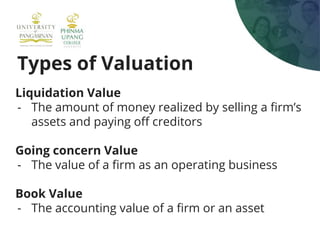

This document discusses valuation concepts and methods. It begins with defining valuation as the process of determining the current or projected worth of an asset or company. It then outlines several types of valuation including liquidation value, going concern value, and book value. Several common valuation methods are also described, such as the book value method, capitalization of earnings method, and discounted cash flow method. The document notes limitations in valuation and concludes with key takeaways about valuation being a quantitative process and that different methods can produce different values.