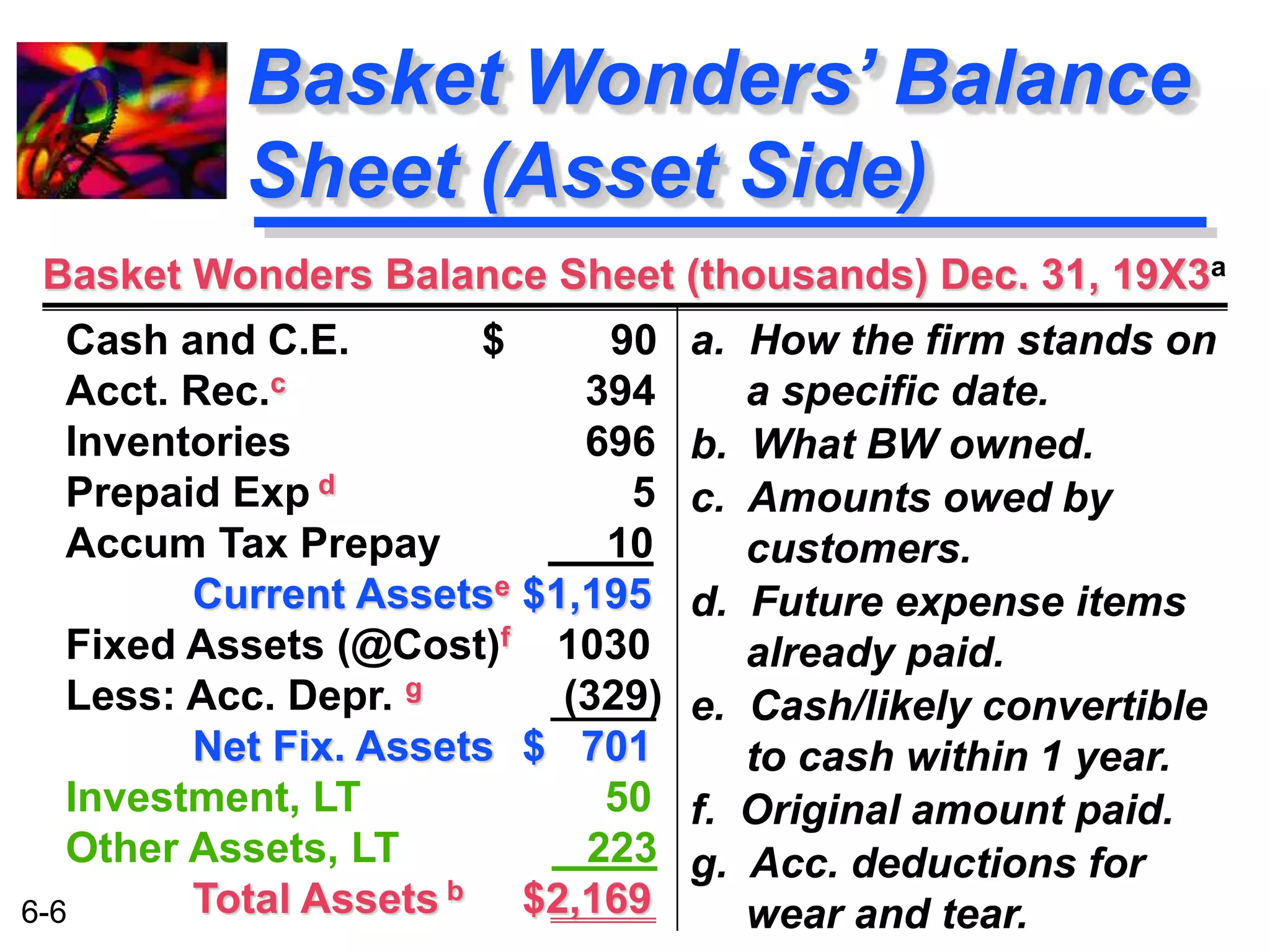

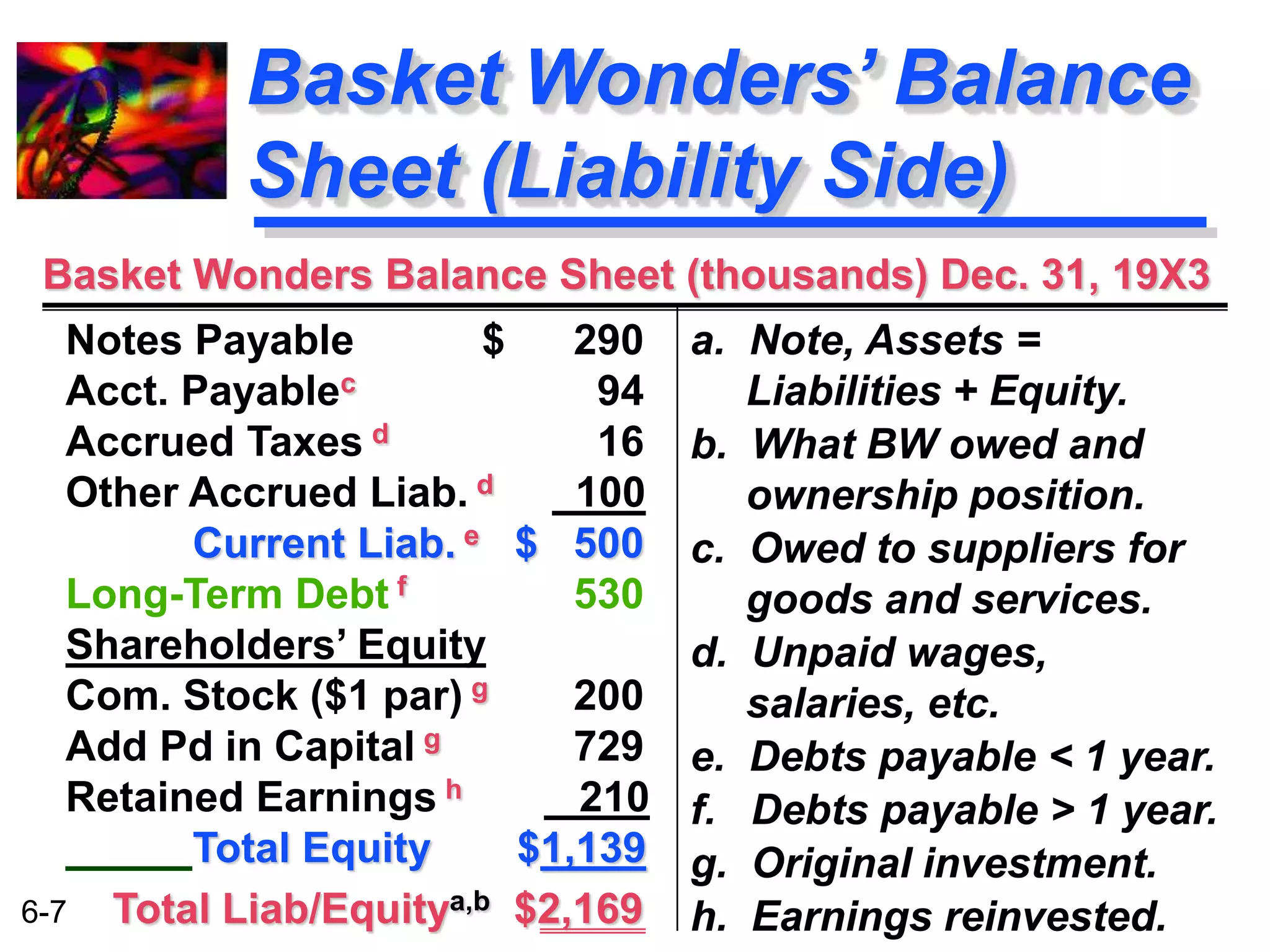

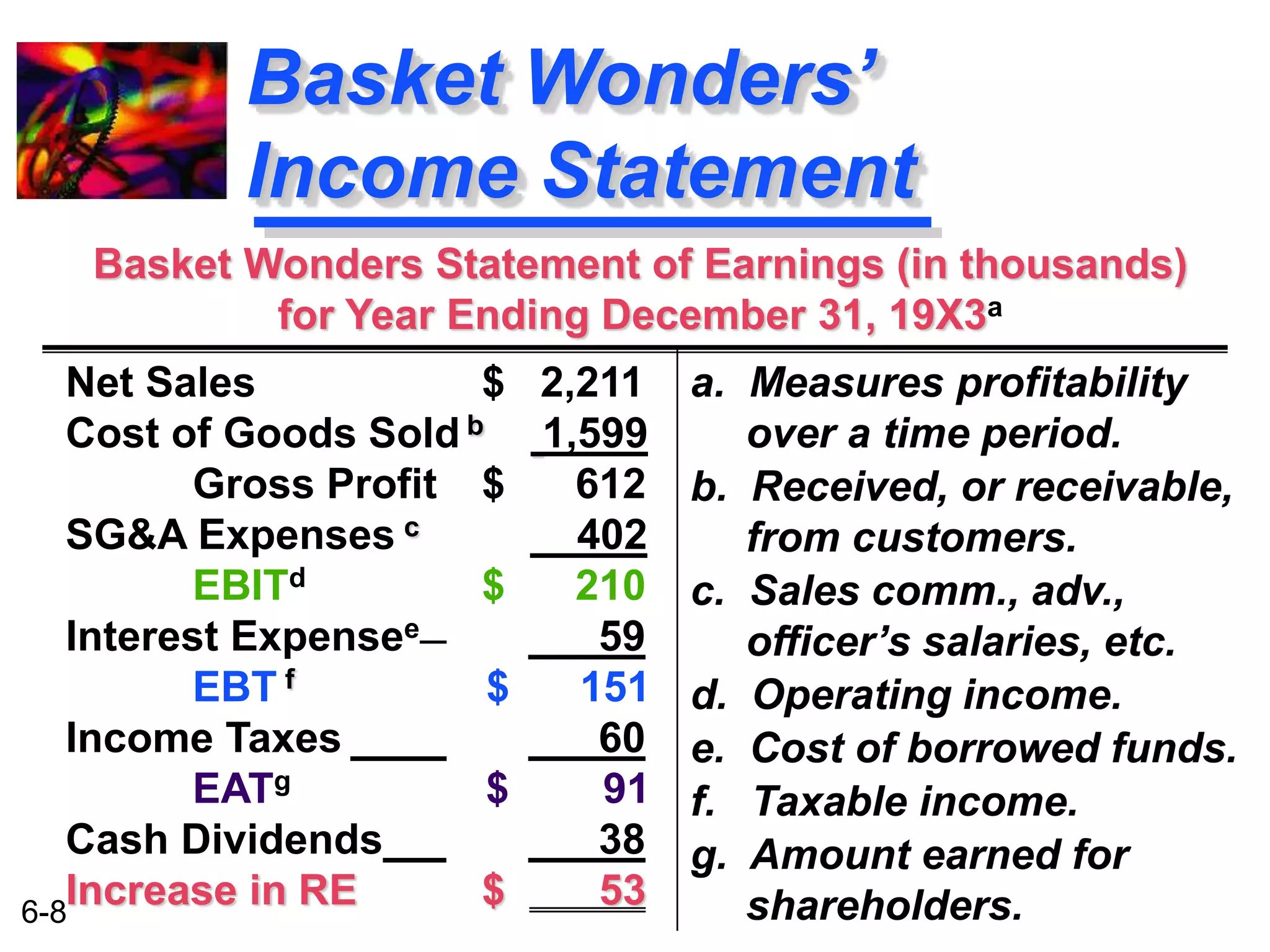

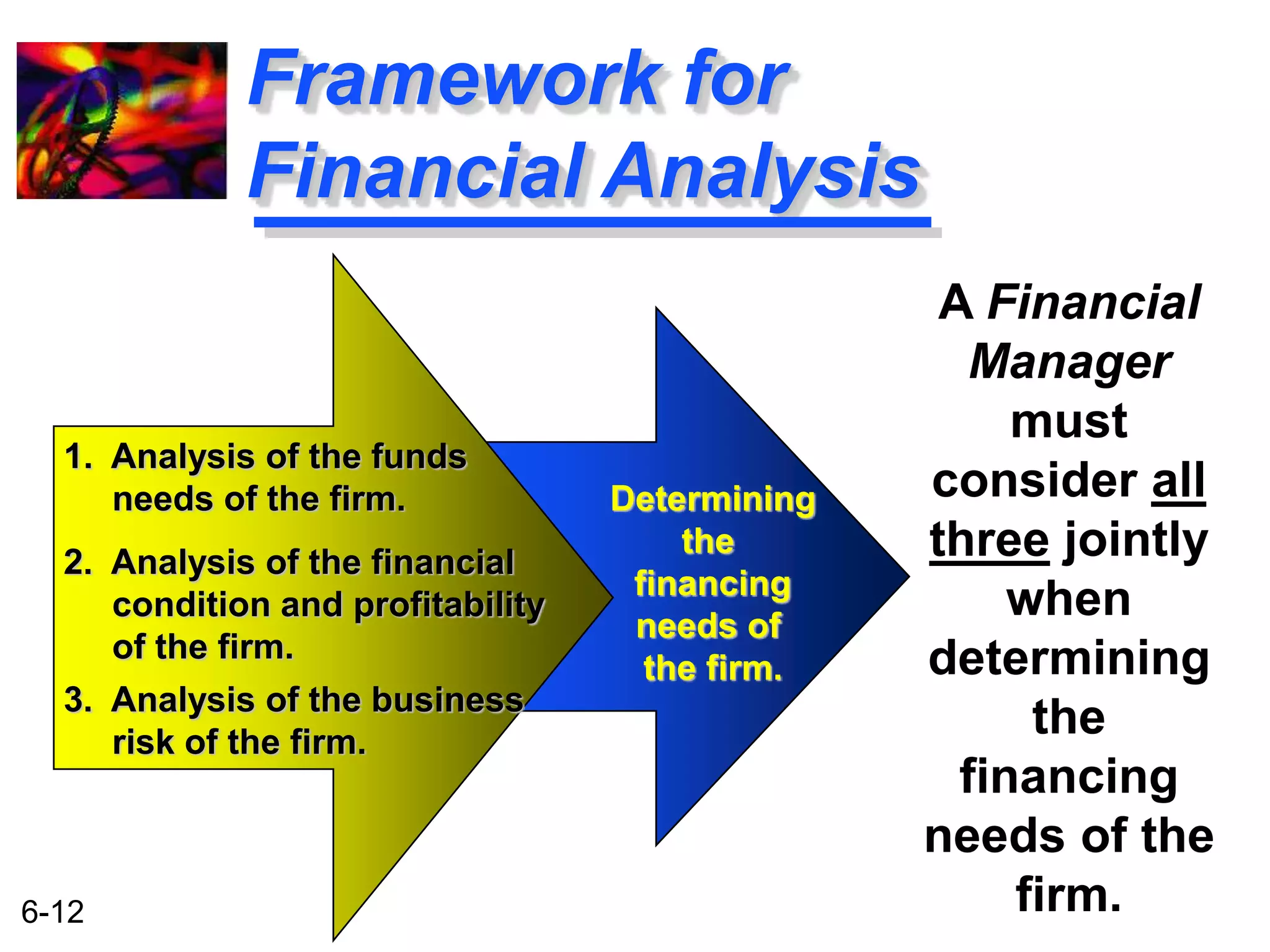

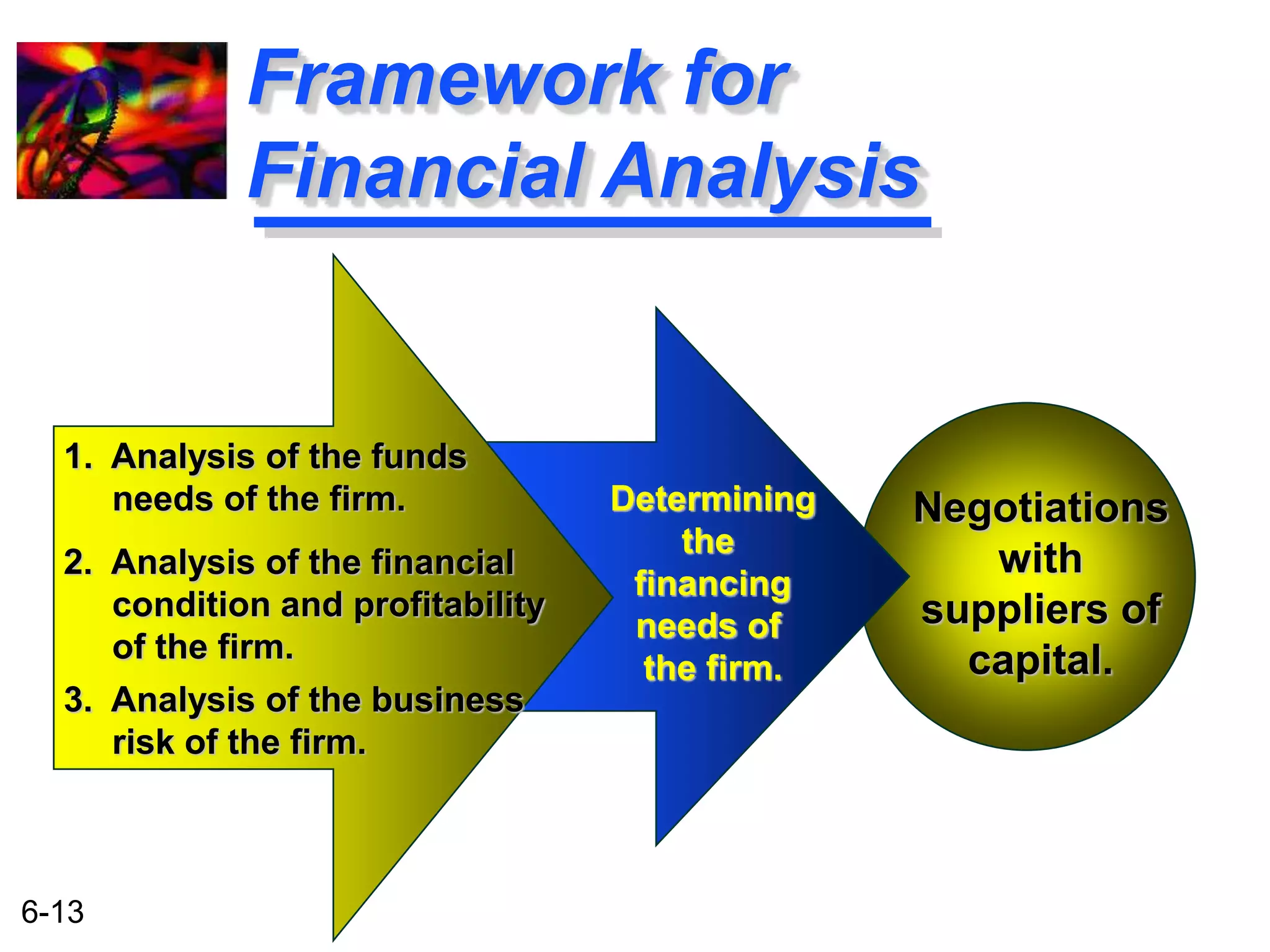

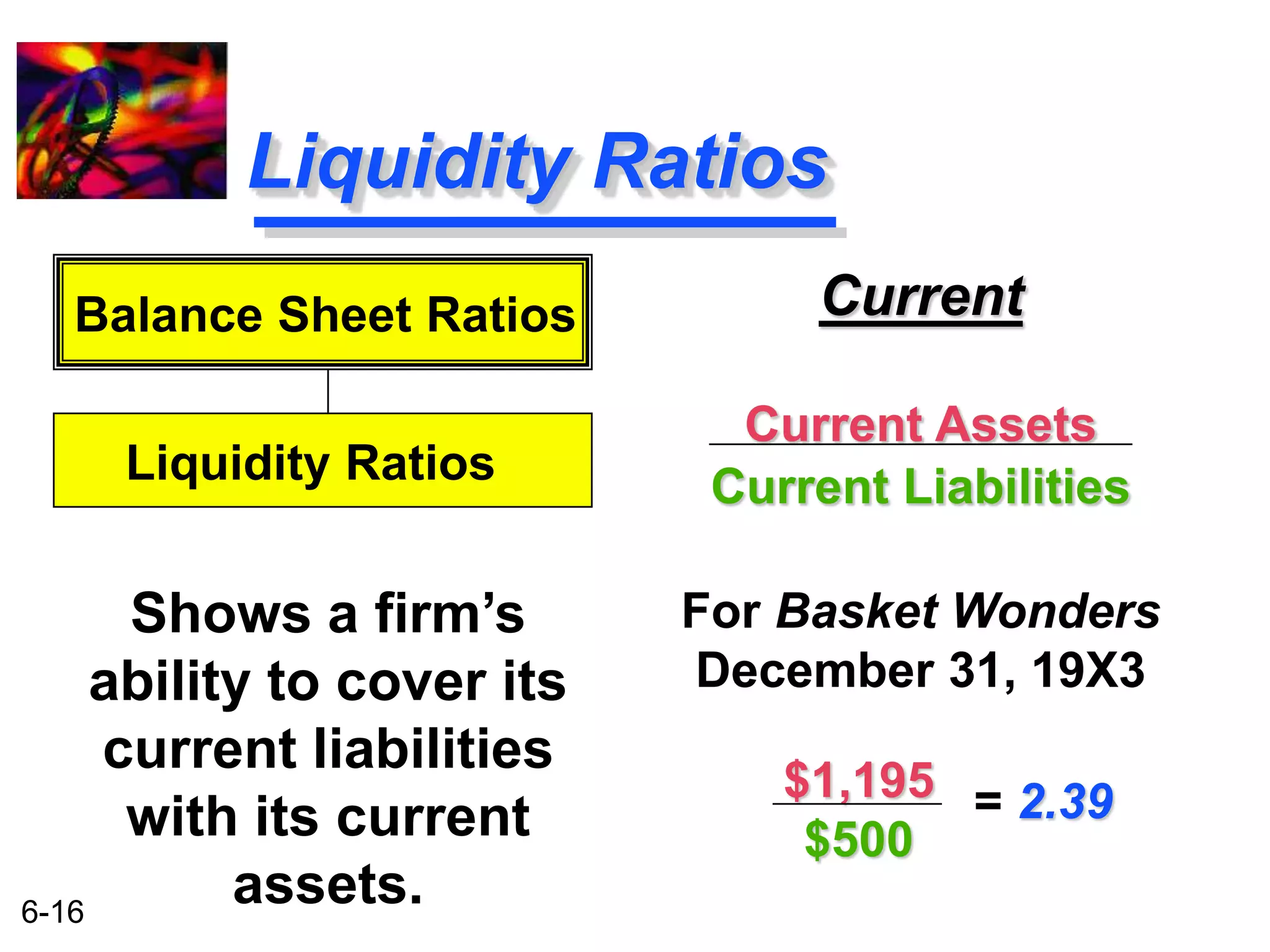

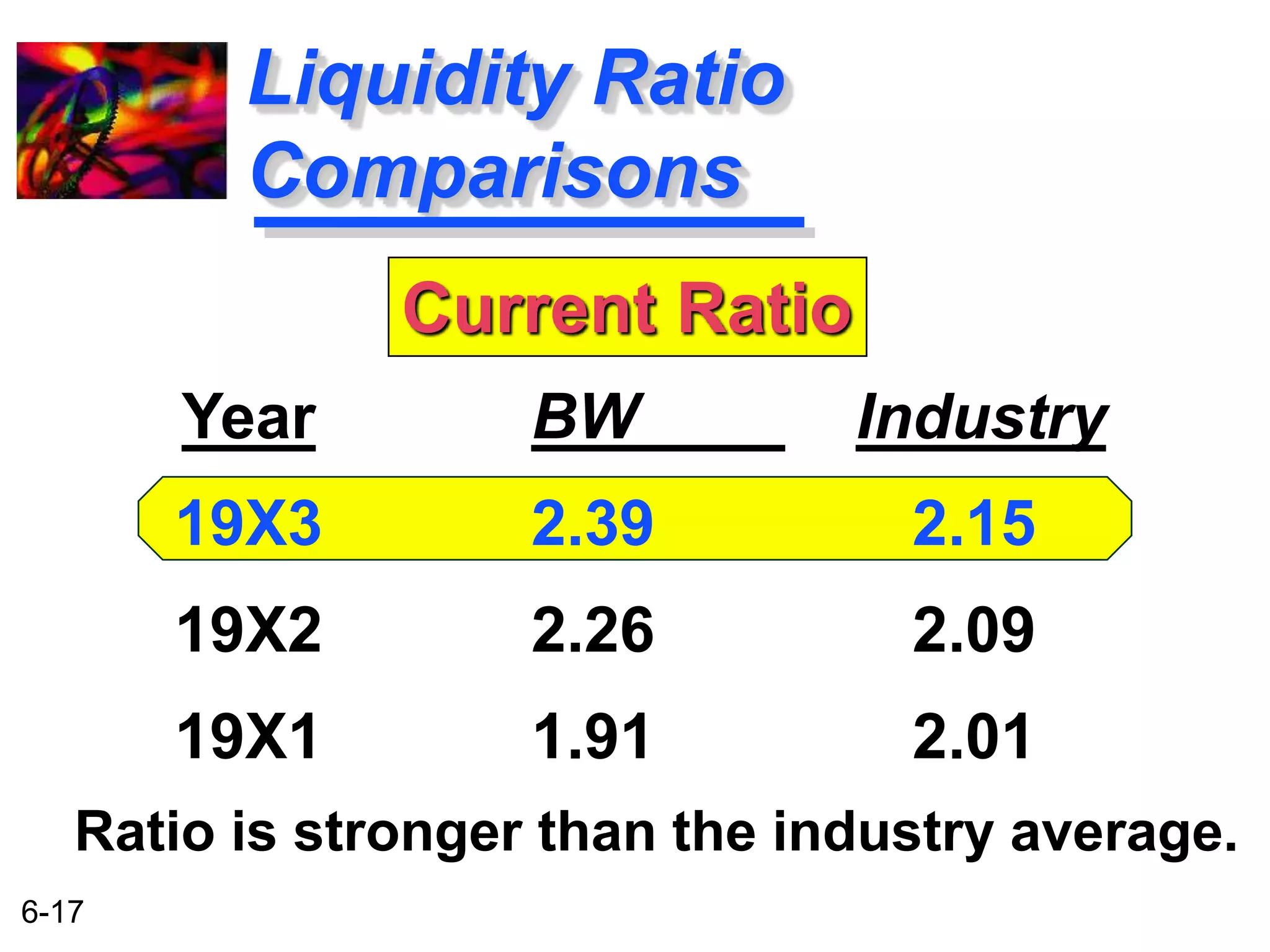

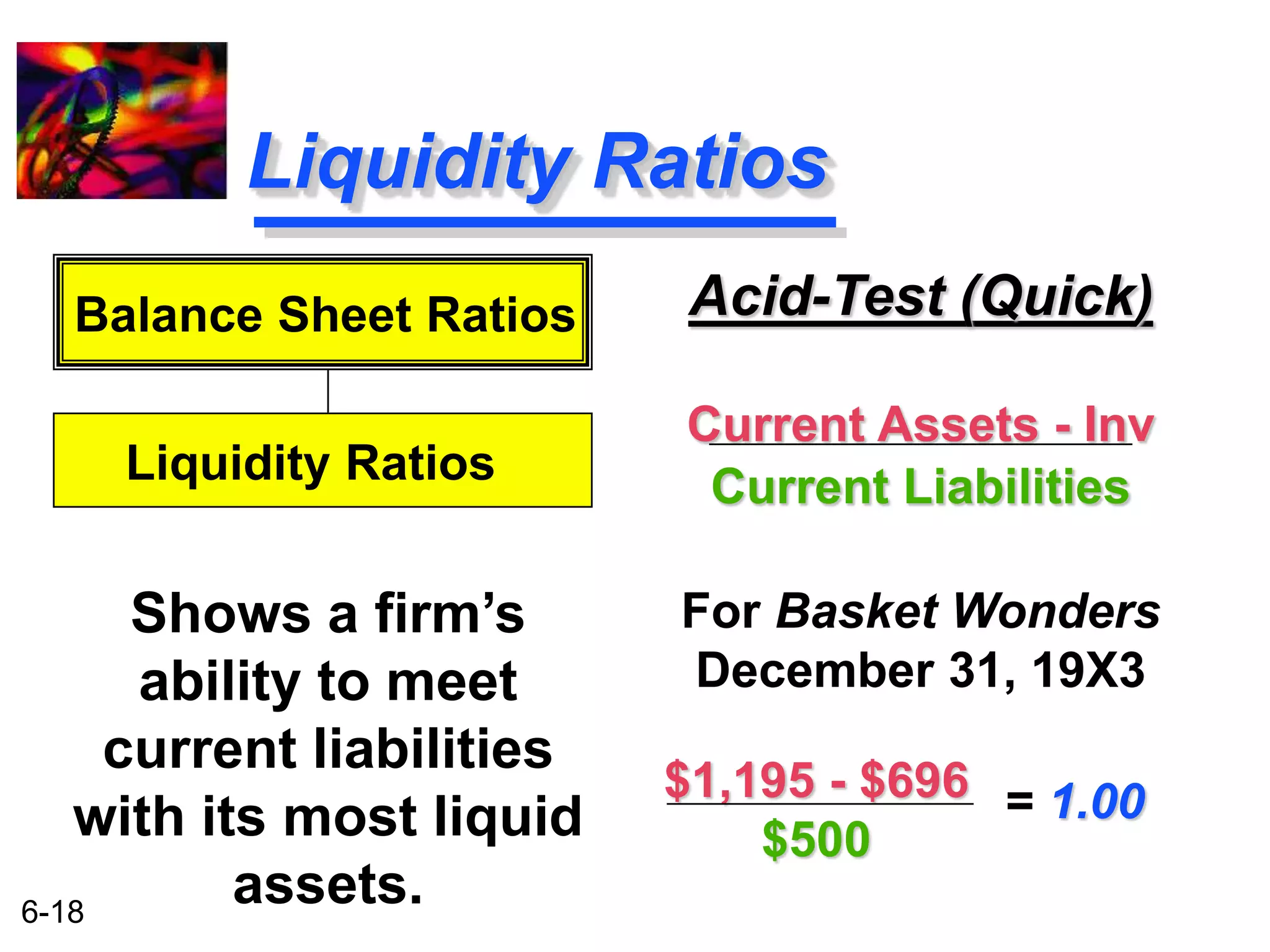

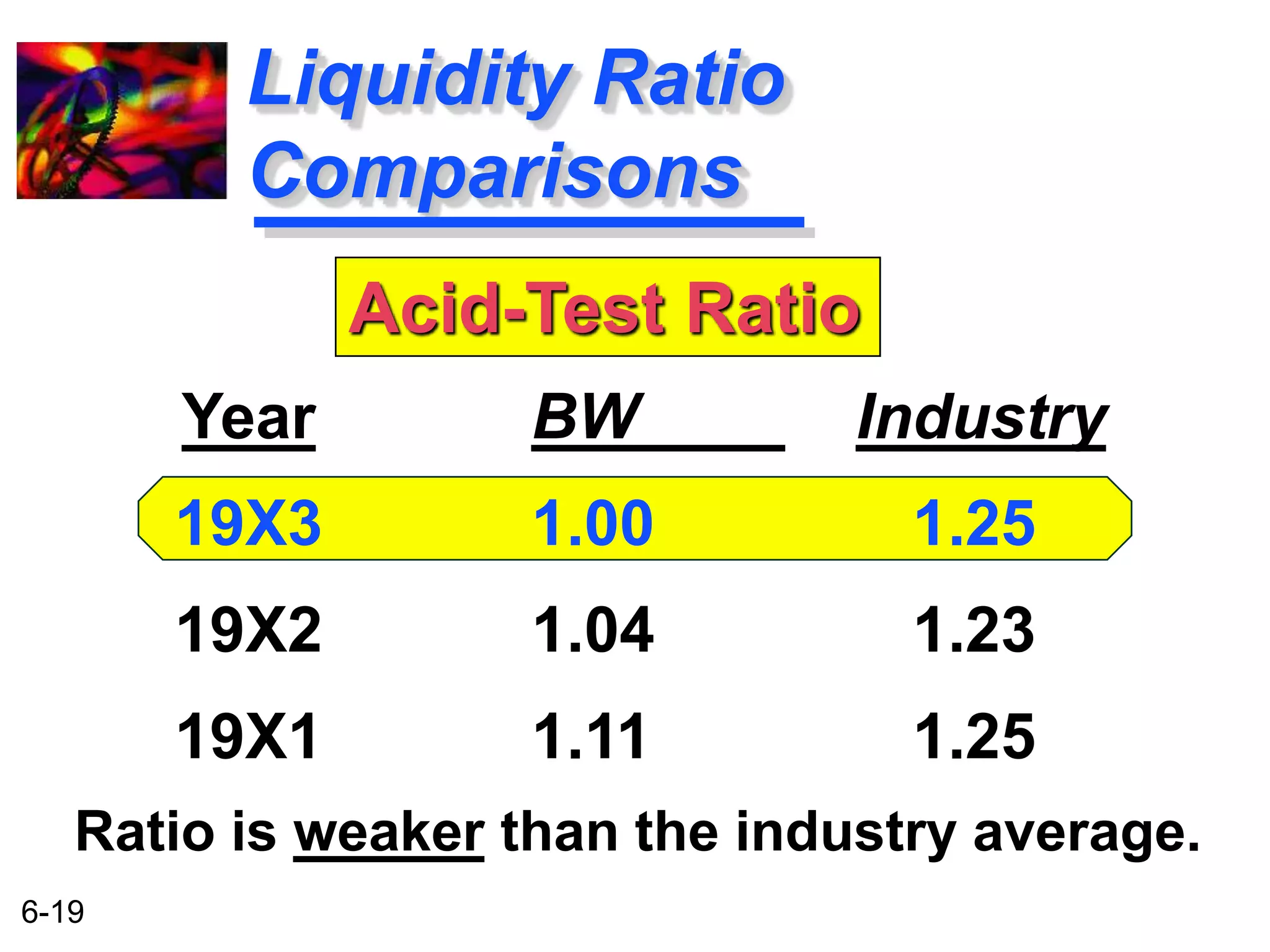

