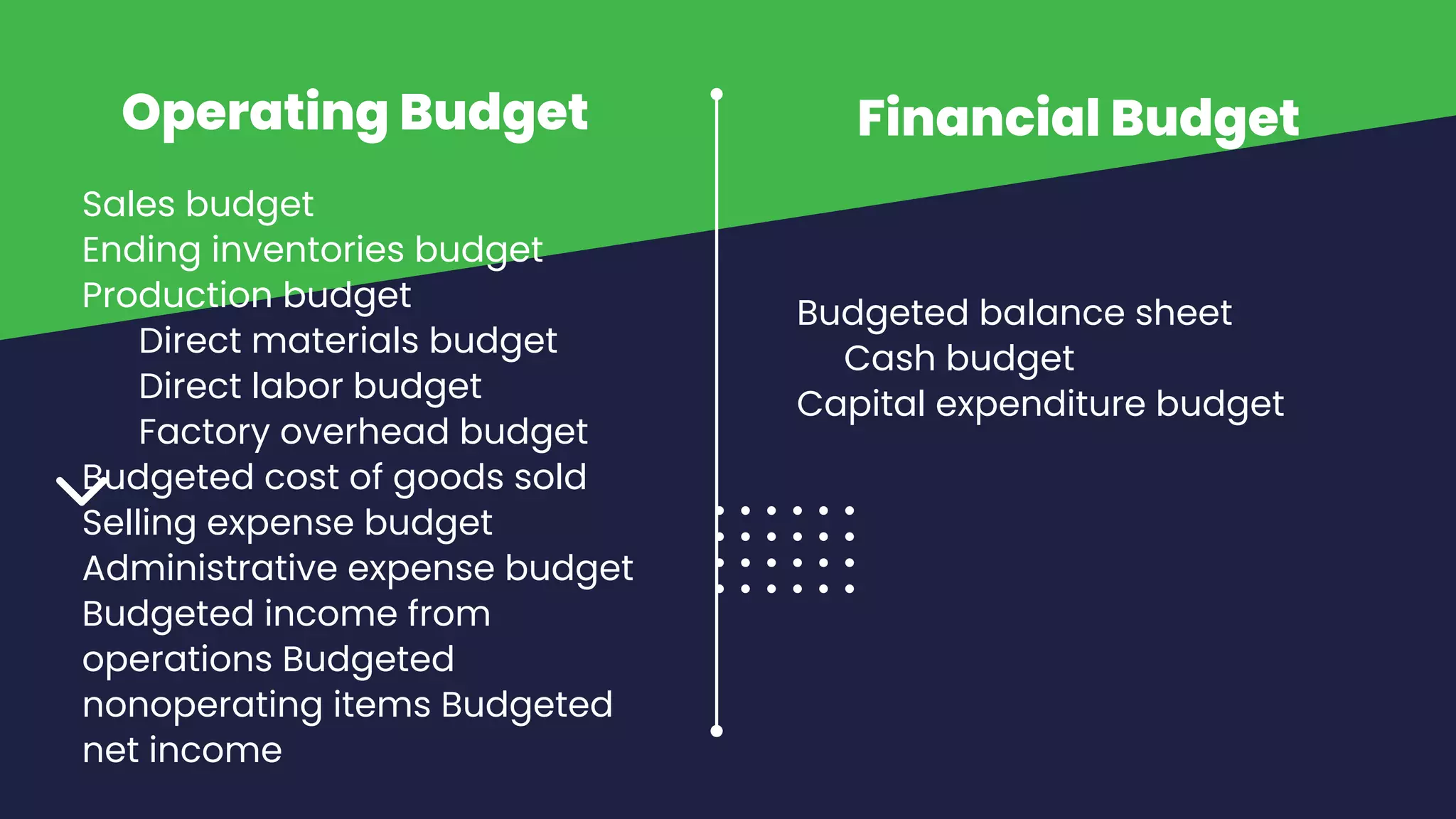

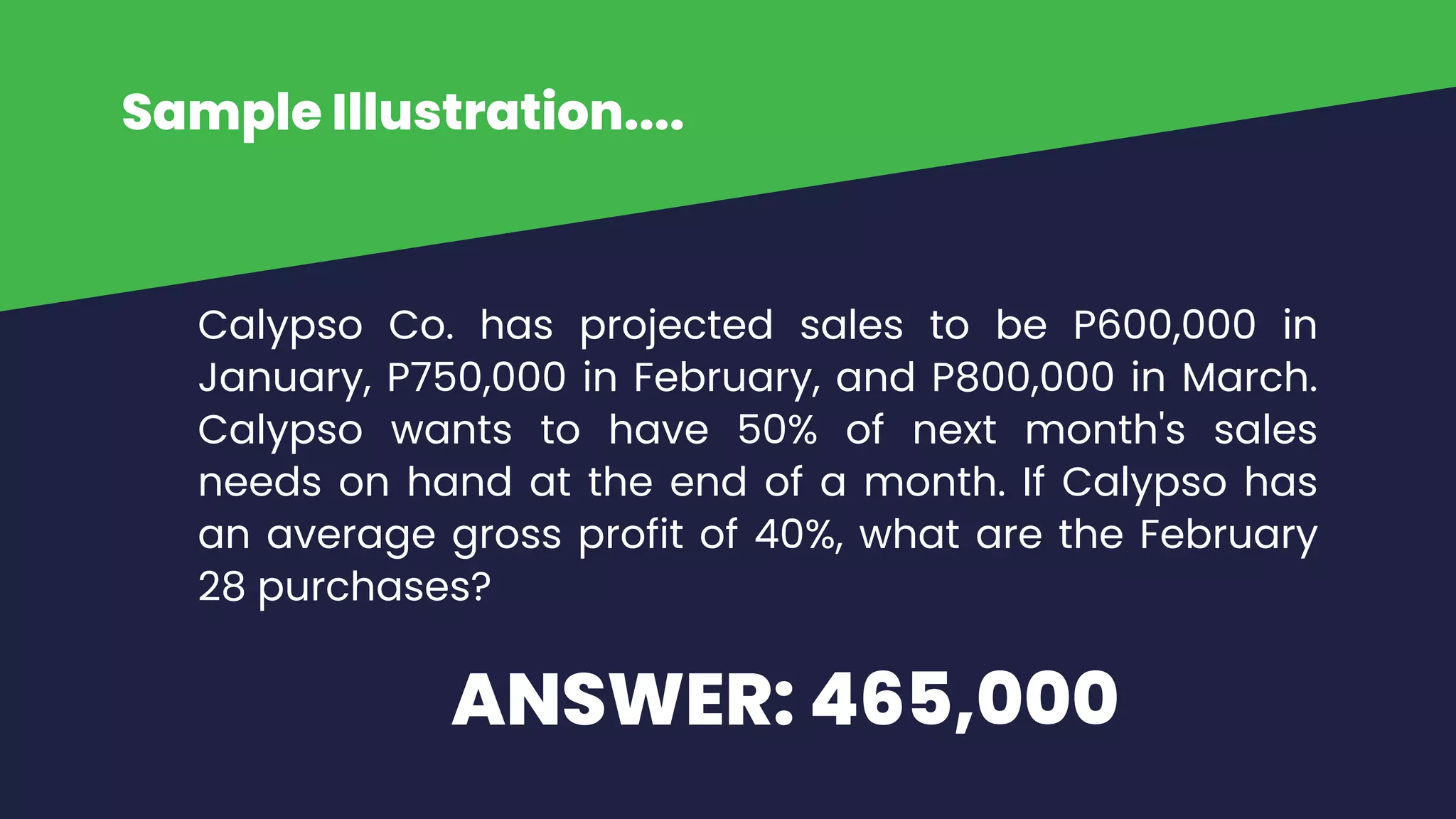

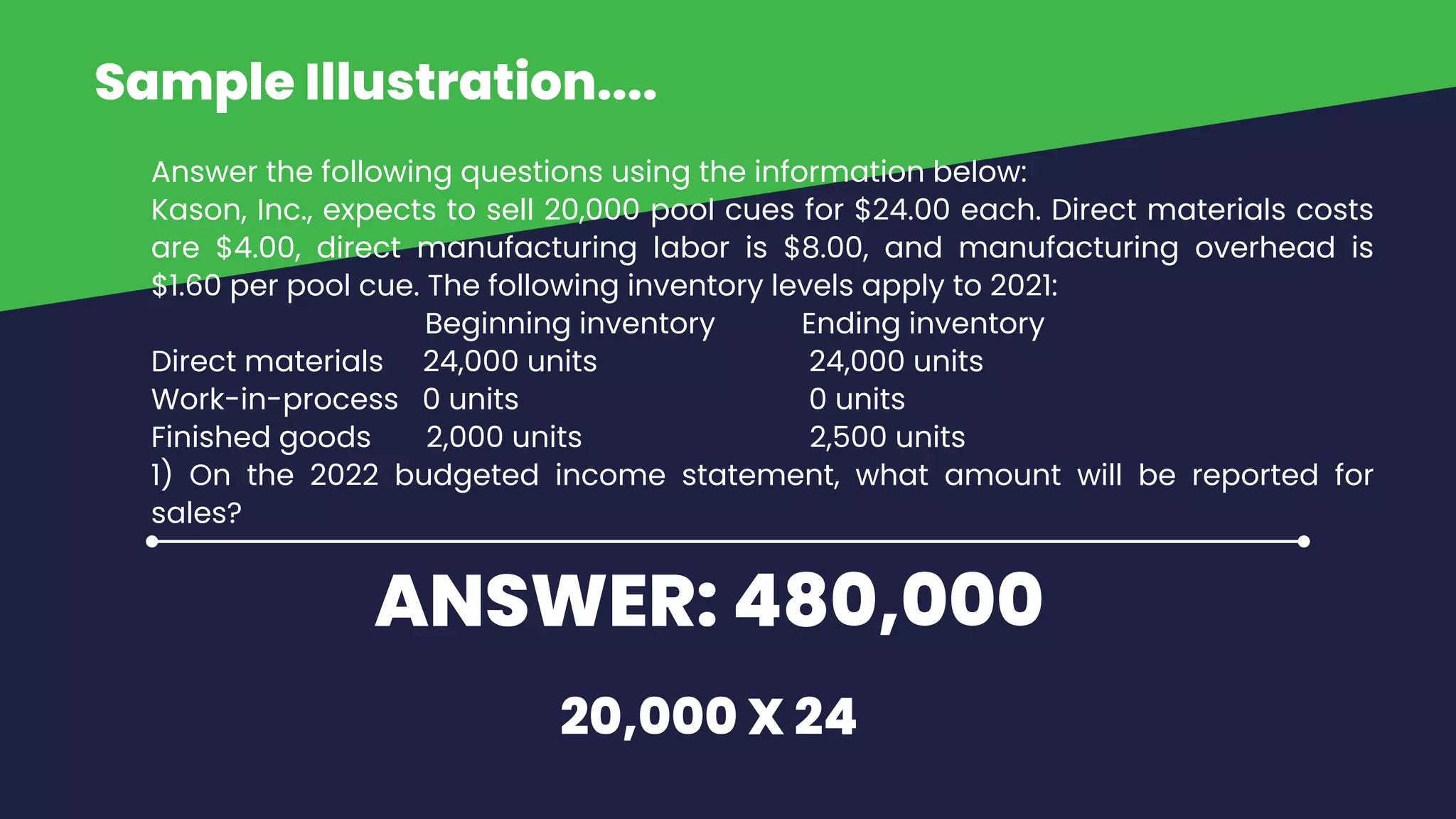

