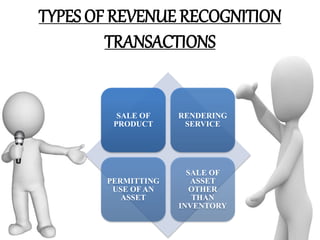

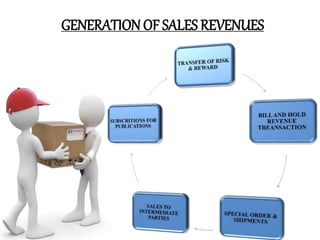

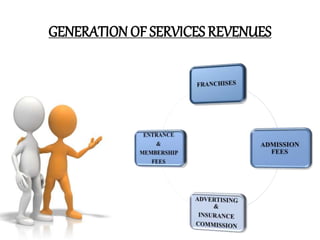

The document discusses revenue recognition principles under GAAP. It defines revenue as the gross inflow of cash or other consideration from business activities. Revenue recognition is the process of recording revenue in the financial statements. There are different types of revenue recognition transactions including sale of products, rendering of services, permitting use of an asset, and sale of assets other than inventory. The document also discusses revenue measurement, generation of sales and service revenues, classification of expenditures as capital or revenue items, and types of revenue and deferred revenue expenditures.