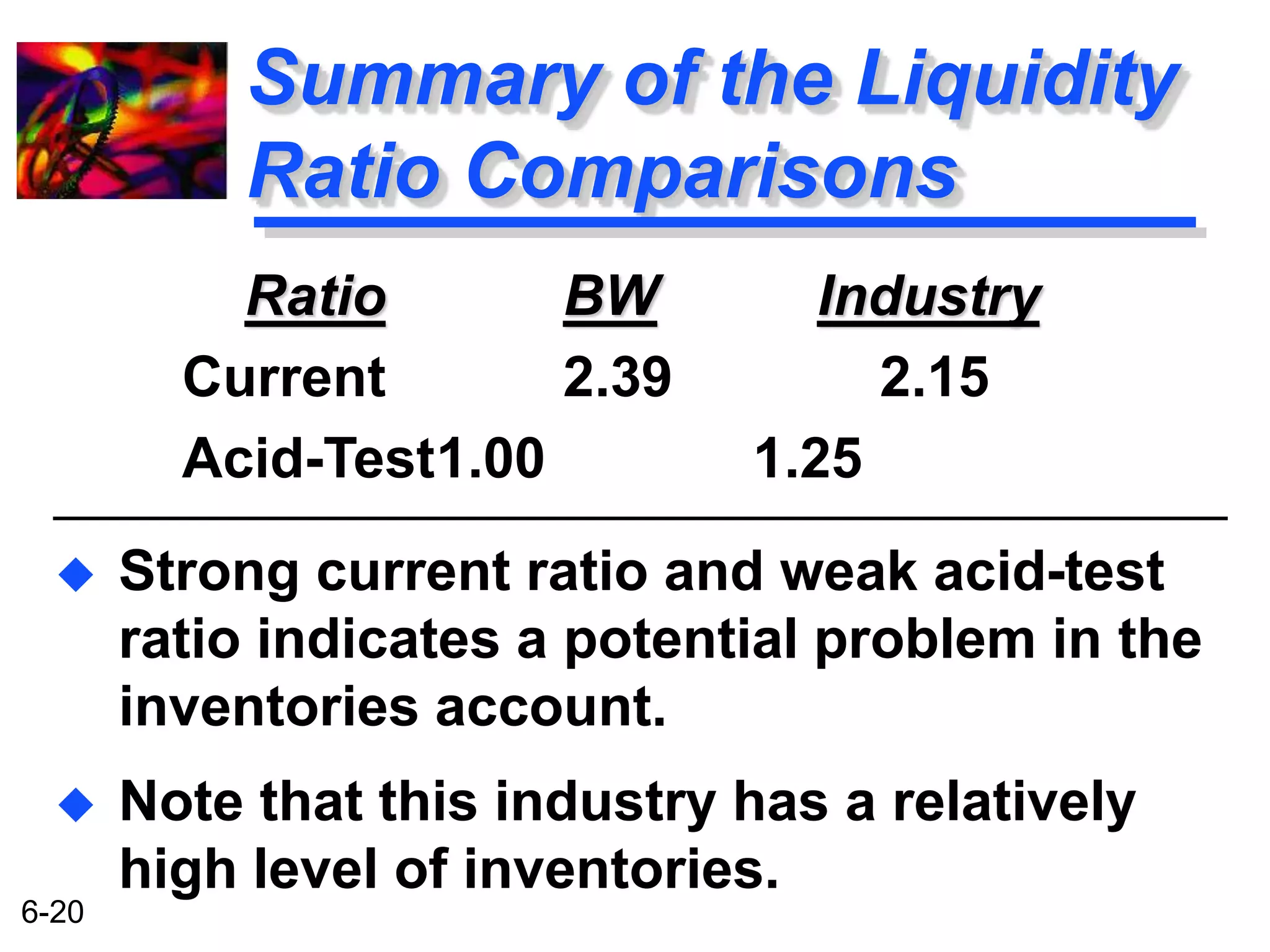

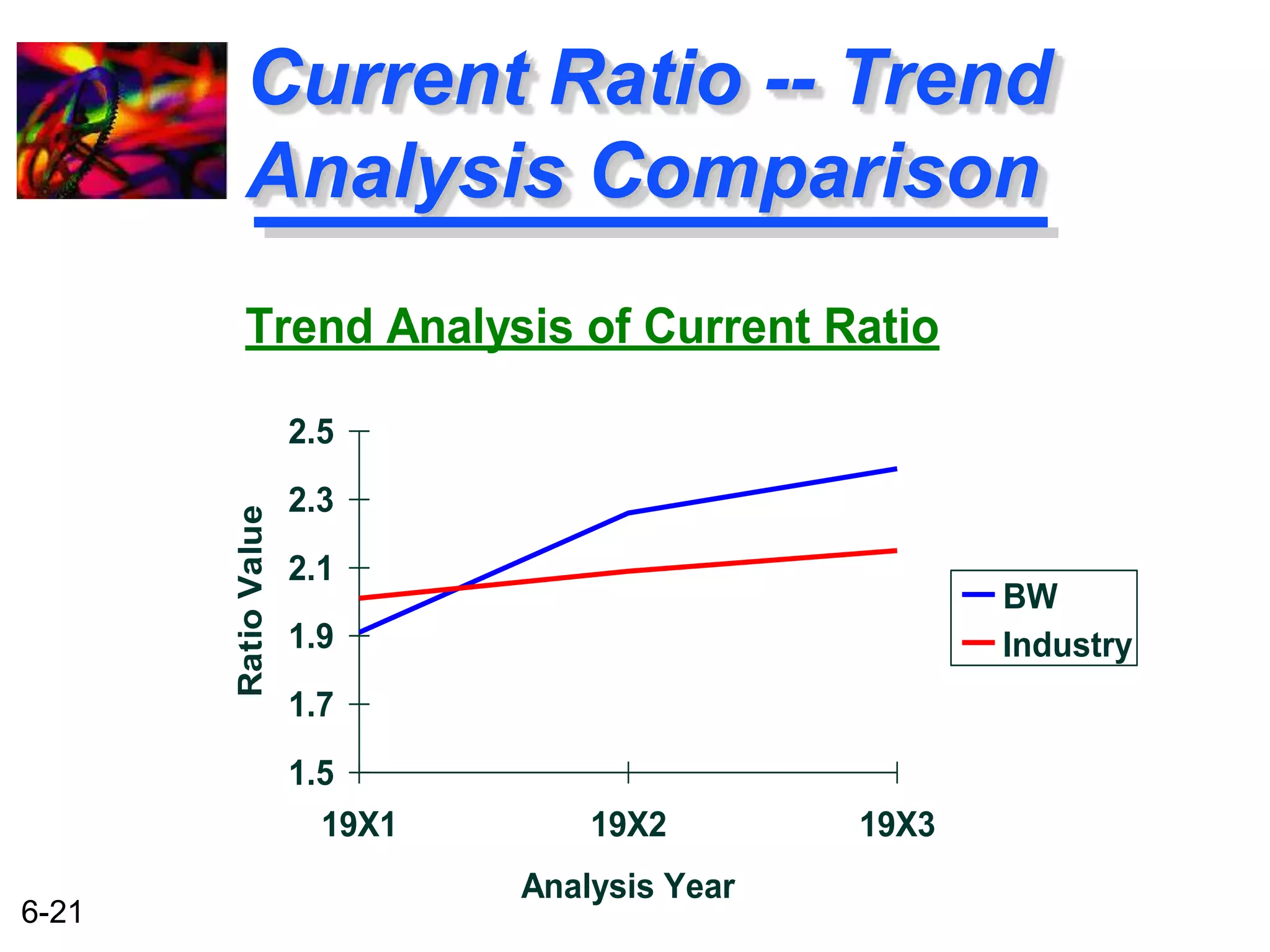

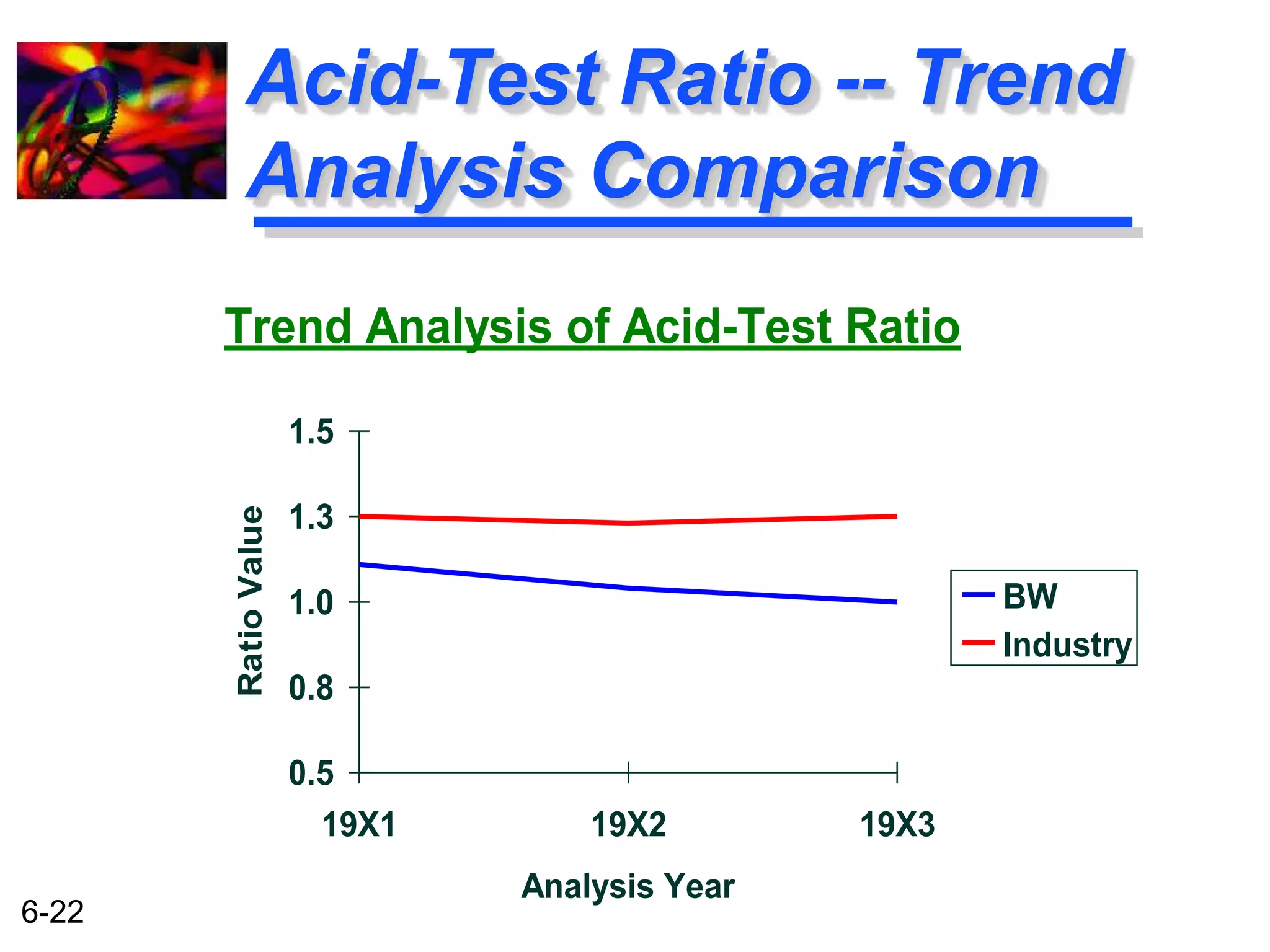

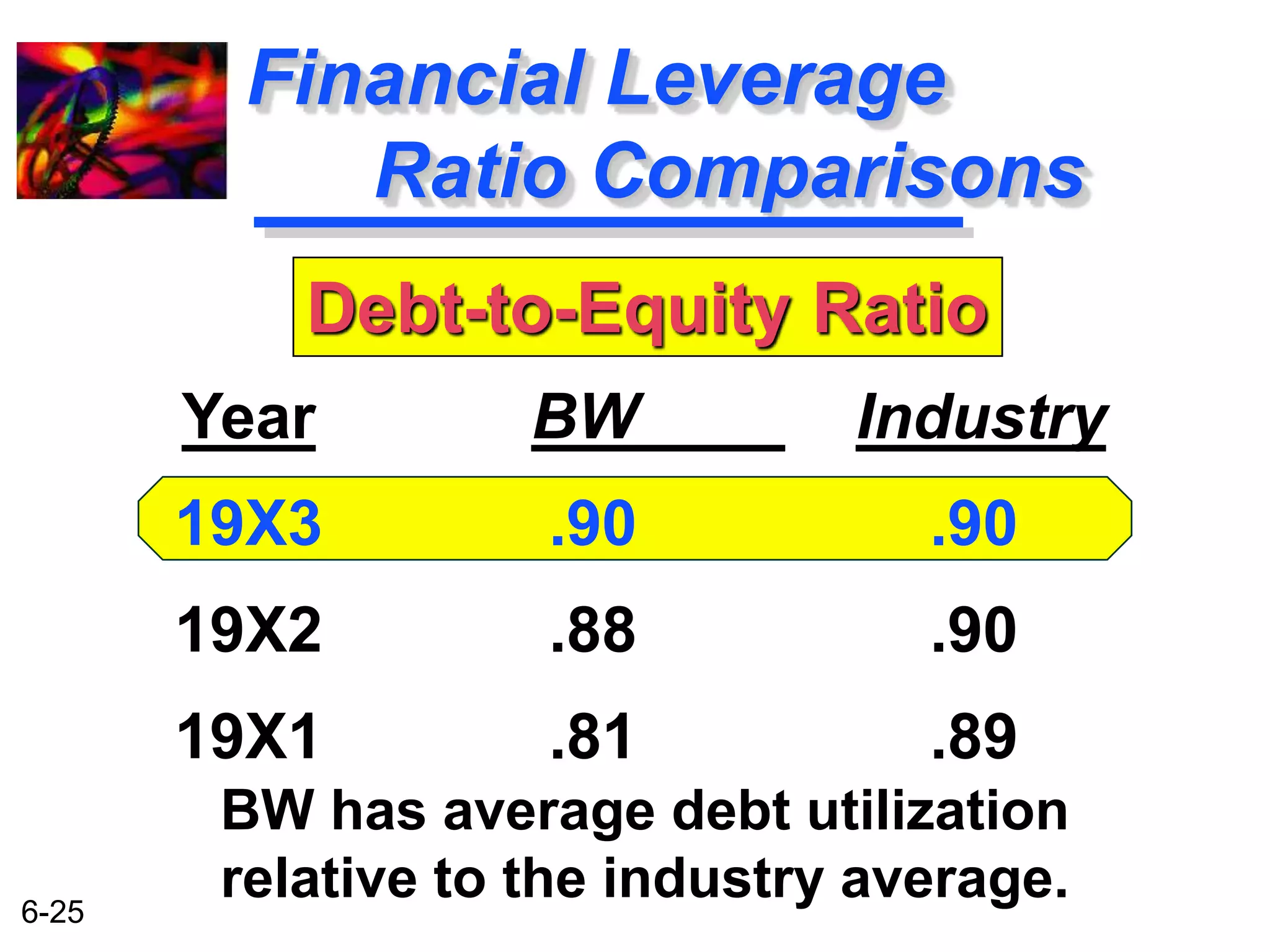

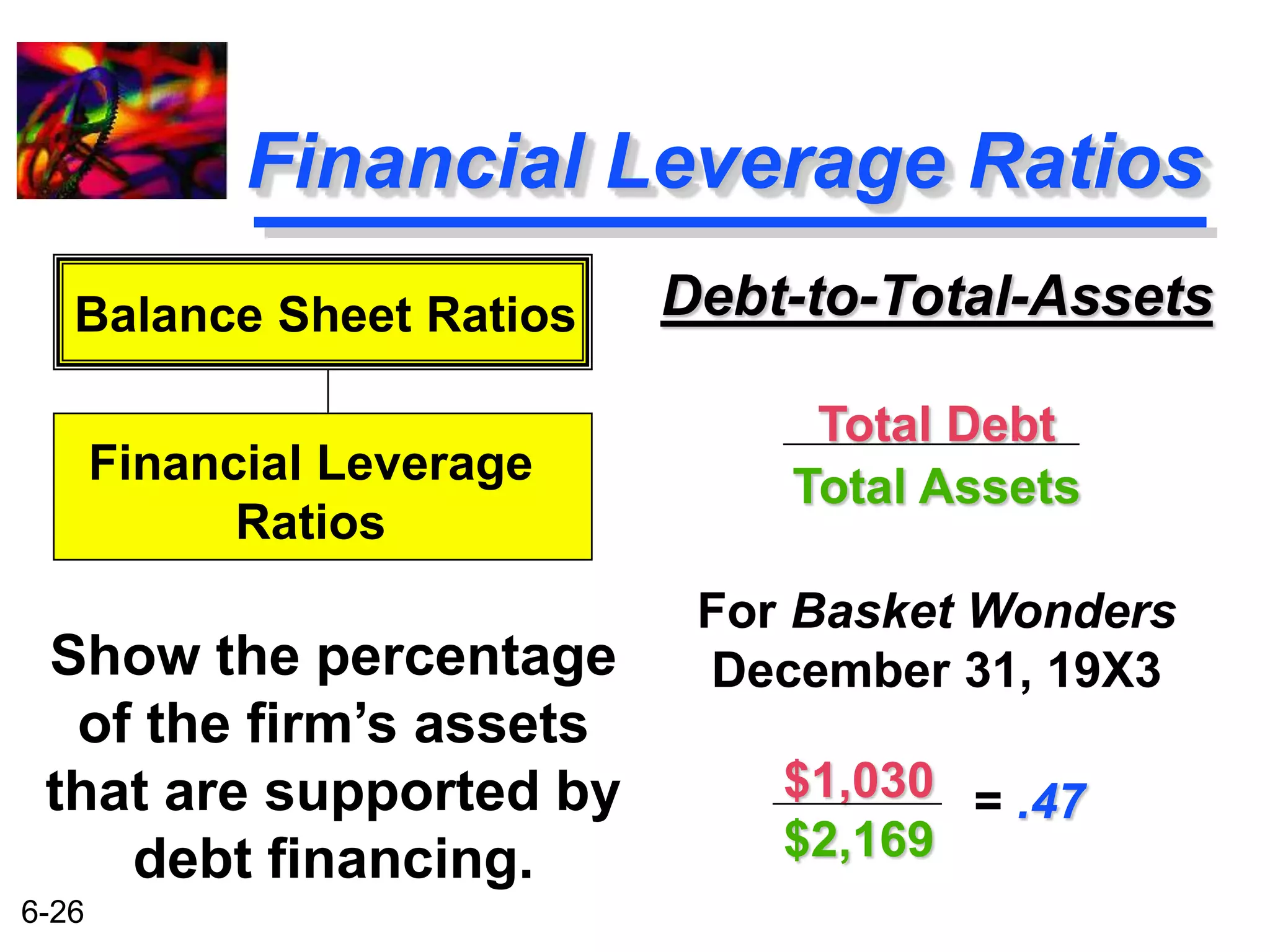

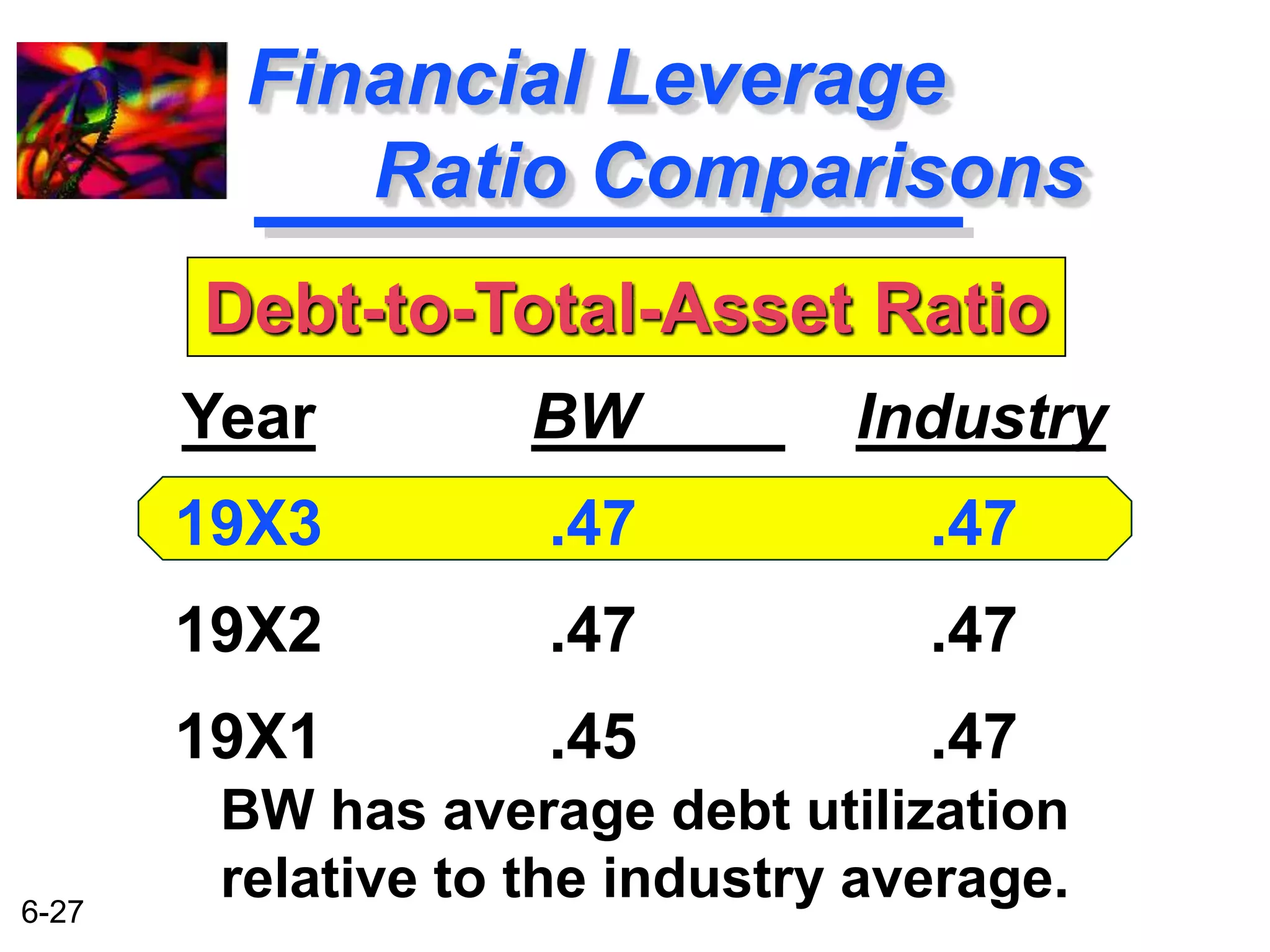

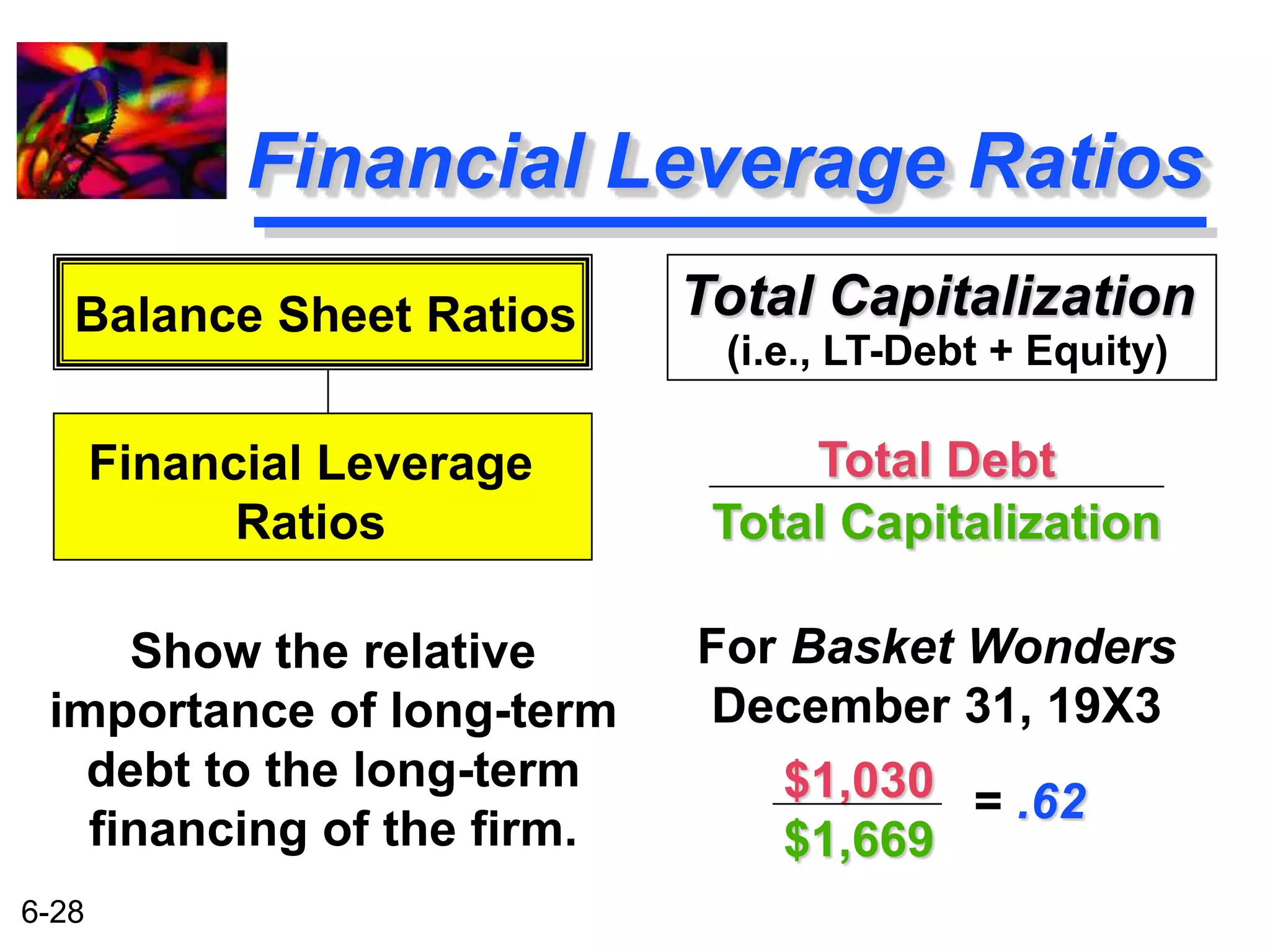

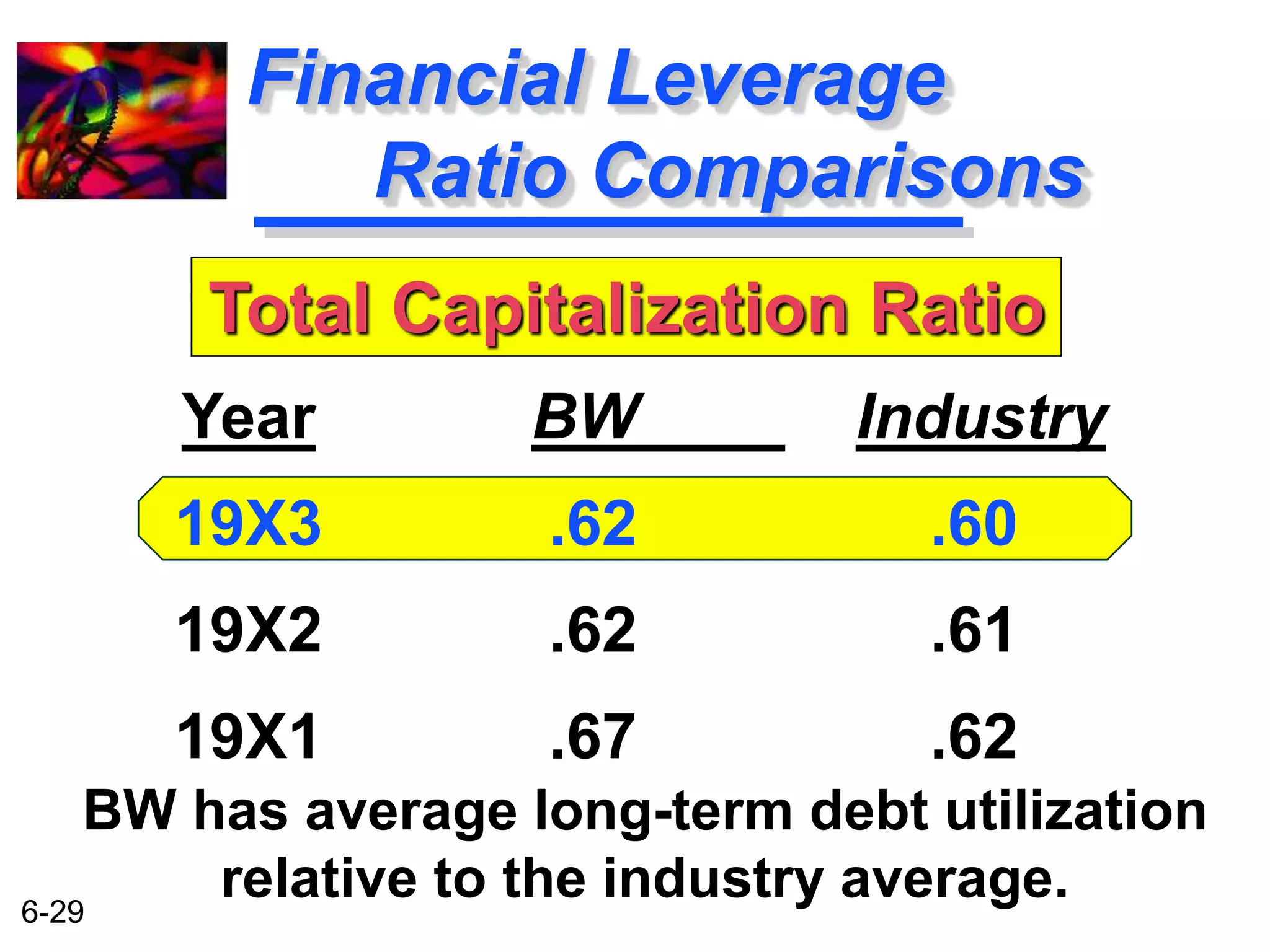

