NTPC

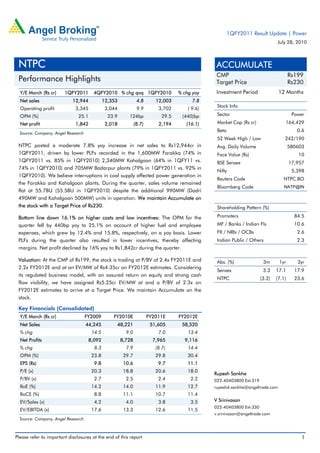

- 1. 1QFY2011 Result Update | Power July 28, 2010 NTPC ACCUMULATE CMP Rs199 Performance Highlights Target Price Rs230 Y/E March (Rs cr) 1QFY2011 4QFY2010 % chg qoq 1QFY2010 % chg yoy Investment Period 12 Months Net sales 12,944 12,353 4.8 12,003 7.8 Stock Info Operating profit 3,345 3,044 9.9 3,702 ( 9.6) OPM (%) 25.1 23.9 124bp 29.5 (440)bp Sector Power Net profit 1,842 2,018 (8.7) 2,194 (16.1) Market Cap (Rs cr) 164,429 Beta 0.6 Source: Company, Angel Research 52 Week High / Low 242/190 NTPC posted a moderate 7.8% yoy increase in net sales to Rs12,944cr in Avg. Daily Volume 580603 1QFY2011, driven by lower PLFs recorded in the 1,600MW Farakka (74% in Face Value (Rs) 10 1QFY2011 vs. 85% in 1QFY2010) 2,340MW Kahalgoan (64% in 1QFY11 vs. BSE Sensex 17,957 74% in 1QFY2010) and 705MW Badarpur plants (79% in 1QFY2011 vs. 92% in Nifty 5,398 1QFY2010). We believe interruptions in coal supply affected power generation in Reuters Code NTPC.BO the Farakka and Kahalgoan plants. During the quarter, sales volume remained Bloomberg Code NATP@IN flat at 55.7BU (55.5BU in 1QFY2010) despite the additional 990MW (Dadri 490MW and Kahalgoan 500MW) units in operation. We maintain Accumulate on the stock with a Target Price of Rs230. Shareholding Pattern (%) Bottom line down 16.1% on higher costs and low incentives: The OPM for the Promoters 84.5 quarter fell by 440bp yoy to 25.1% on account of higher fuel and employee MF / Banks / Indian Fls 10.6 expenses, which grew by 12.4% and 15.8%, respectively, on a yoy basis. Lower FII / NRIs / OCBs 2.6 PLFs during the quarter also resulted in lower incentives, thereby affecting Indian Public / Others 2.3 margins. Net profit declined by 16% yoy to Rs1,842cr during the quarter. Valuation: At the CMP of Rs199, the stock is trading at P/BV of 2.4x FY2011E and Abs. (%) 3m 1yr 3yr 2.2x FY2012E and at an EV/MW of Rs4.35cr on FY2012E estimates. Considering Sensex 3.3 17.1 17.9 its regulated business model, with an assured return on equity and strong cash NTPC (3.2) (7.1) 23.6 flow visibility, we have assigned Rs5.25cr EV/MW at and a P/BV of 2.3x on FY2012E estimates to arrive at a Target Price. We maintain Accumulate on the stock. Key Financials (Consolidated) Y/E March (Rs cr) FY2009 FY2010E FY2011E FY2012E Net Sales 44,245 48,221 51,605 58,520 % chg 14.5 9.0 7.0 13.4 Net Profits 8,092 8,728 7,965 9,116 % chg 8.3 7.9 (8.7) 14.4 OPM (%) 23.8 29.7 29.8 30.4 EPS (Rs) 9.8 10.6 9.7 11.1 P/E (x) 20.3 18.8 20.6 18.0 Rupesh Sankhe P/BV (x) 2.7 2.5 2.4 2.2 022-40403800 Ext:319 RoE (%) 14.2 14.0 11.9 12.7 rupeshd.sankhe@angeltrade.com RoCE (%) 8.8 11.1 10.7 11.4 EV/Sales (x) 4.2 4.0 3.8 3.5 V Srinivasan 022-40403800 Ext:330 EV/EBITDA (x) 17.6 13.3 12.6 11.5 v.srinivasan@angeltrade.com Source: Company, Angel Research Please refer to important disclosures at the end of this report 1

