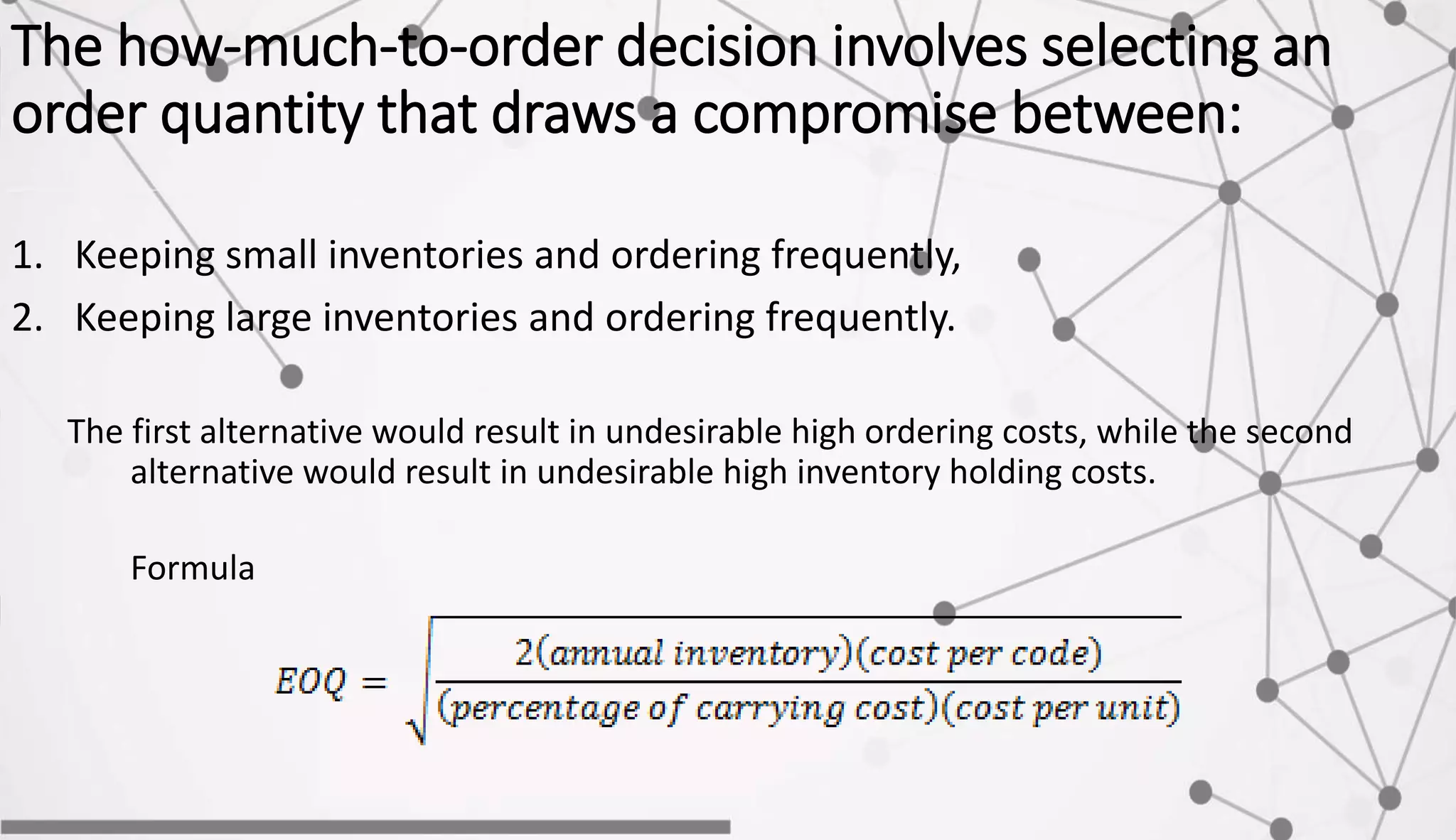

