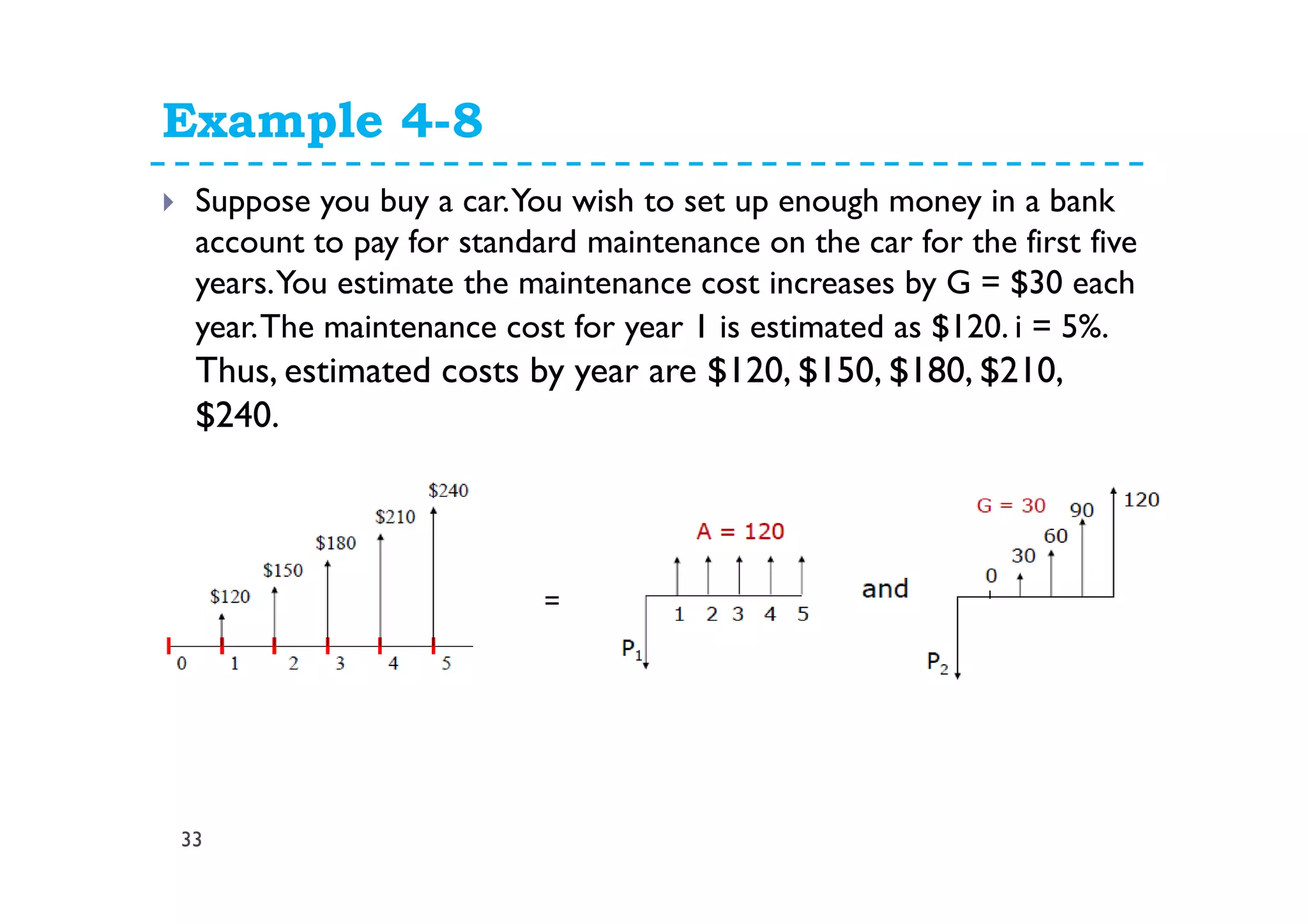

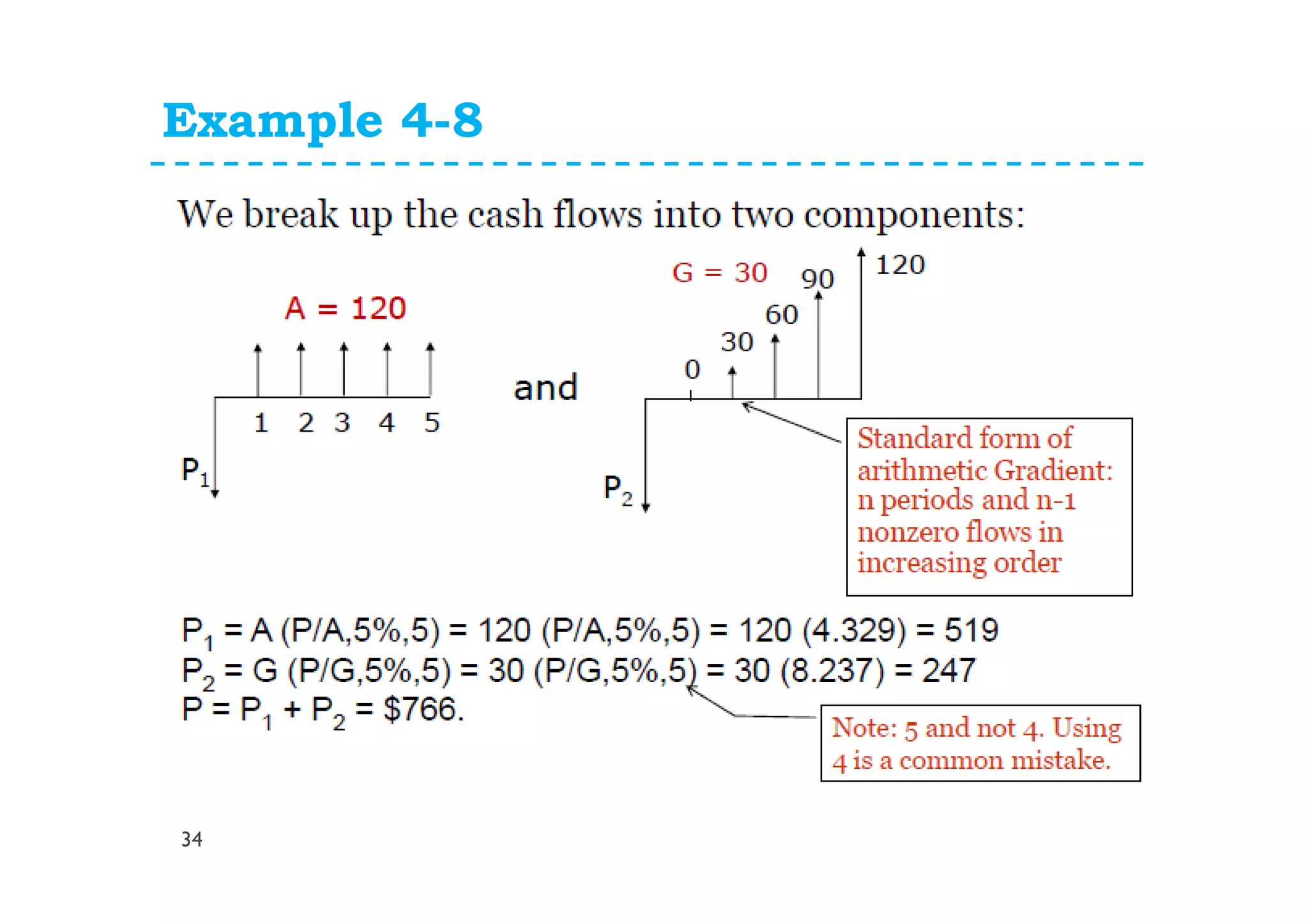

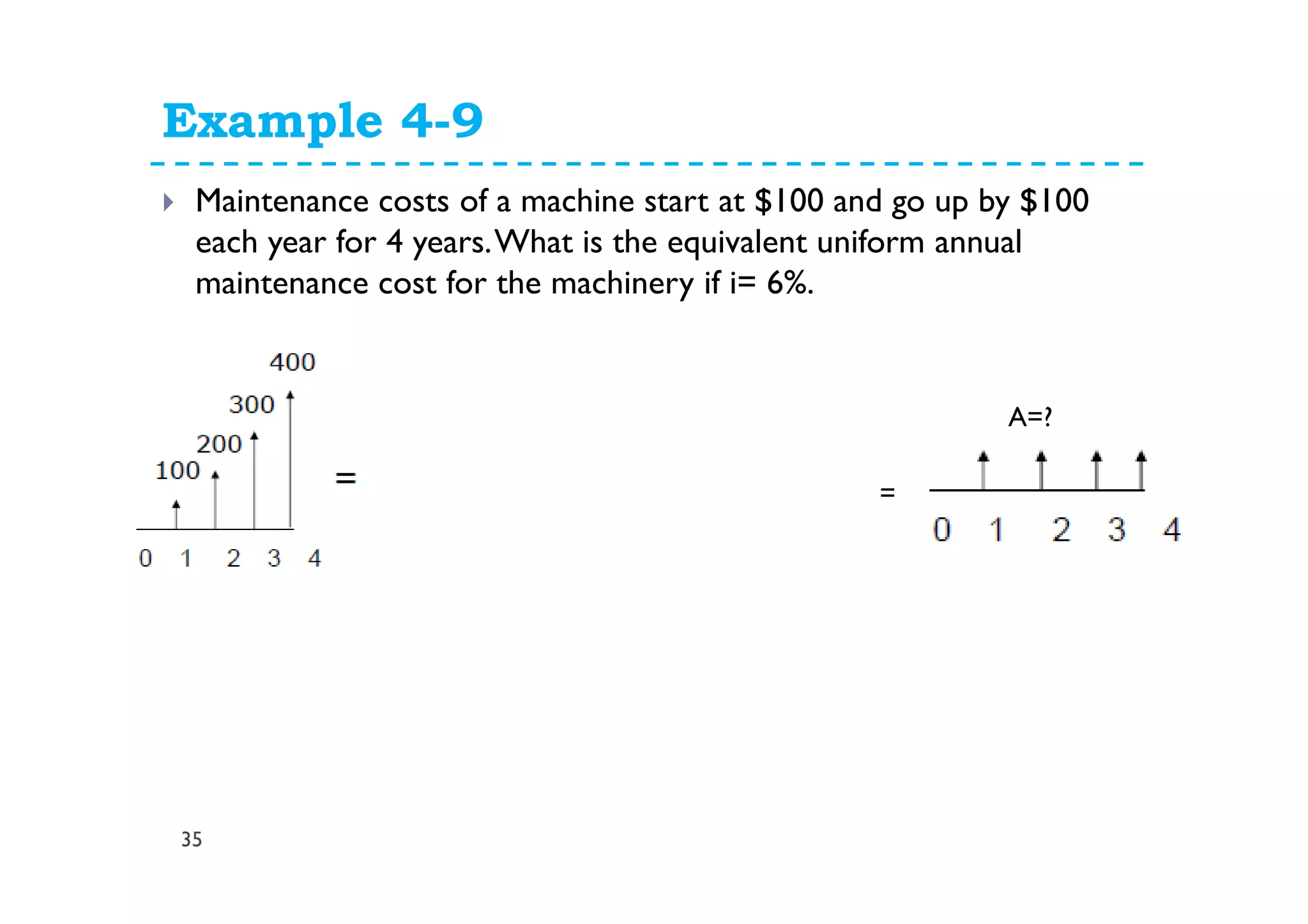

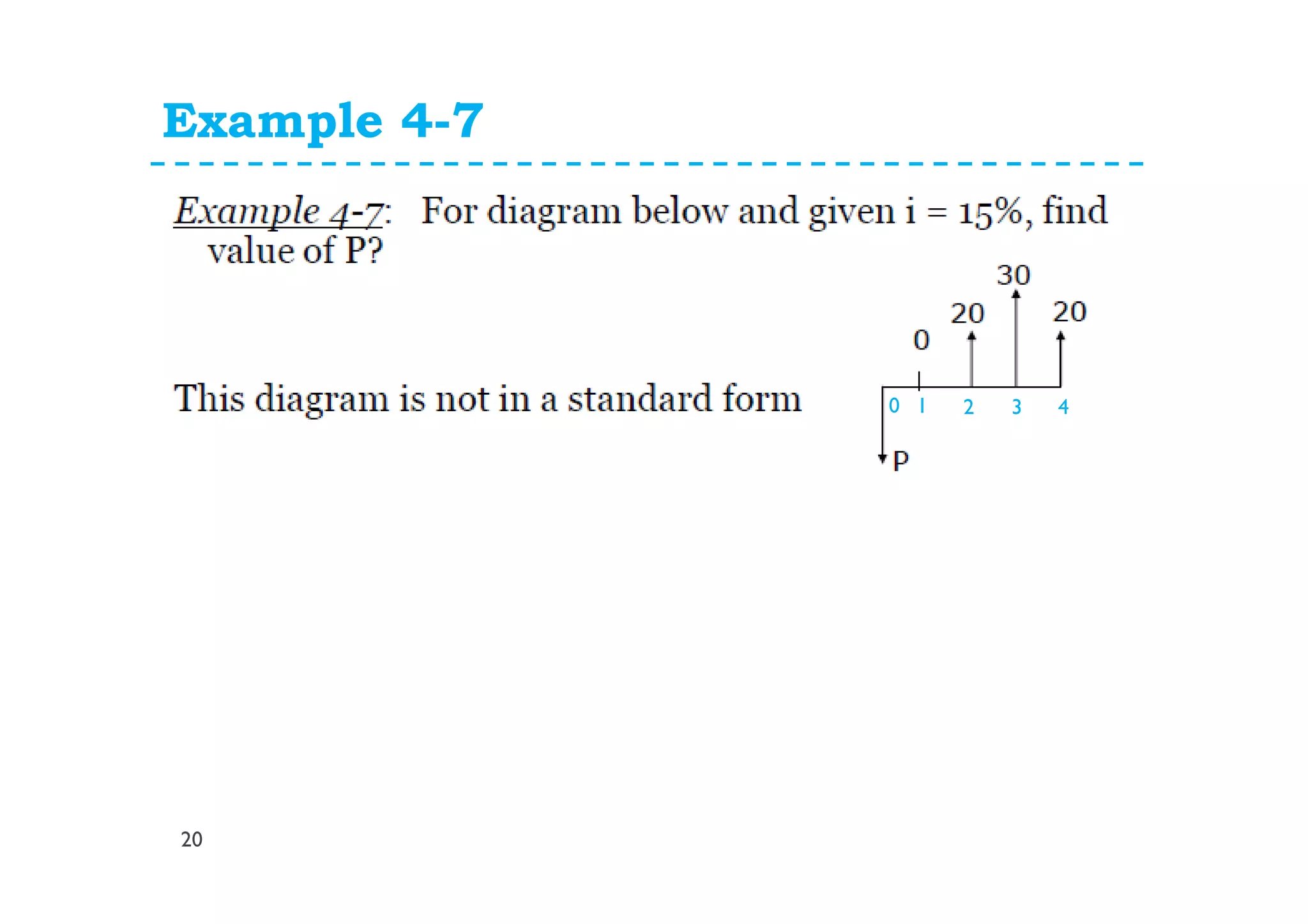

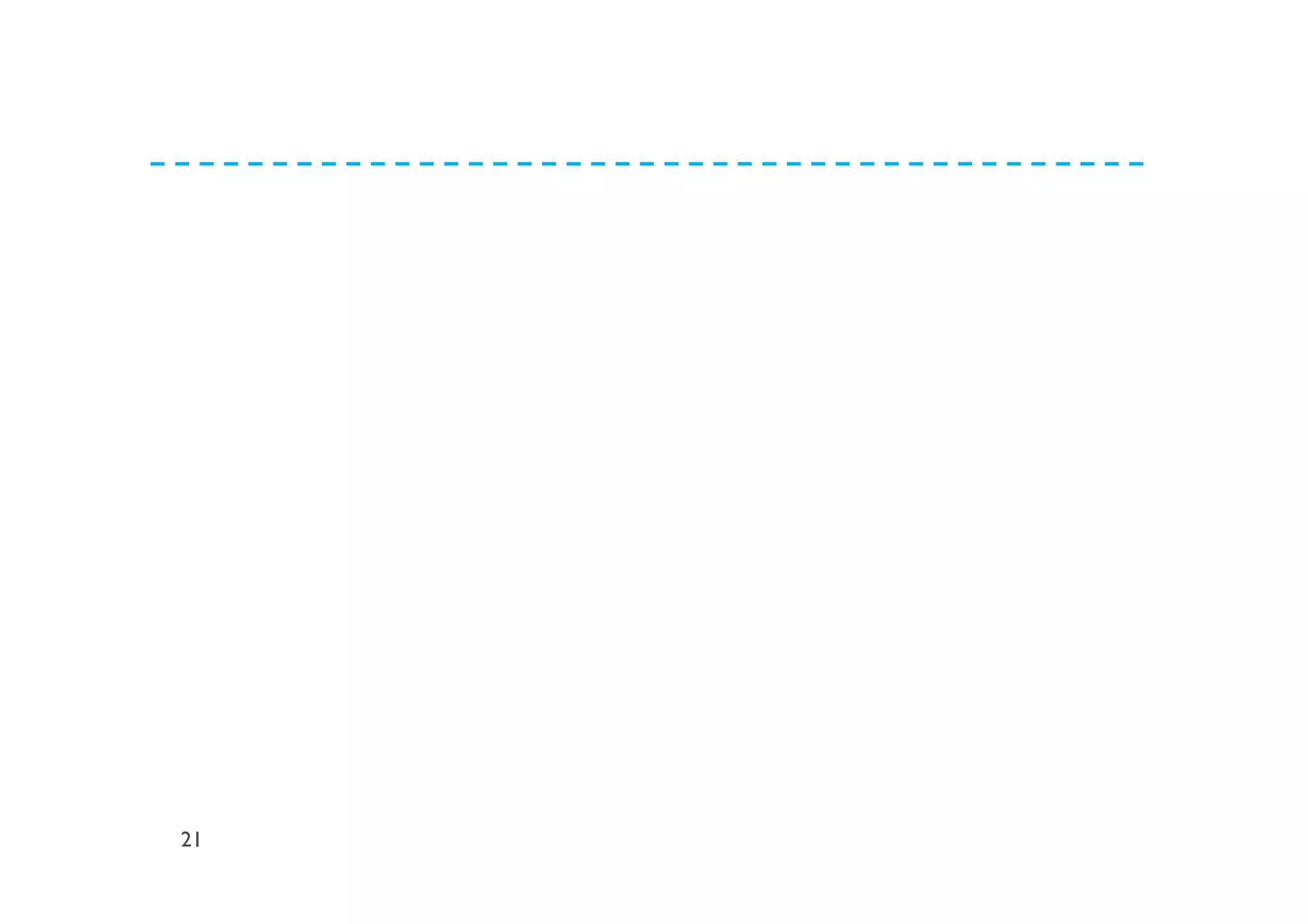

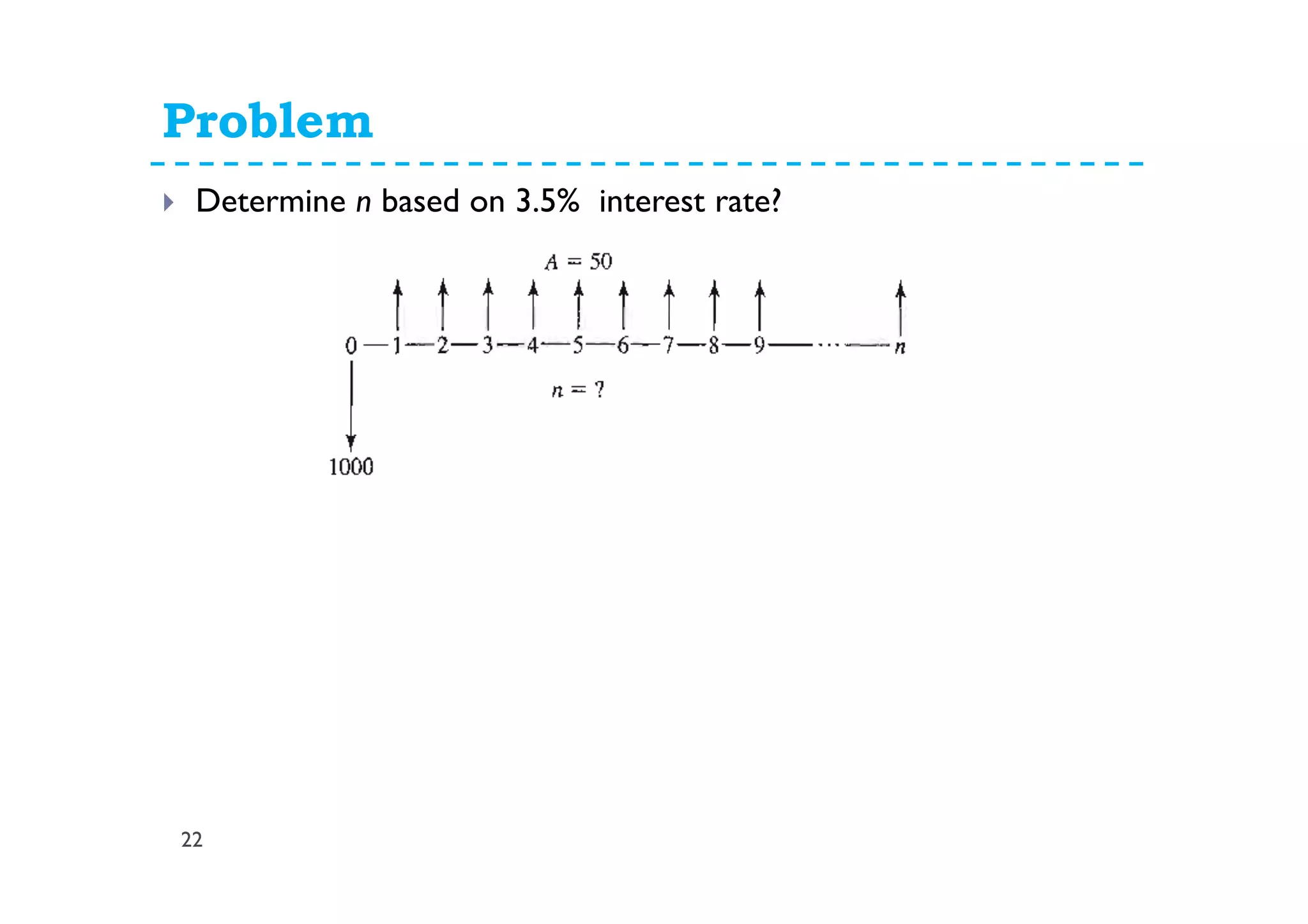

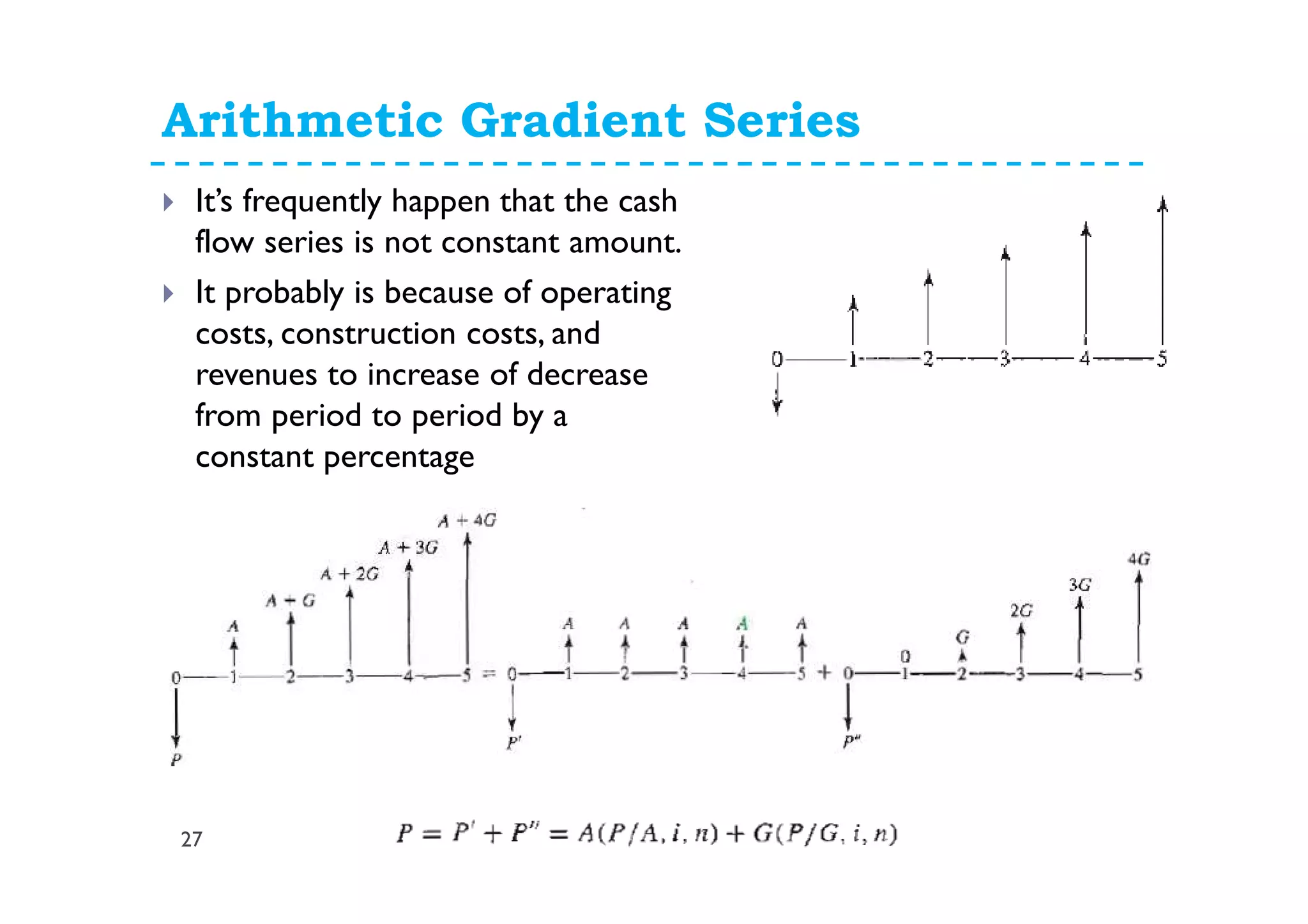

This document provides lecture notes on uniform series and arithmetic gradient interest formulas. It begins by deriving the uniform series compound interest formula and defines the uniform series compound amount factor. It then derives the uniform sinking fund formula and defines the uniform series sinking fund factor. Similar derivations are shown for the uniform capital recovery factor and present worth factor. The document then discusses arithmetic gradient series where cash flows increase by a fixed amount each period. It derives the arithmetic gradient future worth factor and present worth factor. Examples are provided to demonstrate applying these formulas.

