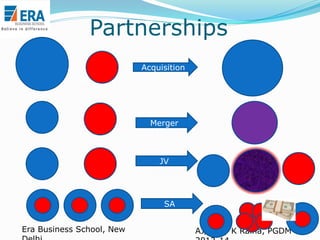

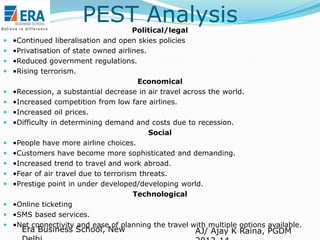

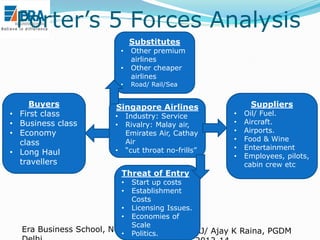

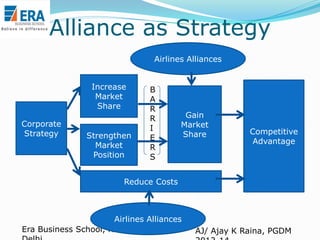

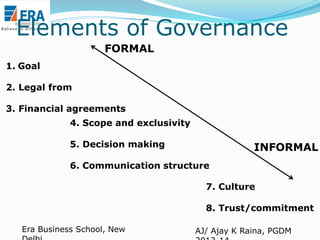

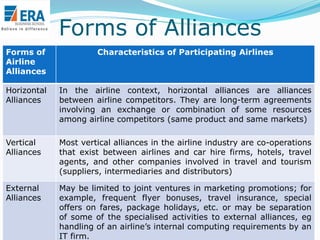

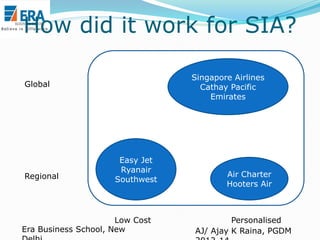

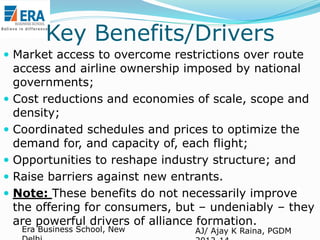

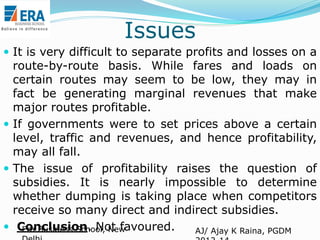

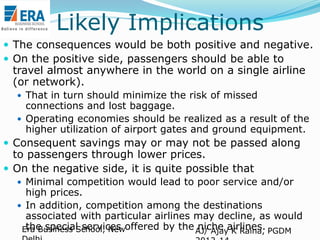

The document discusses the dynamics of airline alliances as a strategy for increasing market share and overcoming international barriers in the airline industry. It analyzes trends, challenges, and the necessity of partnerships in response to globalization, regulatory controls, and economic pressures. Key aspects include the formation of alliances to streamline operations, enhance customer service, and maintain competitiveness among airlines.