- 2. NTPC |1QFY2011 Result Update Exhibit 1: 1QFY2011 performance - Standalone Y/E March (Rs cr) 1QFY2011 4QFY2010 % Chg 1QFY2010 % Chg FY2010 FY2009 % Chg Net Sales 12,944 12,353 4.8 12,003 7.8 46,323 41,924 10.5 Other Operating Income 358 378 (5.3) 525 (31.8) 1,899 2,176 (12.7) Total Operating Income 13,303 12,732 4.5 12,528 6.2 48,221 44,099 9.3 Fuel Cost 8,702 8,346 4.3 7,743 12.4 29,463 27,111 8.7 (% of Sales) 67 68 64 65 Staff Costs 684 746 (8.3) 590 15.8 2,412 2,463 (2.1) (% of Sales) 5 6 5 6 Other Expenses 572 596 (4.1) 493 15.9 2,027 1,952 3.8 (% of Sales) 4 5 4 5 Total Expenditure 9,958 9,688 2.8 8,826 12.8 33,902 31,526 7.5 Operating Profit 3,345 3,044 9.9 3,702 (9.6) 14,319 12,573 13.9 OPM 25.1 23.9 29.5 30.9 30.0 Interest 536 482 11.2 445 20.5 1,809 1,996 (9.4) Depreciation 683 732 (6.8) 613 11.4 2,650 2,364 12.1 Other Income 227 250 (9.1) 251 (9.6) 1,025 1,147 (10.6) PBT (excl. Extr. Items) 2,353 2,079 13.2 2,895 (18.7) 10,885 9,359 16.3 Extr. Income/(Expense) - - PBT (incl. Extr. Items) 2,353 2,079 13.2 2,895 (18.7) 10,885 9,359 16.3 (% of Sales) 18 17 24 23 22 Provision for Taxation 511 62 727.5 701 (27.0) 2,157 1,158 86.3 (% of PBT) 22 3 20 12 Reported PAT 1,842 2,018 (8.7) 2,194 (16.1) 8,728 8,201 6.4 PATM 14 16 18 19 20 Equity Capital 8,245 8,245 8,245 8,245 8,245 EPS (Rs) 2.2 2.4 2.7 10.6 9.9 Adjusted PAT 1,842 2,018 (8.7) (8.7) 8,728.2 8,201 6.4 Source: Company, Angel Research Exhibit 2: 1QFY2011- Actual v/s Angel estimates (Rs cr) Actual Estimates Variation (%) Net Sales 12,944 13,110 (1.3) Operating Profit 3,345 3,445 (2.9) Net Profit 1,842 2,279 (19.2) Source: Company, Angel Research July 28, 2010 2

