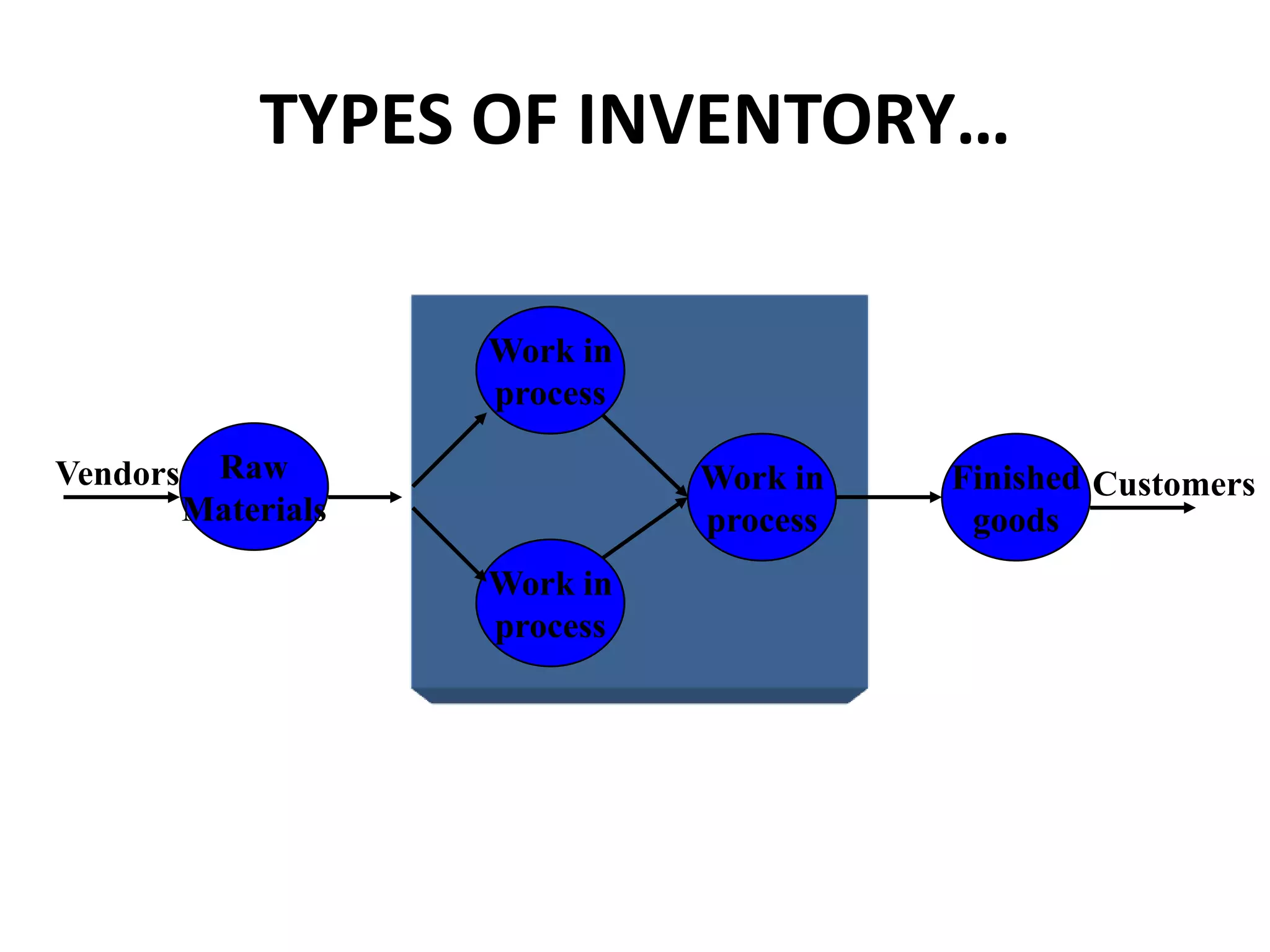

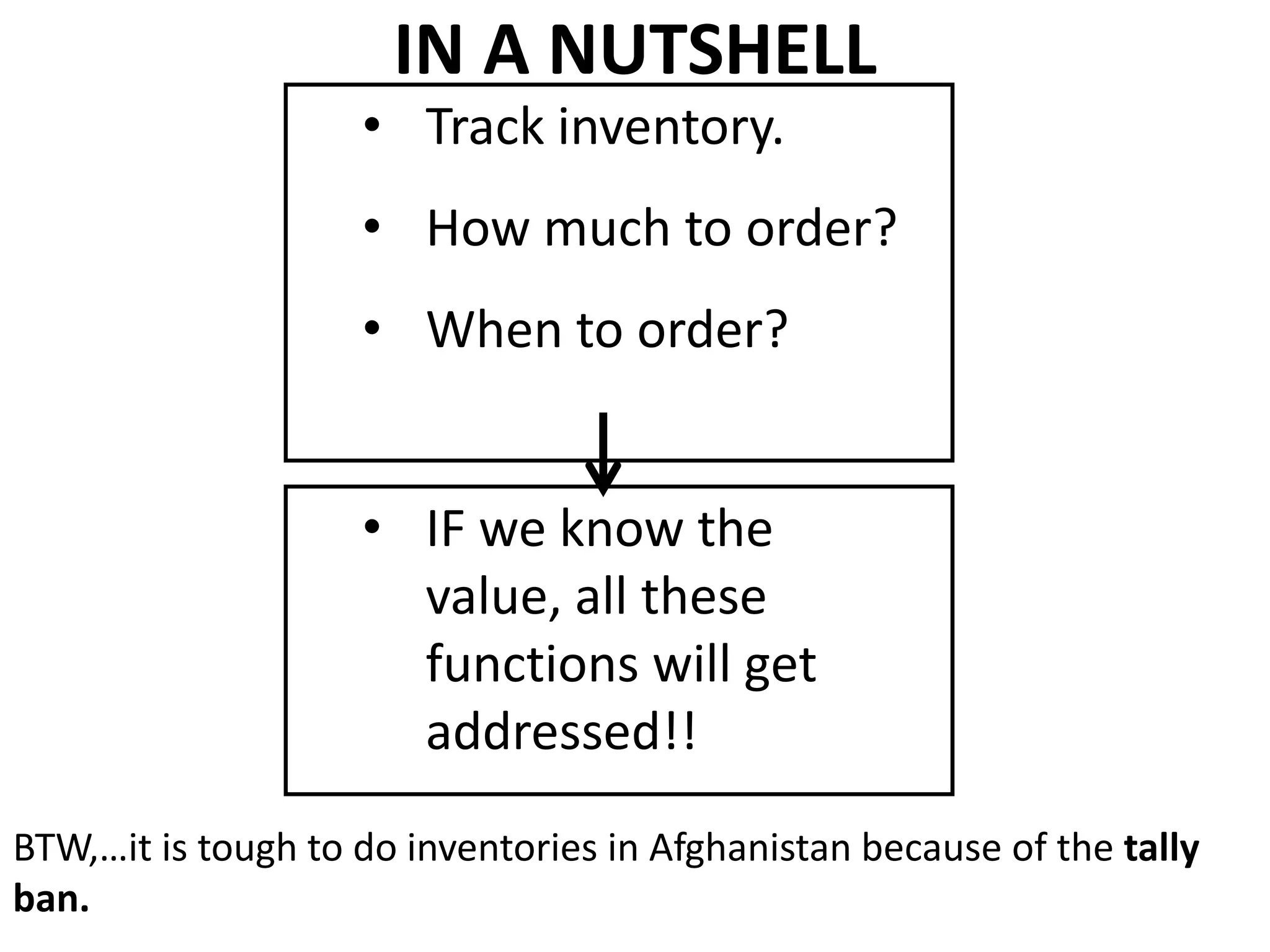

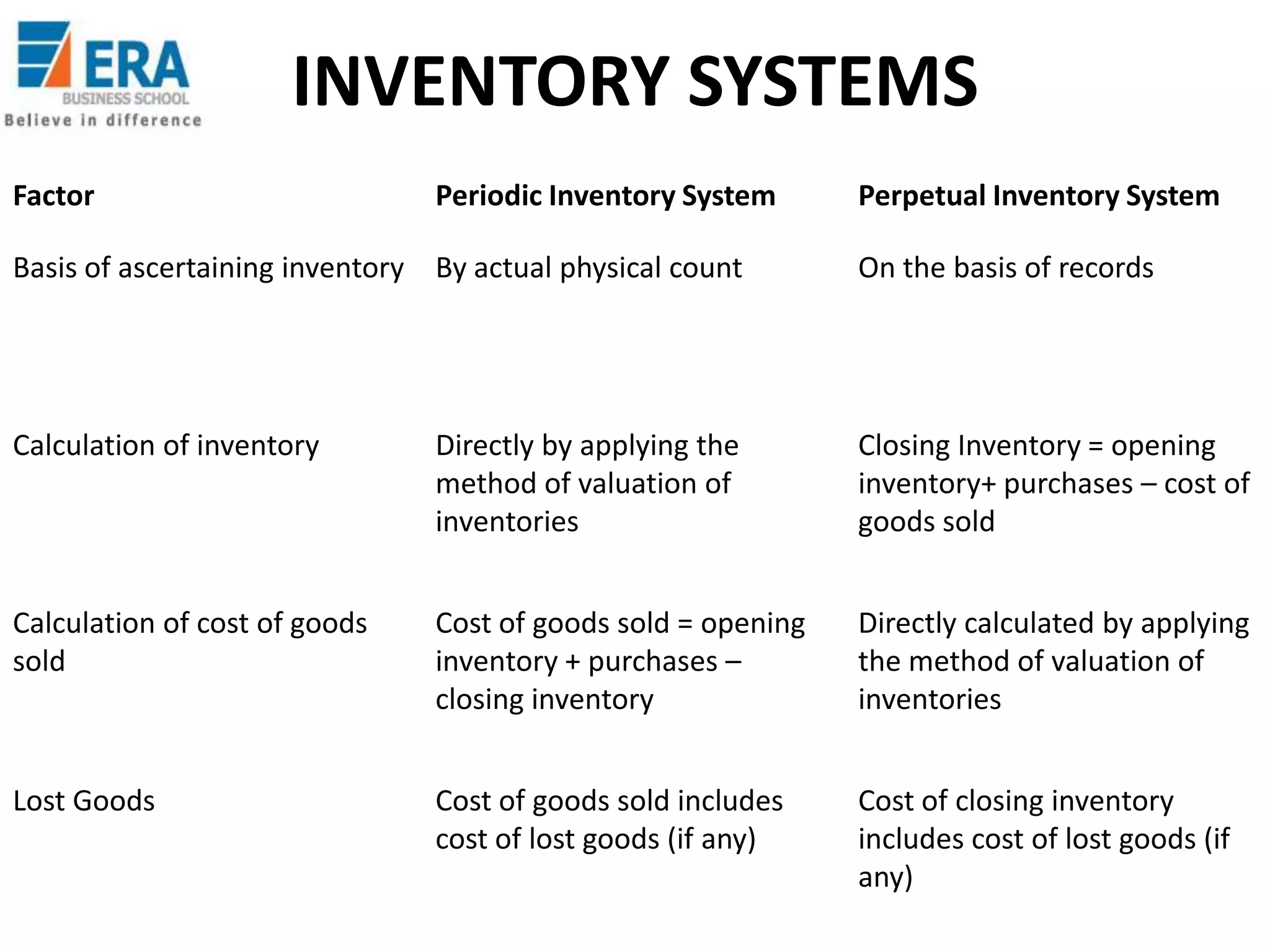