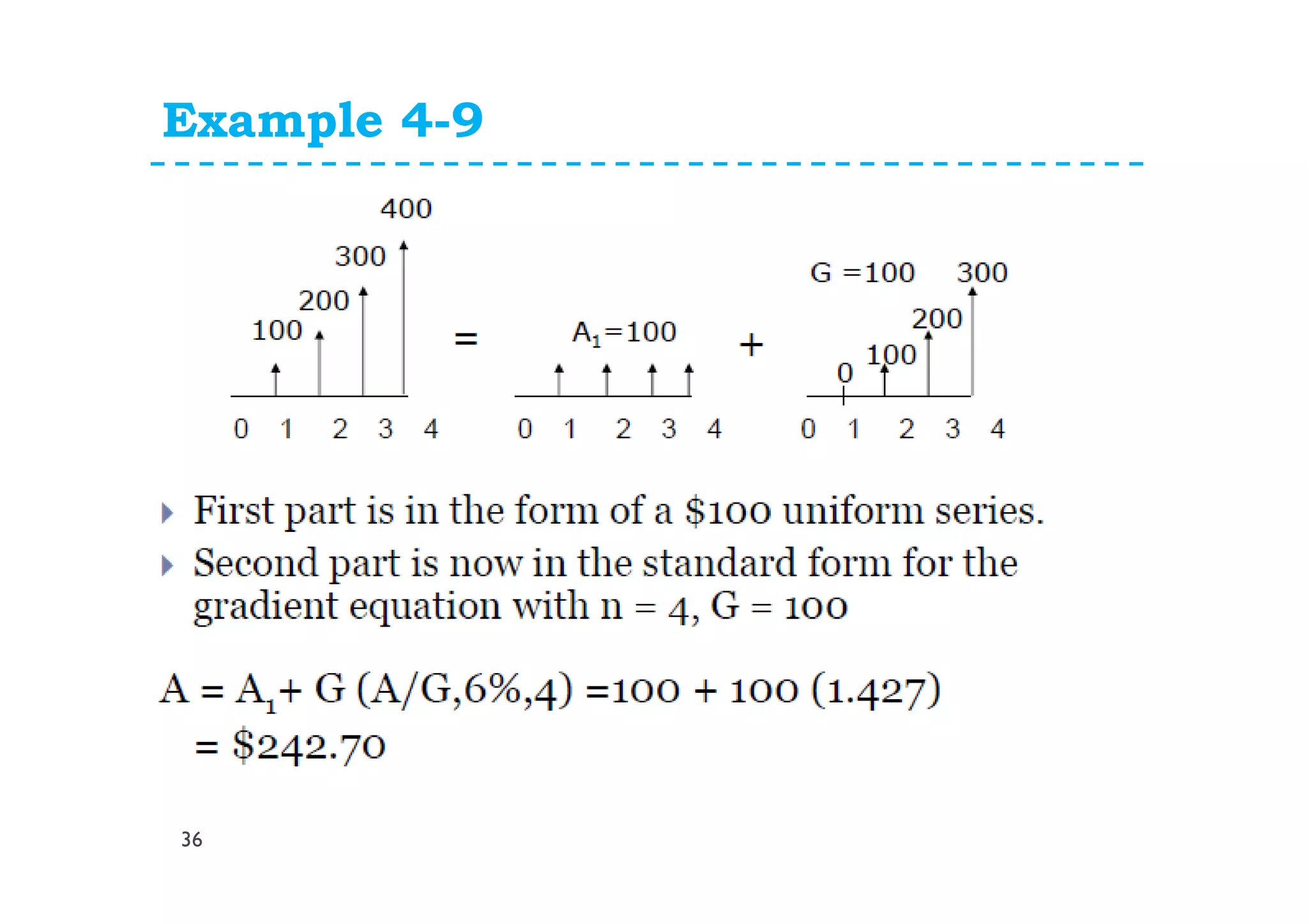

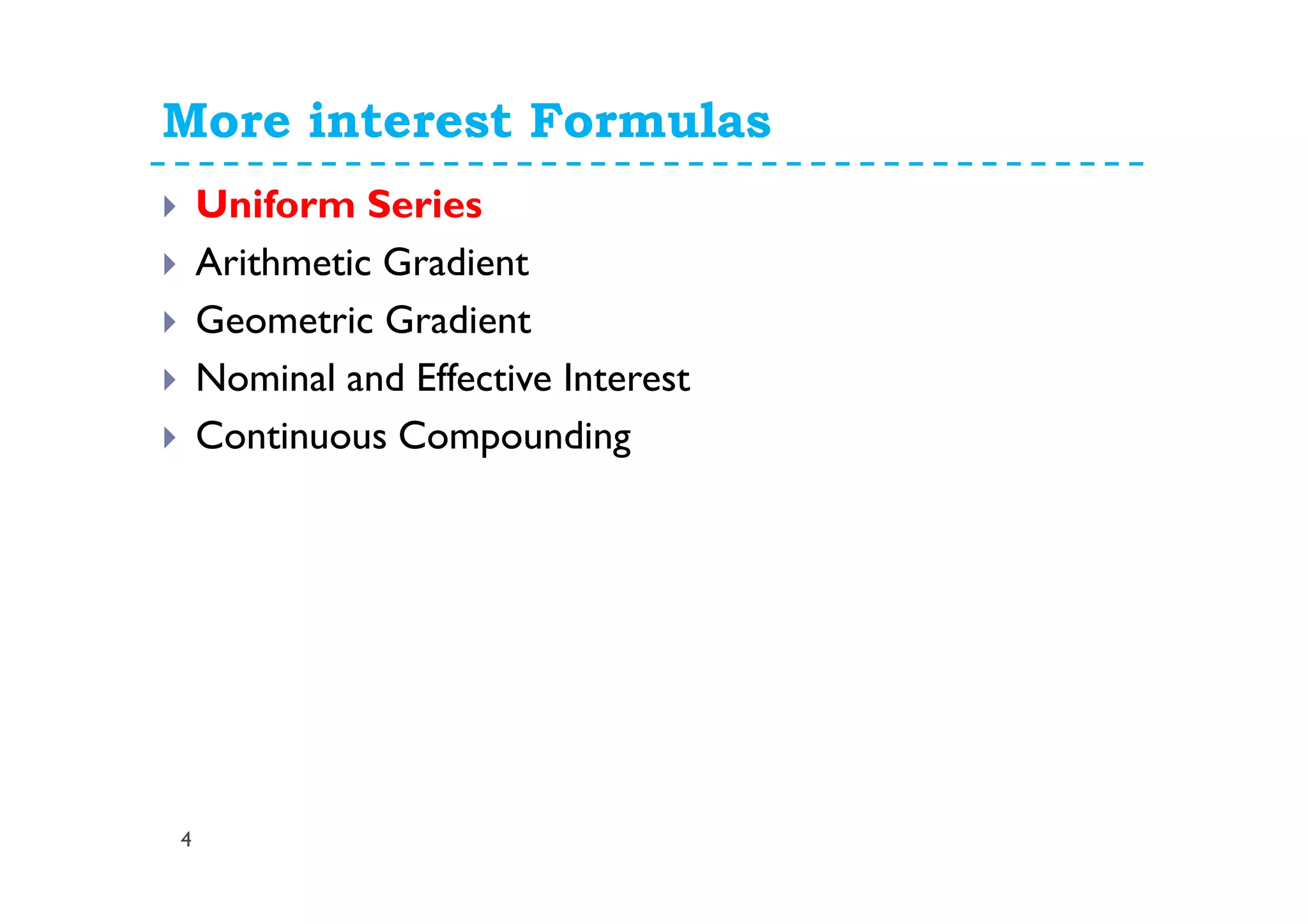

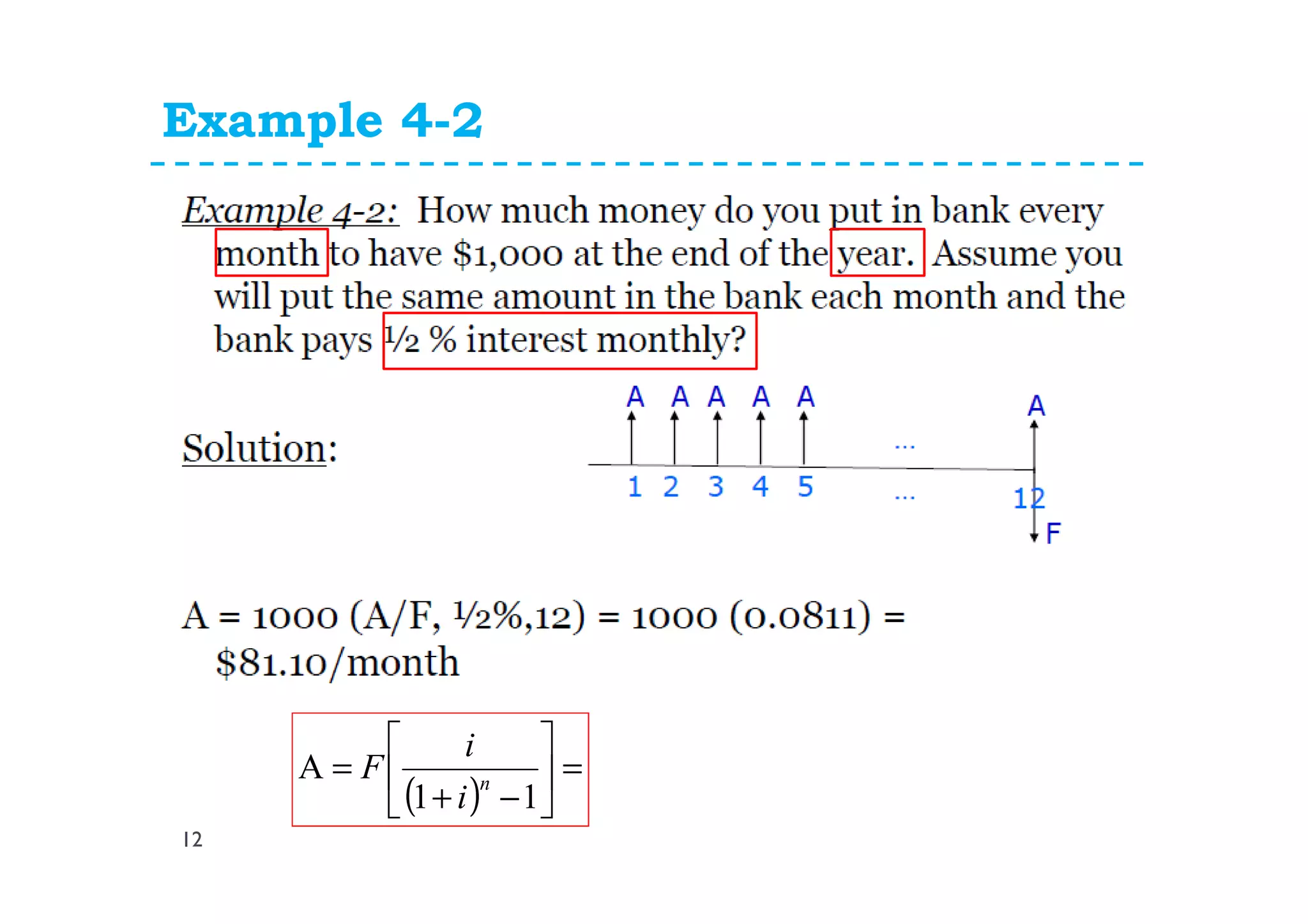

![Deriving Uniform Series Formula

0 1 2 3 4

A F

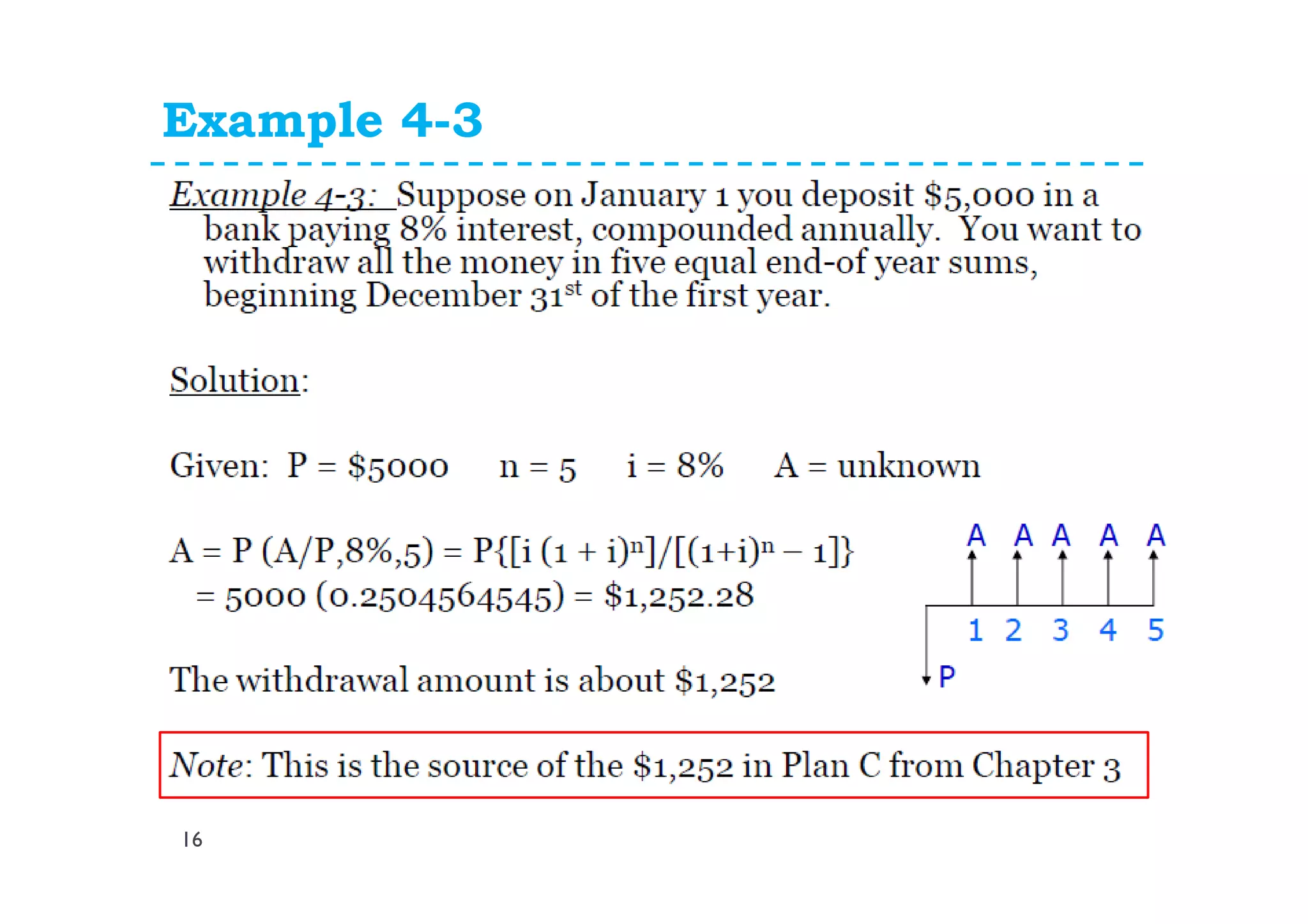

F=F1+F2+F3+F4

( )3

1F1 iA += ( )2

1F2 iA +=

( )1

1F3 iA += ( )0

1F4 iA +=

F =

+ +

+

( ) ( ) ( ) AiAiAiA ++++++=

123

111F

For general case, we can write that

Multiplying both sides with (1+i)

( ) ( ) ( ) ( ) ( )

( ) ( ) ( ) ( ) ( )[ ]iiiiAi

iAiAiAiAi

nnn

nnn

++++++++=+

++++++++=+

−−

−−

1...1111F

1...1111F

21

21

( ) ( ) ( )

