp 60.5 (2,349bp) Market Cap (` cr) 32,015 Net profit 385 166 131.3 1,302 (70) Beta 1.4 Source: Company, Angel Research 52 Week High / Low 495/266 Sesa Goa’s 2QFY2011 results were lower than our estimates. The top line was Avg. Daily Volume 1715008 lower by 10.3% on account of 14% lower-than-expected iron ore realisations at Face Value (`) 1 US $73/tonne. The bottom line was lower by 21.3% compared to our estimates. BSE Sensex 20,169 Dismal operating performance: Sesa Goa’s top line increased by 70.5% yoy to Nifty 6,076 `918cr. Iron ore sales volume at 2.0mn tonnes was up by 23.7% yoy. However, Reuters Code SESA.BO volumes were severely affected by the export restriction imposed by the Karnataka Bloomberg Code SESA@IN government at the end of July. Despite benchmark iron ore prices increasing by ~30% qoq, average realisations were lower by 19.1% qoq (up 48% yoy) at US $73/tonne. Pig iron sales volume increased by 25.4% yoy to 84,000 tonnes. Shareholding Pattern (%) Average realisation also increased by 35.6% yoy to `25,326/tonne, flat on a qoq Promoters 55.7 basis. In 2QFY2011, EBITDA margin declined by 2,349bp qoq to 37% because of lower-than-expected realisations, higher export duty, increased royalty rates and MF / Banks / Indian Fls 3.4 higher freight cost per tonne. Other income decreased by 37.6% qoq to `100.4cr FII / NRIs / OCBs 27.2 (up 12.5% yoy). Lower tax rate at 4.6% v/s 22.9% in 2QFY2010 led to a 131.3% Indian Public / Others 13.7 yoy increase in the bottom line to `385cr, down 70.4% qoq. Outlook and valuation: Sesa Goa is currently trading at 4.8x FY2011E and 4.1x FY2012E EV/EBITDA. On a P/BV basis, the stock is trading at 2.5x FY2011E and Abs. (%) 3m 1yr 3yr 2.0x FY2012E estimates. With volume growth minimal at 8–10% due to Sensex 12.7 18.7 3.2 government policy actions, reduction in Chinese imports of iron ore and Sesa Goa 10.2 9.1 32.8 Sesa Goa’s diversification into an unrelated business through a 20% stake purchase in Cairn, we maintain our Neutral view on the stock. Further, downside risk to our estimates exists in case the ban on export of iron ore from Karnataka is not revoked. Key Financials (Consolidated) Y/E March (` cr) FY2009 FY2010 FY2011E FY2012E Net sales 4,918 5,798 8,648 9,233 % chg 30.6 17.9 49.2 6.8 Net profit 1,988 2,629 4,102 3,641 % chg 28.4 32.2 56.0 (11.2) FDEPS (`) 25.3 29.5 46.1 40.9 OPM (%) 51.3 53.7 53.4 51.7 P/E (x) 14.7 12.6 8.1 9.1 Paresh Jain P/BV (x) 6.2 3.9 2.5 2.0 Tel: 022-40403800 Ext: 348 RoE (%) 51.9 41.6 38.4 24.3 E-mail: pareshn.jain@angeltrade.com RoCE (%) 63.9 41.7 38.7 30.9 Pooja Jain EV/Sales (x) 5.1 4.3 2.6 2.1 Tel: 022-40403800 Ext: 311 EV/EBITDA (x) 9.9 7.9 4.8 4.1 E-mail: pooja.j@angeltrade.com Source: Company, Angel Research Please refer to important disclosures at the end of this report 1