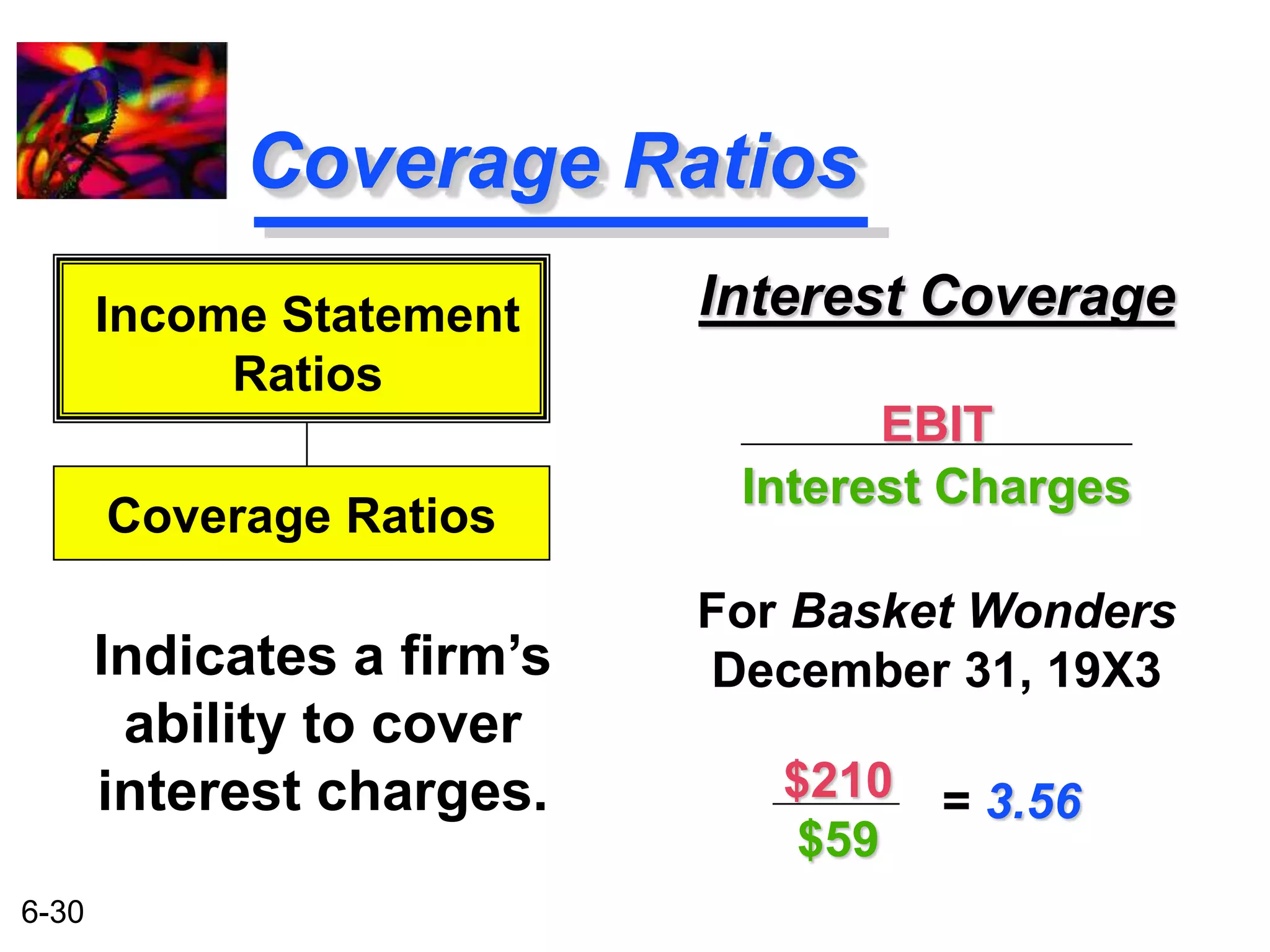

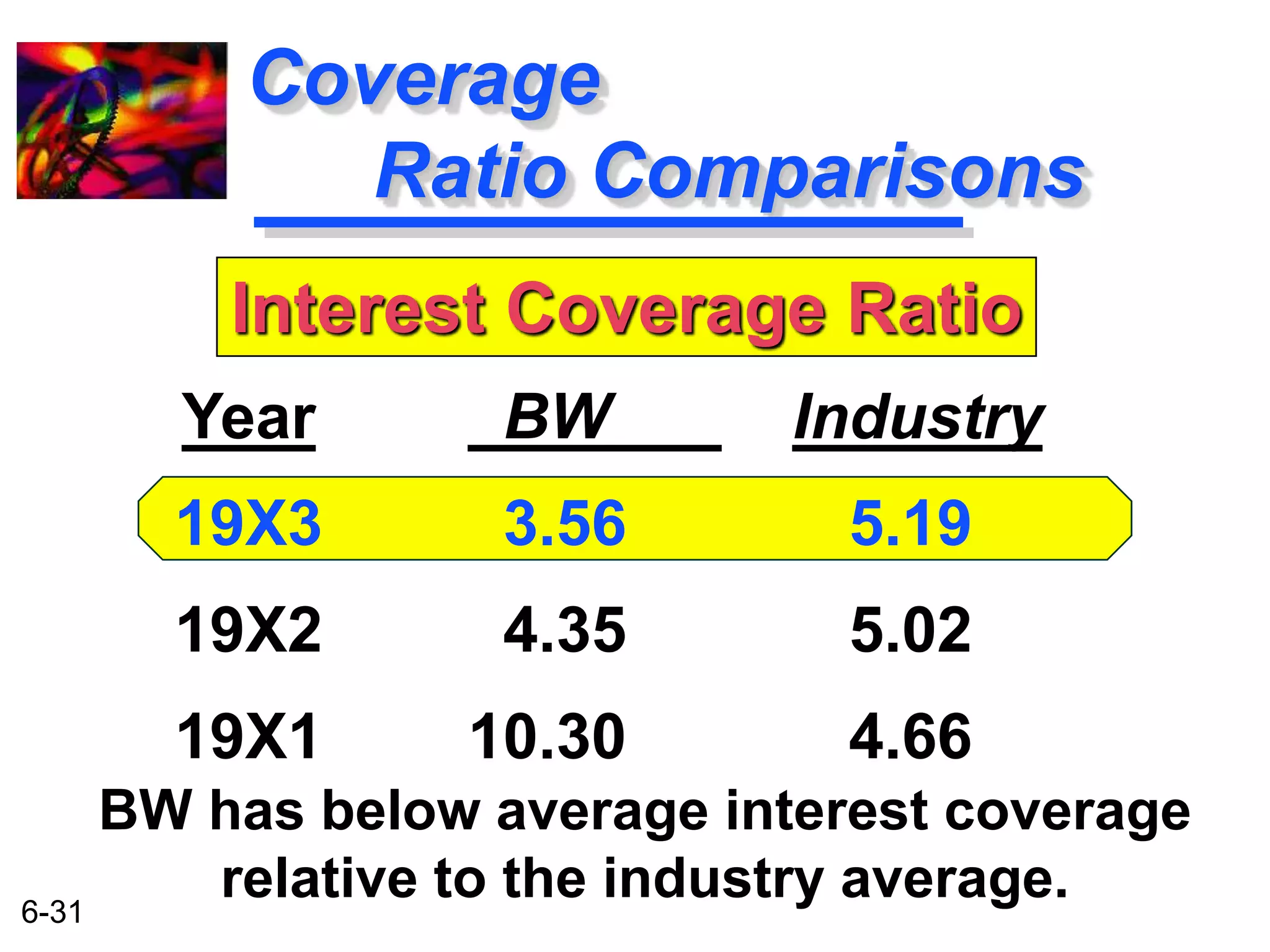

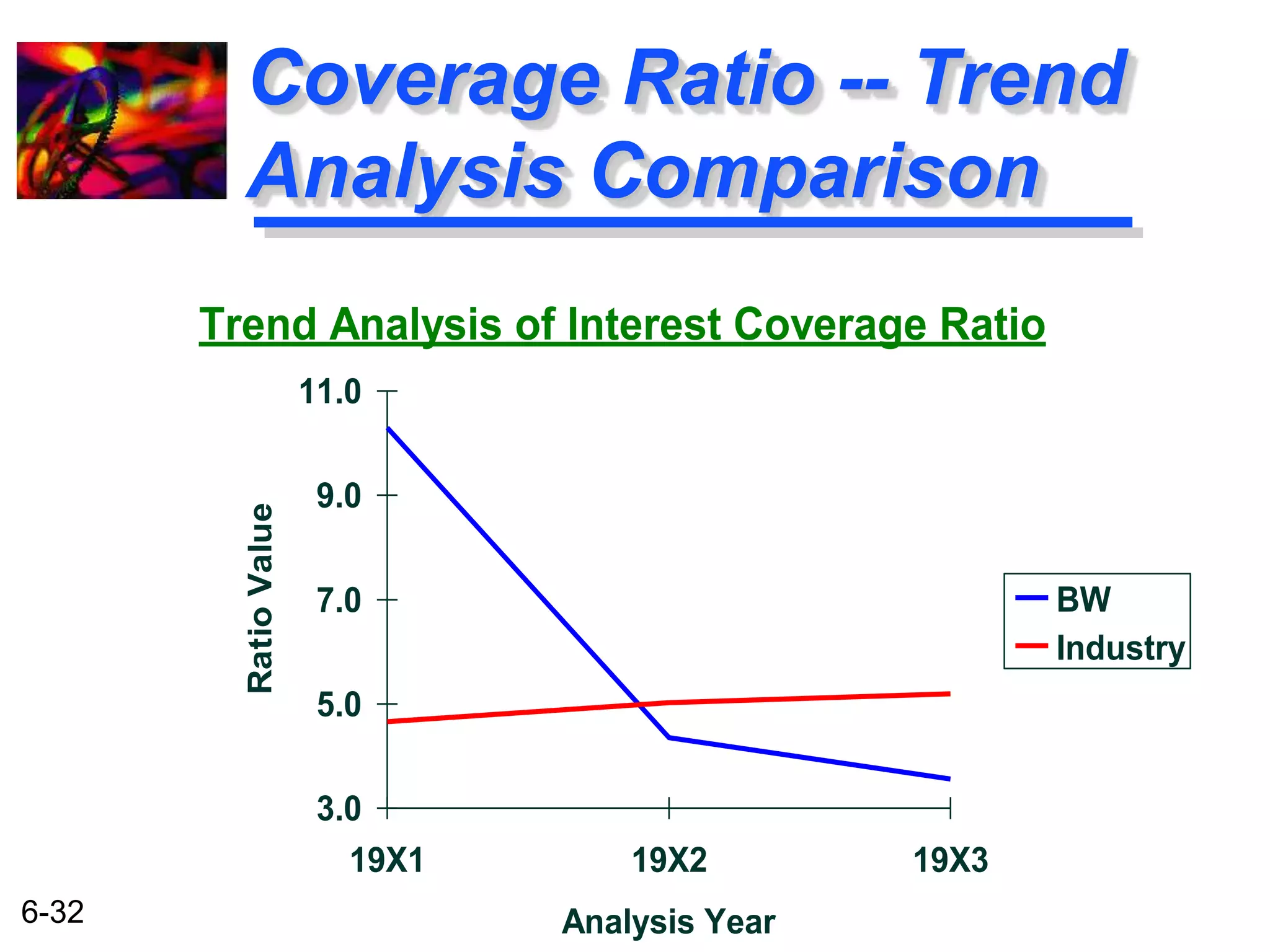

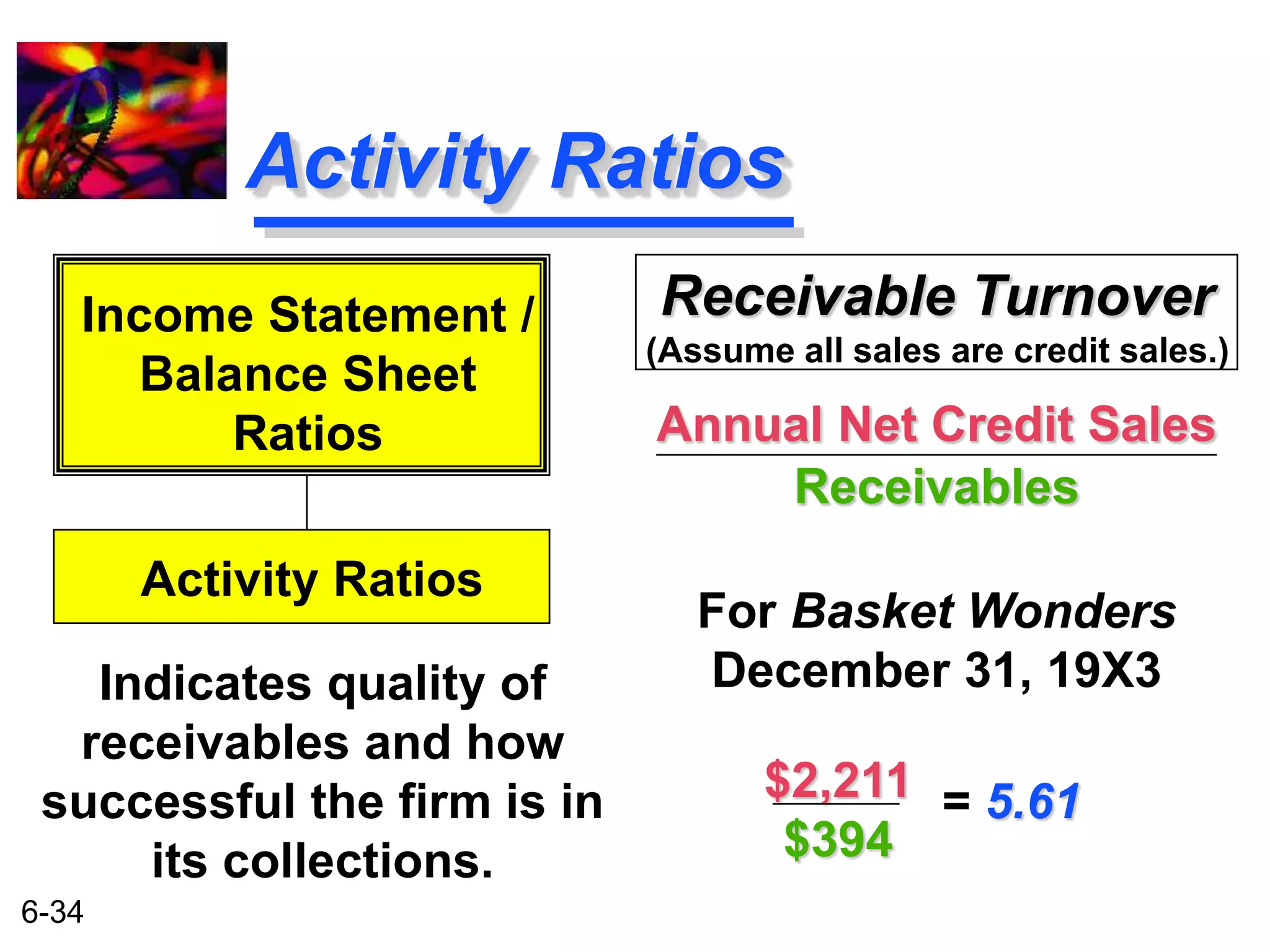

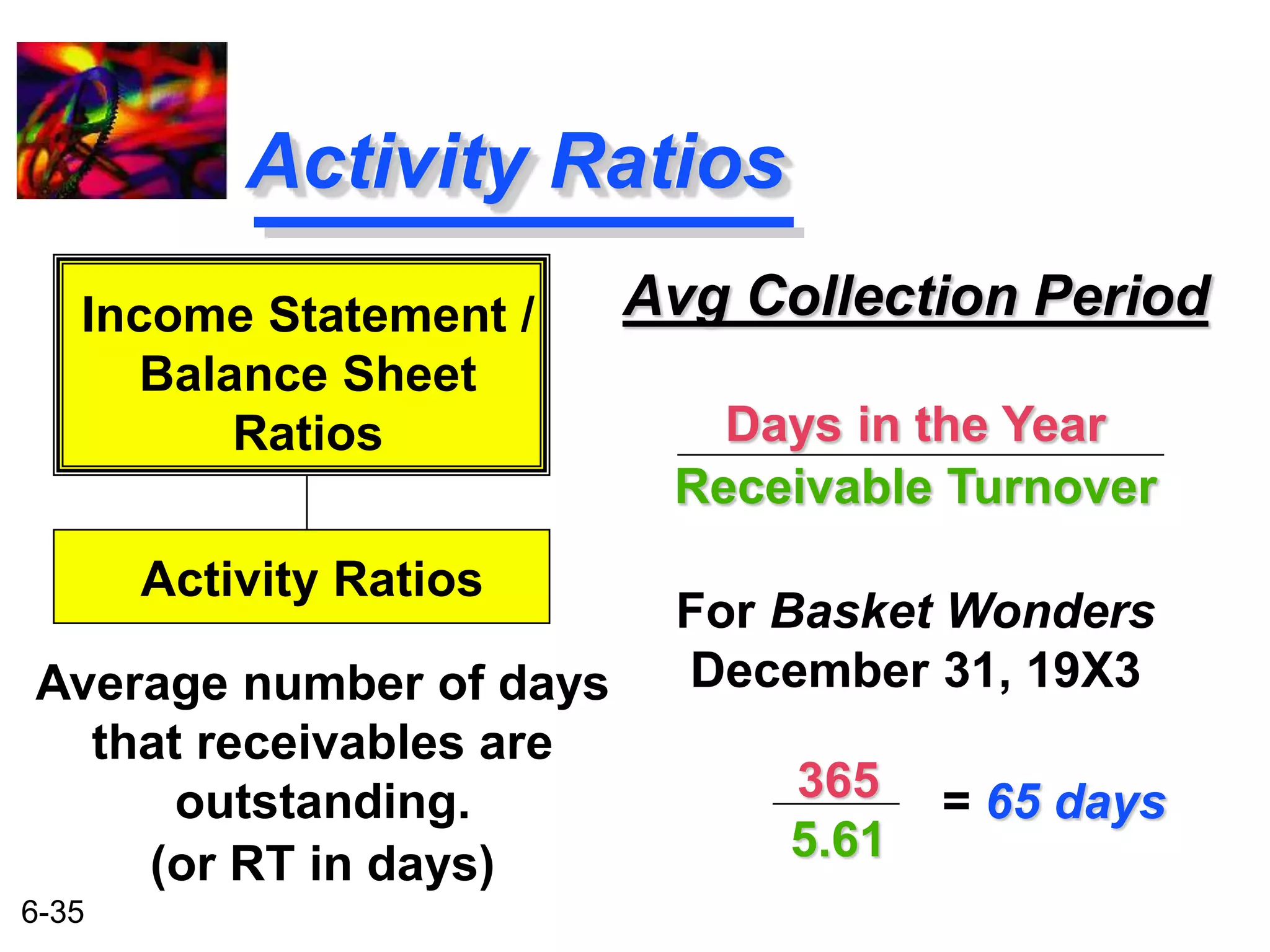

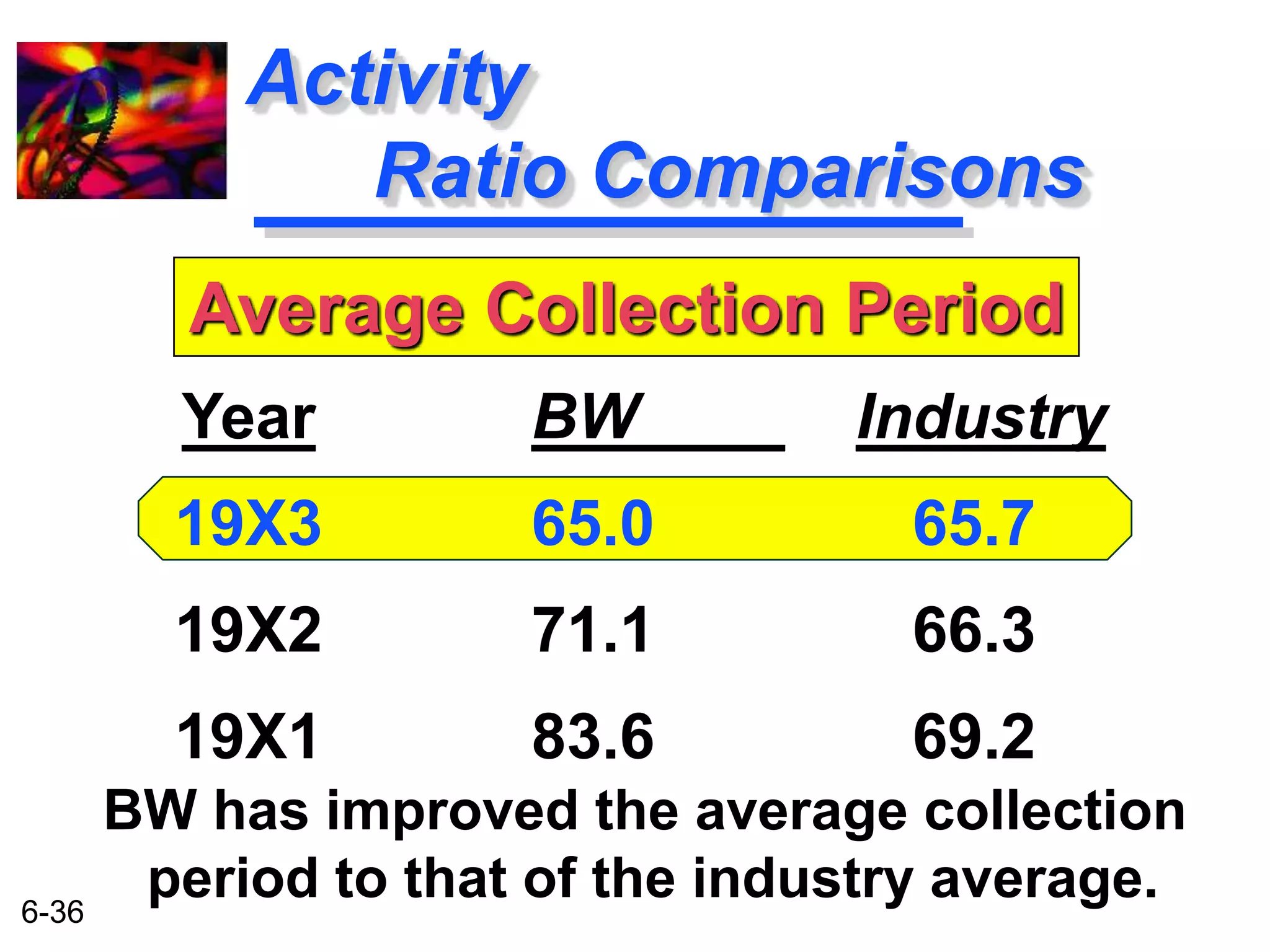

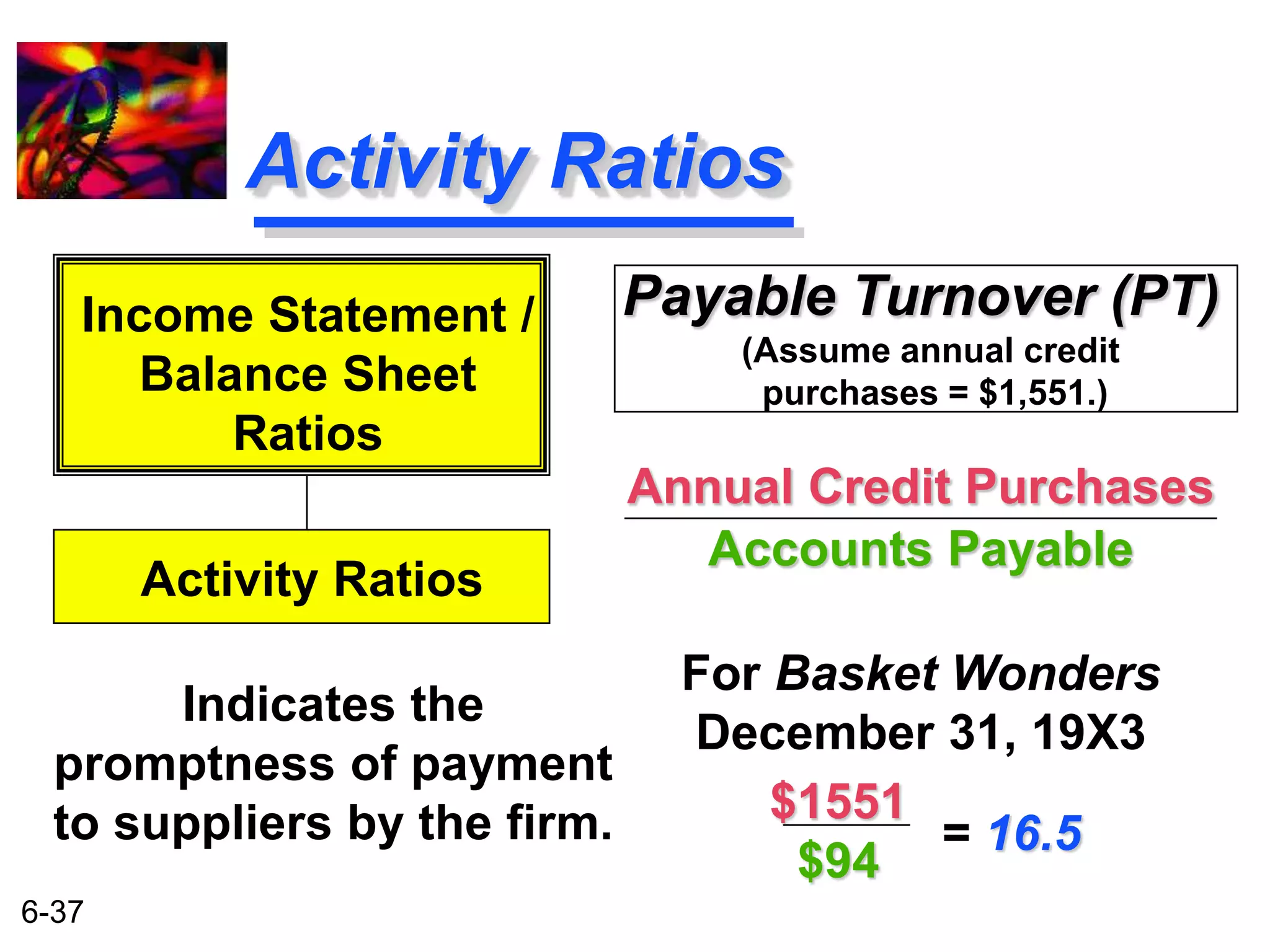

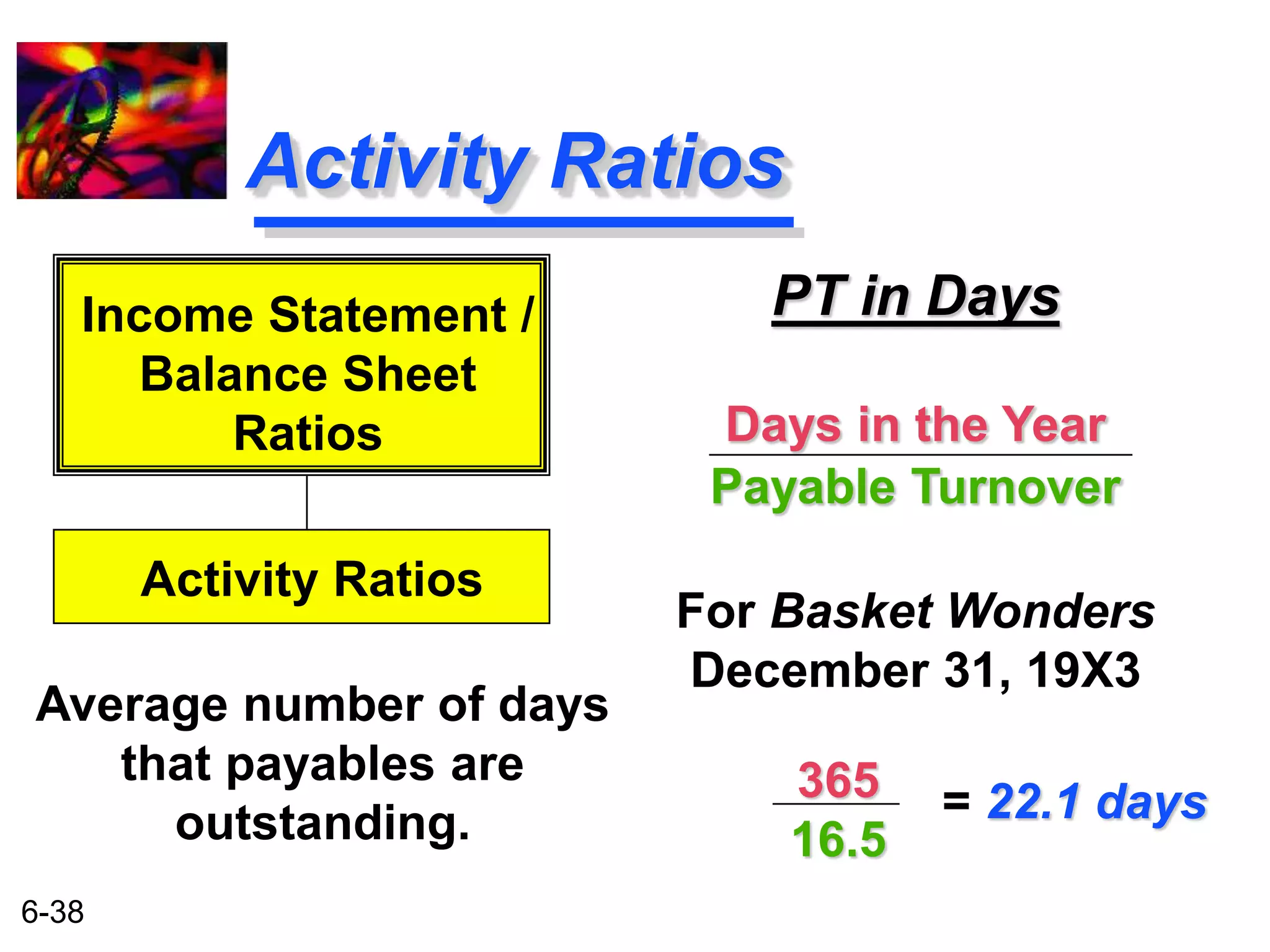

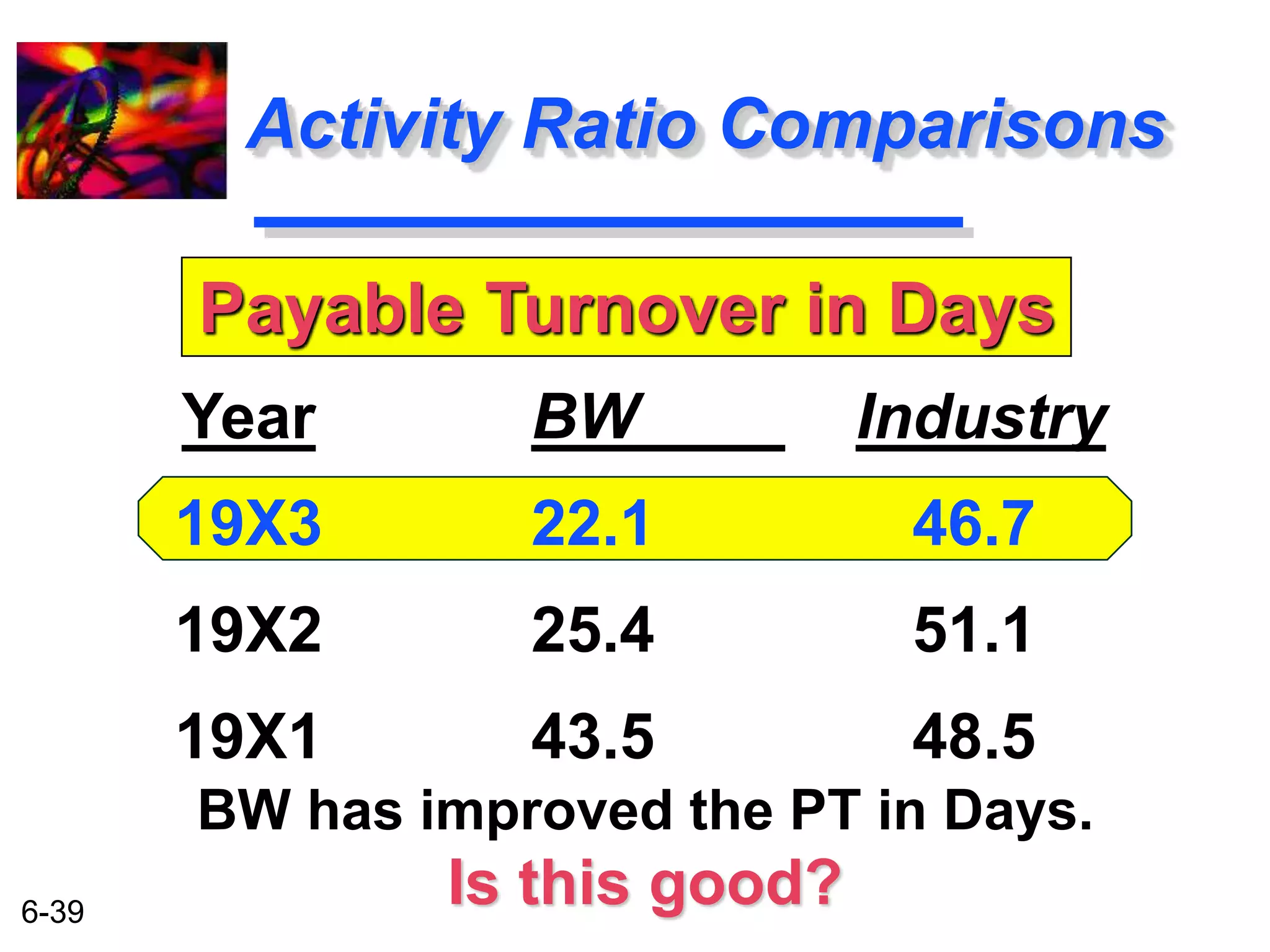