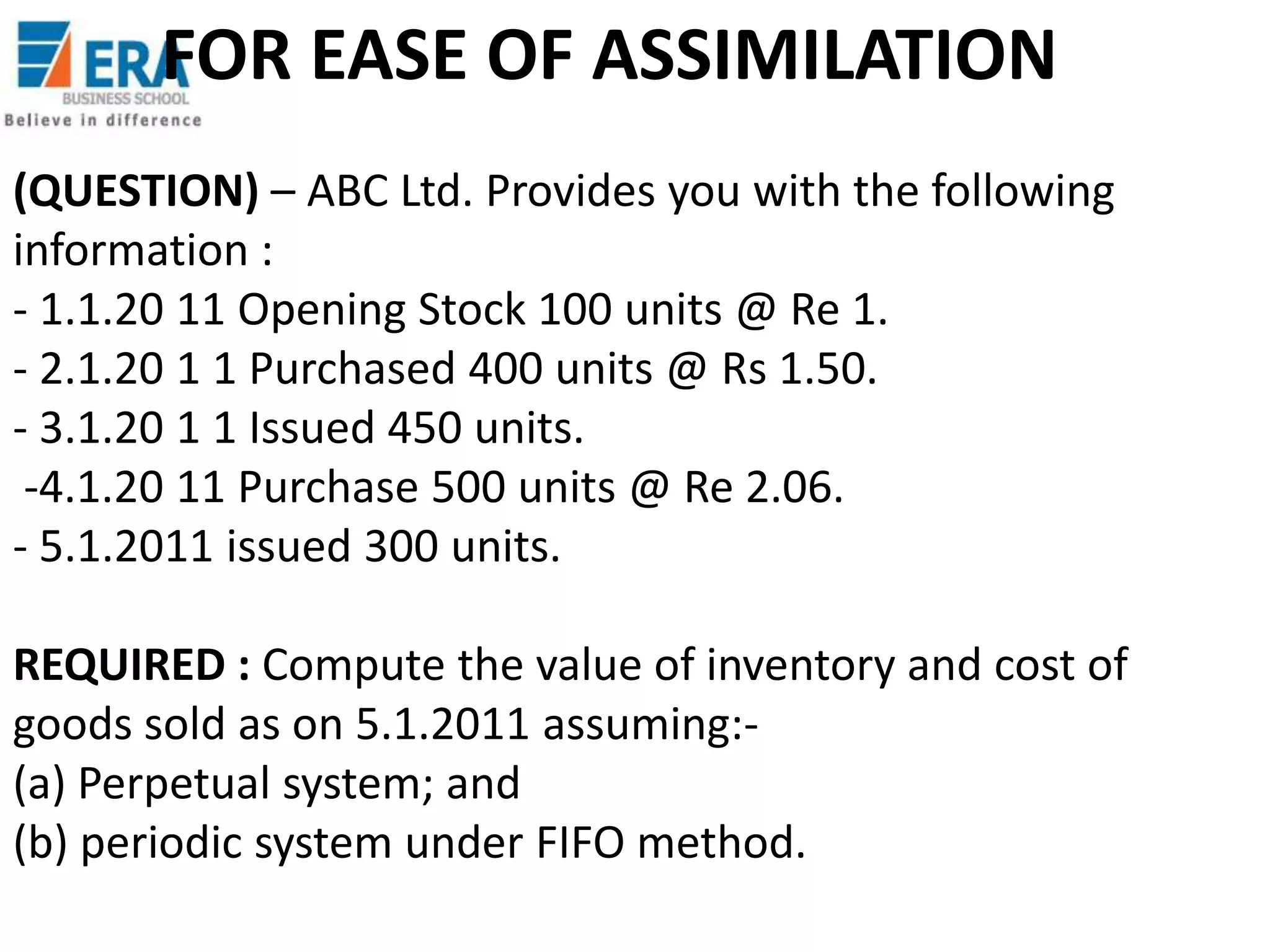

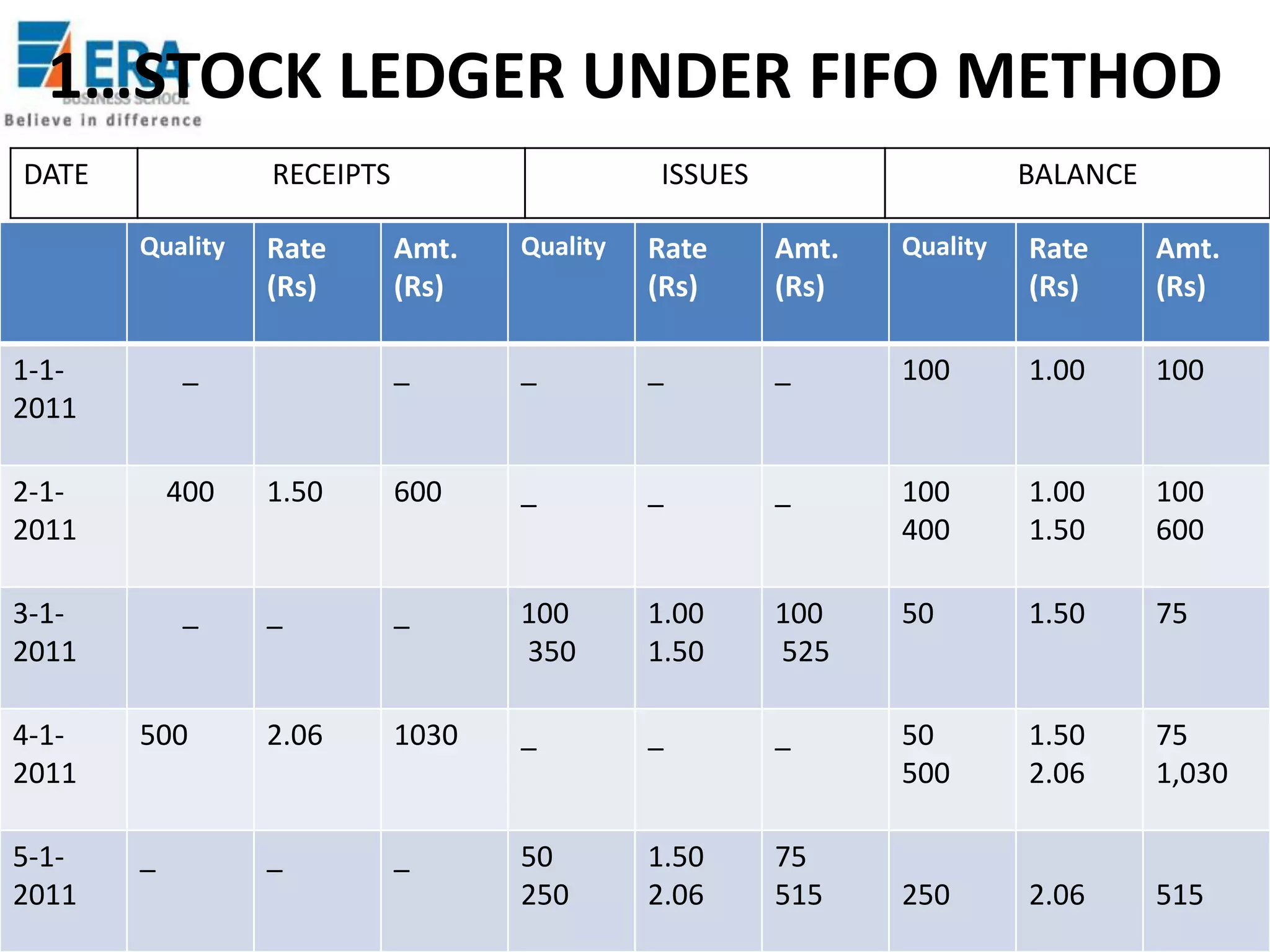

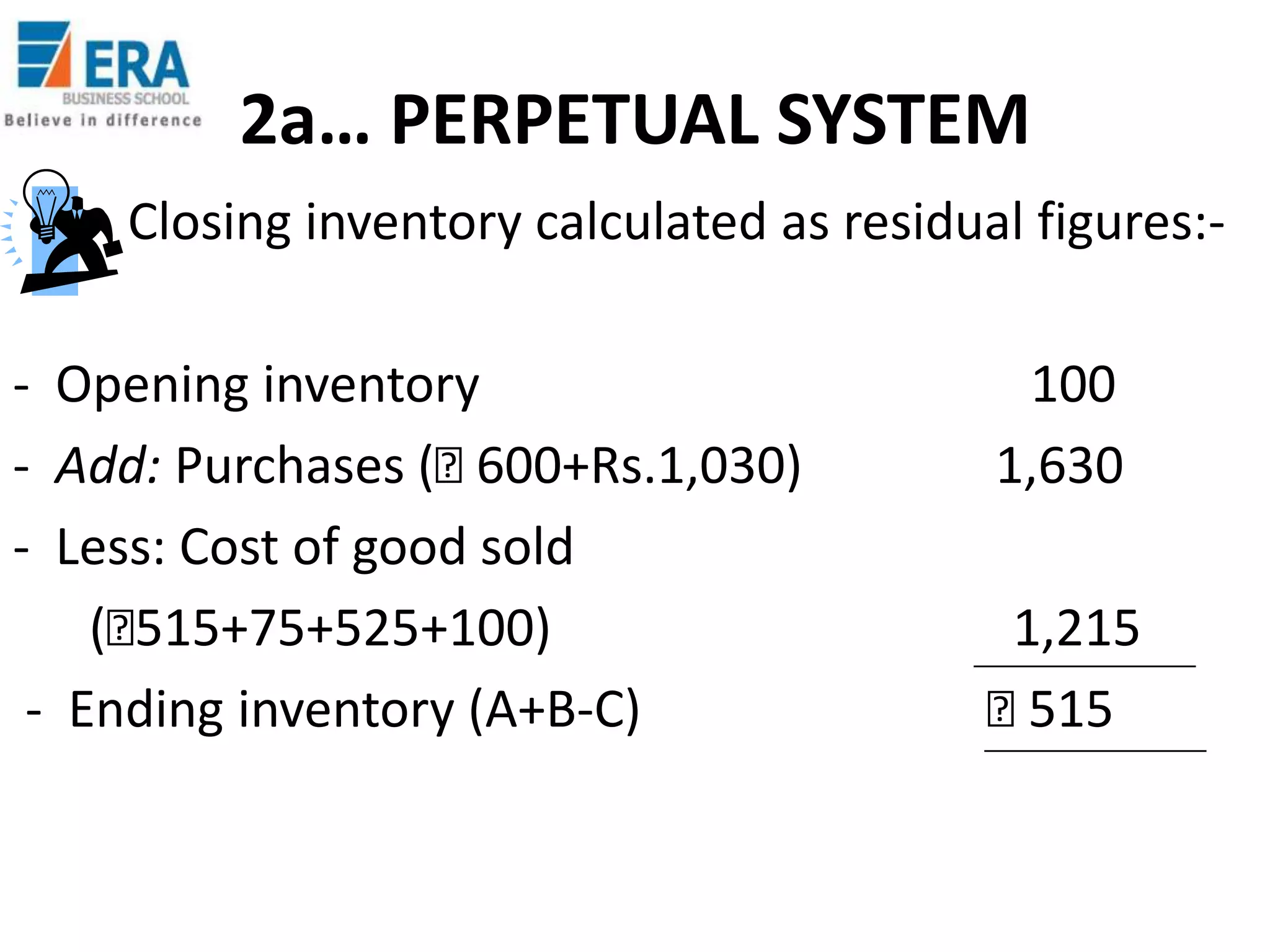