- 2. Sesa Goa|2QFY2011 Result Update Exhibit 1: 2QFY2011 performance (Consolidated) (` cr) 2QFY11 2QFY10 yoy (%) 1HFY11 1HY10 yoy (%) Net sales 918 539 70.5 3,331 1,550 114.9 Raw material 55 (13) (527.8) 149 114 30.5 % of net sales 6.0 (2.4) 4.5 7.3 Consumption of stores 61 53 16.8 135 106 27.3 % of net sales 6.7 9.8 4.1 6.8 Staff cost 47 33 39.5 91 73 24.9 % of net sales 5.1 6.2 2.7 4.7 Export duty 53 5 1,031.1 180 9 1,998.8 % of net sales 5.7 0.9 5.4 0.6 Other expenditure 357 305 17.0 980 648 51.4 % of net sales 38.9 56.7 29.4 41.8 Total expenditure 579 386 49.9 1,532 944 62.2 % of net sales 63.0 71.7 46.0 60.9 EBITDA 340 153 122.5 1,799 606 197.0 % of net sales 37.0 28.3 865.4 54.0 39.1 1,493.5 Interest 14 2 607.6 28 4 592.0 Depreciation 19 20 (4.0) 39 35 8.8 Other income 100 89 12.5 261 164 59.0 Exceptional items 0 0 Profit before tax 407 220 85.1 1,994 731 172.9 % of net sales 44.3 40.8 59.9 47.1 Tax 19 50 (62.5) 302 137 120.1 % of PBT 4.6 22.9 15.1 18.8 Profit after tax 385 166 131.3 1,687 589 186.5 % of net sales 41.9 30.9 50.6 38.0 EPS (`) 4.4 1.9 131.3 19.5 7.3 167.4 Source: Company, Angel Research Exhibit 2: 2QFY2011 - Actual v/s Angel estimates (` cr) 1QFY11A 1QFY11E Variation (%) Net sales 918 1,024 (10.3) EBITDA 340 533 (36.3) EBITDA margin (%) 37.0 52.1 (1,505bp) PBT 407 1,588 (74.4) PAT 385 489 (21.3) Source: Company, Angel Research October 18, 2010 2

- 3. Sesa Goa|2QFY2011 Result Update Volume growth affected by government actions Sesa Goa reported 70.5% yoy increase in top line to `918cr during 2QFY2011. Iron ore sales volume at 2.0mn tonnes increased by 23.7% yoy. While Goa accounted for ~ 1.0mn tonnes of iron ore sales, Karnataka and Orissa accounted for 0.5mn tonnes each. China accounted for ~75% of the sales volume and the domestic market accounted for 8% of the sales volume. Volumes were, however, severely affected by the temporary export restriction imposed by the Karnataka government at the end of July. During 2QFY2011, iron ore production fell by 3.0% yoy to 3.2mn tonnes. Average iron ore realisations were lower by 19.1% qoq (up 48% yoy) at US $73/tonne. Pig iron sales volume increased by 25.4% yoy to 84,000 tonnes. Average realisation also increased by 35.6% yoy to `25,326/tonne, flat on a qoq basis. Exhibit 3: Iron ore sales increased by 23.7% yoy Exhibit 4: Cost/tonne trending up 8.0 50 100 40 80 6.0 (US $/tonne) 60 (mn tonne) 30 4.0 (%) 20 40 2.0 20 10 0 0.0 0 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 Volume - LHS change (yoy) - RHS Revenue/tonne Cost/tonne EBIT/tonne Source: Company, Angel Research Source: Company, Angel Research EBITDA margin declines In 2QFY2011, EBITDA margin declined by 2,349bp qoq to 37% on account of lower-than-expected realisations, higher export duty, increased royalty rates and higher freight cost per tonne. Freight cost per tonne increased by US $20/tonne from Orissa and Karnataka. Other income decreased by 37.6% qoq to `100.4cr (up 12.5% yoy). Lower tax rate at 4.6% in 2QFY2011 v/s 22.9% in 2QFY2010 led to a 131.3% yoy increase in the bottom line to `385cr, down 70.4% qoq. Exhibit 5: EBITDA margin tend Exhibit 6: Net profit trend 1,600 80 1,400 80 1,400 1,200 1,200 60 60 1,000 1,000 800 (%) (` cr) 800 40 (` cr) (%) 40 600 600 400 20 400 20 200 200 0 0 0 0 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 EBITDA - LHS EBITDA margin - RHS Net profit - LHS Net margin - RHS Source: Company, Angel Research Source: Company, Angel Research October 18, 2010 3