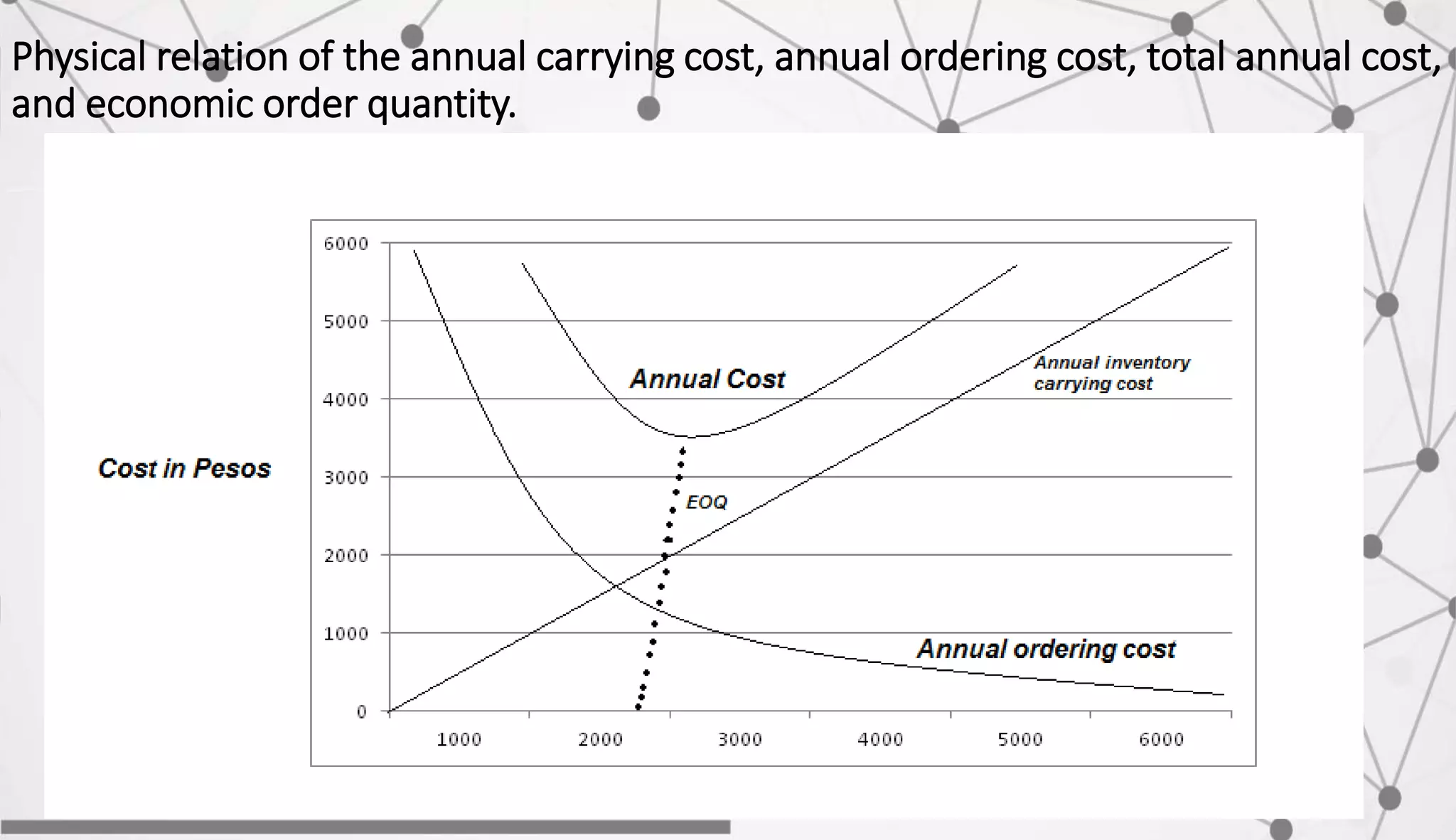