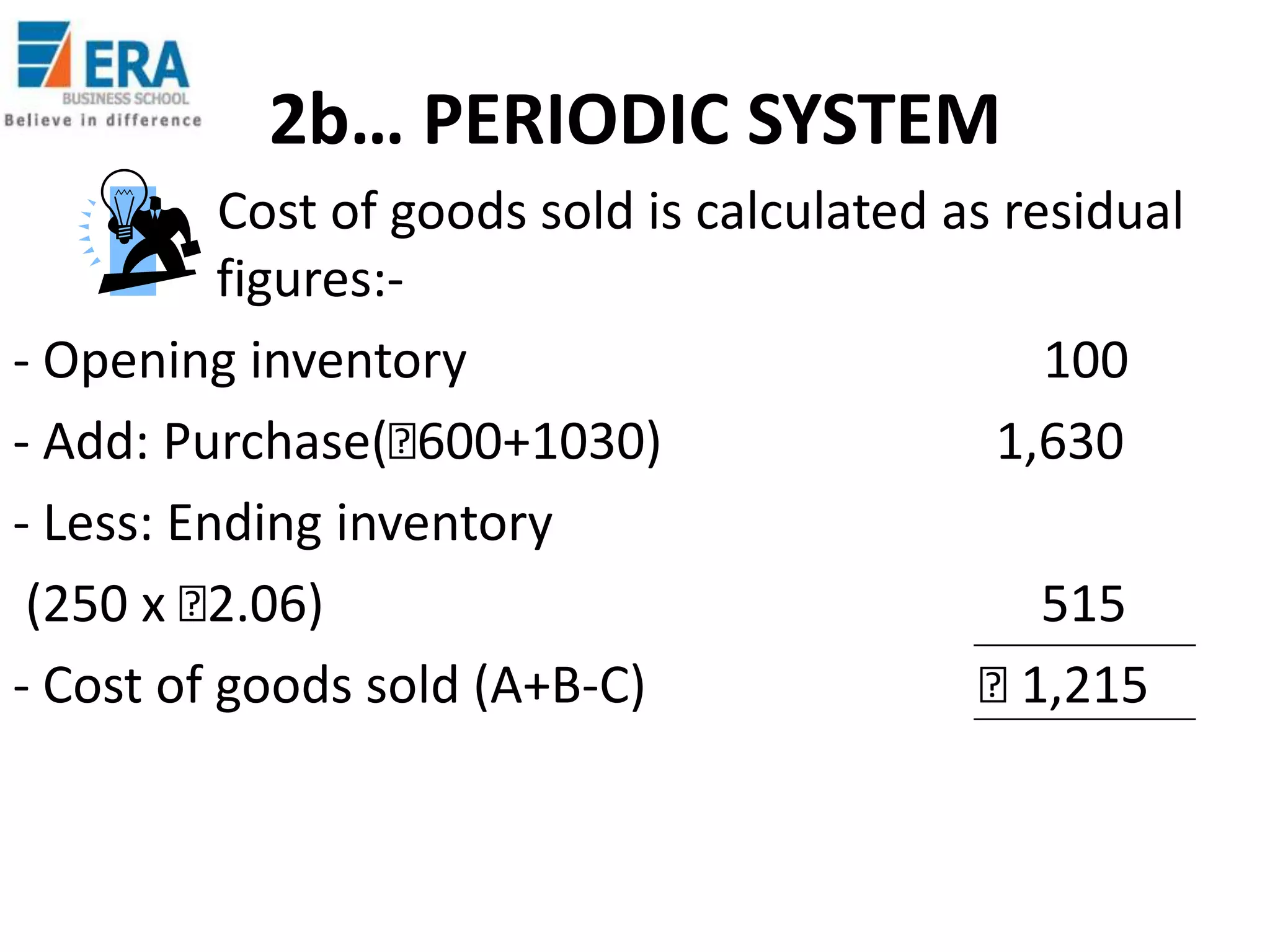

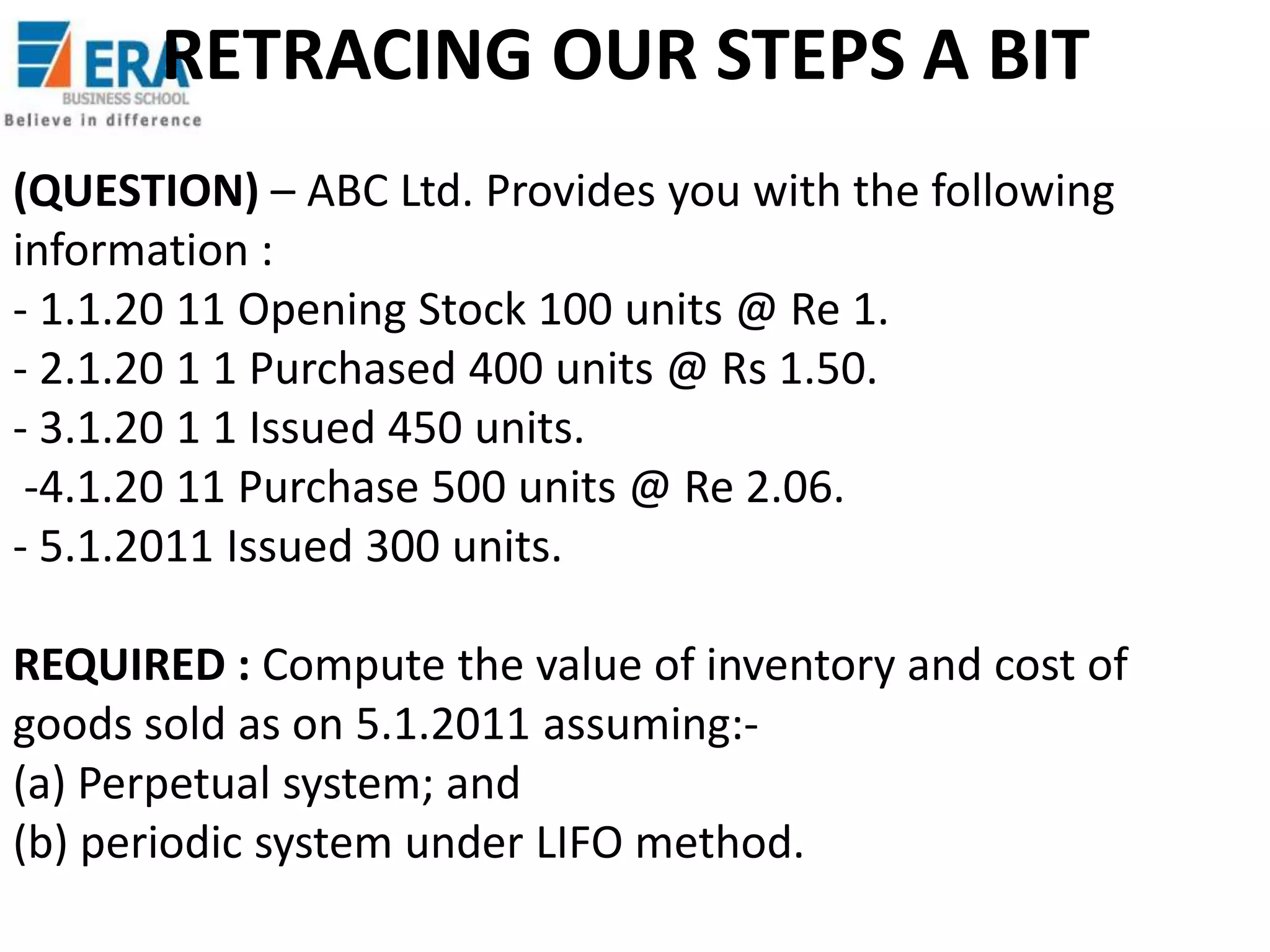

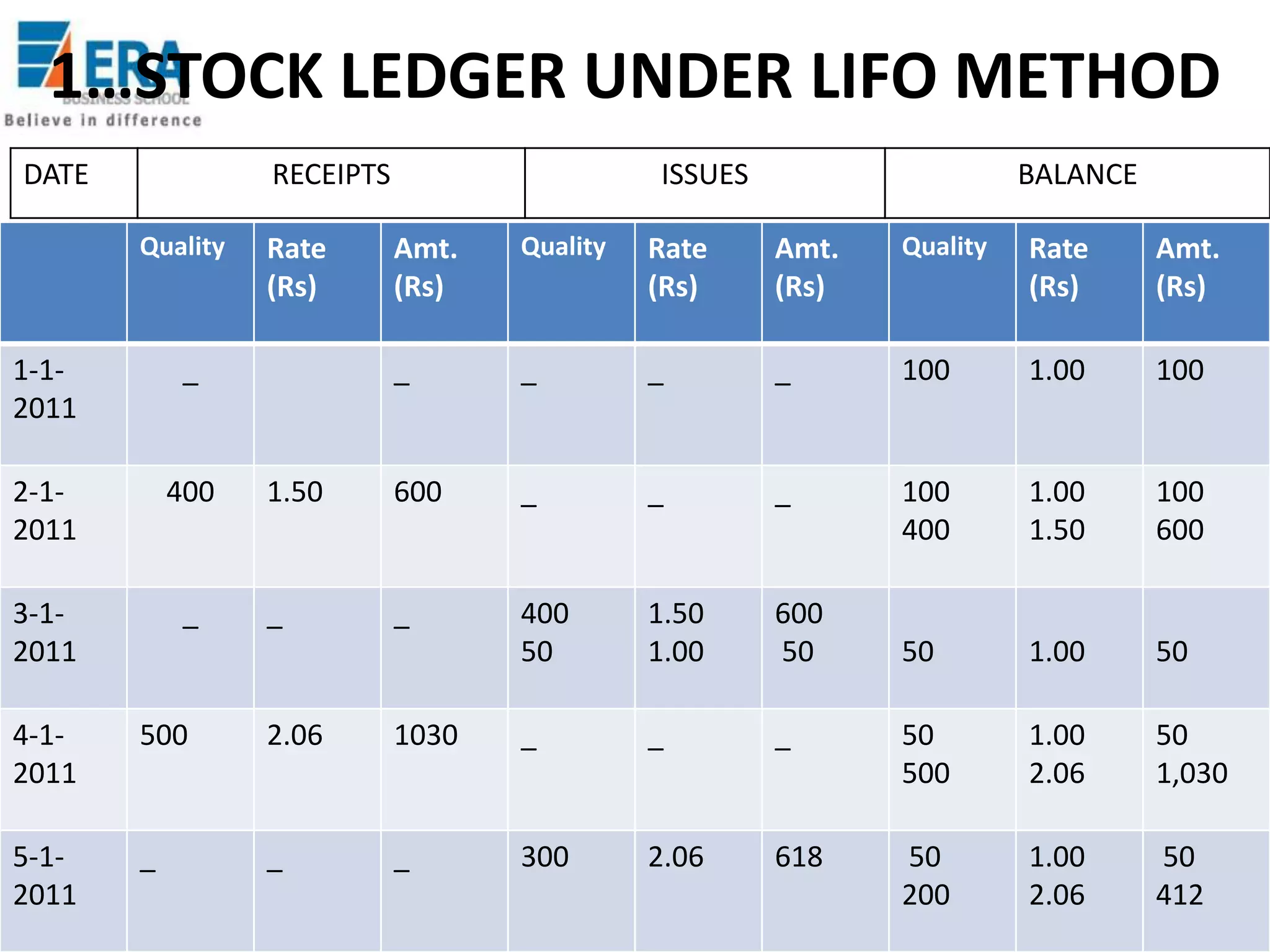