- 4. Sesa Goa|2QFY2011 Result Update Key highlights Management reduced its sales volume guidance for FY2011 to 10% from 20–25% earlier. Due to the export ban from Karnataka, the company witnessed sales loss of 1mn tonne during the quarter. Further, downward revision in sales volume can be expected in case the ban on export of iron ore from Karnataka is not revoked. Iron ore inventory at the end of the quarter stood at 5.3mn tonnes. Excluding the intercorporate deposit of `1,000cr, extended to Vedanta Alumnium, the company had cash and cash equivalents of `7,575cr. The Extra Ordinary General meeting passed a resolution to increase the company’s investment limit up to `16,000cr and increased its borrowing limit up to `15,000cr. Average royalty rate charged on iron ore stood at `150–175/tonne. Currently, Sesa Goa’s mines in Karnataka and Goa enjoy tax benefits, which will expire by March 2011. October 18, 2010 4

- 5. Sesa Goa|2QFY2011 Result Update Outlook Declining crude steel production in China… For the first eight months of CY2010, China produced 426mn tonnes of crude steel, up 15.6% YTD. However, over the last three months, the country has witnessed a decline in steel production on an mom basis, with production degrowing by 4.2%, 3.8% and 0.2% in June, July and August 2010, respectively. Production growth, which was 20%+ yoy during the first five months of CY2010, has also tapered off in the last three months. In August 2010, production fell by 1.3% yoy. Exhibit 7: China steel production degrowing since June Exhibit 8: China steel production slowing annually 60 20 60 50 50 15 50 40 10 30 40 40 (mn tonnes) (mn tonnes) 5 20 30 30 (%) (%) 0 10 20 20 (5) 0 10 (10) 10 (10) 0 (15) 0 (20) Jan-07 Nov-07 Sep-08 Jul-09 May-10 Jan-07 Nov-07 Sep-08 Jul-09 May-10 Chinese steel production (LHS) mom change (RHS) Chinese steel production (LHS) yoy change (RHS) Source: Bloomberg, Angel Research Source: Bloomberg, Angel Research …coupled with increasing domestic iron ore supplies With iron ore prices trading above US $100/tonne, many high-cost iron ore mines in China have started operations, thus leading to a surge in iron ore production. For the first eight months of CY2010, domestic iron ore production increased by 28.5% to 681mn tonnes. From June–August 2010, iron ore production was at an all-time high of ~100mn tonnes/month. Exhibit 9: China domestic iron ore prod. – All-time high Exhibit 10: China domestic iron ore prod. up annually 120 40 120 80 100 100 60 20 80 80 (mn tonnes) (mn tonnes) 40 60 0 60 (%) (%) 20 40 40 (20) 20 20 0 0 (40) 0 (20) Jan-07 Nov-07 Sep-08 Jul-09 May-10 Jan-07 Nov-07 Sep-08 Jul-09 May-10 Iron ore production (LHS) mom change (RHS) Iron ore production (LHS) yoy change (RHS) Source: Bloomberg, Angel Research Source: Bloomberg, Angel Research October 18, 2010 5

