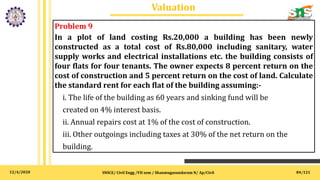

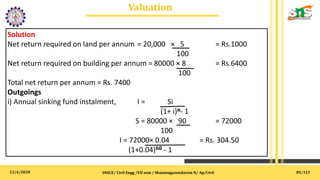

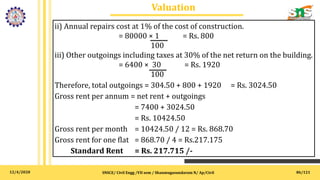

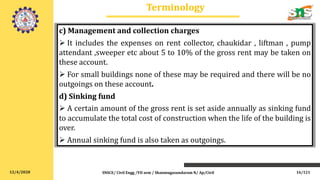

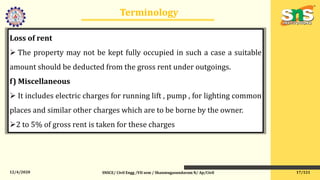

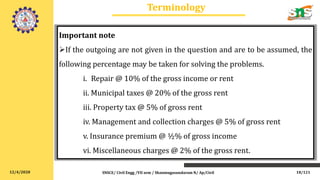

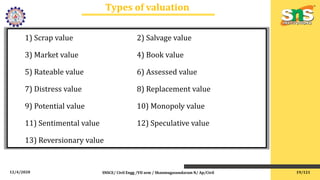

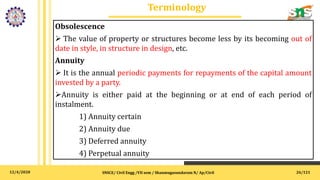

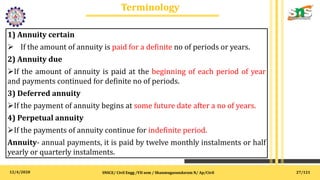

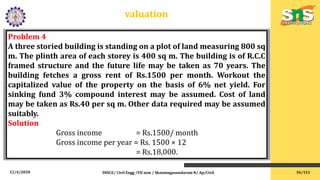

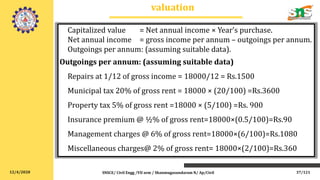

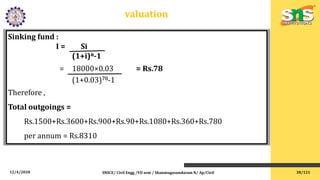

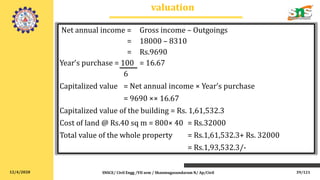

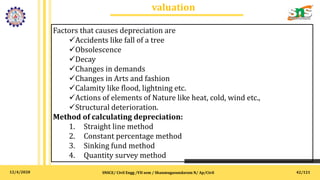

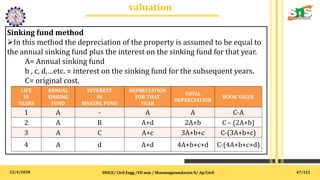

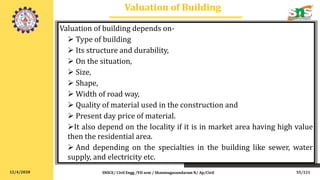

The document provides a comprehensive overview of valuation in civil engineering, detailing the definitions, types, and methods of valuation along with factors affecting property value. It discusses the importance of valuation for property sales, taxation, and rent fixation, and outlines various terminologies related to property income and expenses. Additionally, it includes practical calculations and examples related to sinking funds and valuation methods.

