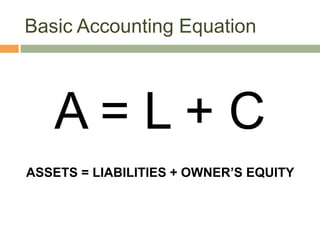

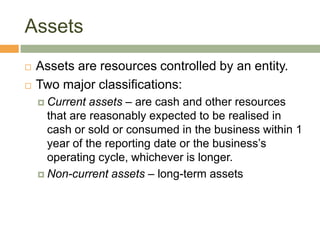

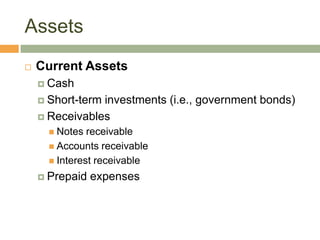

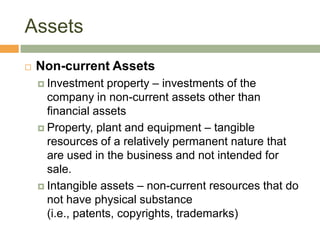

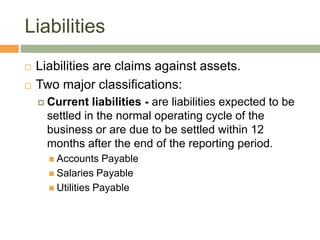

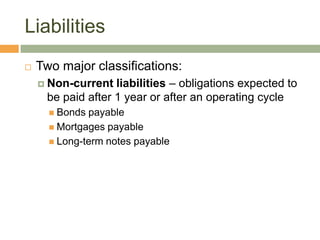

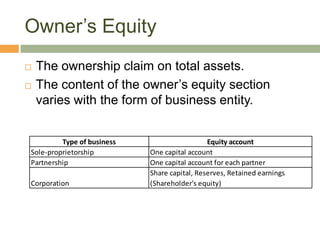

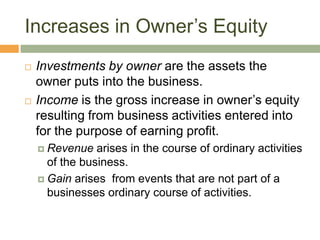

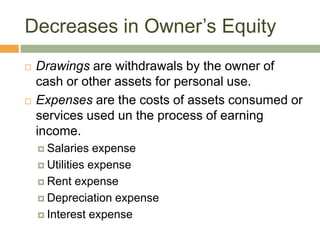

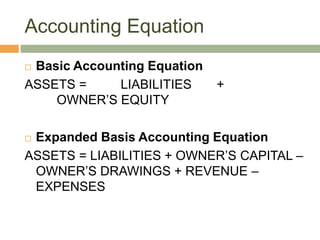

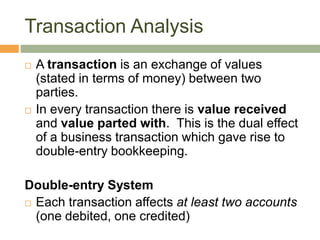

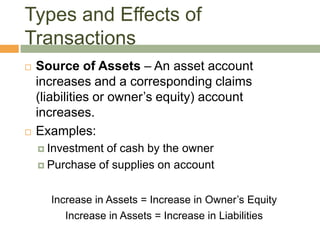

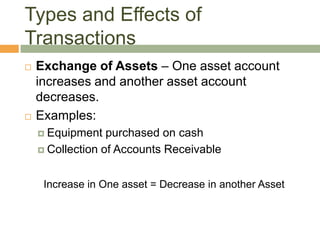

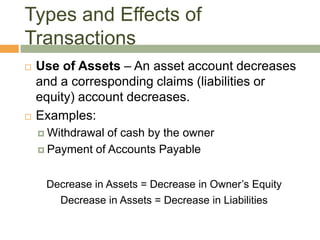

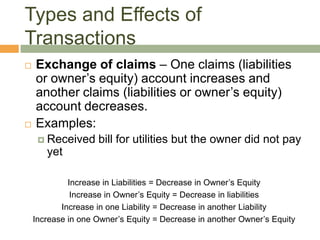

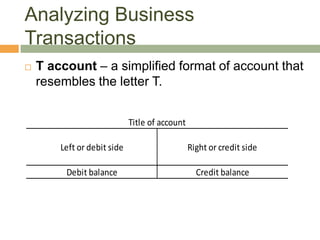

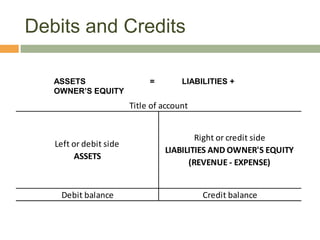

The document discusses the basic accounting equation of Assets = Liabilities + Owner's Equity. It defines key accounting concepts such as assets, liabilities, owner's equity, and how transactions affect accounts. Assets are resources owned, liabilities are amounts owed, and owner's equity is the residual claim. The accounting equation is expanded to track increases and decreases in owner's equity from revenues, expenses, investments, and withdrawals. Transactions are analyzed to show their dual effects on at least two accounts.