- 6. Sesa Goa|2QFY2011 Result Update …leading to reduced demand for imported ore Demand for imported ore has been declining, as domestic Chinese iron ore production is outpacing steel production. Consequently, imports have witnessed successive declines over the last five months on a yoy basis. In July, August and September 2010, imports declined by 14.7%, 11.7% and 10.2%, respectively. Iron ore inventory at Chinese ports has also increased over the last one month from 69mn tonnes to 73.7mn tonnes. Exhibit 11: Falling iron ore imports to China Exhibit 12: Increasing inventory at Chinese ports 70 100 80 78 60 80 76 50 74 60 (mn tonnes) (mn tonnes) 72 40 40 (%) 70 30 68 20 66 20 64 10 0 62 0 (20) 60 Jan-07 Nov-07 Sep-08 Jul-09 May-10 Jan 1 26-Feb 16-Apr 28-May 9-Jul 20-Aug 15-Oct 2010 China Iron ore imports (LHS) yoy change (RHS) Iron ore inventory at Chinese ports Source: Bloomberg, Angel Research Source: Bloomberg, Angel Research However, prices continue to remain firm in the spot market on account of supply disruptions from India as the Karnataka government has banned iron ore exports and the Orissa government has imposed strict restrictions to crack down illegal mining in the state. Consequently, India’s share in total imports to China has fallen from ~20% at the beginning of the year to 11.4% in August 2010. Exhibit 13: Spot iron ore prices firm... Exhibit 14: ...as imports from India decline 250 16 35 14 30 200 12 25 (US $/tonne) 10 (mn tonnes) 150 20 8 (%) 100 15 6 10 50 4 2 5 0 0 0 Jan-07 Nov-07 Sep-08 Jul-09 May-10 Jan-07 Nov-07 Sep-08 Jul-09 May-10 Iron ore prices India's exports into China (LHS) % of total Chinese imports (RHS) Source: Bloomberg, Angel Research Source: Bloomberg, Angel Research October 18, 2010 6

- 7. Sesa Goa|2QFY2011 Result Update Valuation Sesa Goa is currently trading at 4.8x FY2011E and 4.1x FY2012E EV/EBITDA. On a P/BV basis, the stock is trading at 2.5x FY2011E and 2.0x FY2012E estimates. With volume growth minimal at 8–10% due to government policy actions, reduction in Chinese imports of iron ore and Sesa Goa’s diversification into an unrelated business through a 20% stake purchase in Cairn, we maintain our Neutral view on the stock. Further, downside risk to our estimates exists in case the ban on export of iron ore from Karnataka is not revoked. Exhibit 15: Key assumptions Earlier Revised FY11E FY12E FY11E FY12E Iron ore Sales volume (mn tonnes) 25.0 27.0 22.8 24.6 Average realisation (US $/tonne) 80.0 80.0 77.5 75.0 Coke Sales volume (tonnes) 260,000 365,000 260,000 365,000 Average realisation (US $/tonne) 398 425 398 425 Coking coal Average cost (US $/tonne) 225 225 225 225 Pig iron Sales volume (tonnes) 237,500 406,250 237,500 406,250 Average realisation (US $/tonne) 475 475 475 500 Royalty (US $/tonne) 4.0 4.0 4.0 4.0 Export duty (US $/tonne) 4.9 4.9 4.6 4.6 US $/` 45.6 45.0 45.6 45.0 Source: Angel Research We have revised our estimates for FY2011E and FY2012E to factor in lower volume growth and realisations. Exhibit 16: Change in estimates (` cr) Earlier estimates Revised estimates Upgrade/(downgrade) (%) FY11E FY12E FY11E FY12E FY11E FY12E Net sales 9,778 10,586 8,648 9,233 (11.6) (12.8) EBITDA 5,358 5,661 4,621 4,777 (13.8) (15.6) EBITDA margin (%) 54.8 53.5 53.4 51.7 (137bp) (173bp) PBT 5,795 6,251 5,057 5,377 (12.7) (14.0) PAT 4,601 4,404 4,013 3,779 (12.8) (14.2) PAT margin (%) 47.1 41.6 46.4 40.9 (66bp) (67bp) Source: Angel Research October 18, 2010 7