- 3. NTPC |1QFY2011 Result Update Operational Highlights During the quarter, the company’s sales volume remained flat at 55.7BU (55.5BU in 1QFY2010). PLF of coal-based plants declined to 90.2% in 1QFY2011 compared to 92.8% in 1QFY2010. The OPM was also down by 440bp yoy to 25.1% during the quarter. Exhibit 3: Operational performance 250 94 200 90 150 86 % BU 100 82 50 78 0 74 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 Generation PLF ‐ (RHS) Source: Company, Angel Research Capacity addition In 4QFY2010, 490MW of coal-based capacity at Dadri in Uttar Pradesh and the 500MW unit at Kahalgoan in Bihar were declared commercial. Currently, the company’s capacity stands at 31,704MW (incl. 2,864MW under the JV), while capacity under construction is at 17,830MW. Management has guided that it would add 4,150MW and 6,500MW of capacity in FY2011E and FY2012E, respectively. On a consolidated basis, the company plans to incur capex of Rs29,000cr during FY2011E and add 4,150MW of capacity during FY2011. Exhibit 4: Capacity addition planned for FY2011E Project MW Sipat Stage-I, Unit-I 660 Jhajjar, Unit- I &2 1,000 Korba Stage–III, Unit -7 500 NCTPP Stage–II, Unit – 6 490 Simhadri, Stage–II, Unit- 3&4 1,000 Farakka, Stage-III, Unit 6 500 Total 4,150 Source: Company, Angel Research July 28, 2010 3

- 4. NTPC |1QFY2011 Result Update Investment Arguments Capacity addition to drive future growth: NTPC, India’s largest power generating company, currently has a capacity of 31,704MW. Having the best execution capability in the industry, management has an ambitious target of adding 22,300MW during the Eleventh Plan, thus taking its installed capacity to 50,000MW. The company has till date managed to add only 4,300MW since the beginning of the plan period, with most of its capacity addition expected to be back-ended. In all, we estimate the company to add close to 15,000MW during the plan period. Earnings protected by the regulated return model: NTPC, being a Central Public Utility (CPU), is governed under the regulated return model. The CERC’s regulations for FY2010–14 increased the cap on RoE to 15.5% (on a pre-tax basis, grossed up for tax) from the earlier 14% (on a post-tax basis), which is a positive for all CPUs. NTPC to generate stable cash flows: NTPC has 85% of its overall output tied up under the long-term PPA route, which ensures power offtake, thereby ensuring stable cash flows for the company. July 28, 2010 4

- 5. NTPC |1QFY2011 Result Update Outlook and Valuation India, despite being one of the lowest per capita consumers of power, has an overall power deficit of 11%. Power demand in the country, which has grown at a rate of 6% since FY2003, has continued to outstrip supply. The escalation in power demand is expected to be robust going ahead as well, in line with healthy GDP growth estimated for the country. Apart from the arising demand from the industrial front, domestic demand is also expected to pick up, with the Ministry of Power’s ambitious target of achieving per capita consumption of 1,000 units by 2012. NTPC, the market leader in power generation, has assets of 31,704MW, which translates into a 20% market share of the overall domestic power industry. Moreover, of the 22,300MW capacity that NTPC plans to add during the Eleventh Plan Period (FY2007–12), it has till date managed to add only 4,300MW, while another 17,830MW is under construction. Management has proposed capacity expansions of 4,150MW and 6500MW in FY2011E and FY2012E, respectively. Going forward, we believe NTPC’s regulated business model will provide a high revenue visibility, to the company. However, delays in the completion of its projects would be a dampener. At the CMP of Rs199, the stock is trading at a P/BV of 2.4x FY2011E and 2.2x FY2012E and at an EV/MW of Rs4.35cr on FY2012E estimates. Considering its regulated business model, with an assured RoE and strong cash flow visibility, we have assigned an EV/MW of Rs5.25cr and a P/BV of 2.3x on FY2012E estimates to arrive at a Target Price of Rs230. We maintain an Accumulate rating on the stock. Exhibit 5: Change in estimates (Rs cr) FY2011E FY2012E Earlier Revised Variation (%) Earlier Revised Variation (%) Net Sales 52,812 51,605 (2.3) 62,152 58,520 (5.8) Operating Exp 37,089 36,242 (2.3) 43,275 40,746 (5.8) Operating Profit 15,723 15,363 (2.3) 18,877 17,774 (5.8) Depreciation 3,201 3,440 7.5 3,995 4,096 2.5 Interest 2,531 2,328 (8.0) 3,004 2,933 (2.4) PBT 12,938 10,621 (17.9) 14,825 11,770 (20.6) Tax 3,234 2,655 (17.9) 3,233 2,654 (17.9) PAT 9,703 7,965 (17.9) 11,591 9,117 (21.3) Source: Angel Research July 28, 2010 5

