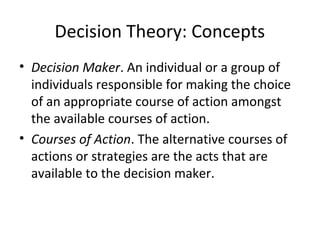

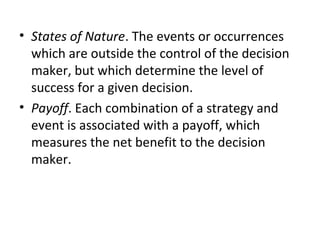

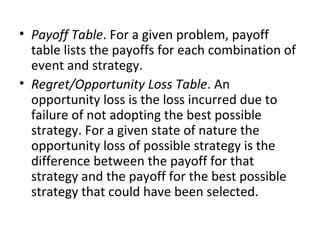

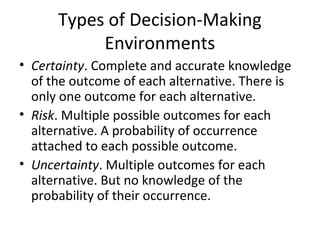

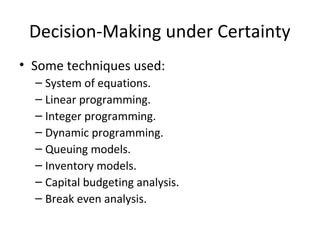

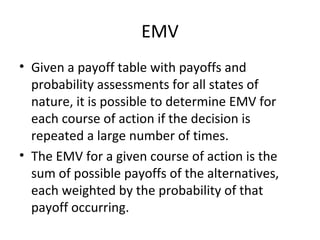

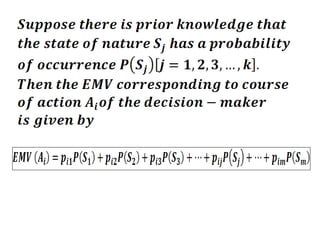

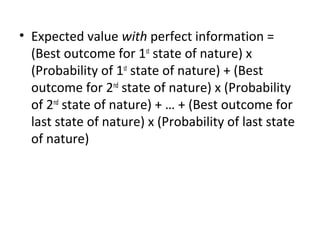

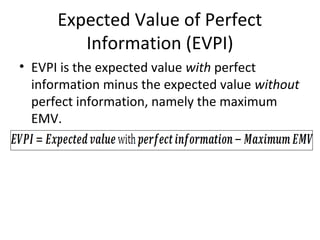

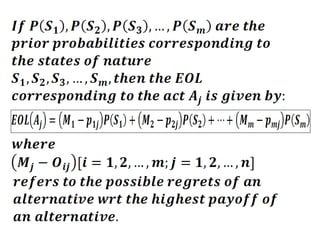

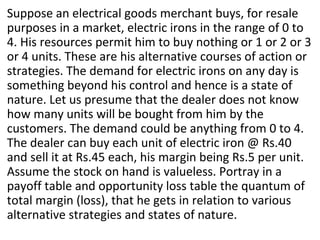

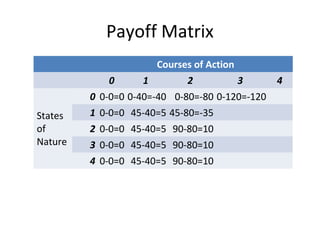

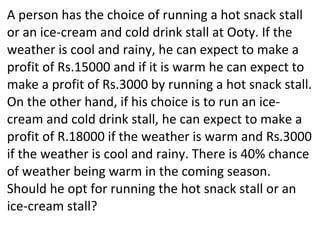

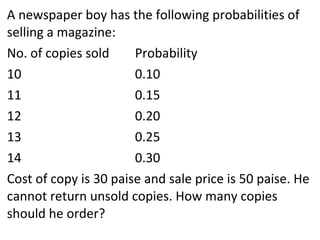

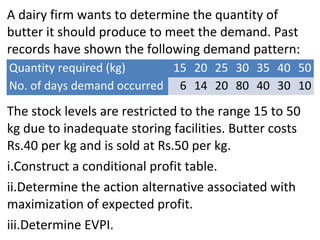

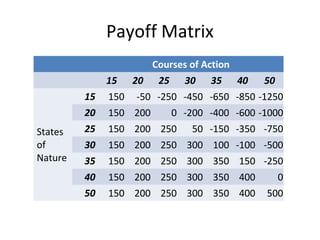

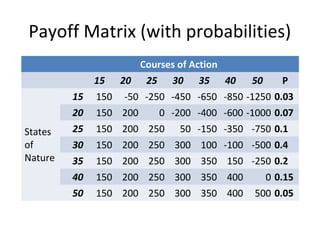

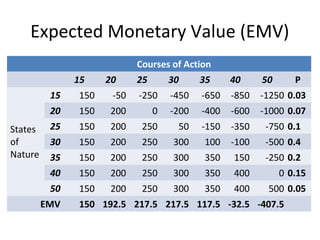

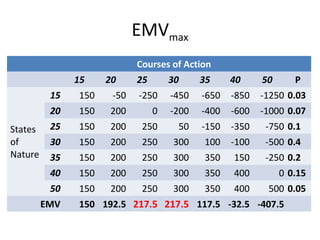

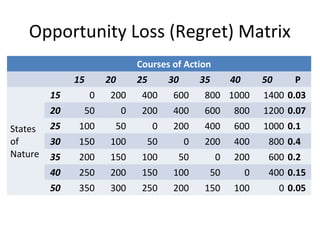

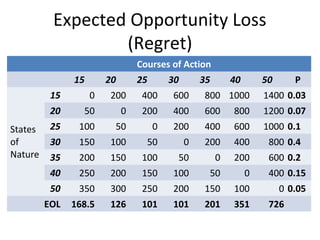

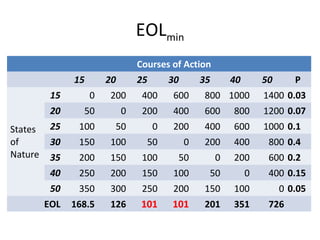

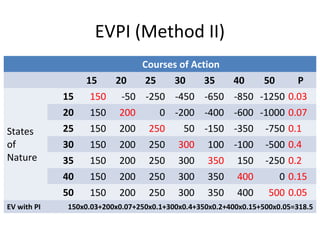

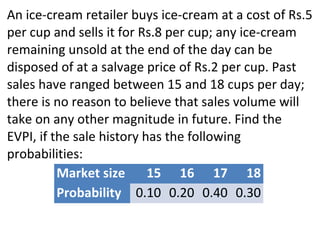

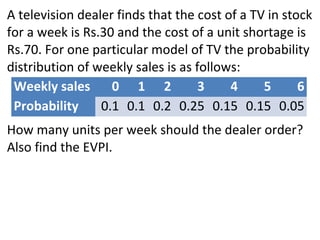

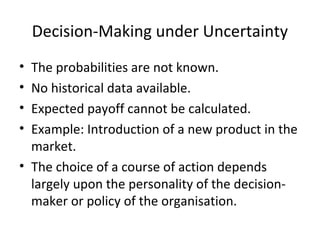

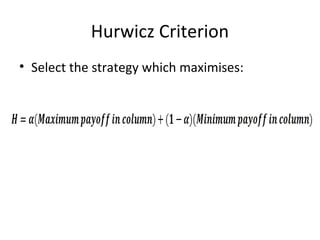