- 8. Sesa Goa|2QFY2011 Result Update Exhibit 17: EPS – Angel forecast v/s consensus Angel forecast Bloomberg consensus Variation Year (%) (%) (%) FY2011E 46.1 49.1 (6.10) FY2012E 40.9 55.4 (26.14) Source: Bloomberg, Angel Research Exhibit 18: Recommendation summary Companies CMP Target Price Reco. Mcap Upside P/E (x) P/BV (x) EV/EBITDA (x) RoE (%) RoCE (%) (`) (`) (` cr) FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E SAIL 222 - Neutral 91,695 - 14.6 12.9 2.4 2.1 9.6 8.3 17.9 17.6 16.3 16.9 Tata Steel 627 702 Accumulate 55,592 12.0 8.6 7.8 1.7 1.4 6.4 5.7 21.2 19.7 13.2 14.1 JSW Steel 1,318 - Neutral 33,680 - 17.3 13.3 1.7 1.5 7.9 6.2 13.9 12.4 12.5 12.6 Bhushan Steel 515 396 Sell 10,936 (23.1) 11.3 8.7 2.6 2.0 9.2 7.5 26.0 26.1 12.6 14.0 Sesa Goa 372 - Neutral 33,134 - 8.1 9.1 2.5 2.0 4.8 4.1 38.4 24.3 38.7 30.9 NMDC 286 - Neutral 113,391 - 17.0 13.4 5.8 4.3 10.8 7.9 39.3 37.1 52.2 49.2 Hindalco 211 - Neutral 40,455 - 11.2 10.4 1.6 1.4 7.2 6.7 15.1 14.2 10.3 10.0 Nalco 408 316 Sell 26,288 (22.5) 25.8 21.8 2.4 2.2 14.9 11.6 9.7 10.7 10.7 12.5 Sterlite 176 196 Accumulate 59,203 11.2 12.3 8.9 1.4 1.2 6.6 4.5 11.6 14.2 11.1 14.1 Hindustan Zinc 1,220 - Neutral 51,549 - 12.6 9.8 2.4 1.9 7.7 5.1 20.4 21.6 20.7 22.3 Source: Angel Research Exhibit 19: EV/EBITDA band 35,000 7.0x 30,000 5.5x 25,000 20,000 4.0x ( `cr) 15,000 2.5x 10,000 5,000 1.0x 0 Apr-02 Apr-03 Apr-04 Apr-05 Apr-06 Apr-07 Apr-08 Apr-09 Apr-10 Source: Bloomberg, Angel Research October 18, 2010 8

- 9. Sesa Goa|2QFY2011 Result Update Exhibit 20: P/E band 600 12.0x 500 400 9.0x 300 (`) 6.0x 200 3.0x 100 0 Apr-02 Apr-03 Apr-04 Apr-05 Apr-06 Apr-07 Apr-08 Apr-09 Apr-10 Source: Bloomberg, Angel Research Exhibit 21: P/BV band 800 700 4.0x 600 500 3.0x (`) 400 2.0x 300 200 1.0x 100 0 Apr-02 Apr-03 Apr-04 Apr-05 Apr-06 Apr-07 Apr-08 Apr-09 Apr-10 Source: Bloomberg, Angel Research October 18, 2010 9