- 6. NTPC |1QFY2011 Result Update Exhibit 6: Key assumptions Earlier Estimates Revised Estimates FY11E FY12E FY11E FY12E Installed Capacity (MW) 35,704 42,204 35,204 41,704 Growth (%) 12.6 18.2 11 18.5 Sale Volume (BU) 235 249 229 249 Growth (%) 8 6 5 9 Realisation (Rs/unit) 2.3 2.3 2.3 2.3 Growth (%) 5 3 5 3 Source: Angel Research Exhibit 7: Angel estimates v/s Bloomberg consensus Year/(Rs) Angel Est. Bloomberg Consensus Var (%) over consensus FY2011E 9.9 12.2 -18.9 FY2012E 11.7 13.6 -14.0 Source: Angel Research, Bloomberg Exhibit 8: Recommendation summary CMP Tgt Price Upside FY12E FY12E FY2010-12E FY12E FY12E RoE Company Reco. (Rs) (Rs) (%) P/BV (x) P/E (x) EPS CAGR (%) RoCE (%) (%) CESC Buy 388 470 21.1 1.0 8.4 15.6 9.3 12.5 GIPCL Buy 112 135 20.9 1.2 8.9 33.6 8.3 12.8 NTPC Buy 199 230 15.5 2.2 17.9 2.3 11.4 12.7 Source: Angel Research Exhibit 9: One year forward P/BV Band (Share Price Rs) 260 210 160 110 60 Apr-06 Apr-07 Apr-08 Apr-09 Apr-10 Price 1.5X 2X 2.5X 3X Source: Company, Angel Research July 28, 2010 6

- 7. NTPC |1QFY2011 Result Update Exhibit 10: Premium to Sensex P/E 100 80 60 40 ( % 20 ) 0 -20 -40 Apr-05 Oct-05 Apr-06 Oct-06 Apr-07 Oct-07 Apr-08 Oct-08 Apr-09 Oct-09 Apr-10 Prem/Disc to Sensex Historic Avg Premium Source: Company, Angel Research July 28, 2010 7

- 8. NTPC |1QFY2011 Result Update Profit and Loss statement (Consolidated) Y/E March (Rs cr) FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E Net Operating Income 33,876 38,635 44,245 48,221 51,605 58,520 Other operating - - - - - - income Total operating income 33,876 38,635 44,245 48,221 51,605 58,520 % chg 22.8 14.0 14.5 9.0 7.0 13.4 Total Expenditure 23,764 27,222 33,702 33,902 36,242 40,746 Net Raw Materials 20,953 22,219 27,347 29,463 30,104 33,844 Other Mfg costs 861 3,050 3,823 2,027 3,816 4,327 Personnel 1,411 1,953 2,533 2,412 2,322 2,575 Other 538 - - - - - EBITDA 10,112 11,413 10,544 14,319 15,363 17,774 % chg 30.0 12.9 (7.6) 35.8 7.3 15.7 (% of Net Sales) 30 30 24 30 30 30 Depreciation& 2,100 2,206 2,495 2,650 3,440 4,096 Amortisation EBIT 8,012 9,207 8,049 11,669 11,923 13,678 % chg 40.3 14.9 (12.6) 45.0 2.2 14.7 (% of Net Sales) 24 24 18 24 23 23 Interest & other 2,010 1,858 2,144 1,809 2,328 2,933 Charges Other Income 2,959 3,002 3,402 1,025 1,025 1,025 (% of PBT) - - - - - - Share in profit of - - - - - - Associates Recurring PBT 8,973 10,351 9,307 10,885 10,621 11,771 % chg - - - - - - Extraordinary 11 - - - - 1 Expense/(Inc.) PBT (reported) 8,961 10,351 9,307 10,885 10,621 11,770 Tax 2,063 2,881 1,215 2,157 2,655 2,654 (% of PBT) 23.0 27.8 13.1 19.8 25.0 22.5 PAT (reported) 6,898 7,470 8,092 8,728 7,965 9,116 ADJ. PAT 6,909 7,470 8,092 8,728 7,965 9,117 % chg 5.4 8.1 8.3 7.9 (8.7) 14.5 (% of Net Sales) 20.4 19.3 18.3 18.1 15.4 15.6 Basic EPS (Rs) 8 9 10 10.6 9.7 11.1 Fully Diluted EPS (Rs) 8 9 10 11 9.7 11.1 % chg 5.4 8.1 8.3 7.9 (8.7) 14.5 July 28, 2010 8