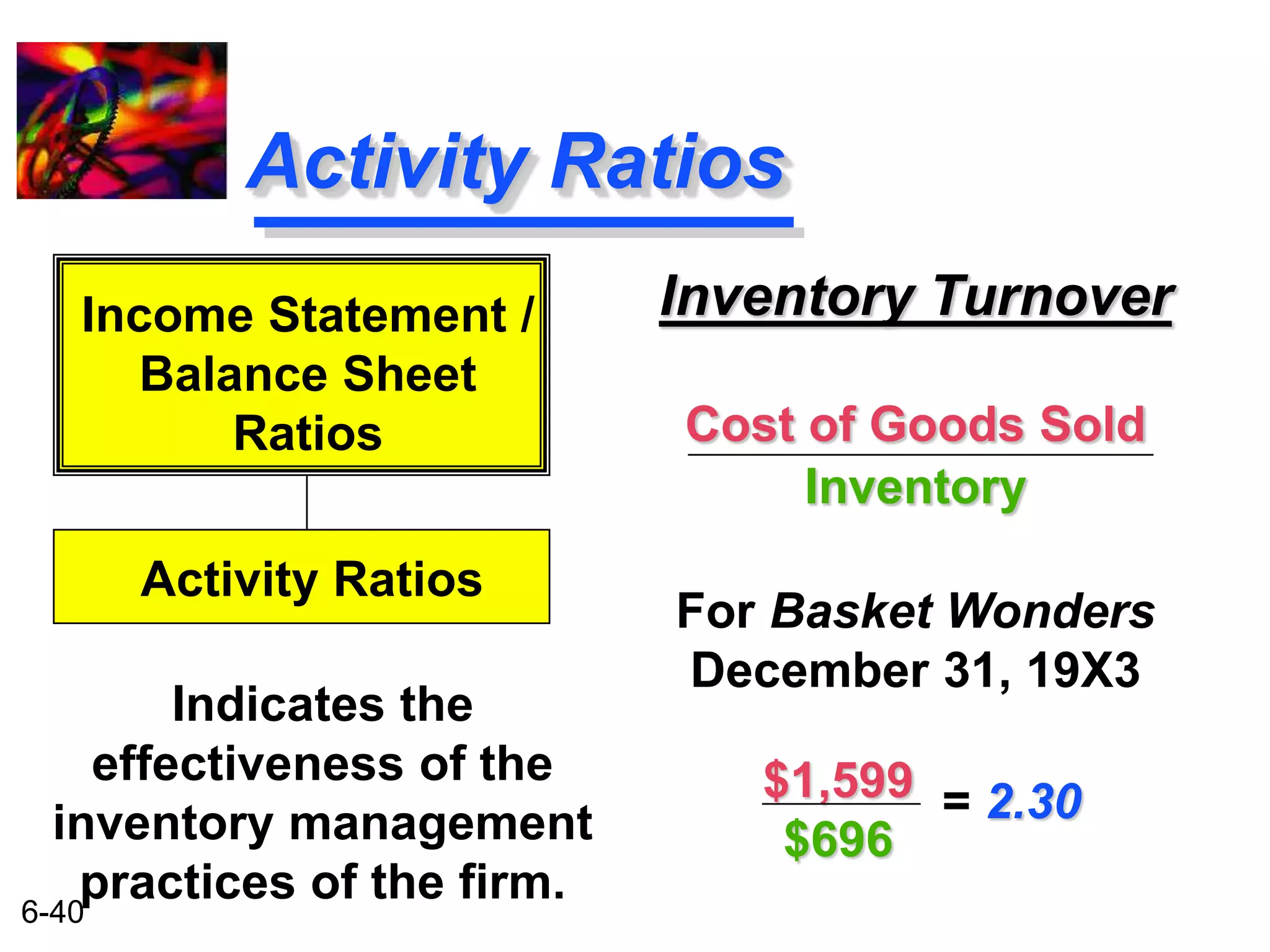

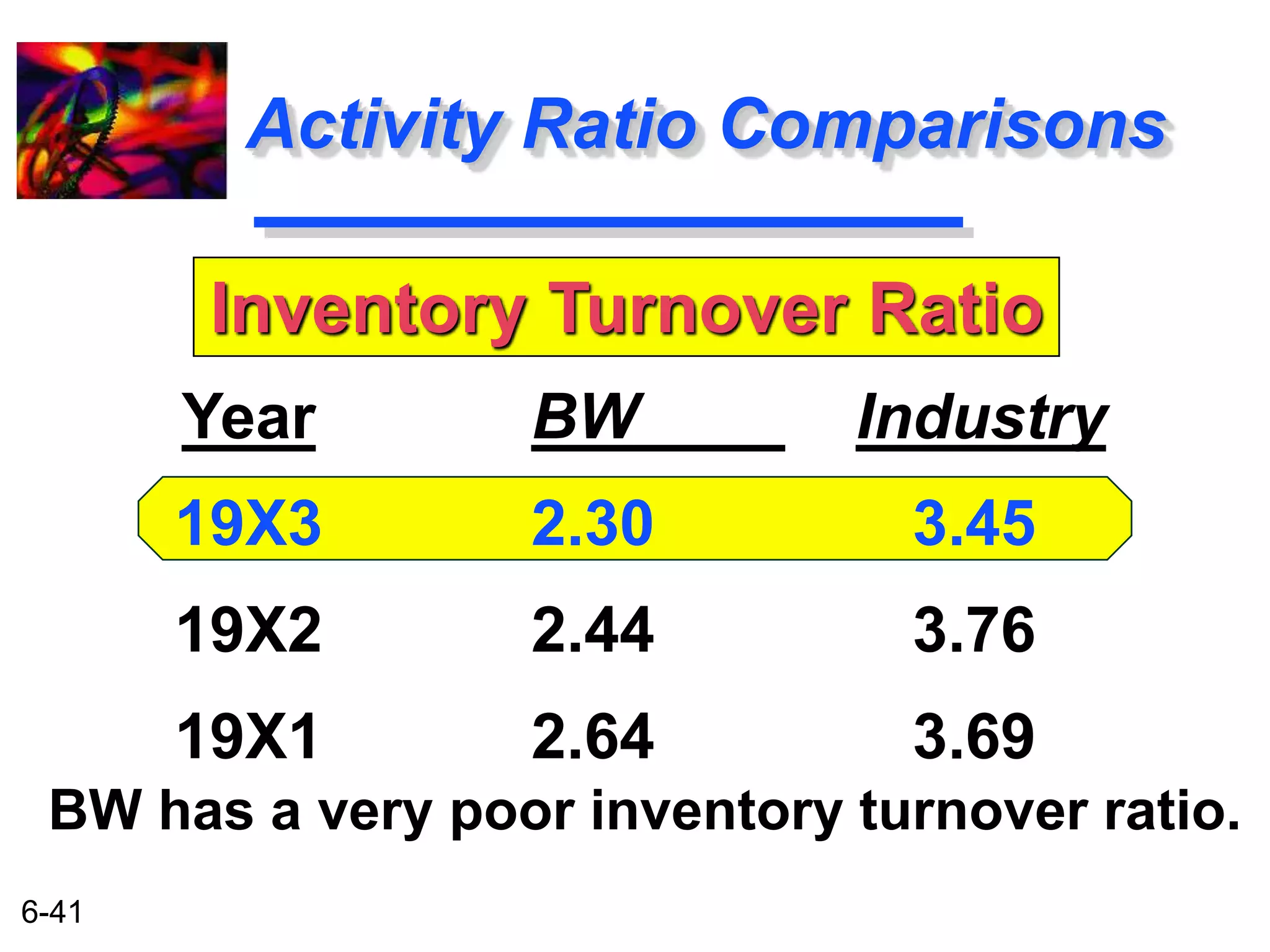

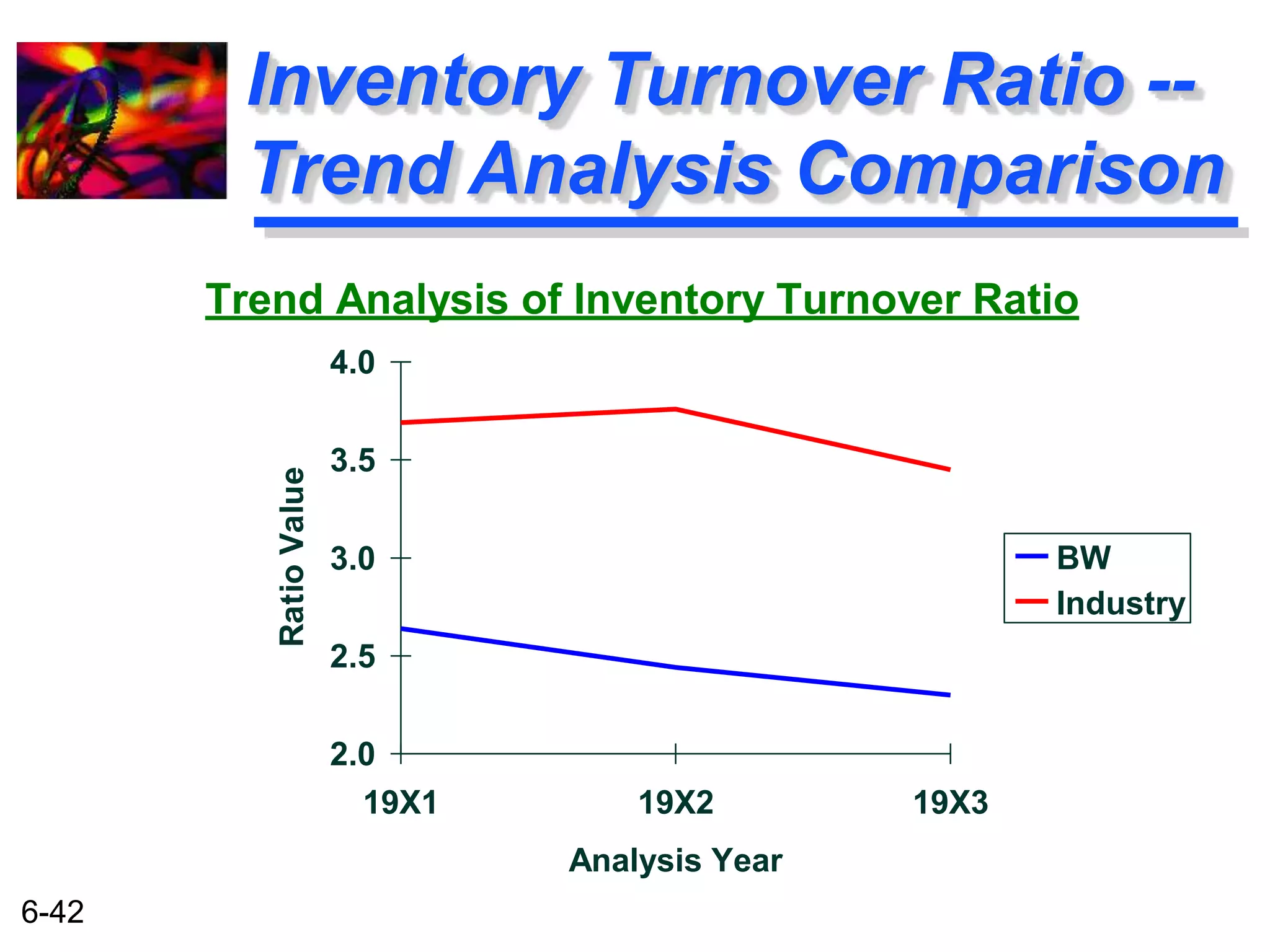

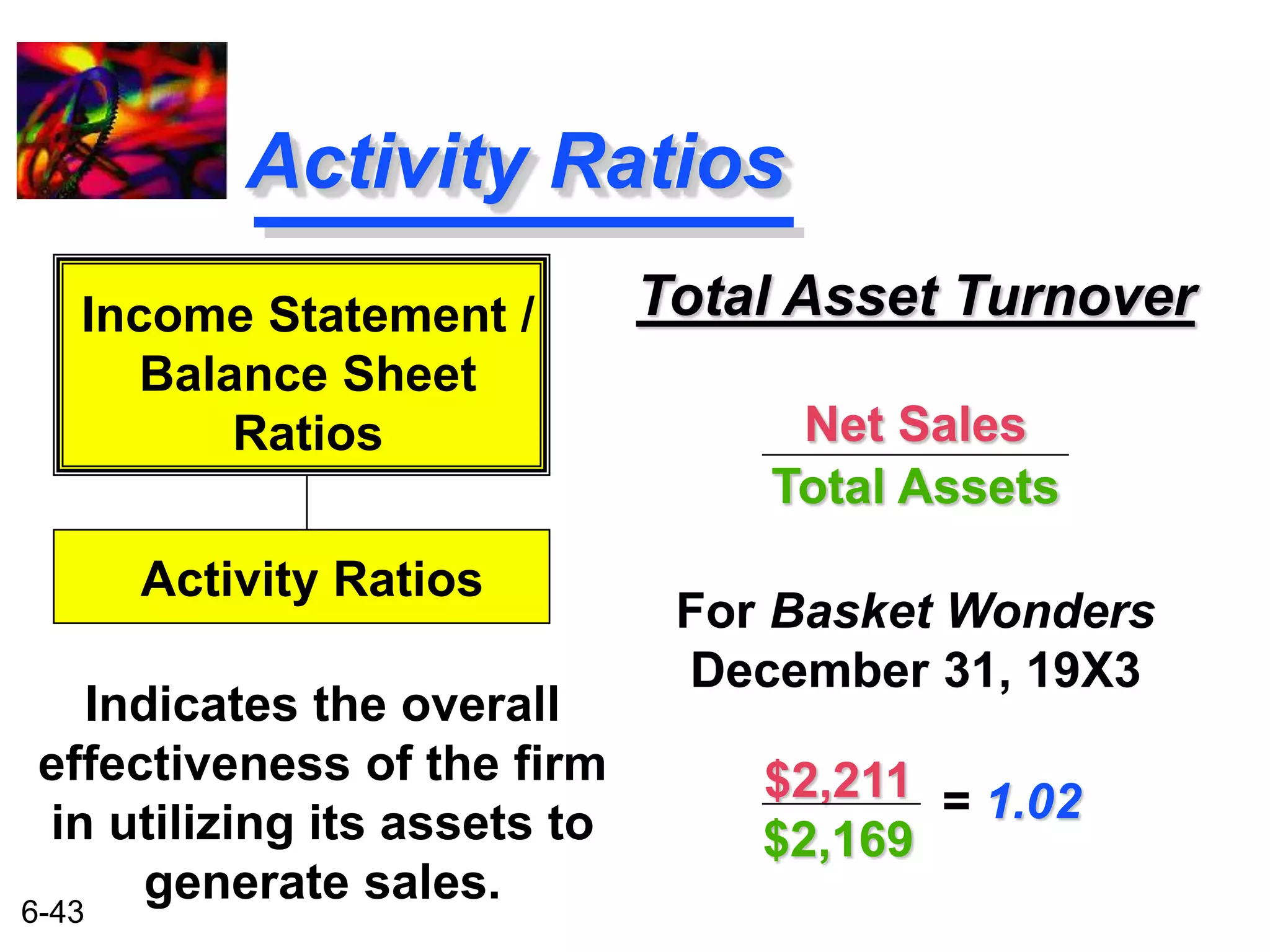

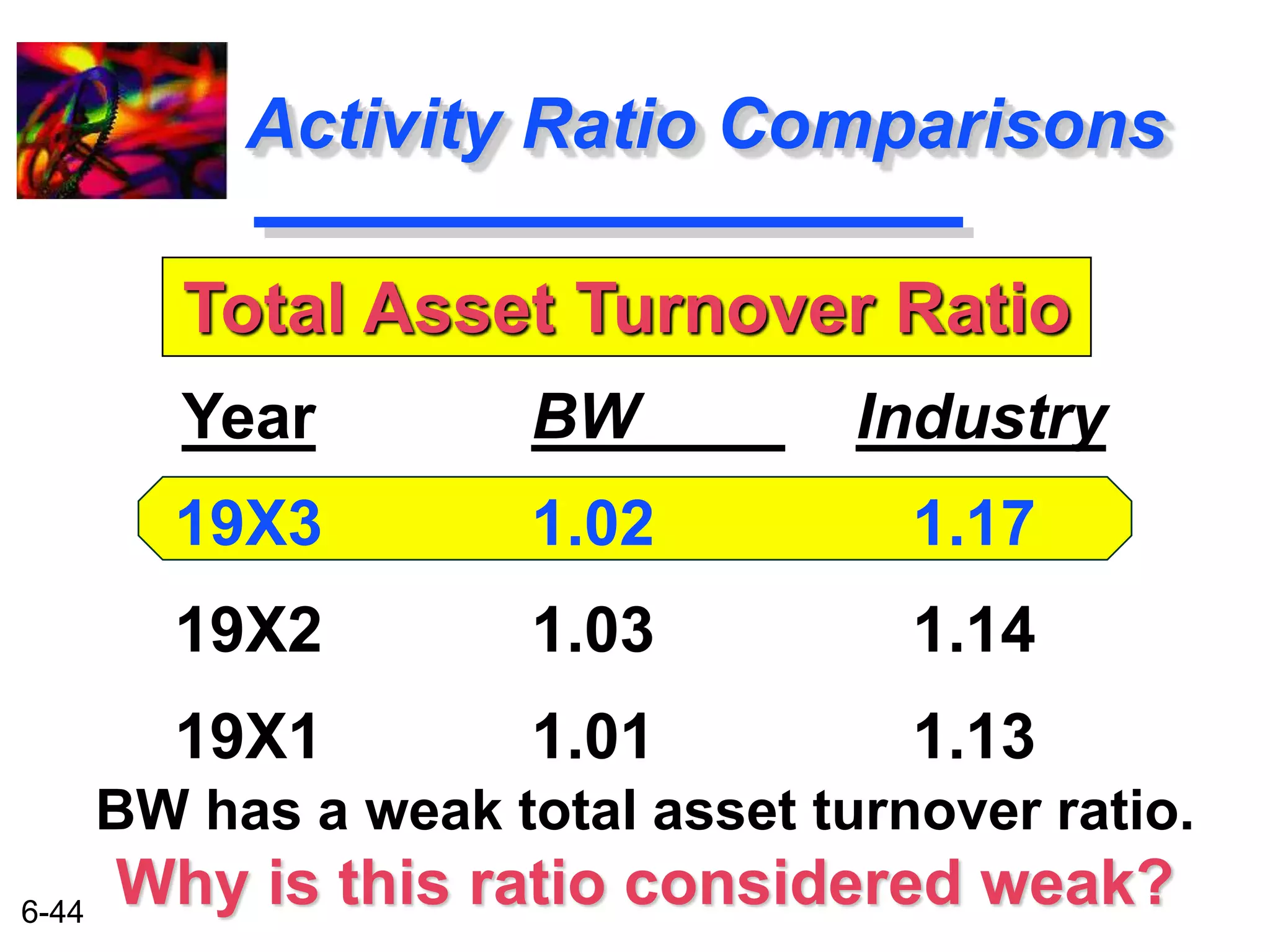

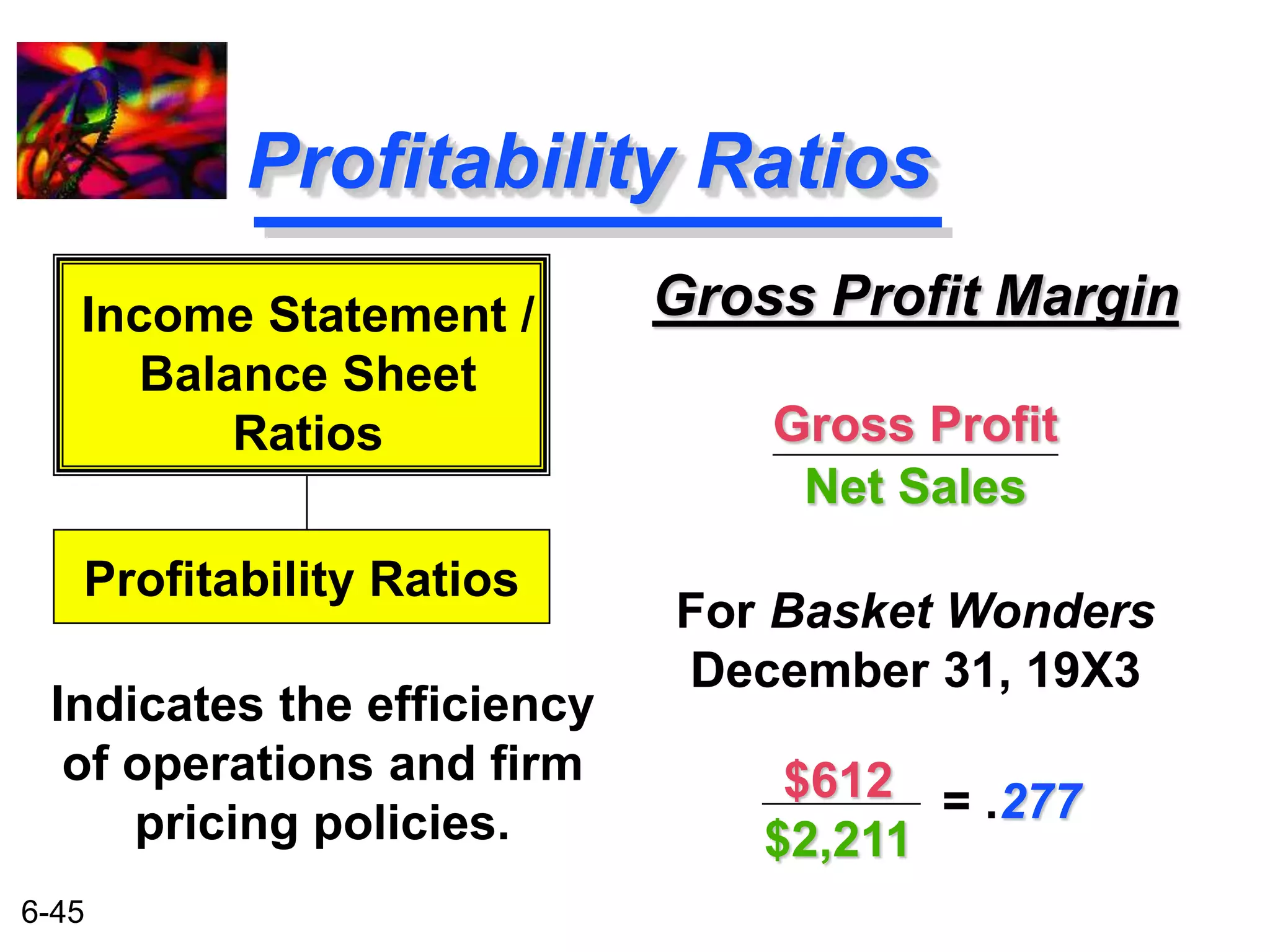

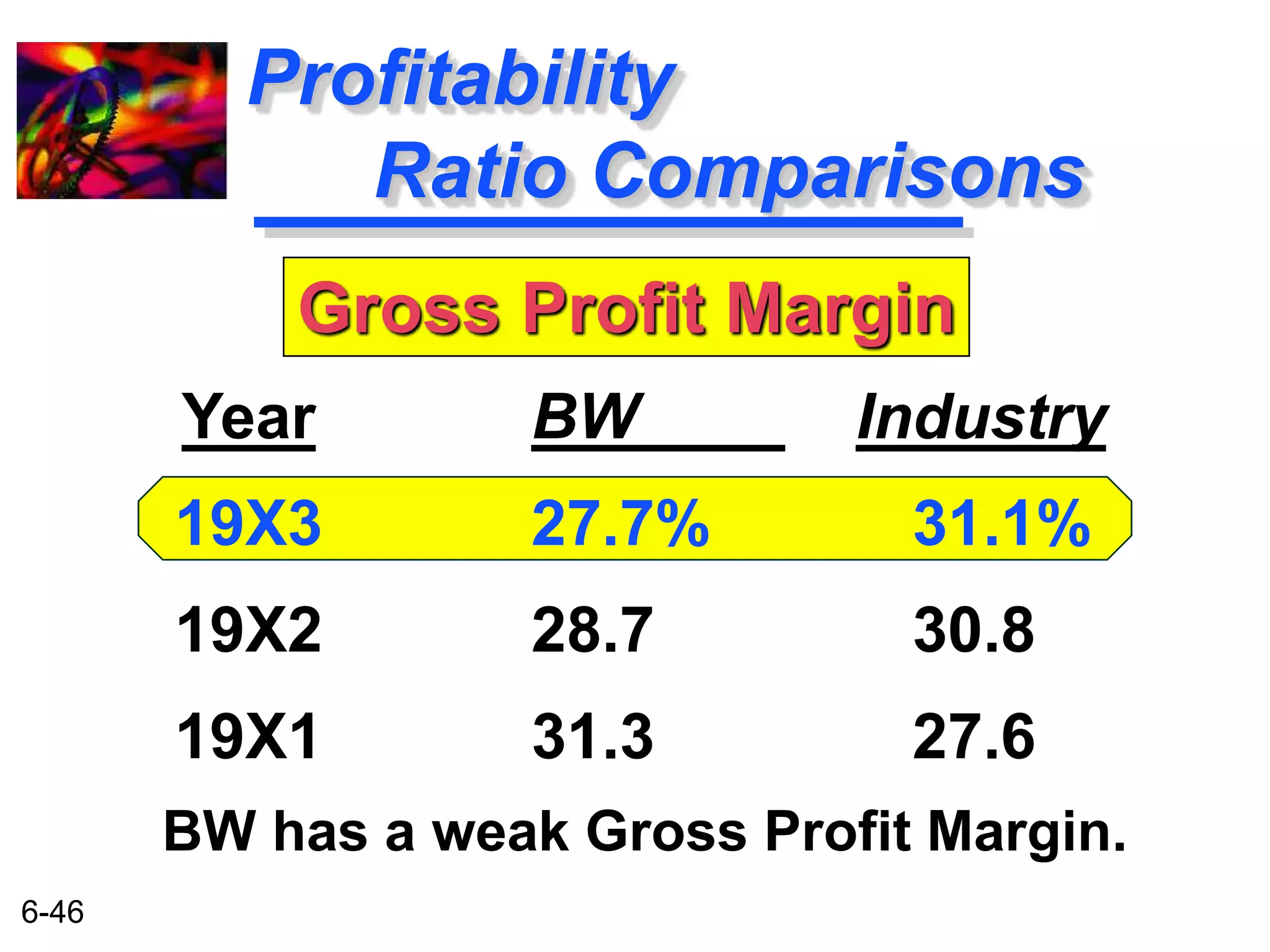

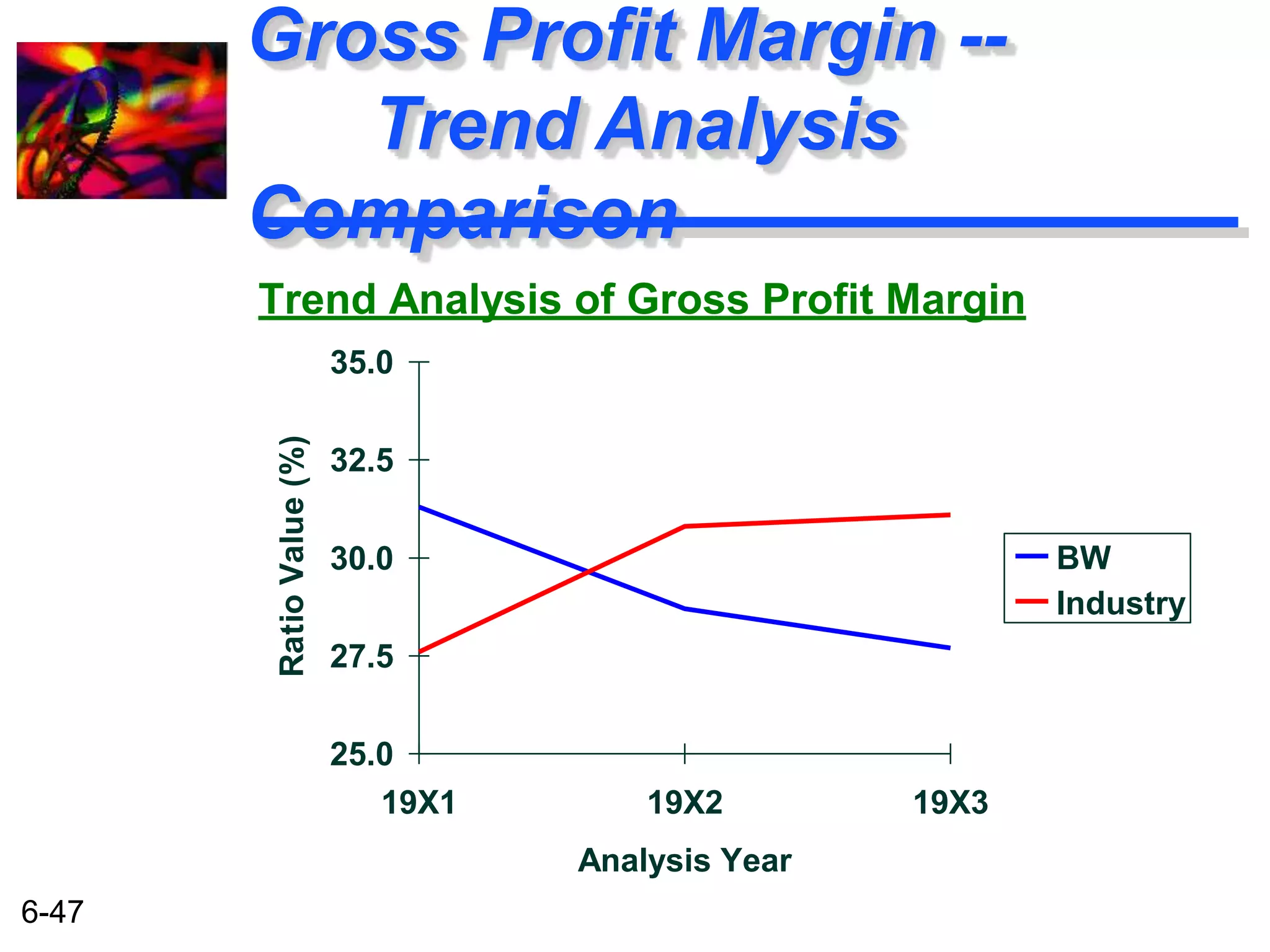