( ) ( ) ( )[ ]1...111

...111

321

321

+++++++=

+++++++=

−−−

−−−

nnn

nnn

iiiAF

AiAiAiAF

Eq. (1)

Eq. (2)](https://image.slidesharecdn.com/5moreinterestformulas-150316005456-conversion-gate01/75/5-more-interest-formulas-8-2048.jpg)

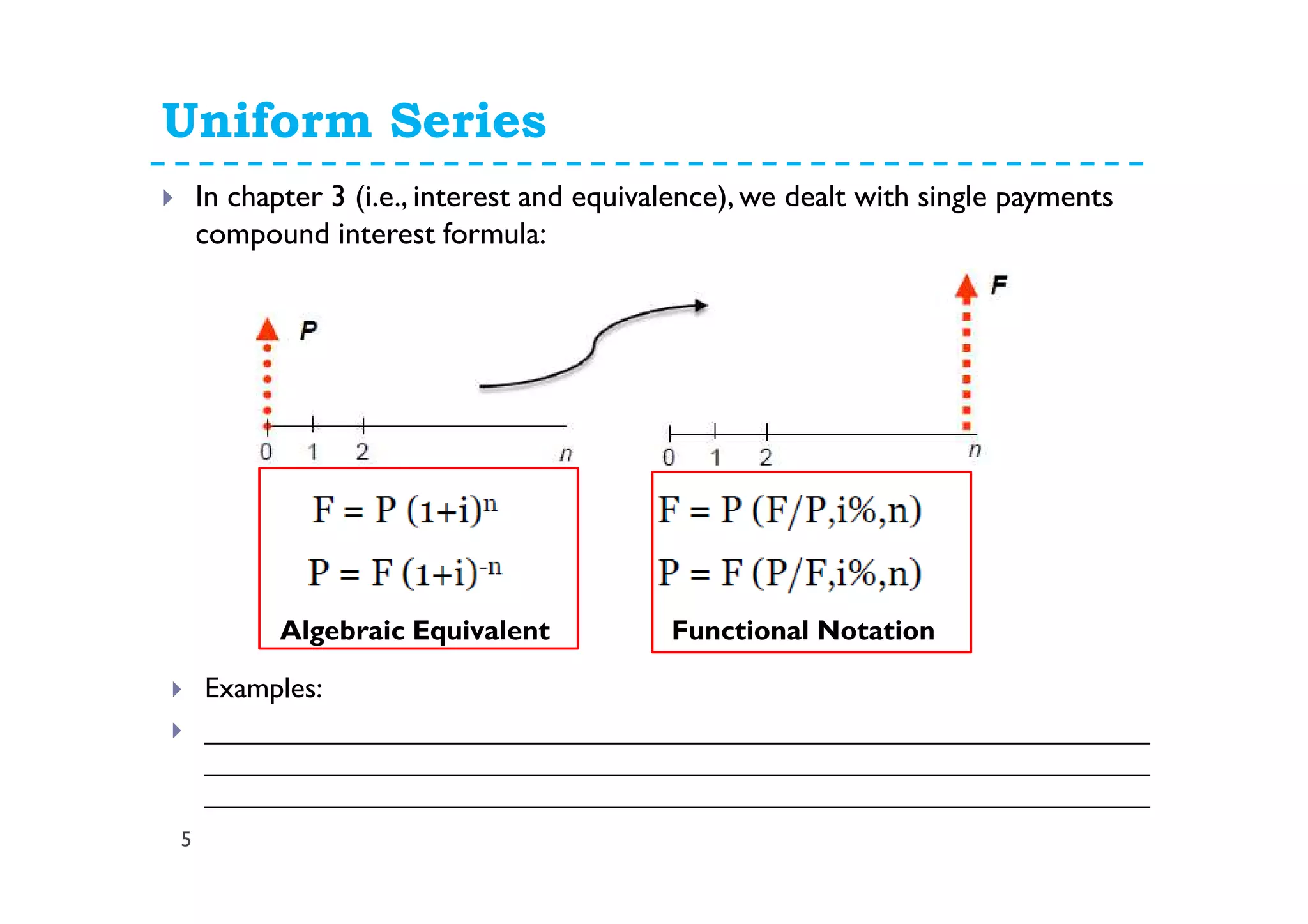

![Deriving Uniform Series Formula

9

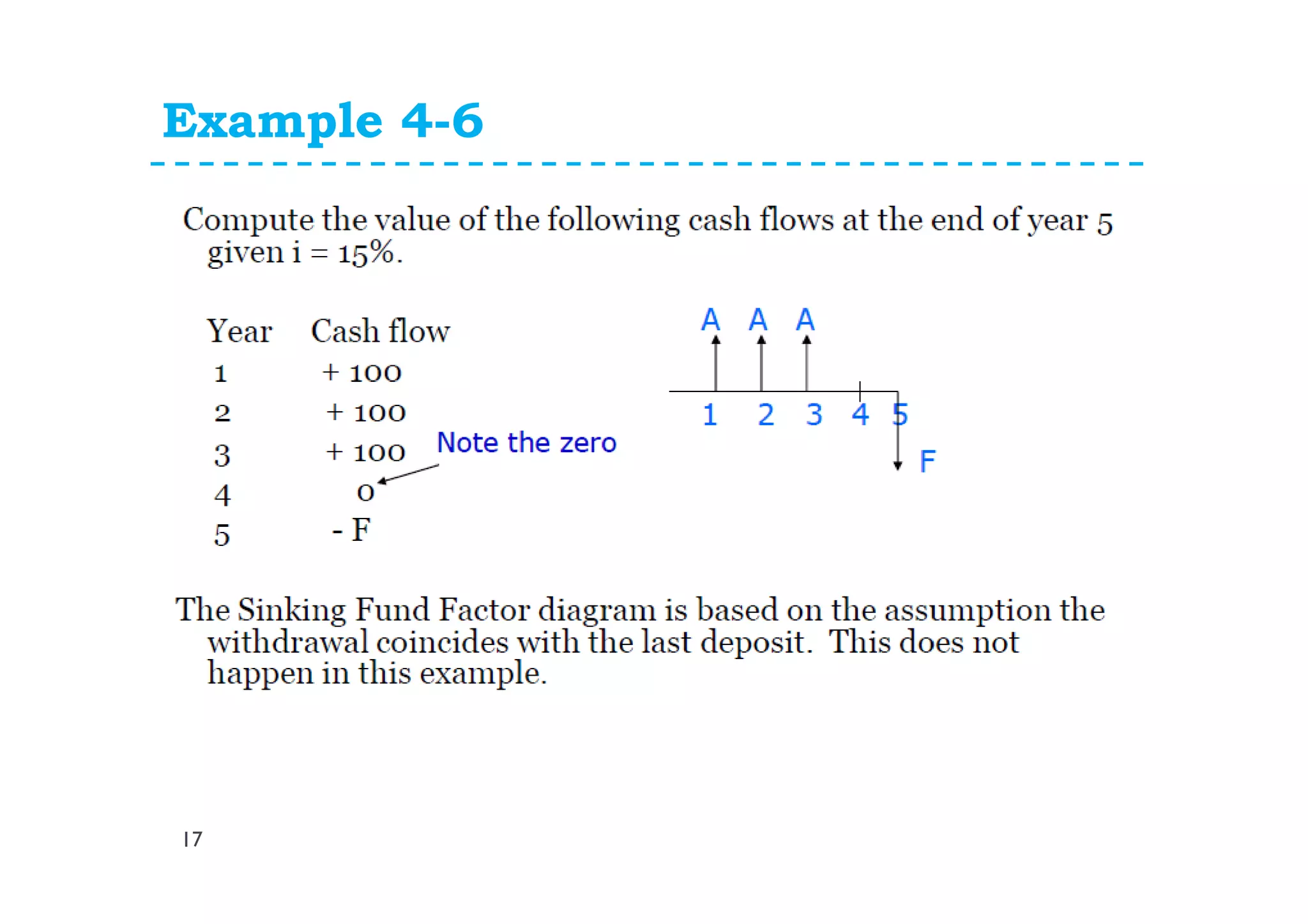

Eq. (2)-Eq. (1)

( ) ( ) ( ) ( ) ( )[ ]iiiiAi

nnn

++++++++=+

−−

1...1111F

21

( ) ( ) ( )[ ]1...111

321

+++++++=

−−− nnn

iiiAF

Eq. (2)

Eq. (1)

-

( )[ ]11iF −+=

n

iA

( ) [ ]niAFA

i

i

A

n

%,,/

11

F =

−+

=

Eq. (3)

Eq. (4)

( )

−+

i

i

n

11

Where is called uniform series compound

amount factor and has notation [ ]niAF %,,/](https://image.slidesharecdn.com/5moreinterestformulas-150316005456-conversion-gate01/75/5-more-interest-formulas-9-2048.jpg)