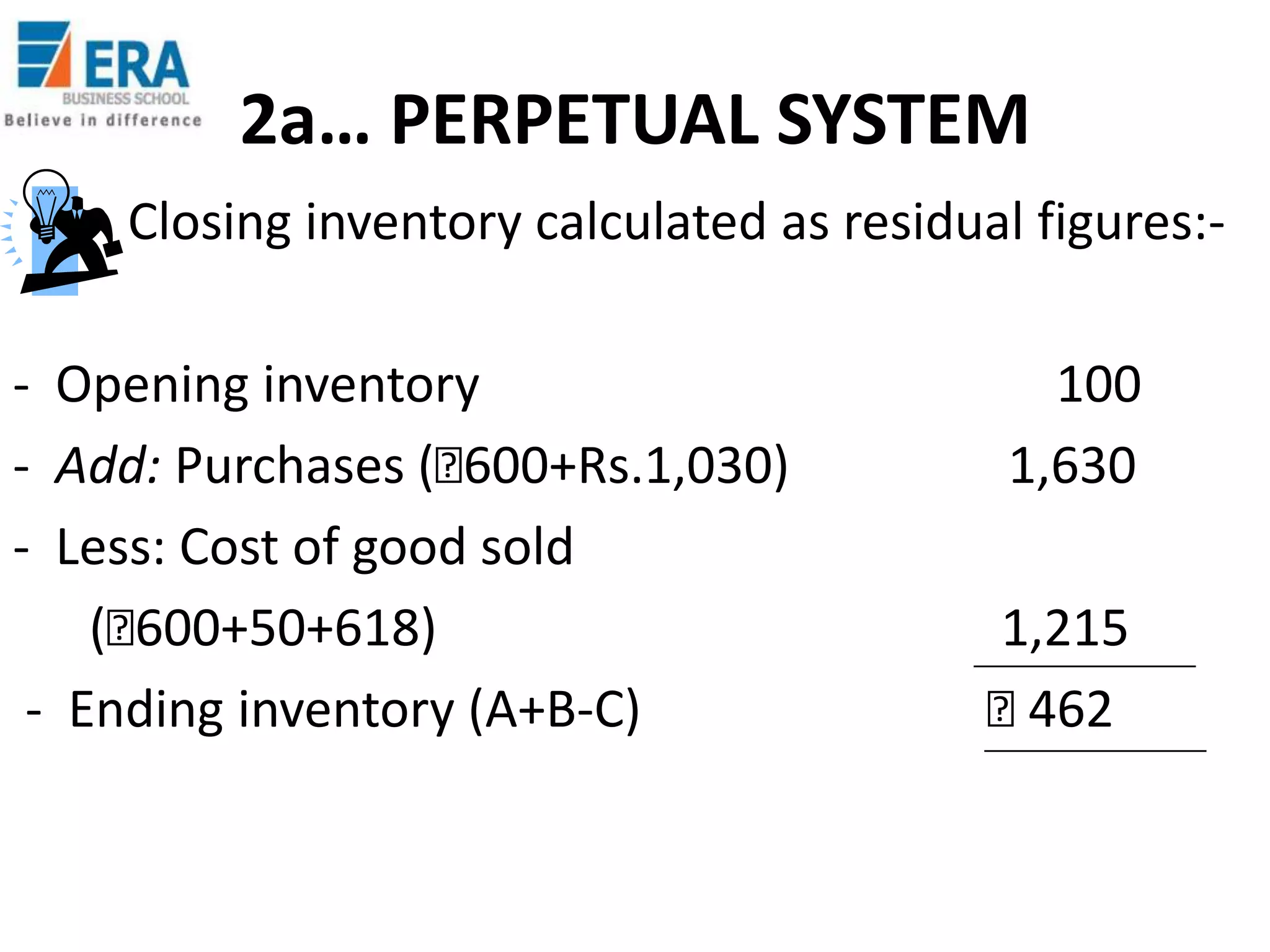

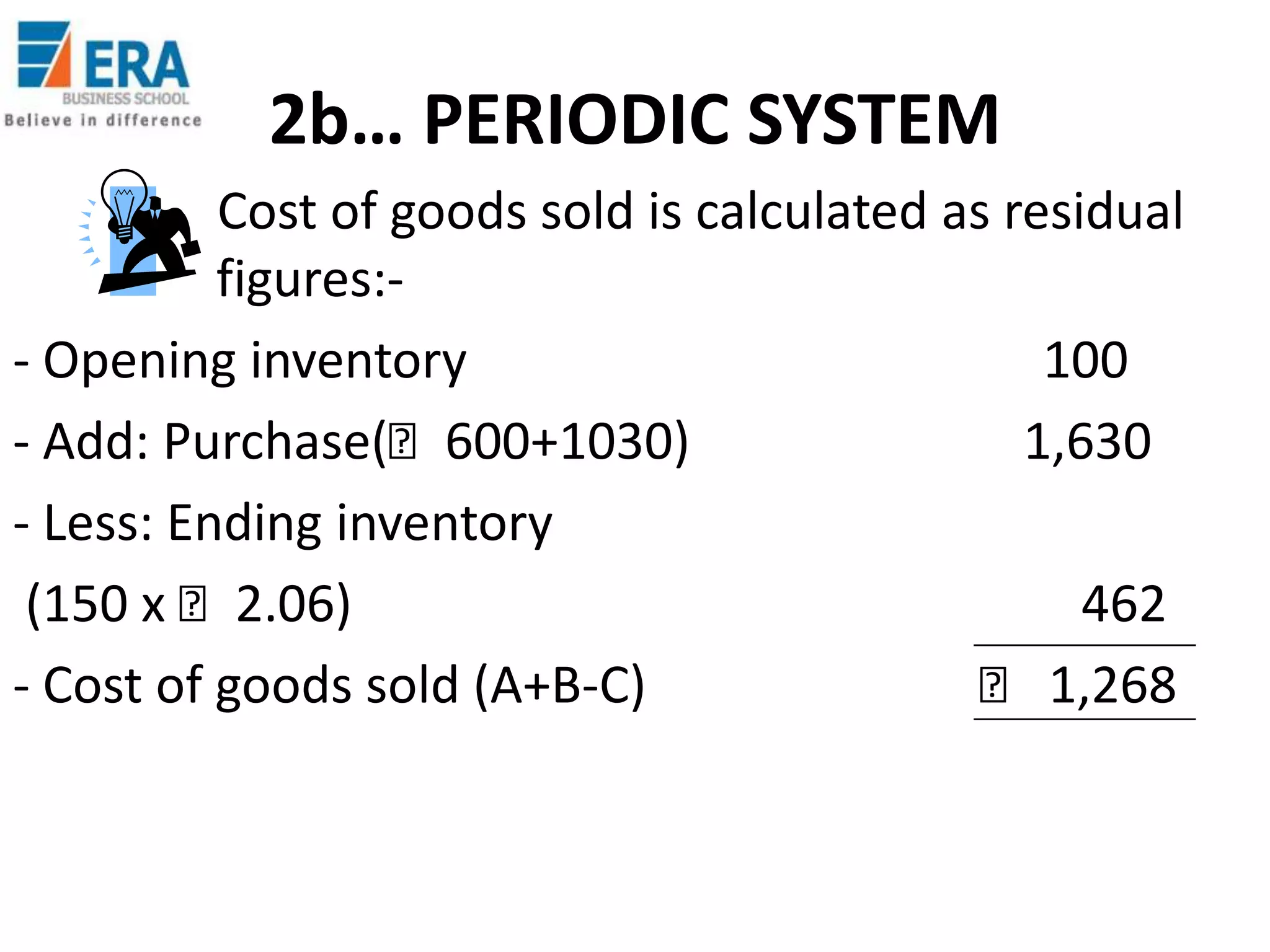

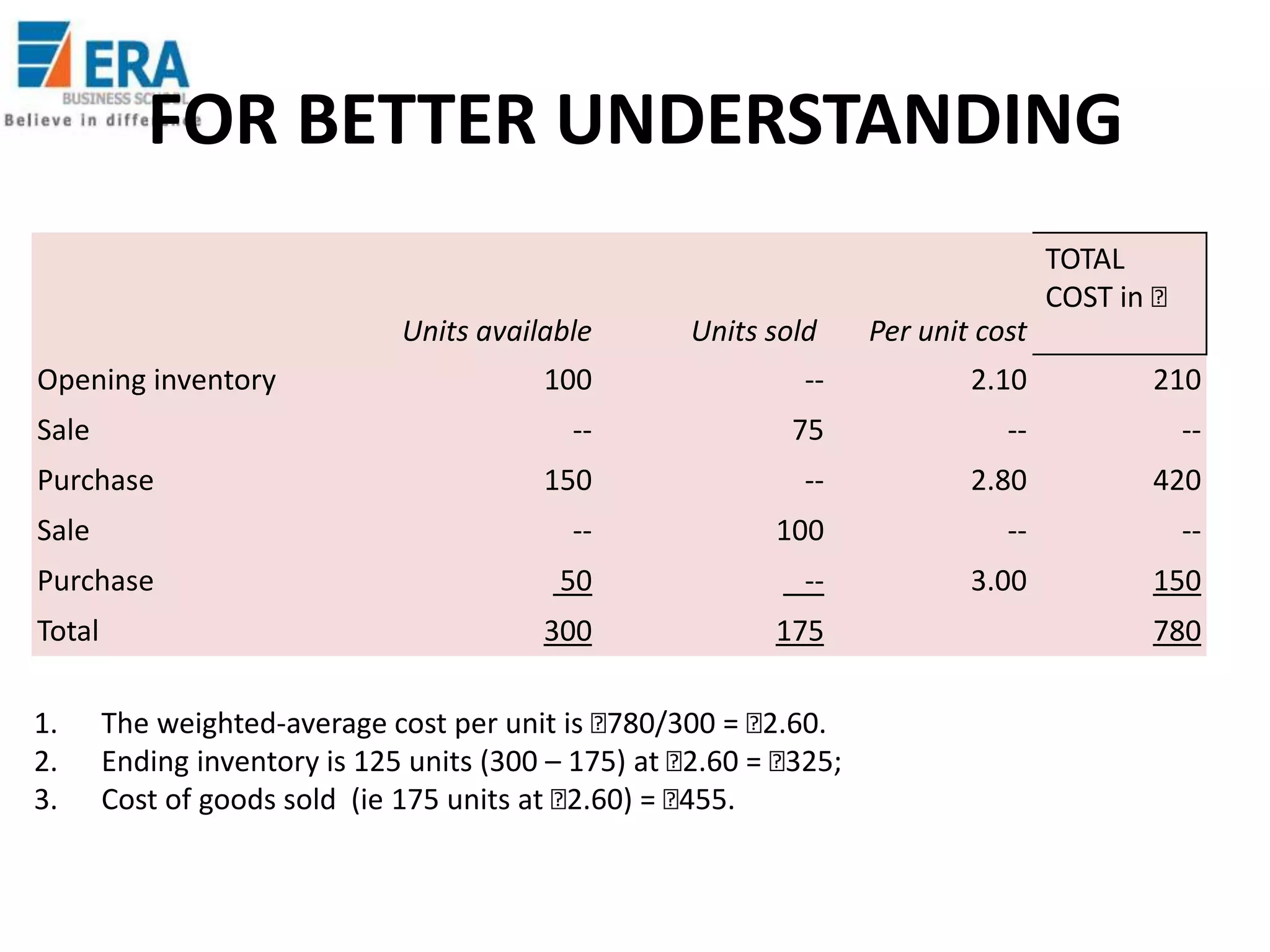