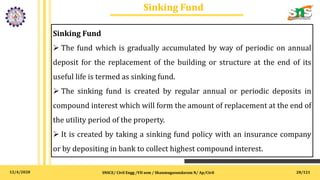

![12/4/2020

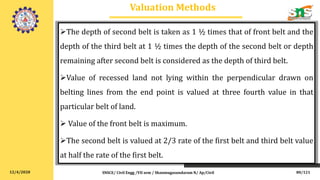

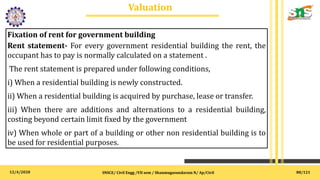

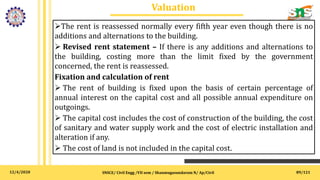

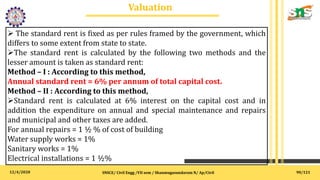

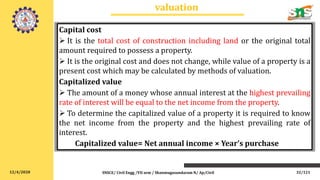

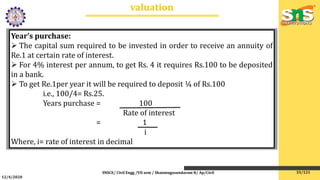

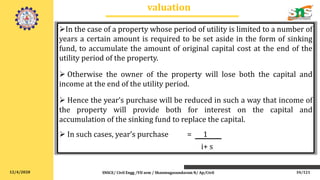

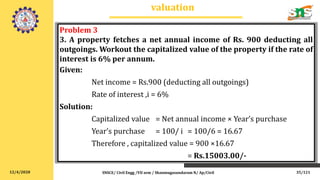

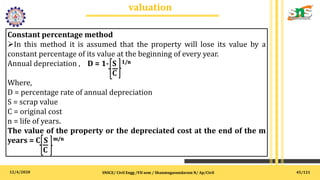

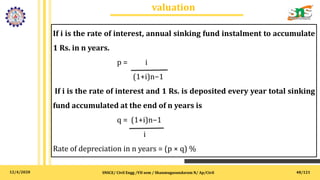

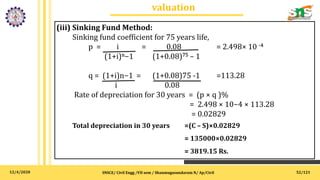

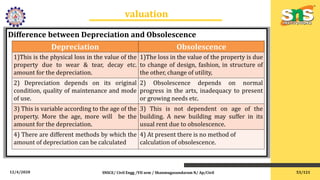

Valuation Methods

.

SNSCE/ Civil Engg /VII sem / Shanmugasundaram N/ Ap/Civil

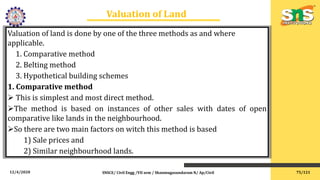

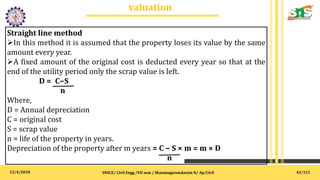

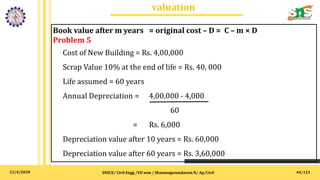

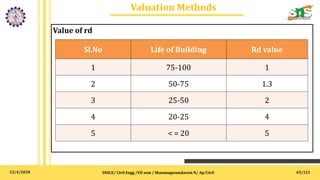

6. Depreciation method of valuation

The depreciated value of the property on the present day rates is

calculated by the formula:

D = P[(100 – rd)/100]n

Where,

D – depreciated value

P – cost at present market rate

rd – fixed percentage of depreciation (r stands for rate and d for

depreciation)

n – The number of years the building had been constructed.

To find the total valuation of the property, the present value of land,

water supply, electric and sanitary fitting etc., should be added to the above

value.

64/121](https://image.slidesharecdn.com/valuation-201204043758/85/Valuation-Estimation-Costing-and-Valuation-Engineering-64-320.jpg)

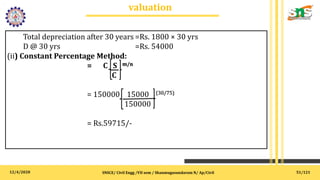

![12/4/2020

Valuation Methods

SNSCE/ Civil Engg /VII sem / Shanmugasundaram N/ Ap/Civil 67/121

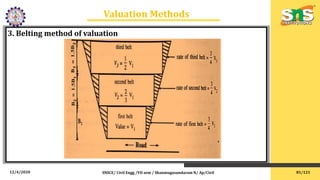

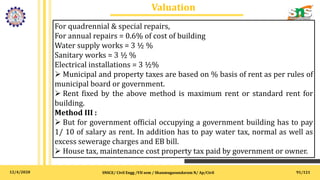

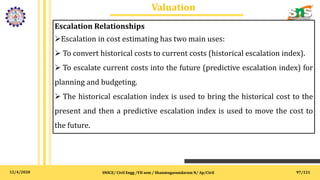

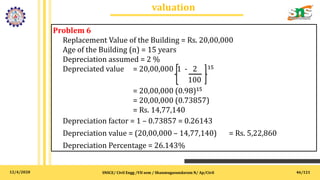

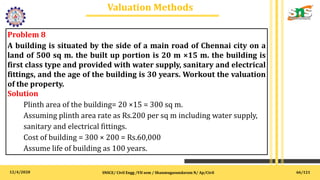

D = P[(100 – rd)/100]n

= 60000 100 - 1 30

100

= 44,280.

Cost of land assuming Rs.60 per sqm = 500 × 60 = Rs. 30,000.

Total valuation of property = 44,280 + 30,000

Total valuation of property = Rs. 74,280.](https://image.slidesharecdn.com/valuation-201204043758/85/Valuation-Estimation-Costing-and-Valuation-Engineering-67-320.jpg)