- 9. NTPC |1QFY2011 Result Update Balance Sheet (Consolidated) Y/E March (Rs cr) FY2007 FY2008 FY2009 FY2010E FY2011E FY2012E SOURCES OF FUNDS Equity Share Capital 8,246 8,246 8,246 8,246 8,246 8,246 Preference Capital - - - - - - Reserves& Surplus 41,124 45,991 51,706 56,712 60,662 65,858 Shareholders Funds 49,369 54,236 59,951 64,958 68,908 74,104 Minority Interest 48 124 166 166 166 166 Total Loans 27,020 30,315 38,823 45,821 42,321 53,320 Deferred Tax Liability - - - - - - Total Liabilities 76,437 84,675 98,940 110,945 111,395 127,590 APPLICATION OF FUNDS Gross Block 51,093 55,648 64,742 70,742 86,008 117,040 Less: Acc. 25,217 27,487 29,776 32,426 35,866 39,962 Depreciation Net Block 25,877 28,161 34,966 38,316 50,142 77,078 Capital Work-in- 20,286 25,630 30,929 39,135 35,263 24,578 Progress Goodwill 2 - - - - - Investments 15,143 13,447 11,696 11,696 14,571 14,571 Current Assets 26,604 26,346 33,486 30,990 24,969 28,313 Cash 13,698 15,361 17,251 19,021 12,161 13,788 Loans & Advances 8,902 5,031 9,006 6,269 6,709 7,608 Other 4,004 5,954 7,230 5,720 6,100 6,917 Current liabilities 11,475 8,908 12,137 9,212 13,787 14,678 Net Current Assets 15,129 17,438 21,349 21,797 11,419 11,362 Mis. Exp. not written - - - - - - off Total Assets 76,437 84,675 98,940 110,945 111,395 127,590 July 28, 2010 9

- 10. NTPC |1QFY2011 Result Update Cash flow statement Y/E March (Rs cr) FY2007 FY2008 FY2009 FY2010E FY2011E FY2012E Profit before tax 8,961 10,351 9,307 10,885 10,621 11,770 Depreciation 2,100 2,206 2,495 2,650 3,440 4,096 Change in Working 1,813 2,063 1,367 1,386 3,289 1,555 Capital Less: Other income 2,959 3,002 3,402 1,025 1,025 1,025 Direct taxes paid 2,063 2,881 1,215 2,157 2,655 2,654 Cash Flow from 7,851 8,736 8,553 11,739 13,670 13,742 Operations (Inc)/ Decin Fixed Assets (8,661) (9,896) (14,394) (14,206) (11,394) (20,347) (Inc)/ Dec in Investments 3,449 1,696 1,751 - (2,875) - (Inc)/ Dec in loans and - - - - - - advances Other income 2,959 3,002 3,402 1,025 1,025 1,025 Cash Flow from (2,252) (5,198) (9,241) (13,181) (13,244) (19,322) Investing Issue of Equity - - - - - - Inc./(Dec.) in loans 4,540 3,295 8,508 6,999 (3,500) 11,000 Dividend Paid (Incl. Tax) 3,038 3,313 3,786 3,786 3,786 3,793 Others 2,010 1,858 2,144 - - - Cash Flow from (508) (1,876) 2,578 3,212 (7,286) 7,207 Financing Inc./(Dec.) in Cash 5,091 1,662 1,890 1,771 (6,860) 1,627 Opening Cash balances 8,608 13,698 15,361 17,251 19,021 12,161 Closing Cash balances 13,698 15,360 17,250 19,021 12,161 13,788 July 28, 2010 10