- 10. Sesa Goa|2QFY2011 Result Update Profit & Loss Statement (Consolidated) Y/E March (` cr) FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E Gross sales 2,236 3,845 4,991 5,842 8,821 9,417 Less: Excise duty 60 79 73 44 173 185 Net sales 2,176 3,766 4,918 5,798 8,648 9,233 Other operating income 42 57 41 60 0 0 Total operating income 2,218 3,823 4,959 5,858 8,648 9,233 % chg 20.2 72.4 29.7 18.1 47.6 6.8 Total expenditure 1,255 1,519 2,417 2,710 4,028 4,456 Net raw materials 466 477 494 534 631 803 Other mfg costs 169 294 394 391 656 692 Personnel 64 68 77 130 118 135 Other 556 680 1,452 1,654 2,623 2,826 EBITDA 963 2,303 2,542 3,149 4,621 4,777 % chg 11.6 139.2 10.4 23.9 46.7 3.4 (% of Net sales) 43.4 60.3 51.3 53.7 53.4 51.7 Depreciation 39 50 52 75 78 111 EBIT 924 2,253 2,490 3,074 4,542 4,666 % chg 10.9 144.0 10.5 23.4 47.8 2.7 (% of Net sales) 41.6 58.9 50.2 52.5 52.5 50.5 Interest charges 3 3 4 56 47 2 Other income 45 74 224 426 561 720 (% of PBT) 4.7 3.2 8.3 12.4 11.1 13.4 Share in profit of asso. - - - - - - Recurring PBT 966 2,325 2,710 3,445 5,057 5,384 % chg 12.5 140.7 16.6 27.1 46.8 6.5 Extra. Inc/(Expense) - - - - - - PBT (reported) 966 2,325 2,710 3,445 5,057 5,384 Tax 315 776 715 806 910 1,777 (% of PBT) 32.6 33.4 26.4 23.4 18.0 33.0 PAT (reported) 651 1,549 1,995 2,639 4,147 3,607 Add: Earnings of asso. - - - - - - Less: Minority interest 0 0 (7) (10) (45) 34 Extra. Expense/(Inc.) - - - - - - PAT after MI (reported) 651 1,549 1,988 2,629 4,102 3,641 ADJ. PAT 651 1,549 1,988 2,629 4,102 3,641 % chg 13.2 137.9 28.4 32.2 56.0 (11.2) (% of Net sales) 29.4 40.5 40.1 44.9 47.4 39.4 Basic EPS (`) 8.3 19.7 25.3 31.6 47.7 40.9 Fully Diluted EPS (`) 8.3 19.7 25.3 29.5 46.1 40.9 % chg 13.2 137.9 28.4 17.0 56.0 (11.2) October 18, 2010 10

- 11. Sesa Goa|2QFY2011 Result Update Balance Sheet (Consolidated) Y/E March (` cr) FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E SOURCES OF FUNDS Equity share capital 39 39 79 83 89 89 Reserves & surplus 1,570 2,904 4,637 7,835 13,332 16,457 Shareholders’ funds 1,609 2,943 4,716 7,918 13,421 16,546 Share warrants - - - - - - Minority interest 19 27 33 43 88 55 Total loans - - 2 1,961 44 44 Deferred tax liability 65 66 66 75 75 75 Total liabilities 1,693 3,036 4,817 9,997 13,628 16,721 APPLICATION OF FUNDS Gross block 722 770 886 2,751 2,901 3,727 Less: Acc. depreciation 262 294 342 574 652 763 Net block 460 476 544 2,177 2,249 2,964 Capital work-in-progress 20 21 49 79 404 104 Goodwill - - - - - - Investments 845 2,051 3,125 4,565 4,565 4,565 Current assets 630 864 1,683 4,416 7,643 10,352 Cash 21 21 18 2,392 5,444 7,965 Loans & advances 39 59 1,103 1,146 1,146 1,146 Other 569 784 562 879 1,053 1,241 Current liabilities 262 376 584 1,240 1,232 1,264 Net current assets 368 488 1,099 3,176 6,410 9,088 Mis. exp. not written off - - - - - - Total assets 1,693 3,036 4,817 9,997 13,628 16,721 Note: Cash and bank balance include deposits October 18, 2010 11