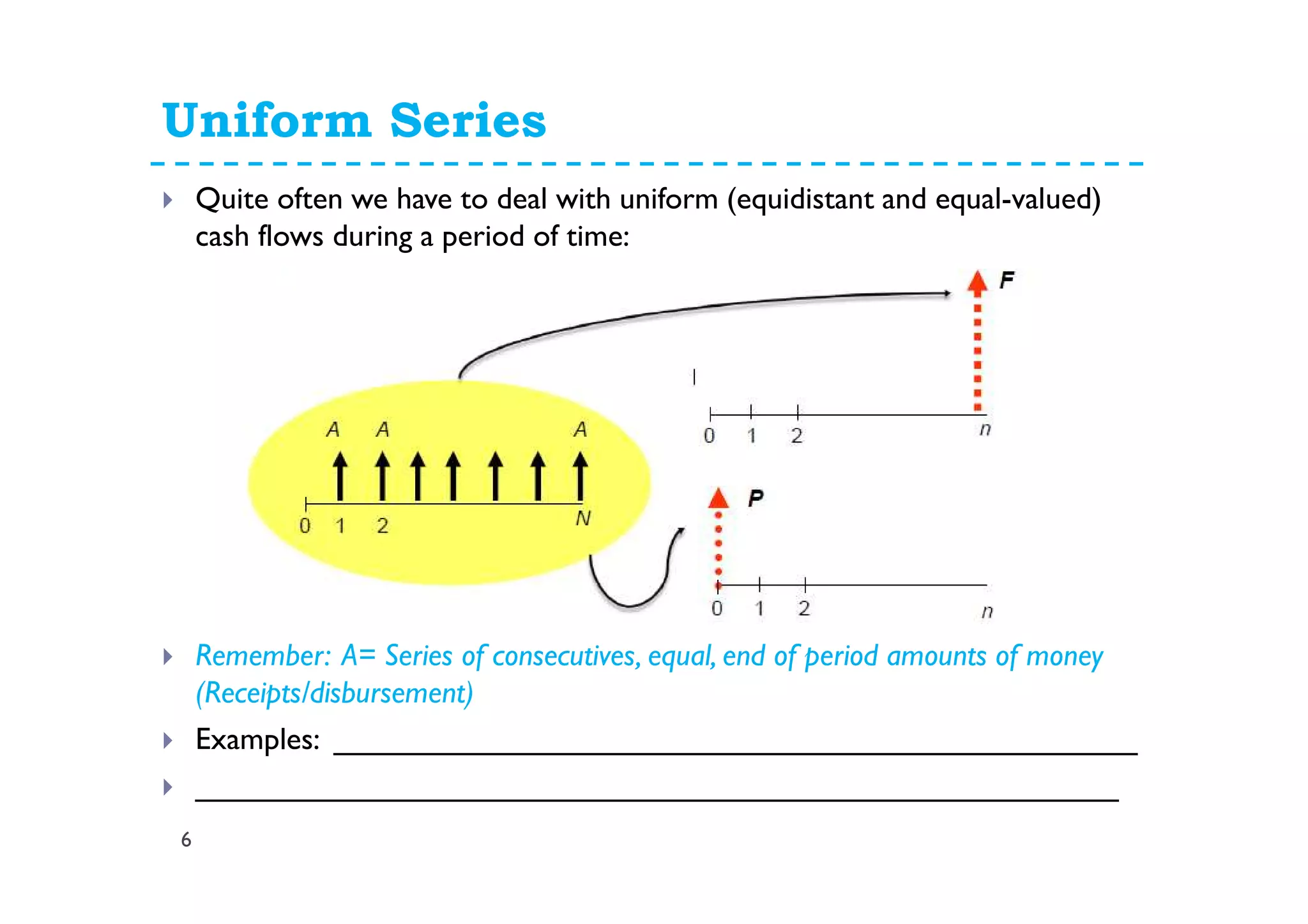

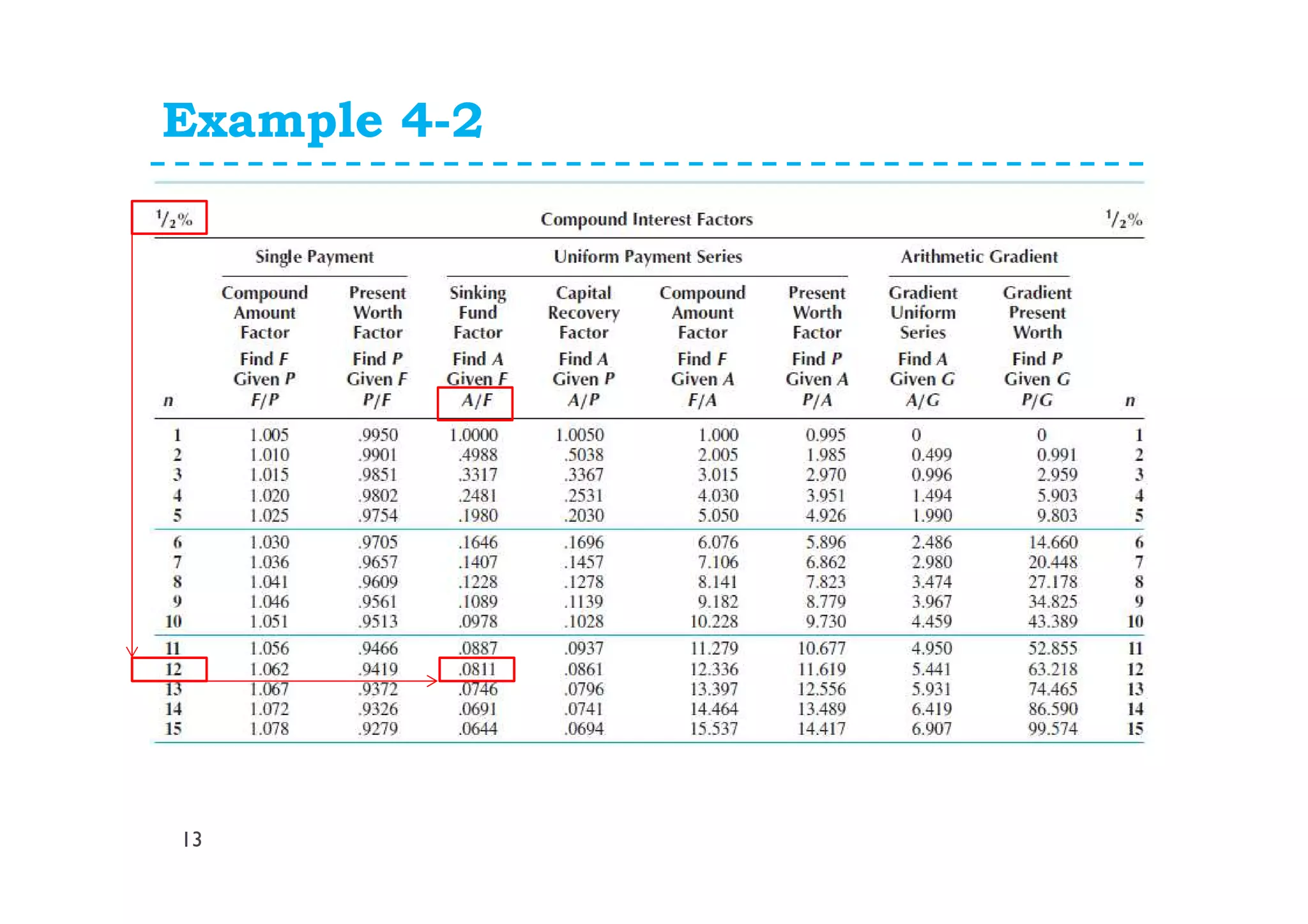

![Deriving Uniform Series Formula

10

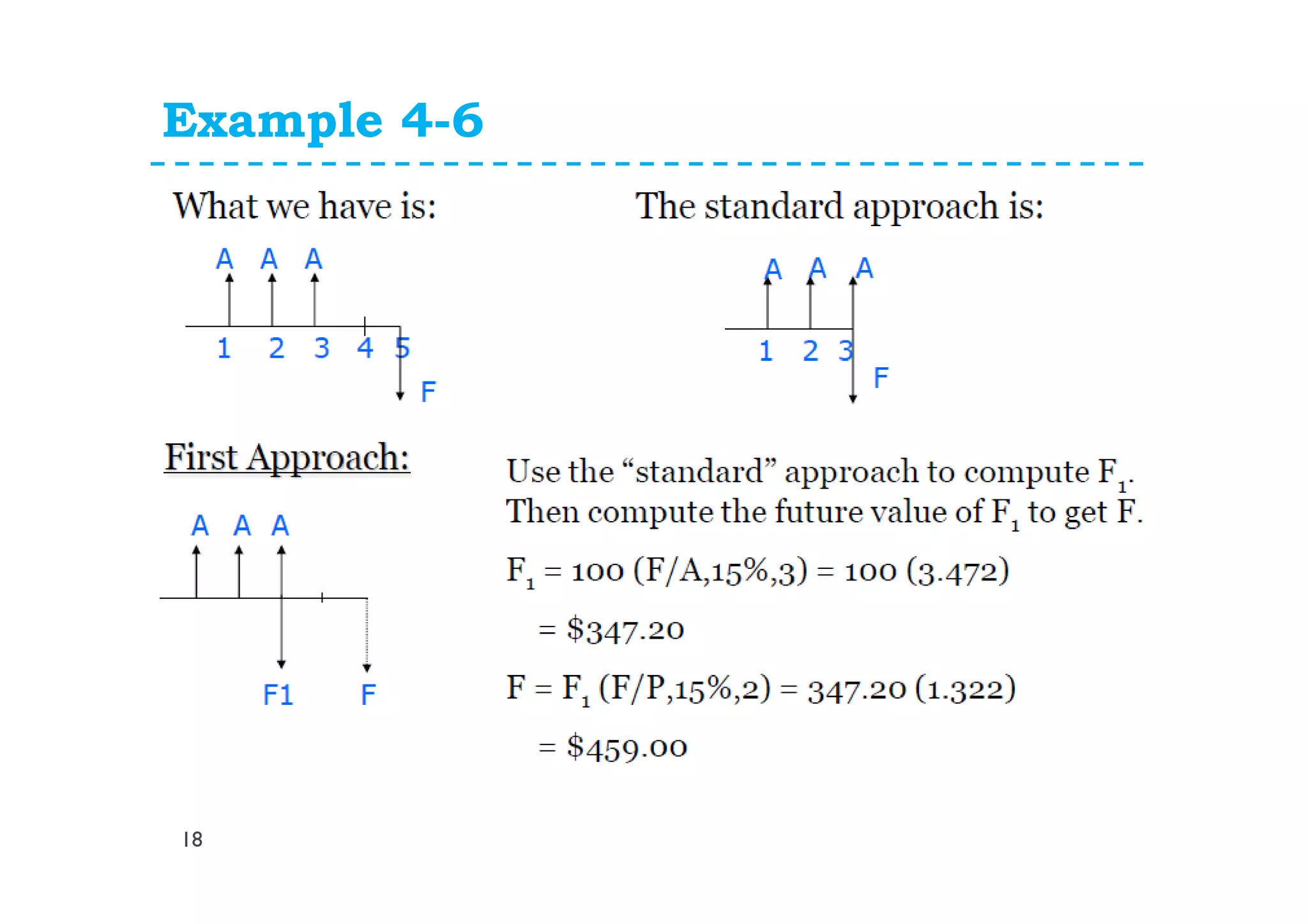

Eq. (4) can also be written as

( )

[ ]niFAF

i

i

F n

%,,/

11

A =

−+

=

( )

−+ 11

n

i

i

Where is called uniform series sinking fund

factor and has notation [ ]niFA %,,/

Eq. (5)

ni

given

Find

%,,](https://image.slidesharecdn.com/5moreinterestformulas-150316005456-conversion-gate01/75/5-more-interest-formulas-10-2048.jpg)