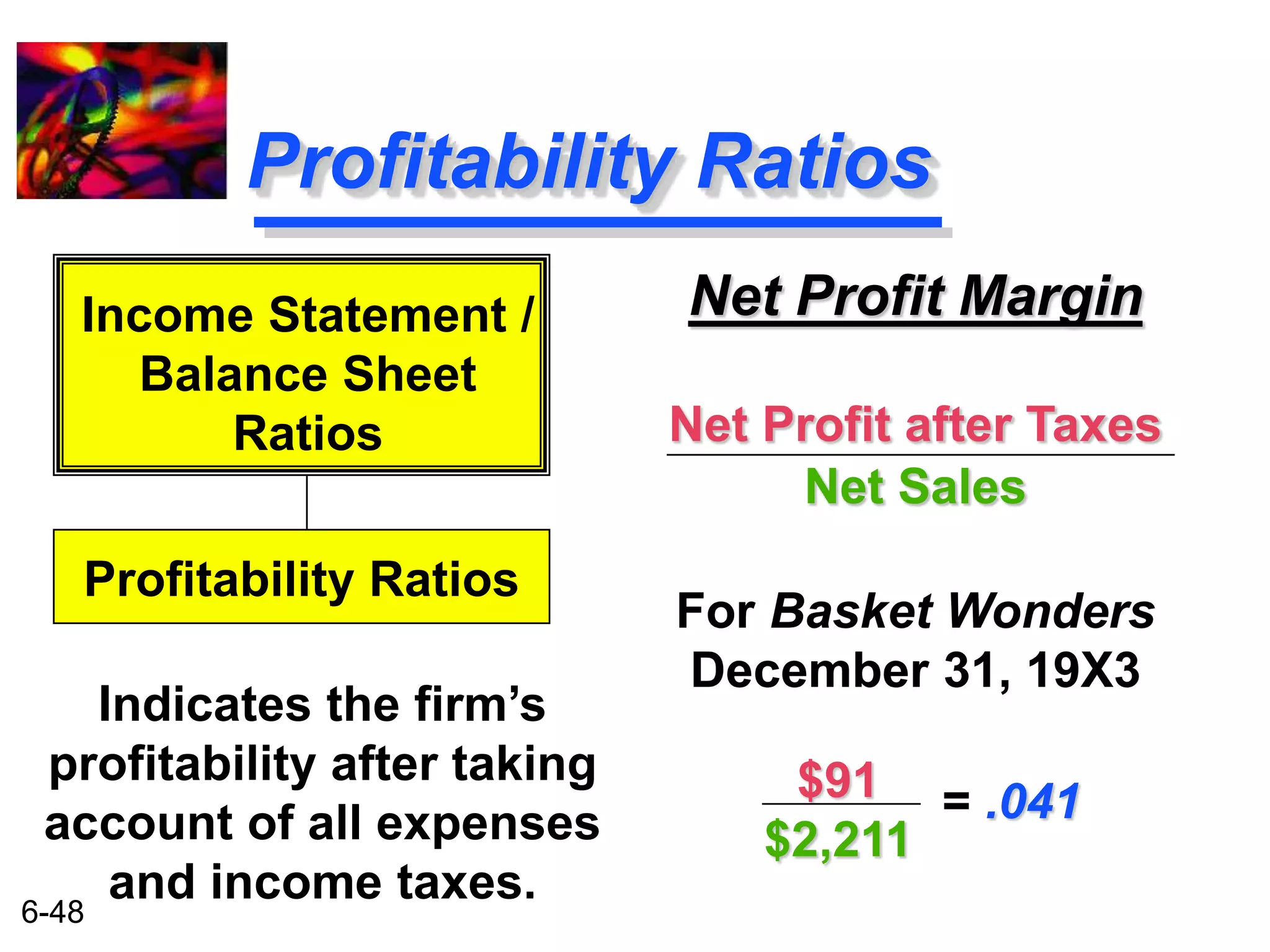

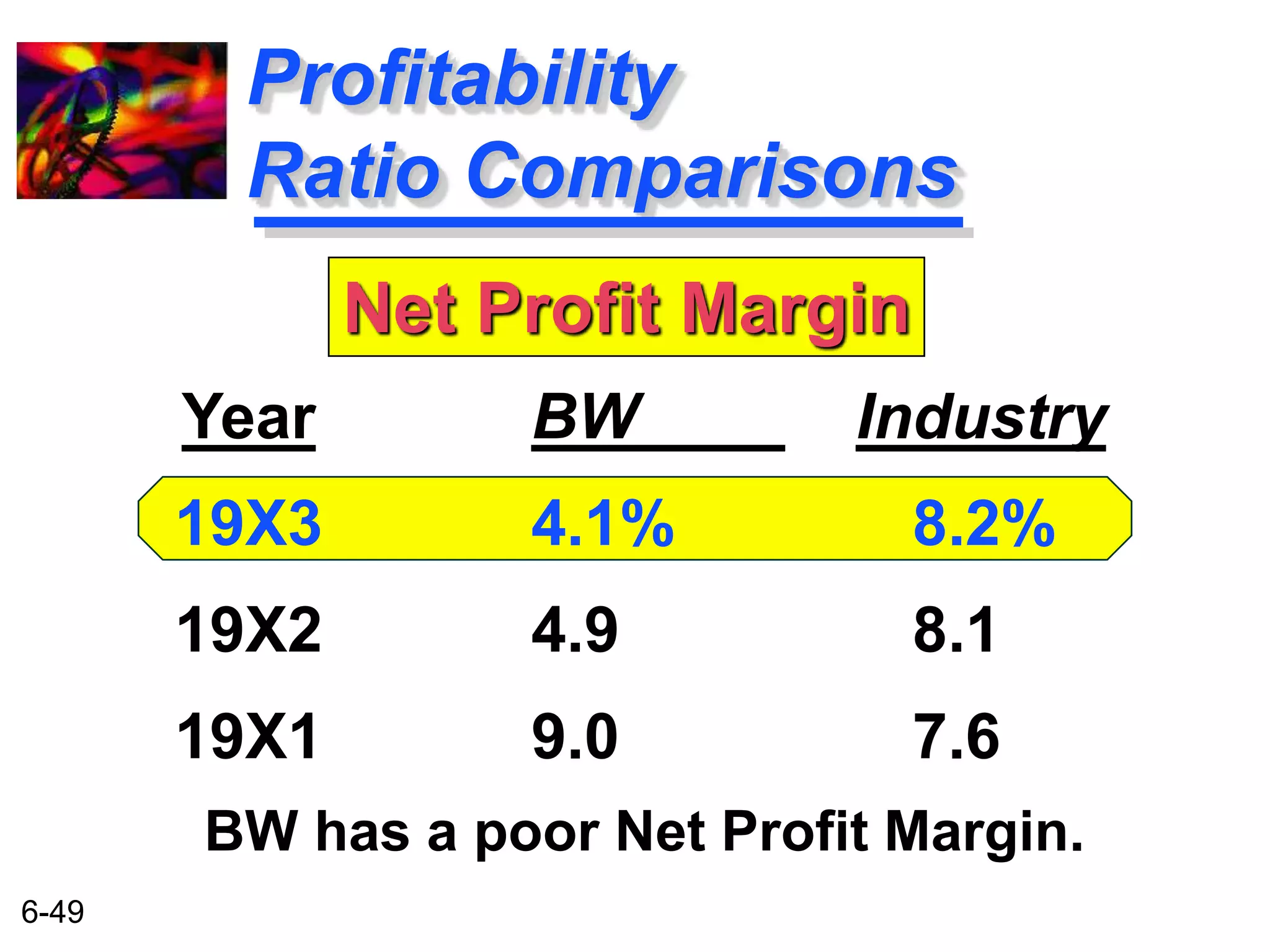

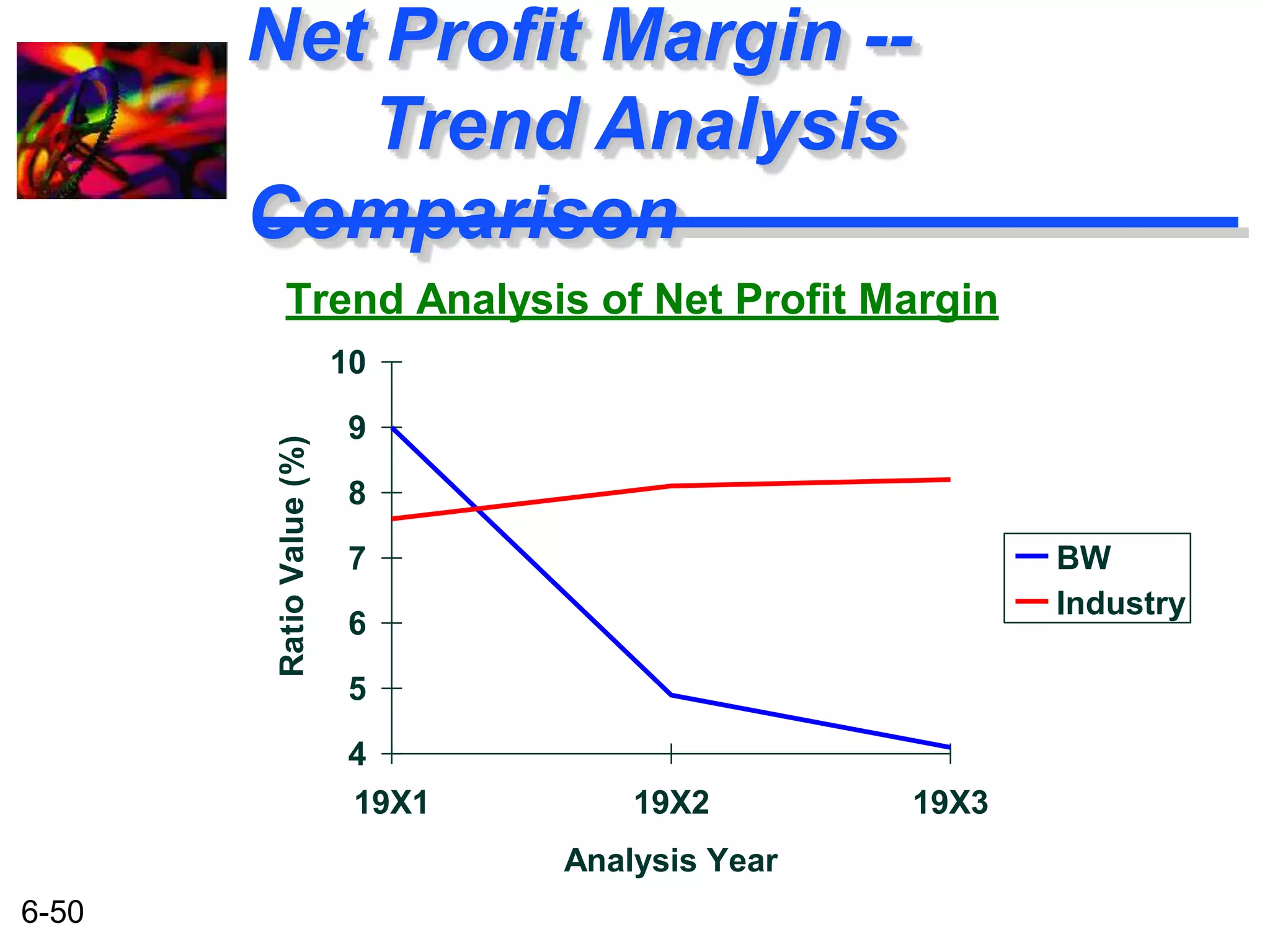

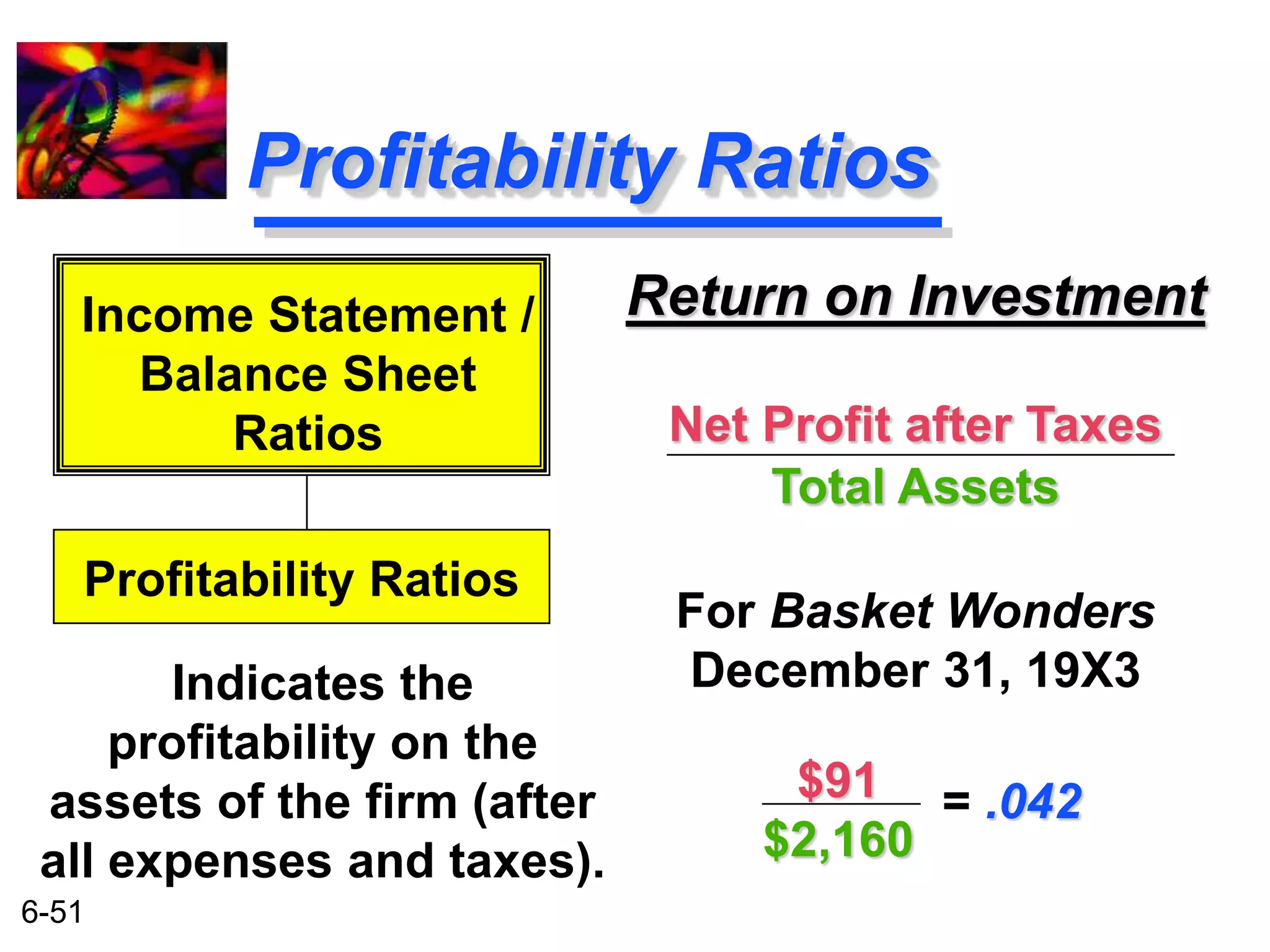

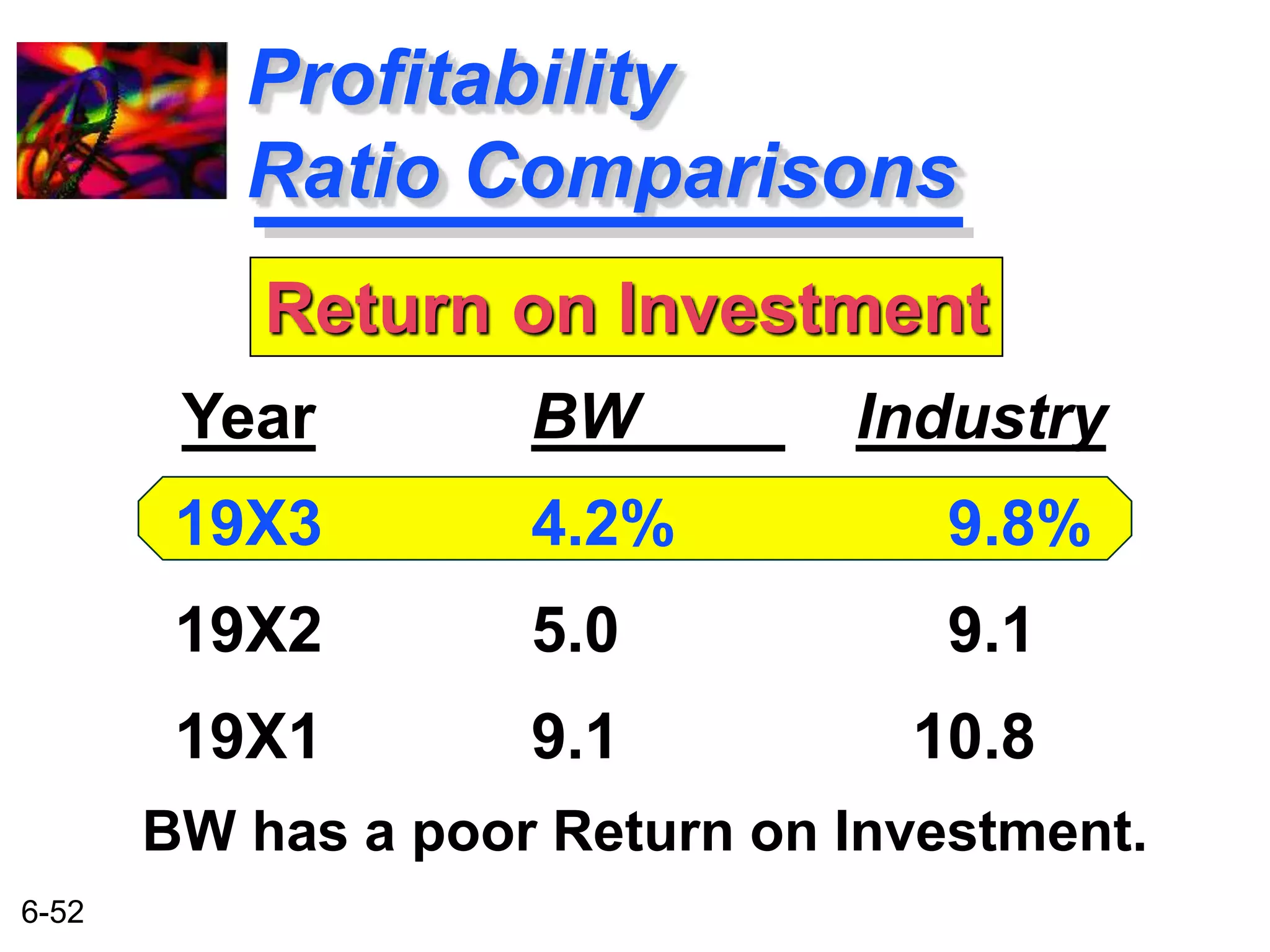

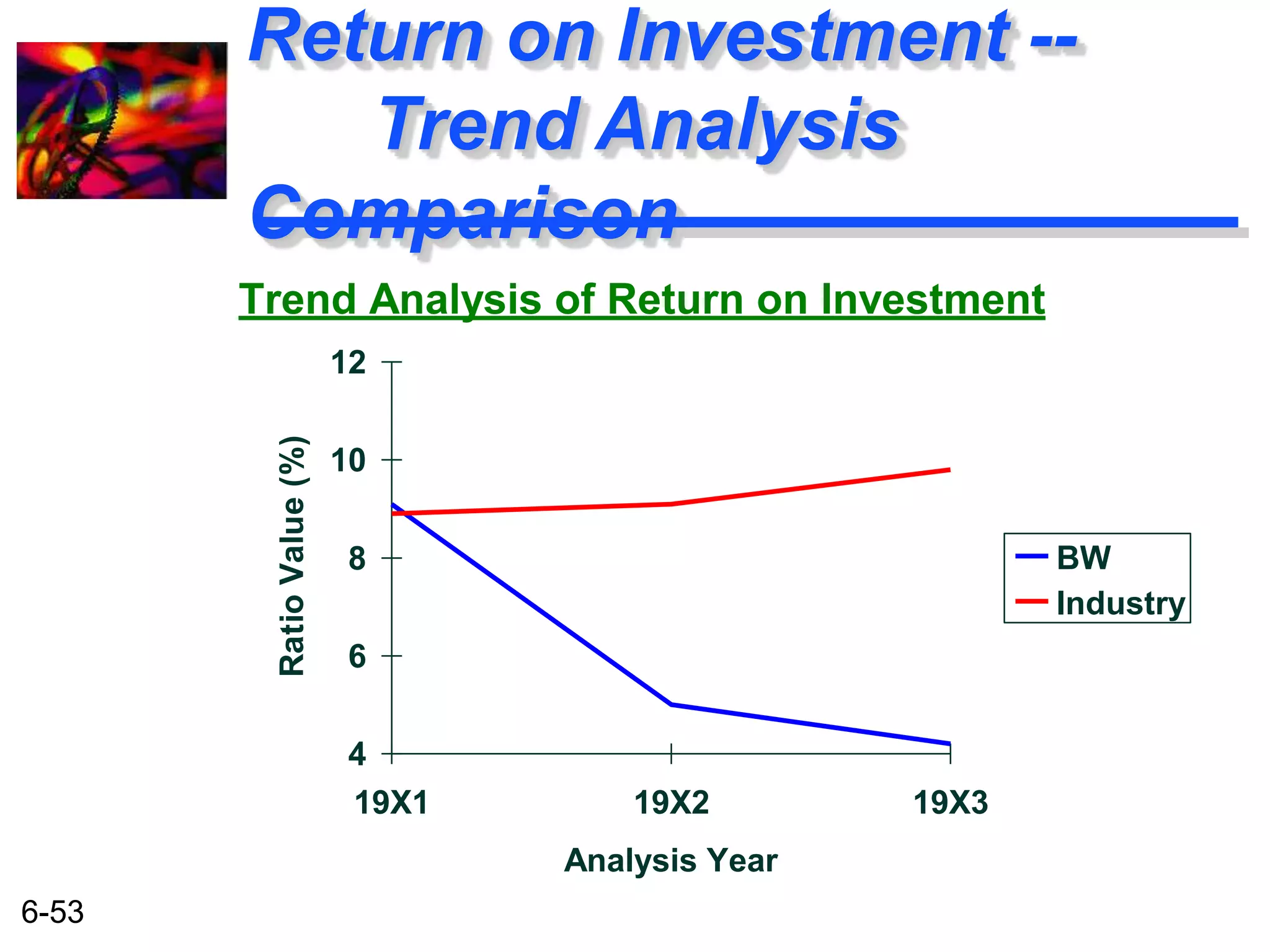

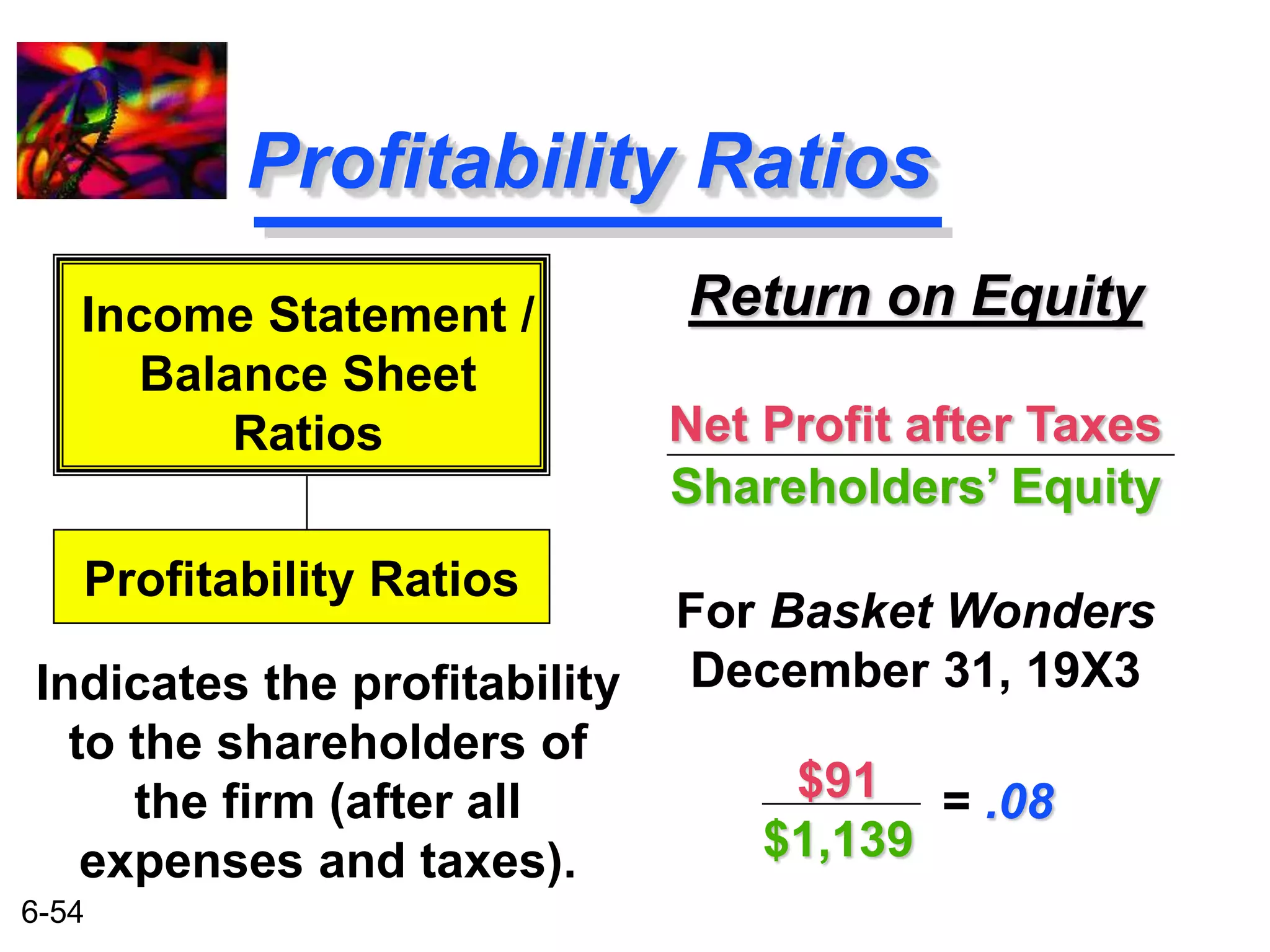

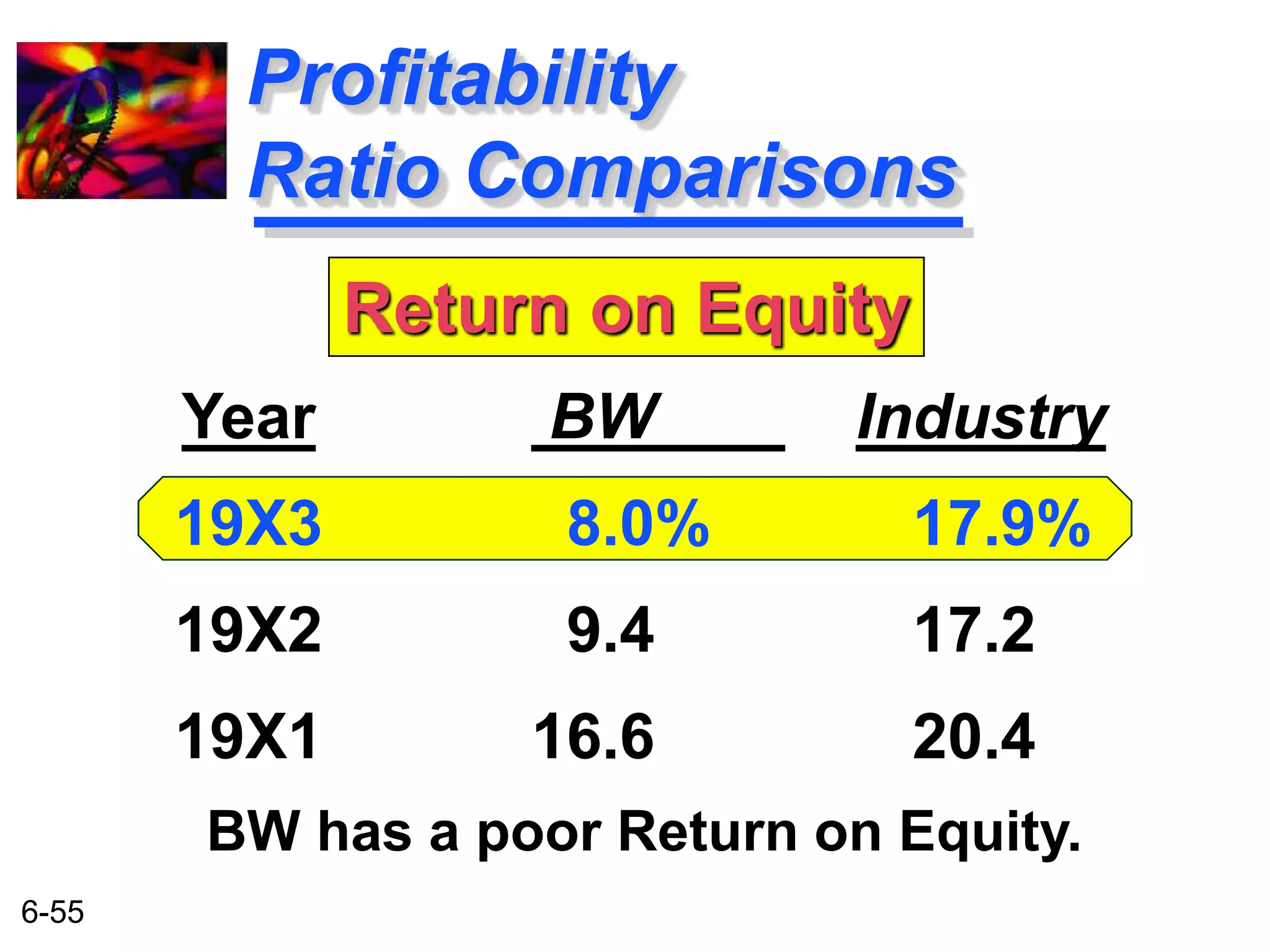

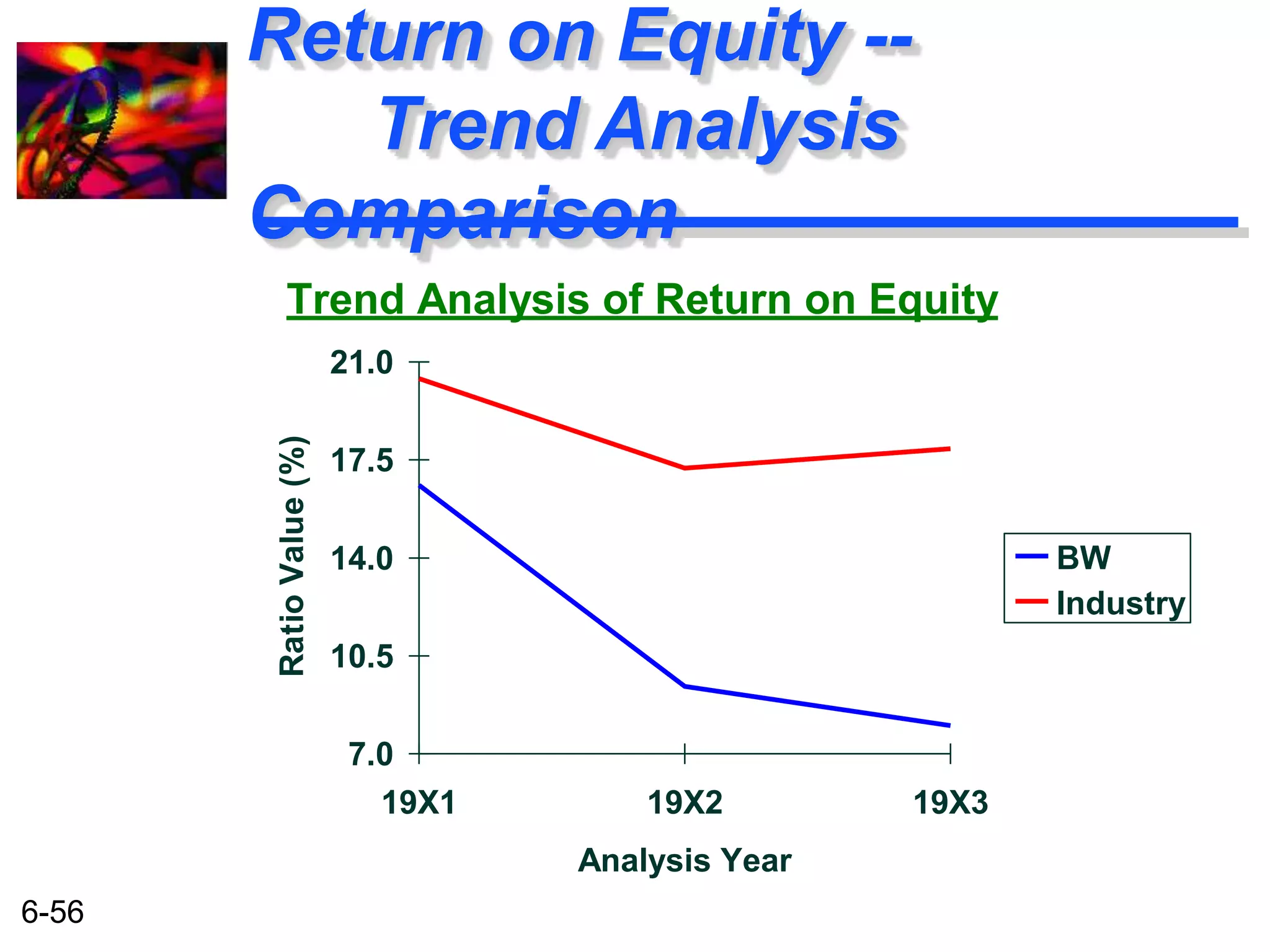

