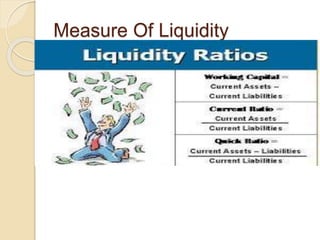

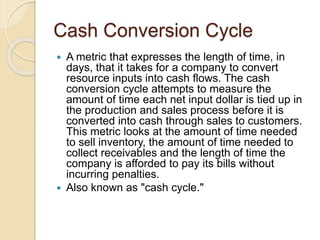

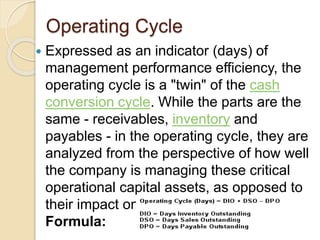

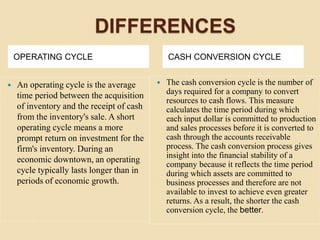

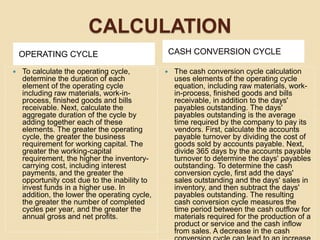

The document discusses working capital management, which involves managing a firm's current assets and liabilities to ensure adequate liquidity and efficient operations. It defines working capital, explores its interpretations, and explains concepts like operating cycle, cash conversion cycle, and liquidity management. Additionally, it outlines methods to calculate these cycles and highlights the importance of effective cash management for financial stability.