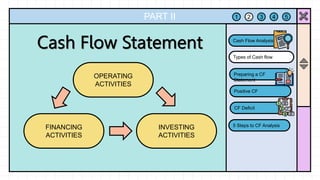

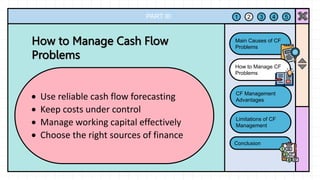

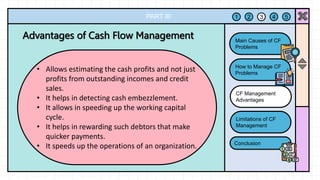

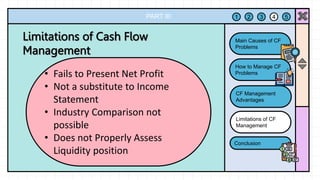

Cash flow is the lifeblood of a business. Effective cash flow management is vital to a business's success. Understanding how to calculate and project cash flow through various formulas allows businesses to properly manage their finances and address potential cash flow problems before they become critical issues.