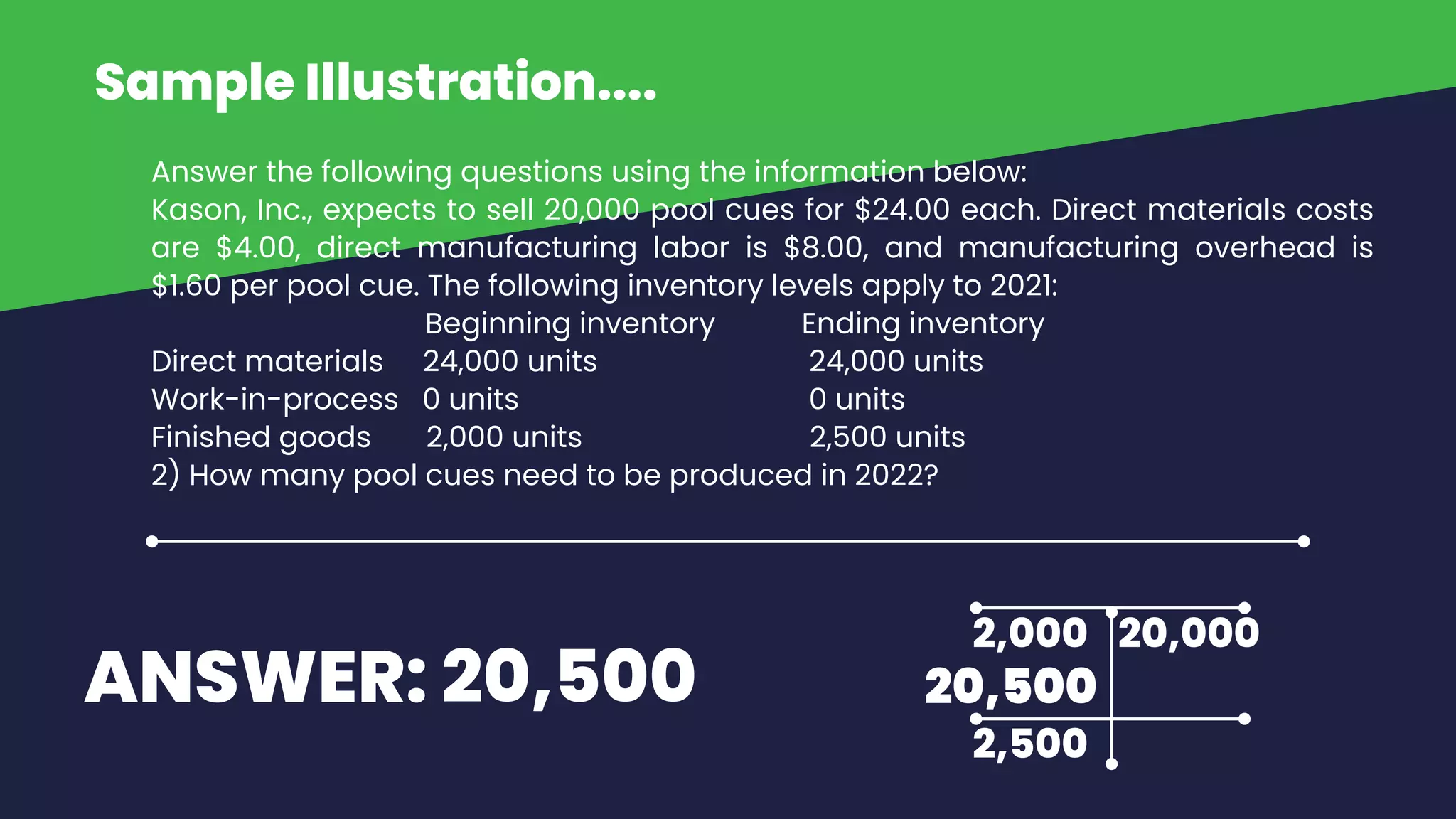

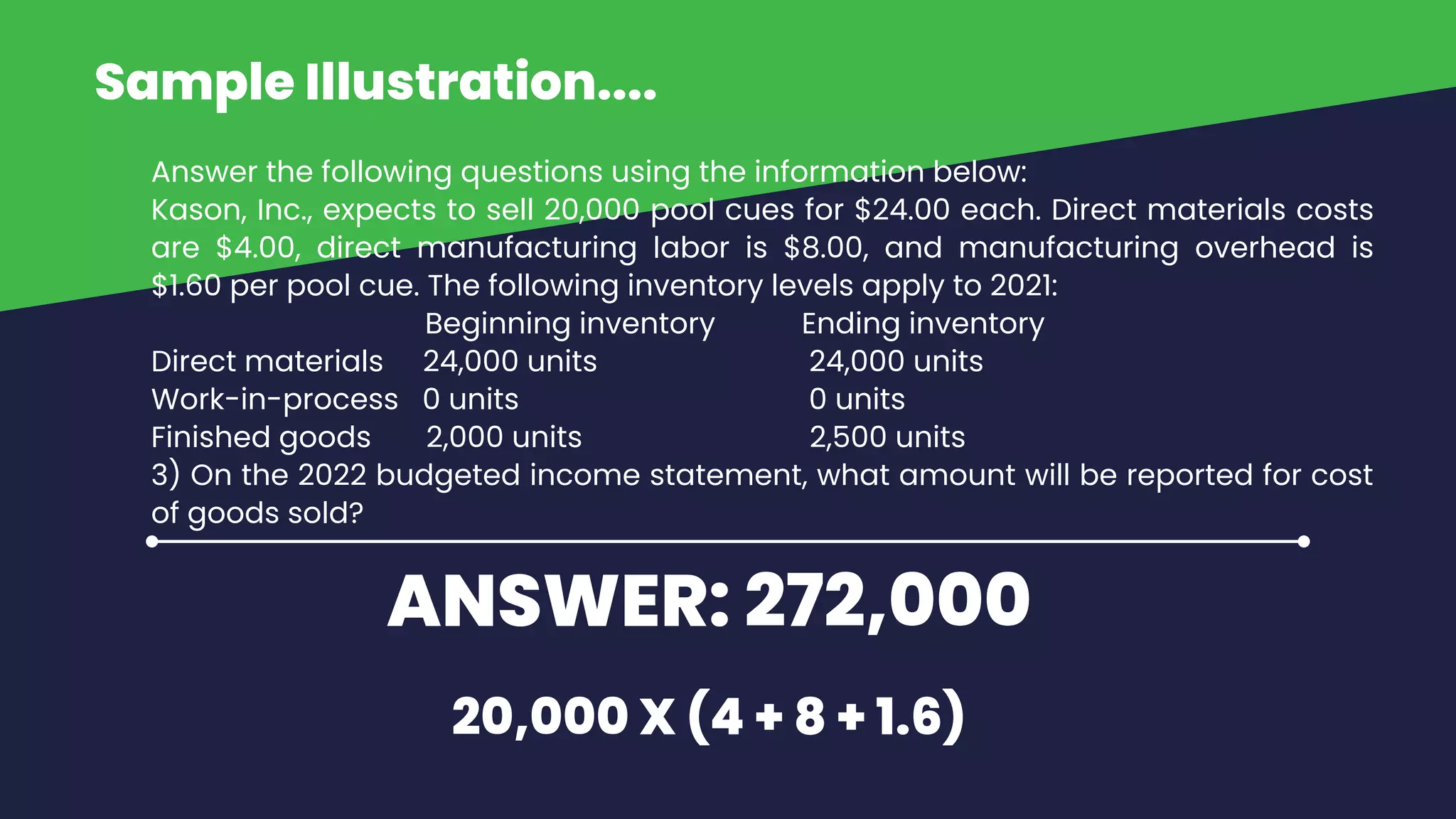

The document is a presentation for a week 10 managerial accounting class. It discusses budgeting and planning, defining these terms and outlining their advantages. The presentation covers different types of budgets including the master budget, and provides examples of sample budgeting problems and their solutions. The presentation aims to help students understand budgeting concepts and calculations.