- 11. NTPC |1QFY2011 Result Update Key Ratios Y/E March FY2007 FY2008 FY2009 FY2010E FY2011E FY2012E Valuation Ratio (x) P/E (on FDEPS) 23.8 22.0 20.3 18.8 20.6 18.0 P/CEPS 18.3 17.0 15.5 14.4 14.4 12.4 P/BV 3.3 3.0 2.7 2.5 2.4 2.2 Dividend yield (%) 1.8 2.0 2.3 2.3 2.3 2.3 EV/Sales 5.2 4.6 4.2 4.0 3.8 3.5 EV/EBITDA 17.5 15.7 17.6 13.3 12.6 11.5 EV / Total Assets 2.3 2.1 1.9 1.7 1.7 1.6 Per Share Data (Rs) EPS (Basic) 8.4 9.1 9.8 10.6 9.7 11.1 EPS (fully diluted) 8.4 9.1 9.8 10.6 9.7 11.1 Cash EPS 10.9 11.7 12.8 13.8 13.8 16.0 DPS 3.7 4.0 4.6 4.6 4.6 4.6 Book Value 59.9 65.8 72.7 79.0 83.8 90.1 Dupont Analysis EBIT margin 23.7 23.8 18.2 24.2 23.1 23.4 Tax retention ratio 77.0 72.2 86.9 80.2 75.0 77.5 Asset turnover (x) 0.6 0.6 0.6 0.6 0.5 0.6 ROIC (Post-tax) 10.2 10.1 9.3 10.8 9.4 10.0 Cost of Debt (Post Tax) 6.3 4.7 5.4 3.4 4.0 4.7 Leverage (x) 0.3 0.3 0.3 0.4 0.4 0.5 Operating ROE 11.3 11.6 10.5 13.6 11.7 12.5 Returns (%) ROCE (Pre-tax) 11.1 11.4 8.8 11.1 10.7 11.4 Angel ROIC (Pre-tax) 19.0 21.5 17.1 22.6 20.5 17.9 ROE 14.6 14.4 14.2 14.0 11.9 12.7 Turnover ratios (x) Asset Turnover (Gross 0.7 0.7 0.7 0.7 0.7 0.6 Block) Inventory / Sales (days) 27.0 25.5 25.5 27.0 27.3 26.6 Receivables (days) 12.7 21.5 28.8 21.9 14.4 14.0 Payables (days) 156.7 136.7 114.0 114.9 115.8 127.5 Working cap cycle 13.4 16.6 25.5 25.9 7.1 (9.9) (ex-cash) (days) Solvency ratios (x) Net debt to equity 0.3 0.3 0.4 0.4 0.4 0.5 Net debt to EBITDA 1.3 1.3 2.0 1.9 2.0 2.2 Interest Coverage (EBIT 4.0 5.0 3.8 6.5 5.1 4.7 / Interest) July 28, 2010 11

- 12. NTPC |1QFY2011 Result Update Research Team Tel: 022 - 4040 3800 E-mail: research@angeltrade.com Website: www.angeltrade.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report. Disclosure of Interest Statement NTPC 1. Analyst ownership of the stock No 2. Angel and its Group companies ownership of the stock Yes 3. Angel and its Group companies' Directors ownership of the stock No 4. Broking relationship with company covered No Note: We have not considered any Exposure below Rs 1 lakh for Angel, its Group companies and Directors. Ratings (Returns) : Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%) Reduce (-5% to 15%) Sell (< -15%) July 28, 2010 12