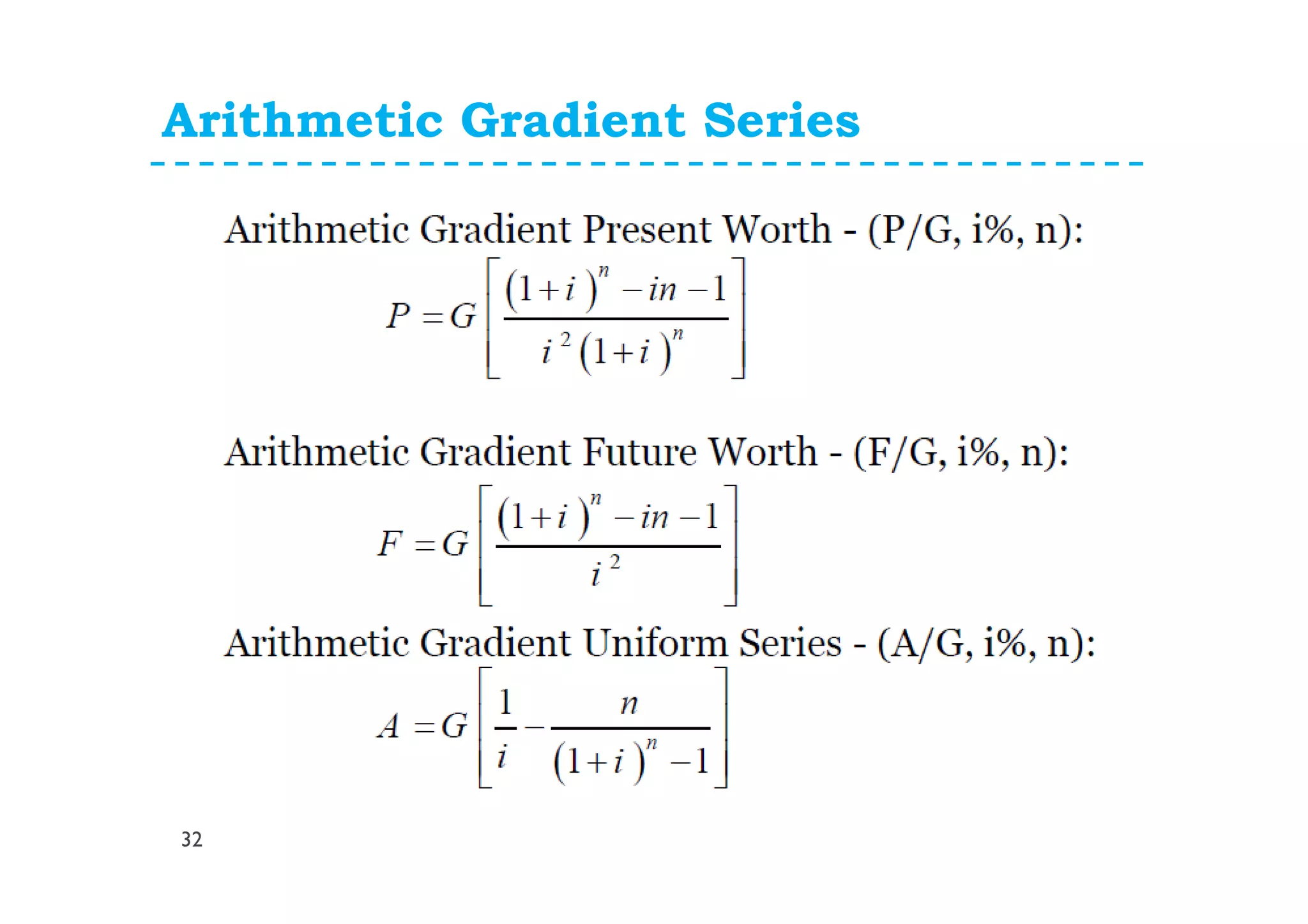

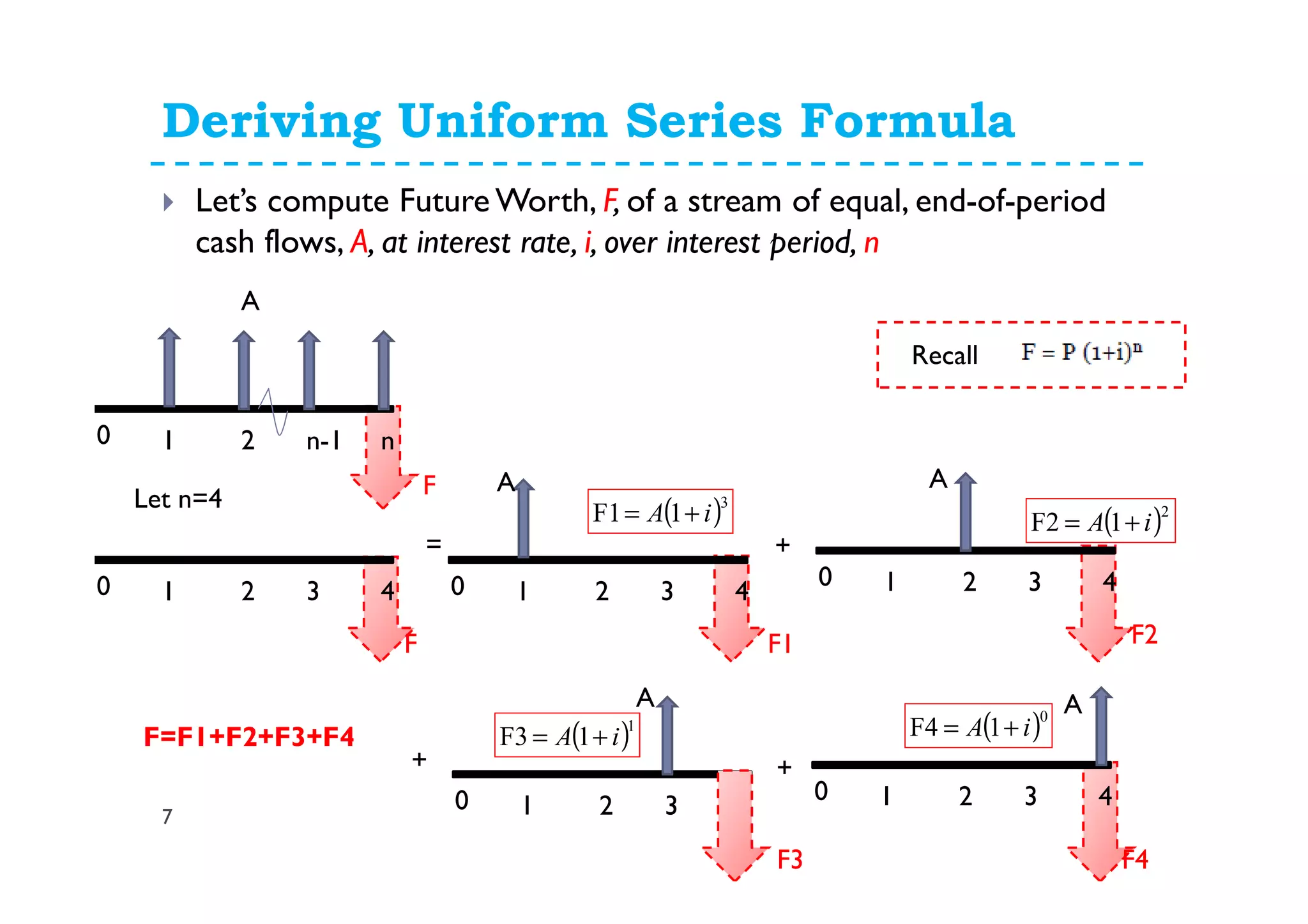

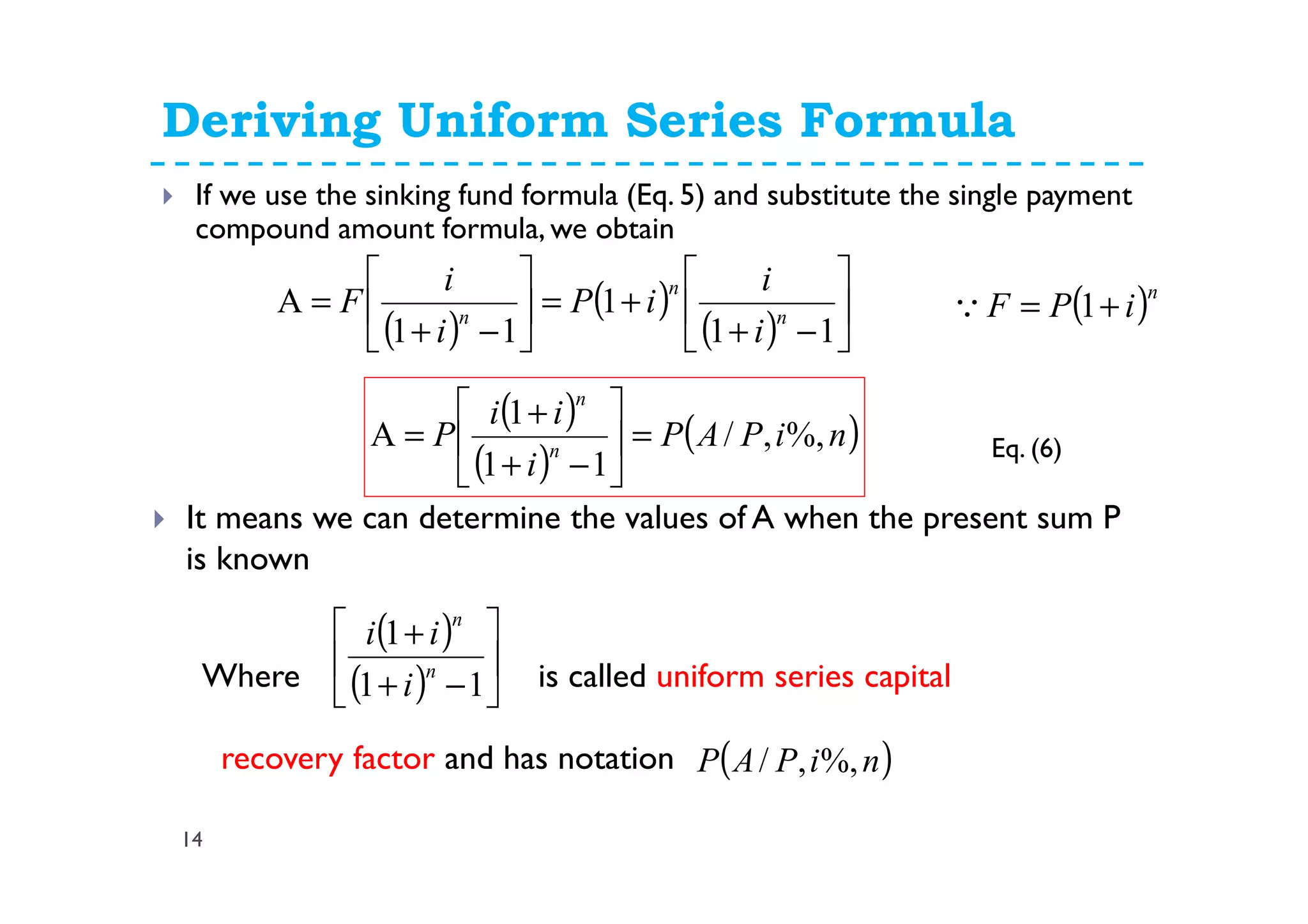

![Arithmetic Gradient Series

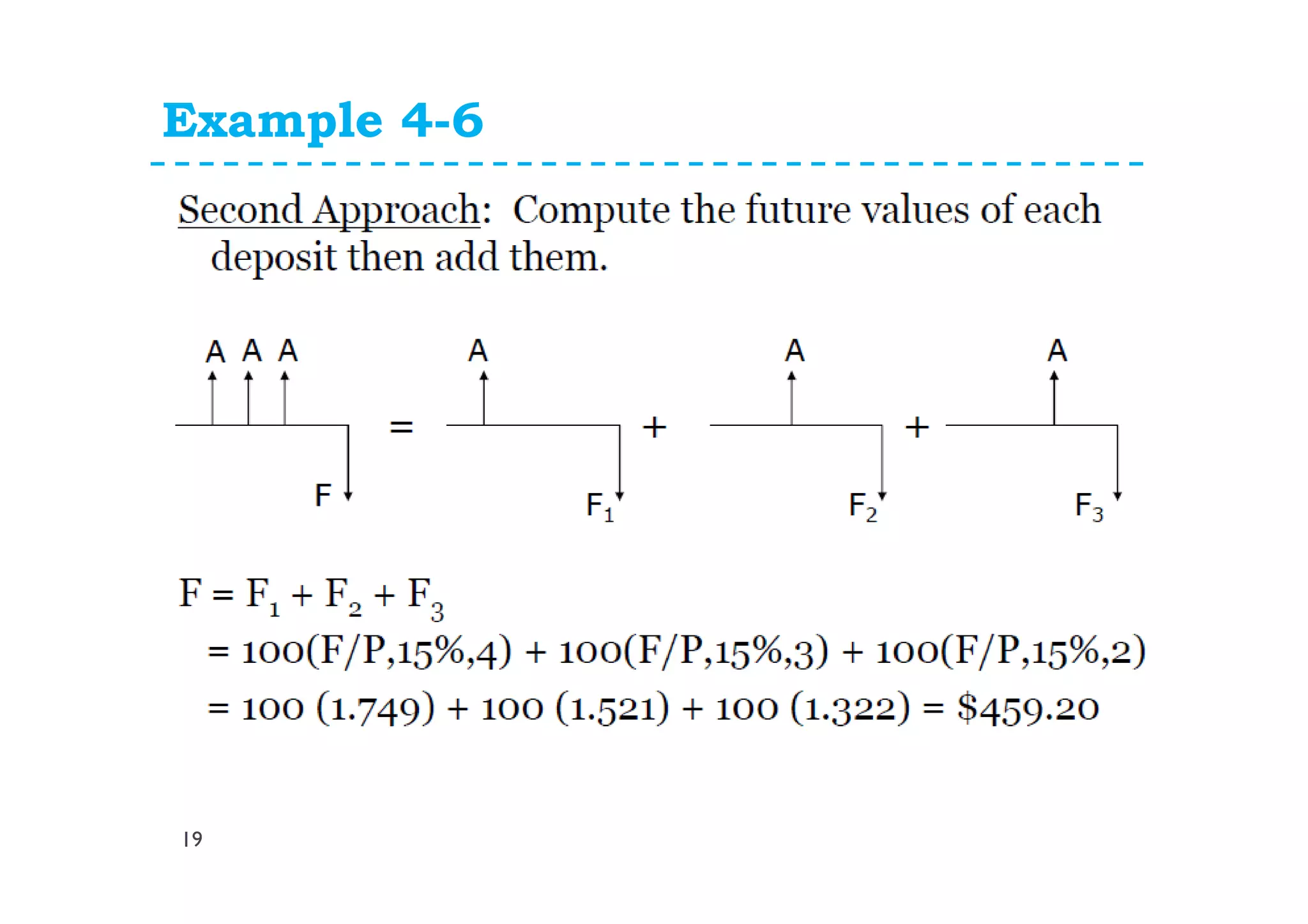

28

Let the cash flows increase/decrease by a uniform fixed amount G

every subsequent period

Eq. (1)

Recall

( ) ( ) ( )

( ) ( ) ( )[ ])1(1)2(...121F

)1()1(1)2(...121F

132

0132

−++−+++++=

+−++−+++++=

−−

−−

niniiG

iGniGniGiG

nn

nn](https://image.slidesharecdn.com/5moreinterestformulas-150316005456-conversion-gate01/75/5-more-interest-formulas-28-2048.jpg)

![Arithmetic Gradient Series

29

Multiplying Eq. (1) with (1+i), we get

( ) ( ) ( ) ( )[ ]1221

)1)(1(1)2(...121Fi1 ininiiG

nn

+−++−+++++=+

−−

( ) ( ) ( ) ( )[ ]1221

)1)(1(1)2(...121Fi1 ininiiG

nn

+−++−+++++=+

−−

( ) ( ) ( )[ ])1(1)2(...121F

132

−++−+++++=

−−

niniiG

nn

( ) ( ) ( ) ( )[ ]

( ) ( ) ( ) ( )[ ] nGiiiiG

niiiiG

nn

nn

−+++++++++=

+−++++++++=

−−

−−

111...11iF

111...11iF

1221

1221

Eq. (2)-Eq. (1)

Eq. (2)

-

( )

( ) ( )

−−+

=

−

−+

=

−

−+

=

2

1111

11

iF

i

nii

Gn

i

i

i

G

F

nG

i

i

G

nn

n

( ) [ ]niGFG

i

ini

GF

n

%,,/

11

2

=

−−+

=

Eq. (3)

Eq. (4)

Arithmetic

gradient future