- 12. Sesa Goa|2QFY2011 Result Update Cash Flow Statement (Consolidated) Y/E March (` cr) FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E Profit before tax 966 2,325 2,710 3,445 5,057 5,384 Depreciation 39 50 52 75 78 111 Change in working capital (24) (170) 314 179 (382) (156) Less: Other income (43) (71) (221) (363) - - Direct taxes paid 324 747 721 764 910 1,777 Cash flow from operations 614 1,387 2,134 2,571 3,844 3,563 (Inc.)/Dec. in fixed assets (112) (67) (147) (149) (476) (526) (Inc.)/Dec. in investments (371) (1,205) (965) (3,078) - - (Inc.)/Dec. in loans & adv. Other income 42 69 113 (2,168) - - Cash flow from investing (441) (1,203) (999) (5,394) (476) (526) Issue of equity - - - 537 1,916 - Inc./(Dec.) in loans (10) - - 2,358 (1,916) - Dividend paid (Incl. tax) 180 184 138 206 316 515 Others - - 1,001 6 - - Cash flow from financing (190) (184) (1,139) 2,682 (316) (515) Inc./(Dec.) in cash (16) (0) (3) (141) 3,052 2,521 Opening cash balances 37 21 21 174 2,392 5,444 Closing cash balances 21 21 18 34 5,444 7,965 October 18, 2010 12

- 13. Sesa Goa|2QFY2011 Result Update Key Ratios Y/E March FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E Valuation ratio (x) P/E (on FDEPS) 45.0 18.9 14.7 12.6 8.1 9.1 P/CEPS 42.4 18.3 14.4 11.4 7.9 8.8 P/BV 18.2 9.9 6.2 3.9 2.5 2.0 Dividend yield (%) 0.5 0.6 0.6 0.9 1.3 1.3 EV/Sales 12.8 7.1 5.1 4.3 2.6 2.1 EV/EBITDA 29.5 11.8 9.9 7.9 4.8 4.1 EV/Total assets 16.8 9.0 5.2 2.5 1.6 1.2 Per share data (`) EPS (Basic) 8.3 19.7 25.3 31.6 47.7 40.9 EPS (fully diluted) 8.3 19.7 25.3 29.5 46.1 40.9 Cash EPS 8.8 20.3 25.9 32.5 47.0 42.2 DPS 2.0 2.3 2.3 3.3 5.0 5.0 Book value 20.4 37.4 59.9 95.3 150.8 186.0 DuPont analysis EBIT margin 41.6 58.9 50.2 52.5 52.5 50.5 Tax retention ratio (%) 67.4 66.6 73.6 76.6 82.0 67.0 Asset turnover (x) 2.9 4.4 3.8 2.5 2.6 2.4 RoIC (post-tax) 82.3 172.0 142.2 101.6 114.1 81.5 Cost of debt - - - - - - Leverage (x) - - - - - - Operating RoE 82.3 172.0 142.2 101.6 114.1 81.5 Returns (%) RoCE (pre-tax) 63.9 96.2 63.9 41.7 38.7 30.9 Angel RoIC (pre-tax) 129.0 264.5 198.5 136.3 150.3 130.4 RoE 47.2 68.0 51.9 41.6 38.4 24.3 Turnover ratios (x) Asset T/o 3.4 5.1 6.0 3.2 3.1 2.8 (gross block) Inventory (days) 247 234 213 261 285 270 Receivables (days) 43 35 28 20 22 24 Payables (days) 95 102 170 351 300 250 WC capital (days) 75 53 33 12 12 21 Solvency ratios (x) Net debt to equity (0.5) (0.7) (0.9) (0.8) (0.8) (0.8) Net debt to EBITDA (0.9) (0.9) (1.6) (1.9) (2.4) (2.8) Interest coverage 311.2 819.4 583.2 55.4 97.6 2,332.9 October 18, 2010 13

- 14. Sesa Goa|2QFY2011 Result Update Research Team Tel: 022 - 4040 3800 E-mail: research@angeltrade.com Website: www.angeltrade.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report. Disclosure of Interest Statement Sesa Goa 1. Analyst ownership of the stock No 2. Angel and its Group companies ownership of the stock Yes 3. Angel and its Group companies' Directors ownership of the stock No 4. Broking relationship with company covered No Note: We have not considered any Exposure below `1 lakh for Angel, its Group companies and Directors. Ratings (Returns) : Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%) Reduce (-5% to 15%) Sell (< -15%) October 18, 2010 14