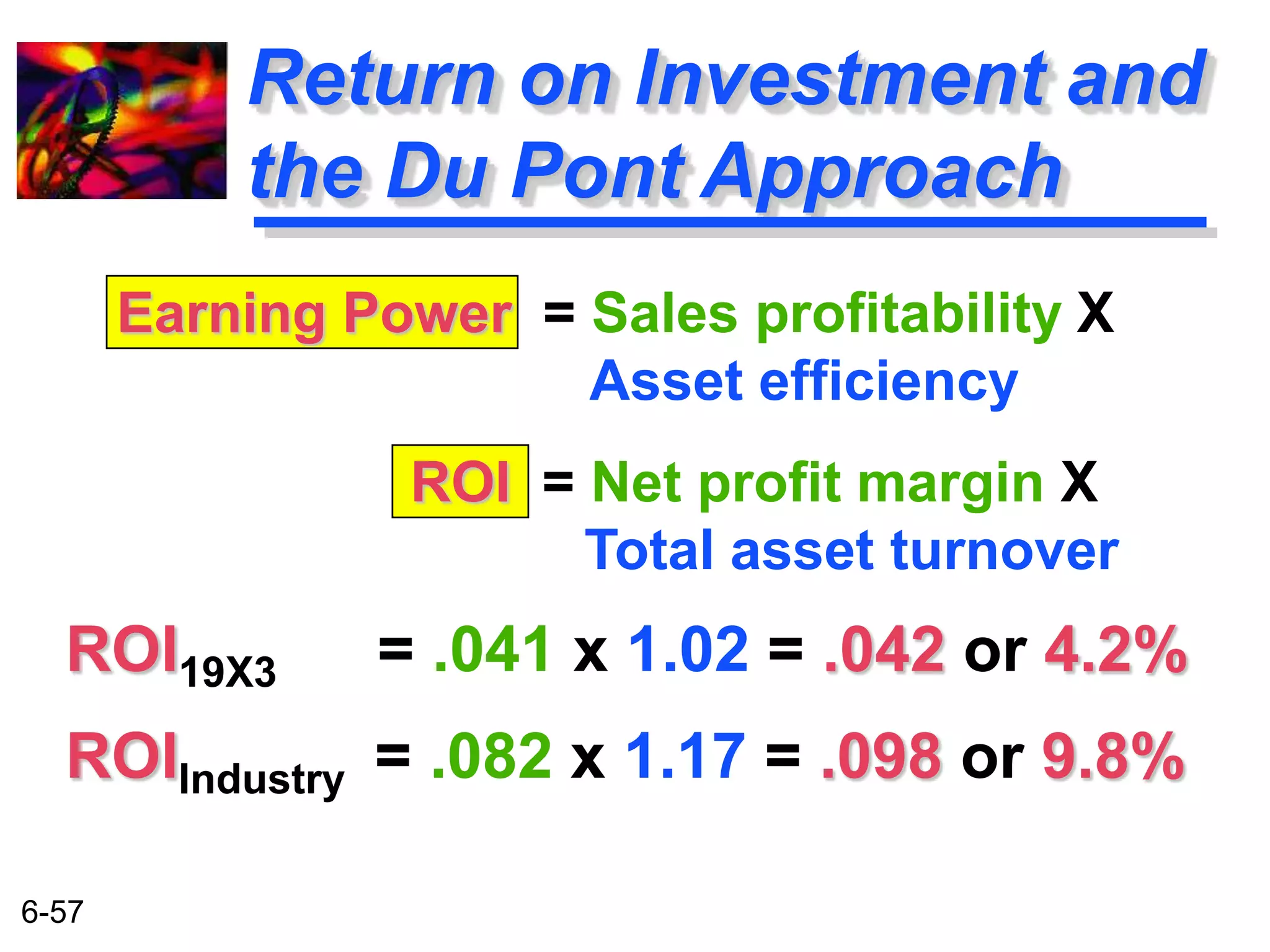

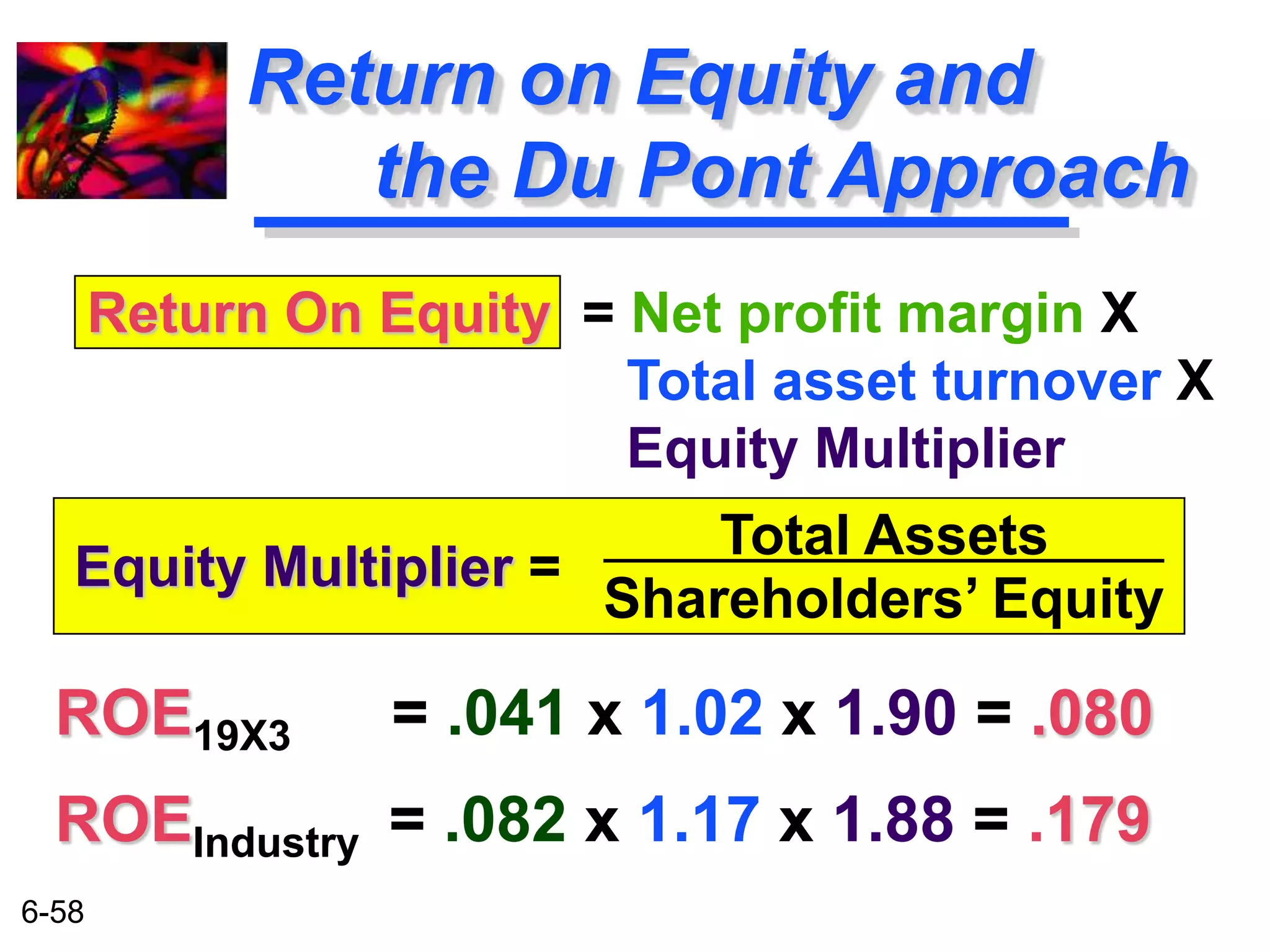

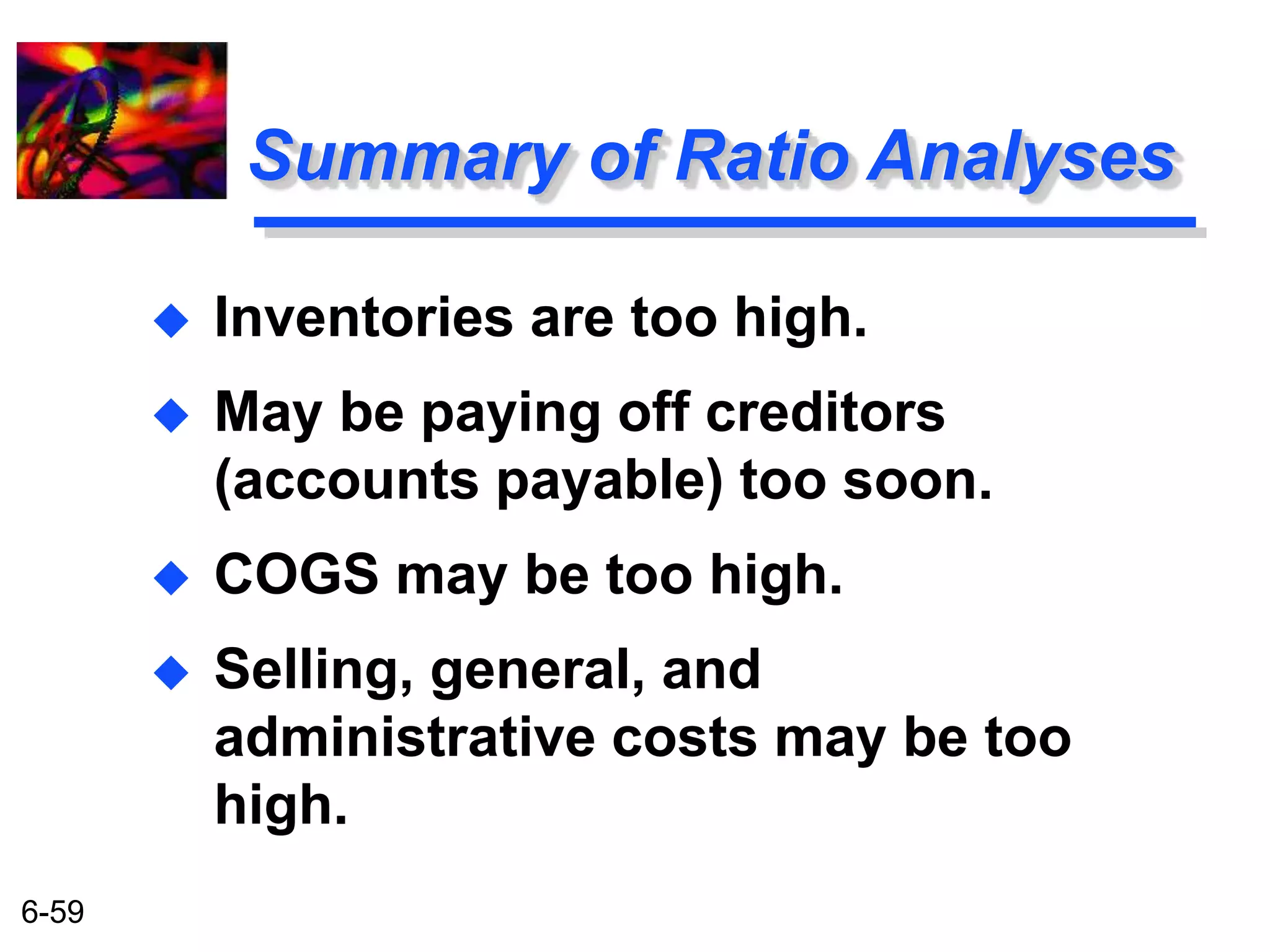

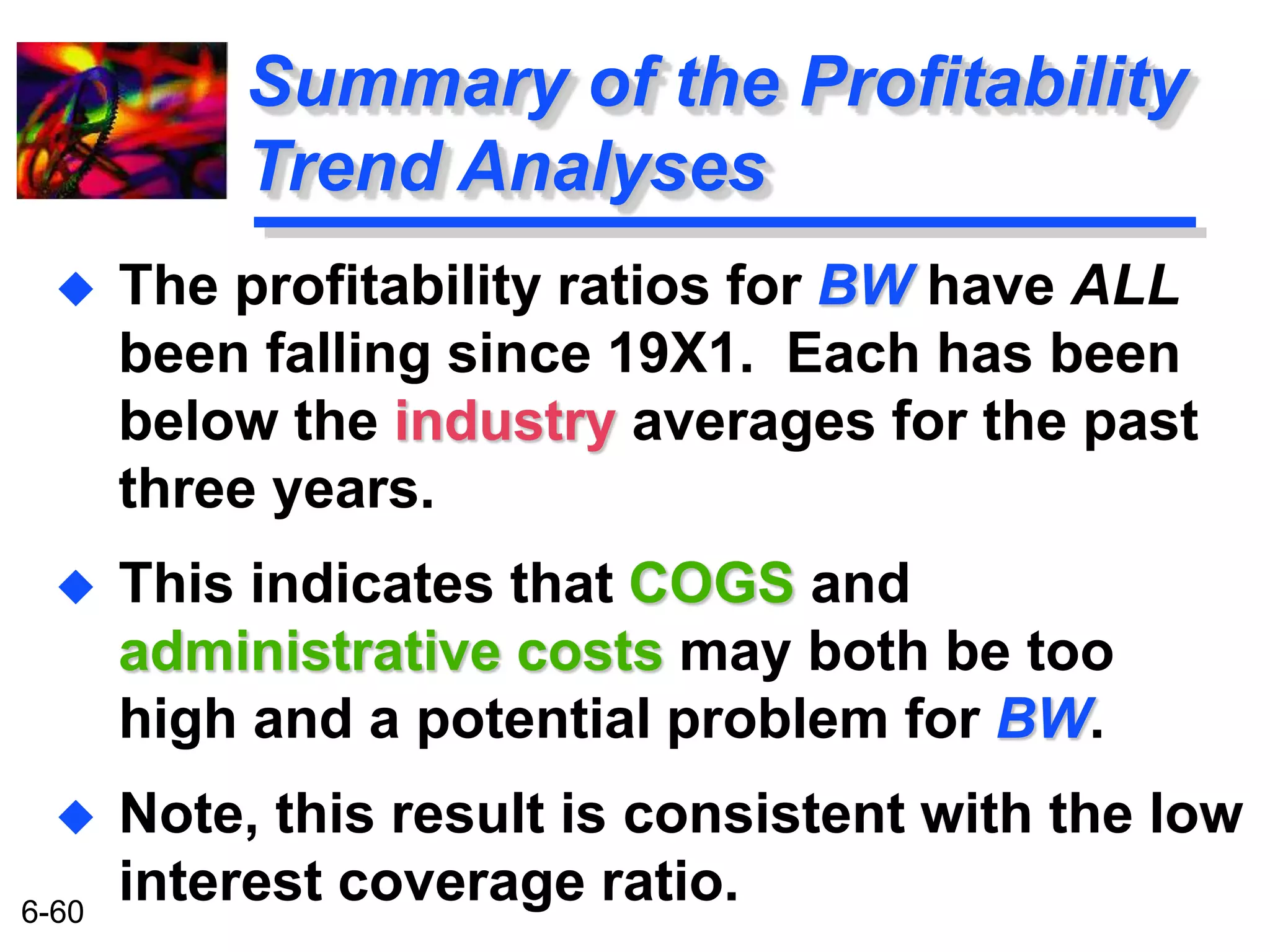

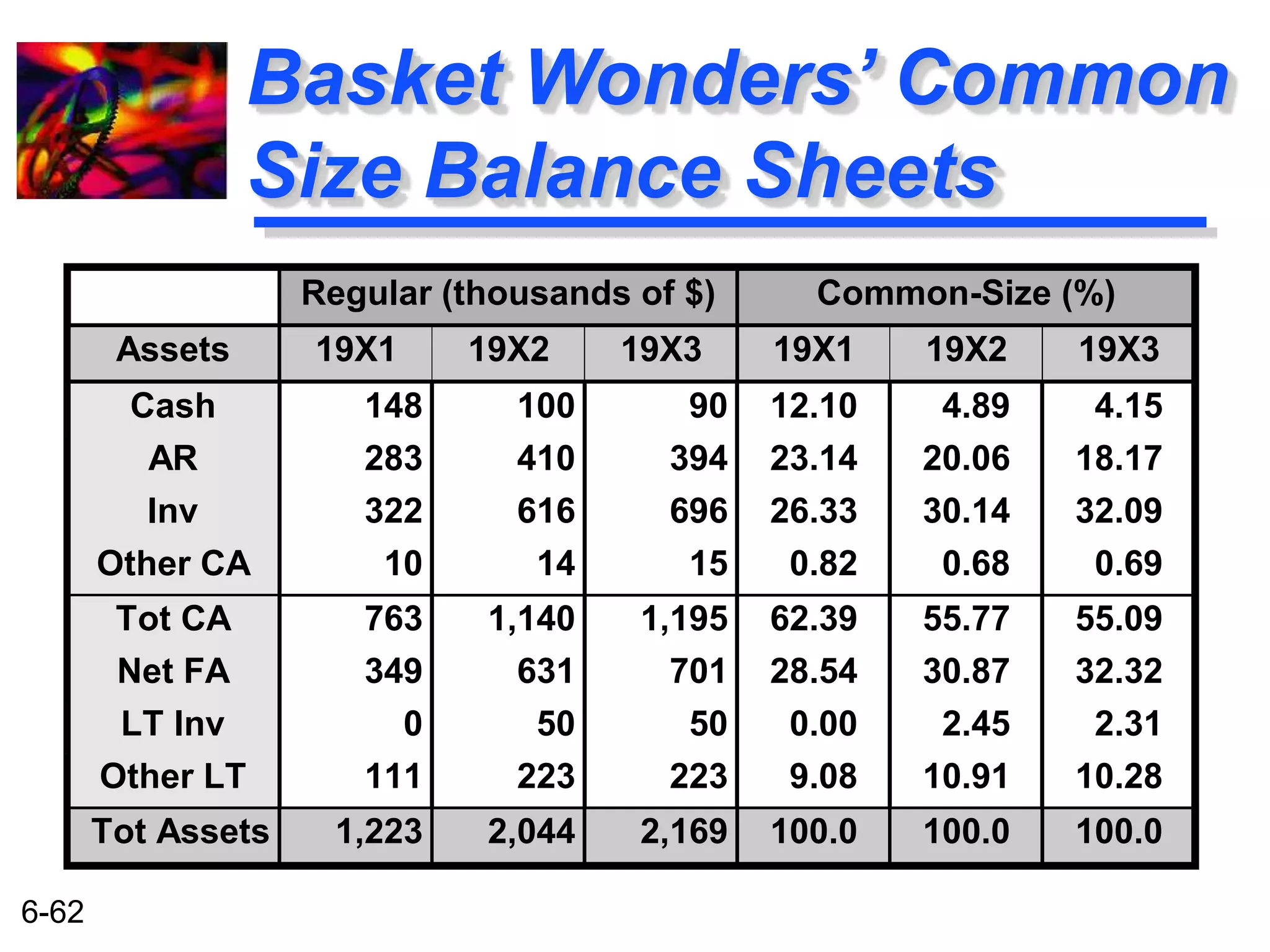

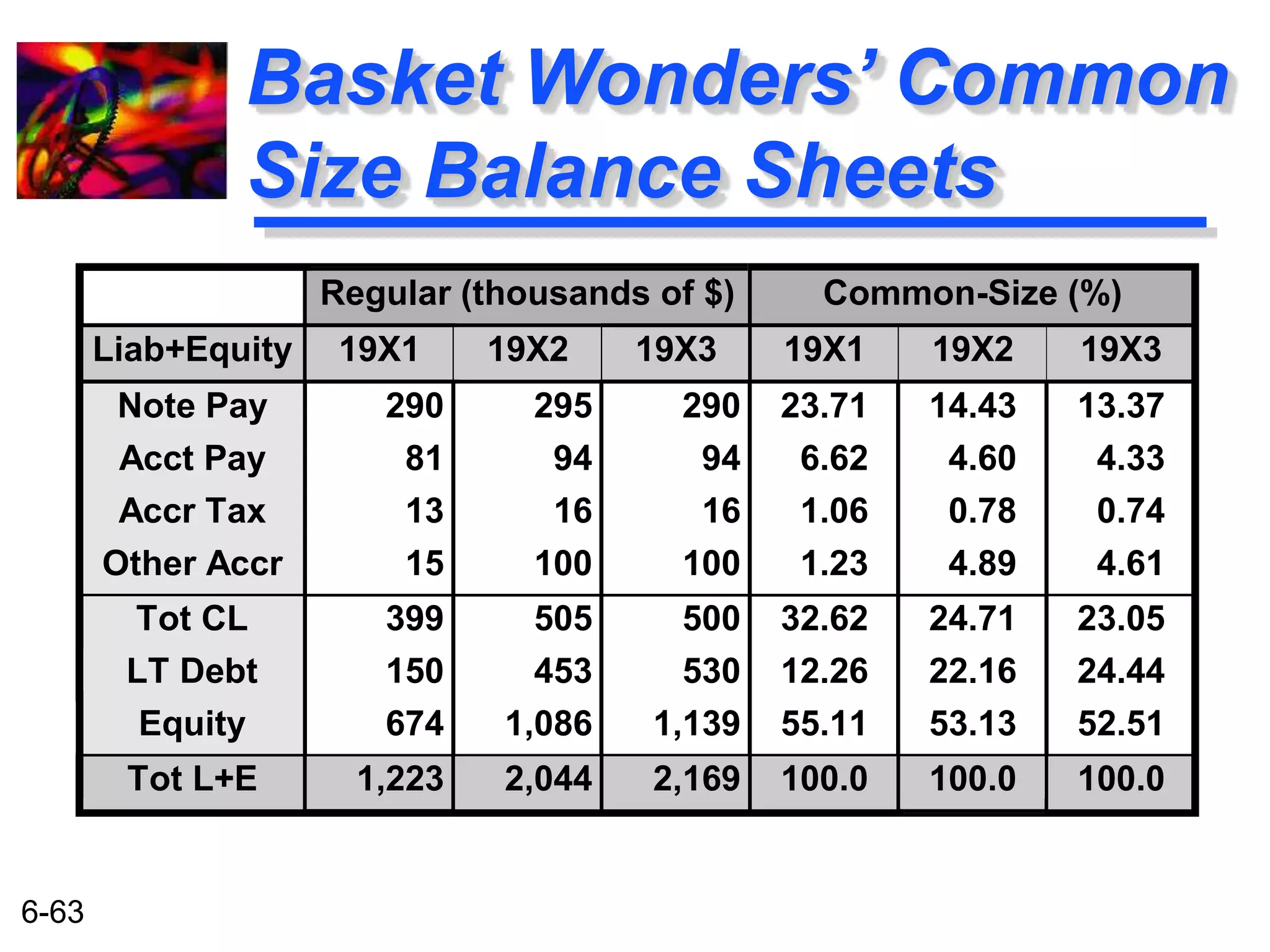

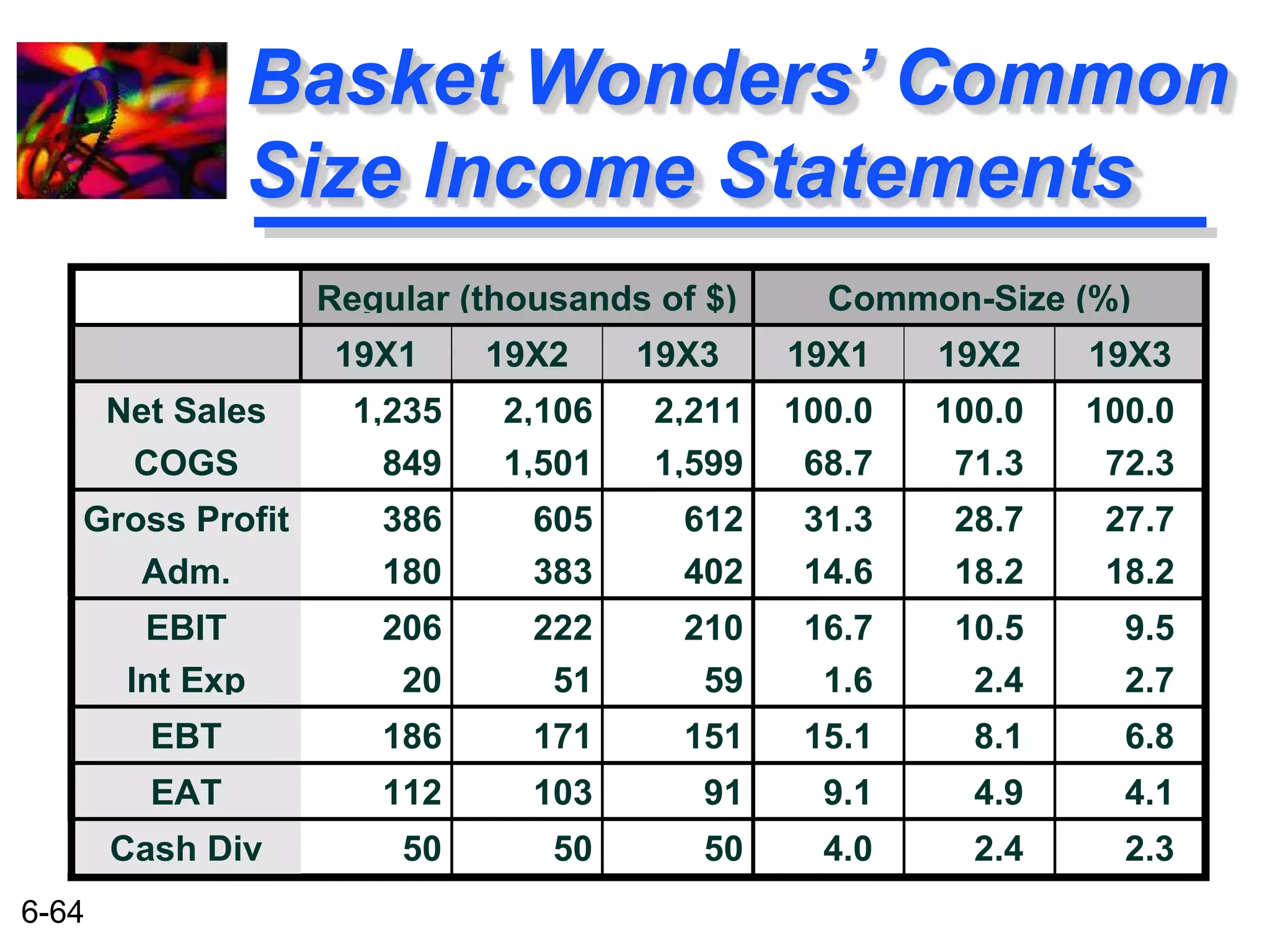

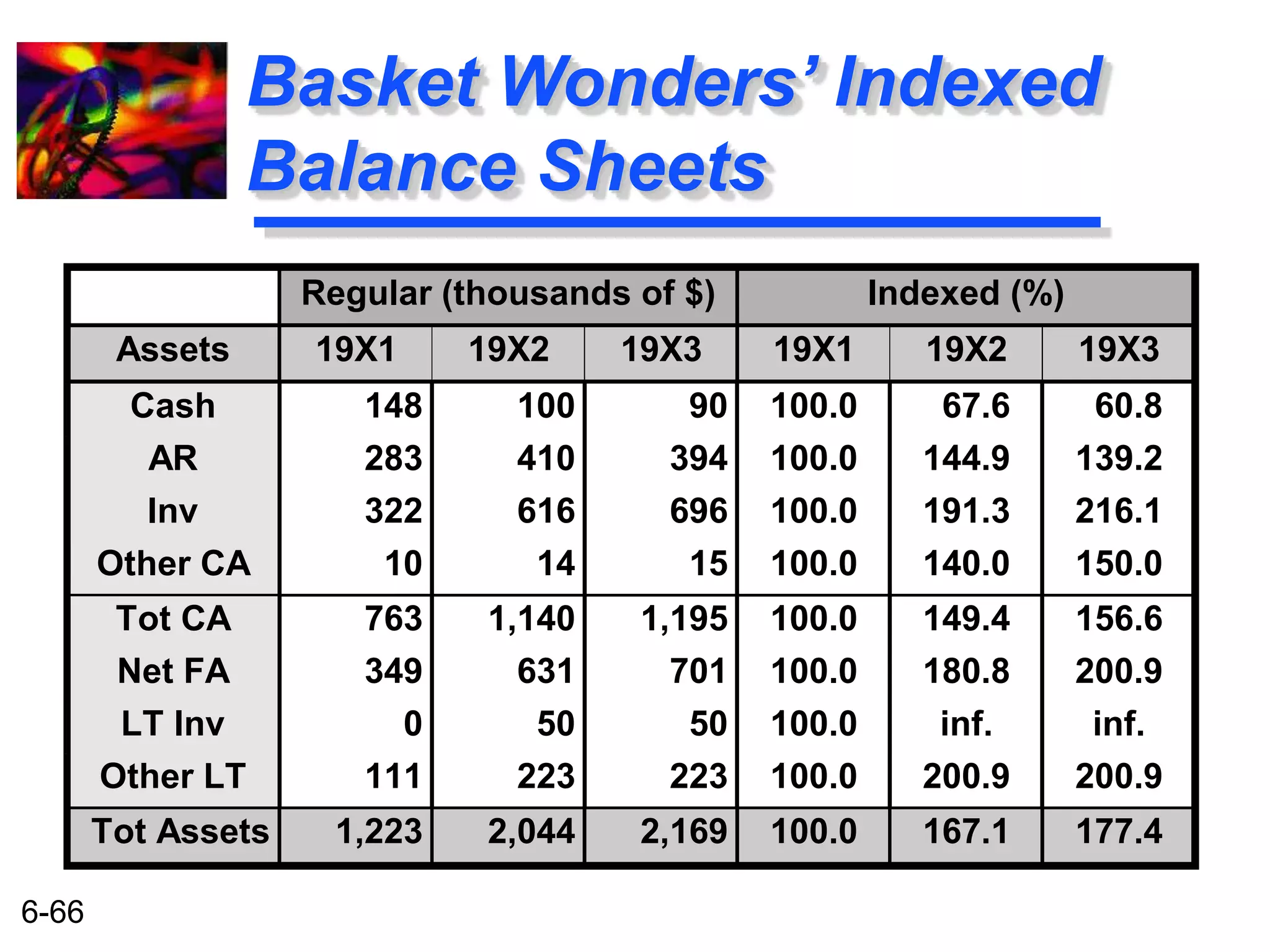

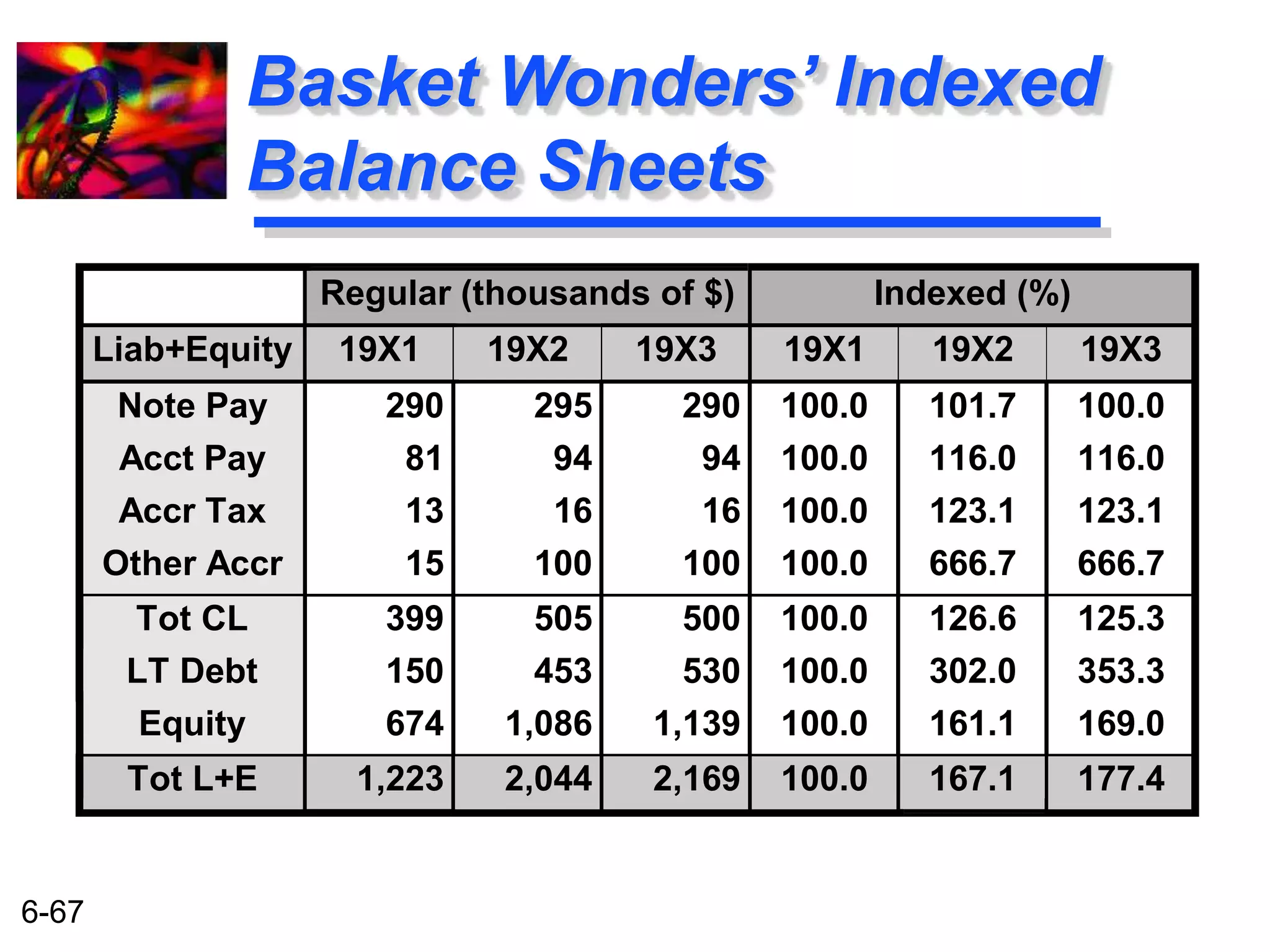