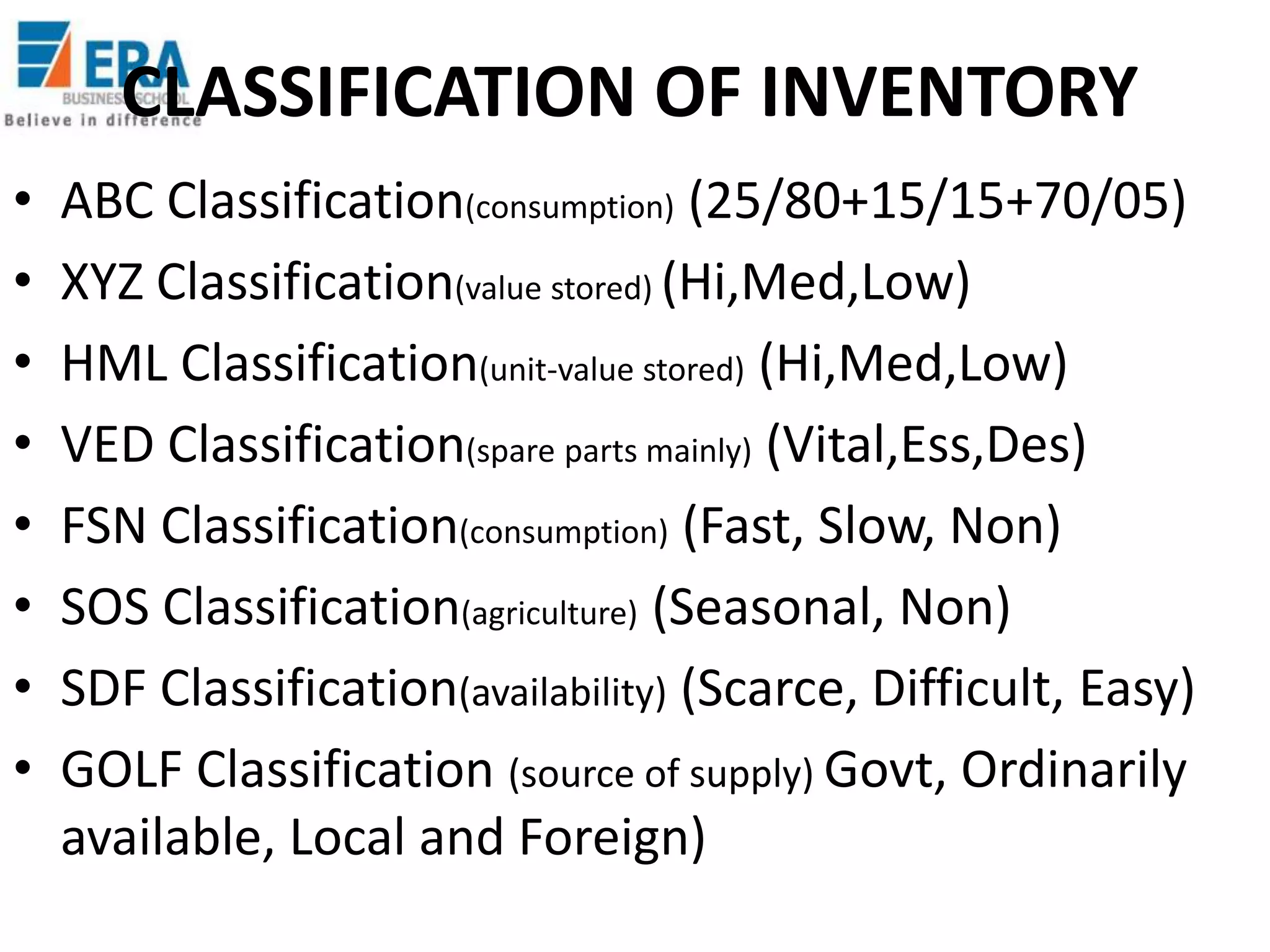

The document discusses inventory management, its types, significance, and the methods of valuation, including FIFO, LIFO, and weighted average cost. It emphasizes the importance of efficient inventory management to avoid financial implications and maintain optimal levels to support production and sales. Additionally, it outlines various classifications of inventory and emerging trends in inventory management processes.