worth factor](https://image.slidesharecdn.com/5moreinterestformulas-150316005456-conversion-gate01/75/5-more-interest-formulas-29-2048.jpg)

![30

( ) ( ) ( ) ( ) ( ) ( )[ ] ( )

( ) ( ) ( ) ( )[ ]

( )[ ]

( ) nG

i

i

GiF

nGiiGiiF

nGiiiiG

inGiiiiiGi

n

n

nn

nn

−

−+

=

−−+=

−+++++++++=

+−++++++++++=+

−−

−

11

11

111...11iF

1111...111iF

1221

231

-](https://image.slidesharecdn.com/5moreinterestformulas-150316005456-conversion-gate01/75/5-more-interest-formulas-30-2048.jpg)

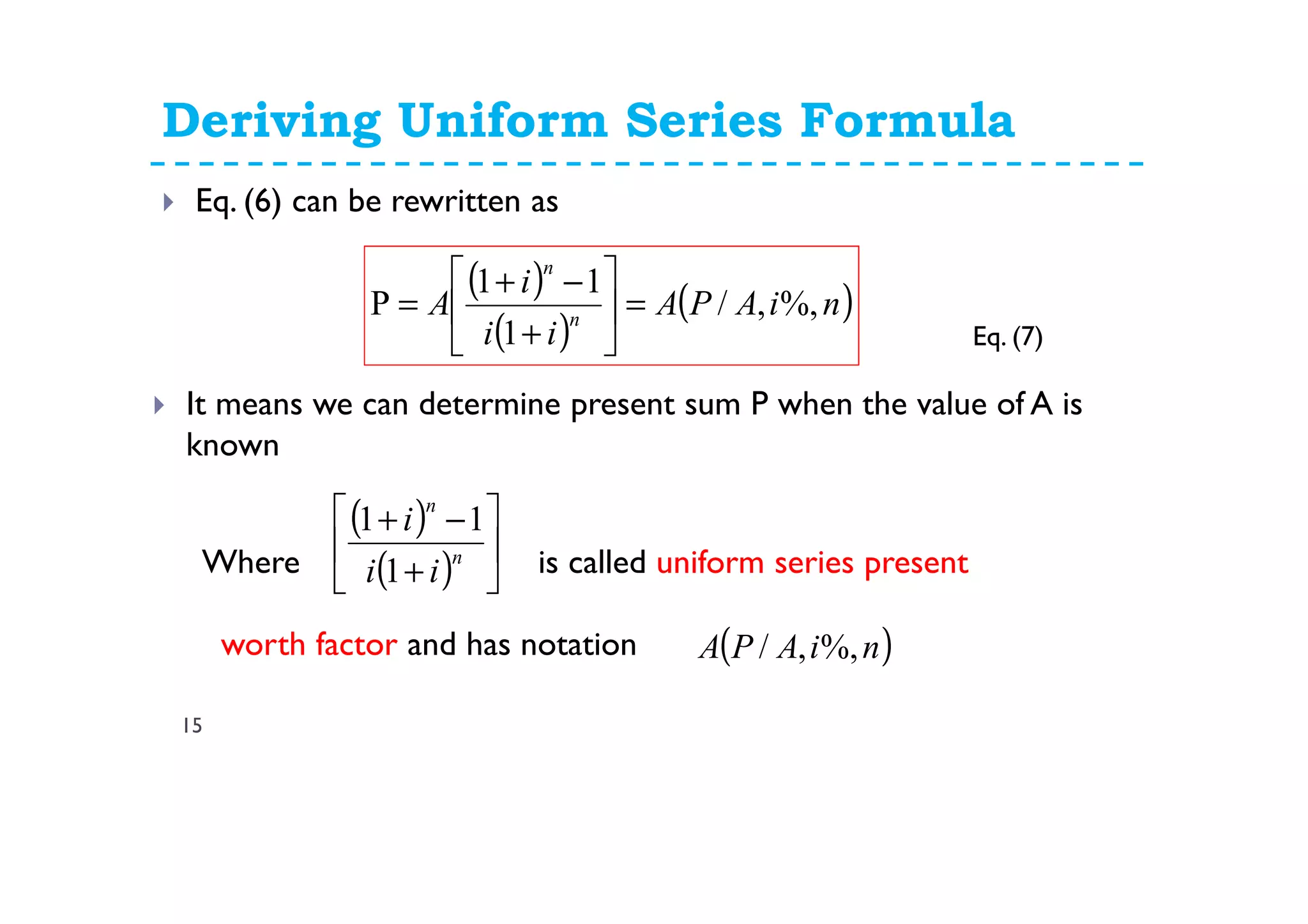

![Arithmetic Gradient Series

31

Substituting F from single payment compound formula, we can write

Eq.(4) as

( )

( )

[ ]niGPG

ii

ini

GP n

n

%,,/

1

11

2

=

+

−−+

=

Eq. (5)

(P/G ,i%, n) is known as Arithmetic gradient present worth factor

Now substituting value of F from uniform series compound amount

factor, we can write Eq. (4) as

Recall

( ) ( )

( )( )

( )( )

( )niGAGA

ii

inii

GA

i

i

A

i

ini

GF

n

n

nn

%,,/

11

11

1111

2

2

=

−+

−−+

=

−+

=

−−+

=

( )

−+

=

i

i

A

n

11

FQ

(A/G, i%, n) is known as Arithmetic gradient uniform series factor](https://image.slidesharecdn.com/5moreinterestformulas-150316005456-conversion-gate01/75/5-more-interest-formulas-31-2048.jpg)