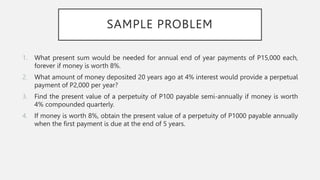

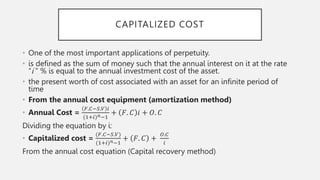

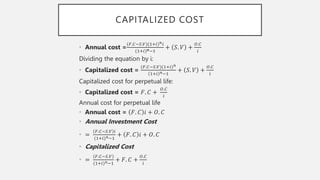

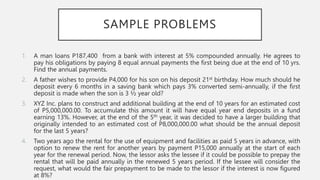

The document discusses different types of annuities including ordinary annuities, annuity due, deferred annuities, and perpetuities. It provides formulas and examples for calculating present and future worth for these annuity types. It also covers capitalized cost, which represents the present worth of the total cost associated with an asset over an infinite time period.

![ANNUITY DUE

is one where the payments are made at the beginning of each period.

• Present Worth

• 𝑃 =

𝐴[(1+𝑖)𝑛−1−1]

(1+𝑖)𝑛−1𝑖

+ 𝐴

• Future Worth

• 𝐹 =

𝐴 [(1+𝑖)𝑛+1−1

𝑖

− 𝐴](https://image.slidesharecdn.com/chapter-2-annuities-231003143022-364a3f1d/85/Chapter-2-ANNUITIES-pptx-7-320.jpg)

![PERPETUITY

is an annuity whose payments continue forever

Formulas:

• 𝑃 =

𝐴

𝑖

Perpetuity payable annually beginning of each year

• 𝑃 = 𝐴 +

𝐴

𝑖

Perpetuity payable annually with the first payment due at the end of “nth” year

• 𝑃 =

𝐴

𝑖

−

𝐴 [(1+𝑖)𝑛−1]

(1+𝑖)𝑛𝑖

Where: P = Present value of perpetuity

A = annuity or amount of perpetuity

i = rate of interest](https://image.slidesharecdn.com/chapter-2-annuities-231003143022-364a3f1d/85/Chapter-2-ANNUITIES-pptx-15-320.jpg)