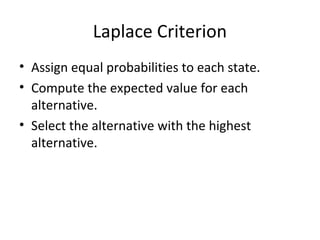

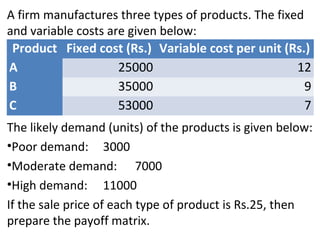

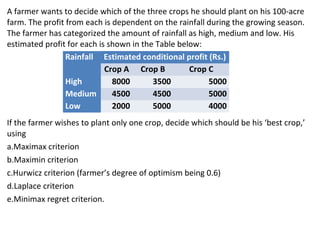

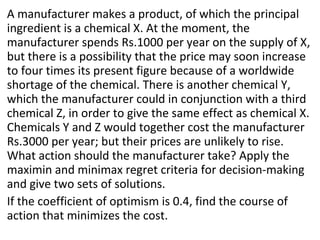

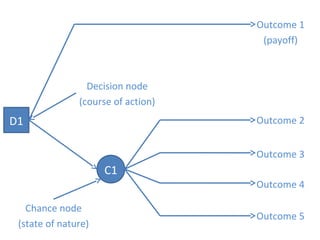

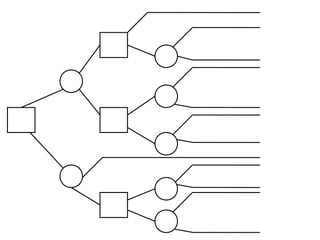

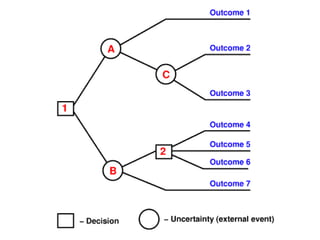

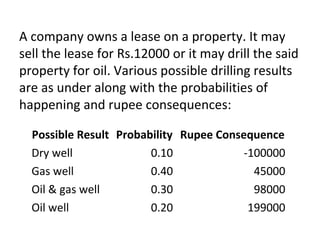

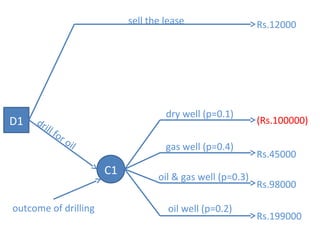

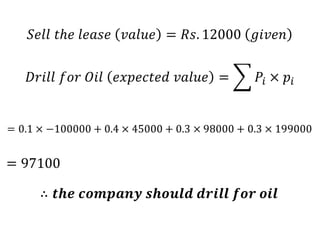

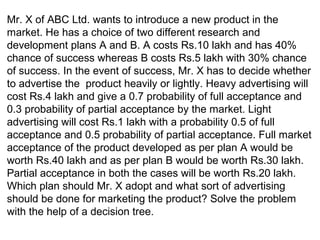

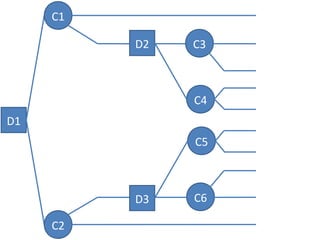

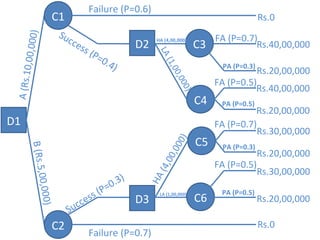

The document discusses decision theory and decision-making under uncertainty. It defines key concepts in decision theory including decision maker, courses of action, states of nature, payoff, and expected monetary value. It describes three types of decision-making environments: certainty, risk, and uncertainty. Under risk, decisions are made using probability assessments and expected monetary value calculations. Several steps and concepts in decision making under risk are outlined, including constructing payoff matrices, calculating expected values, and opportunity loss analysis.