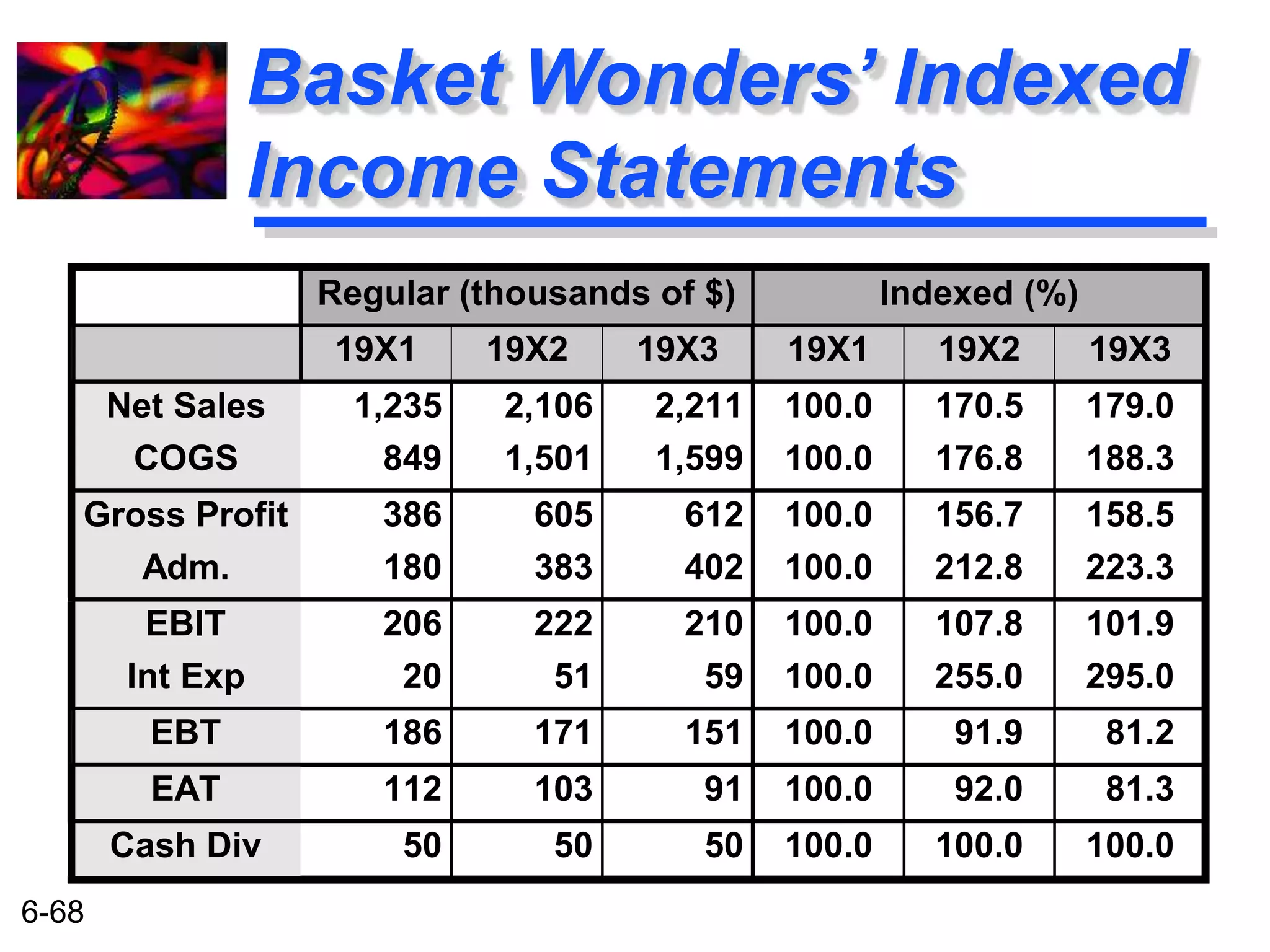

This document provides an overview of financial statement analysis for a company called Basket Wonders. It includes sample financial statements for Basket Wonders including a balance sheet and income statement. It then discusses various types of ratio analysis that can be used to analyze the financial statements including liquidity ratios, leverage ratios, coverage ratios, and activity/turnover ratios. It calculates these ratios for Basket Wonders and compares them to industry averages to identify areas of strength or weakness for the company. Key findings include potential issues with Basket Wonders' inventory levels and lower than average profitability.