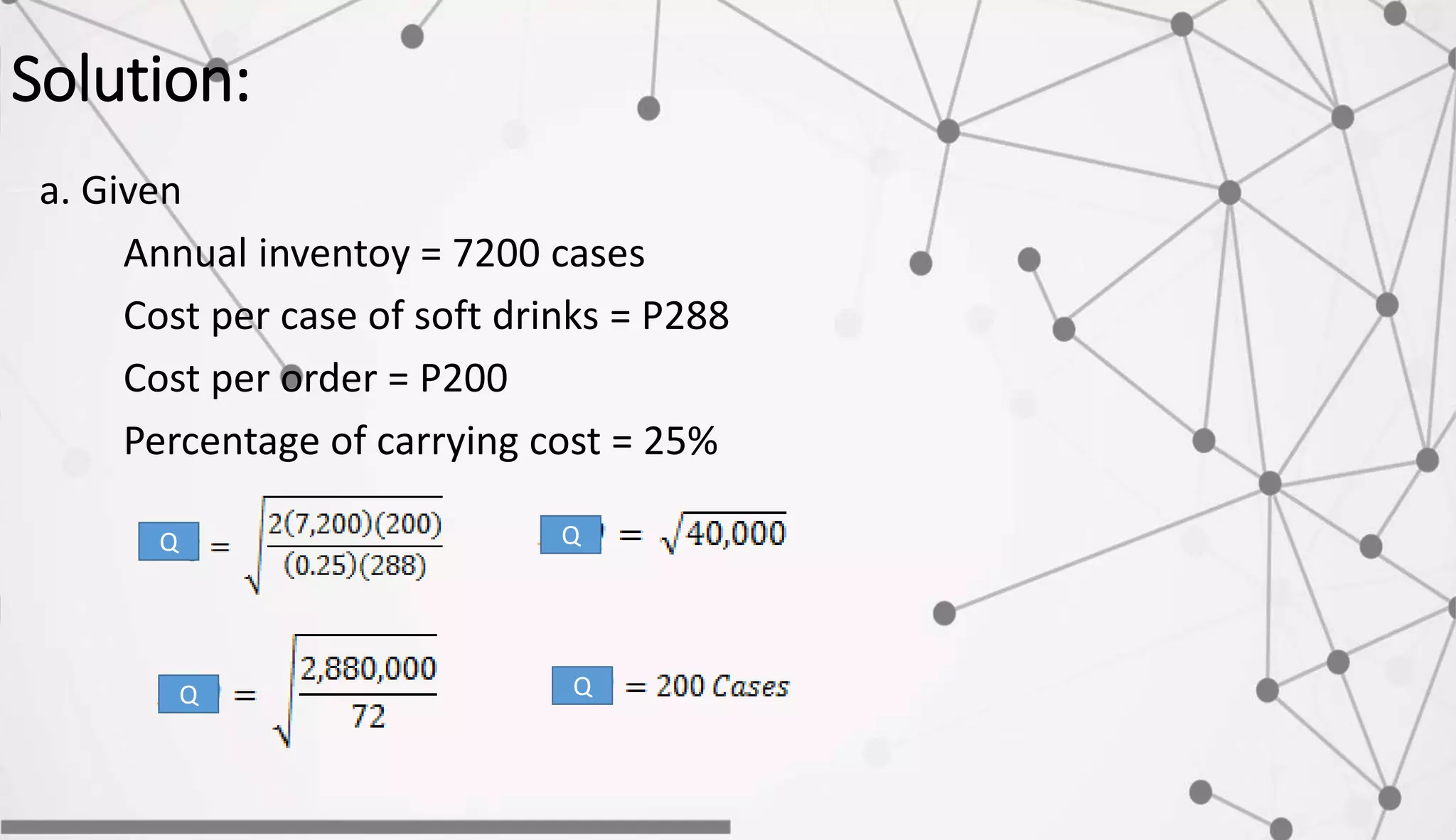

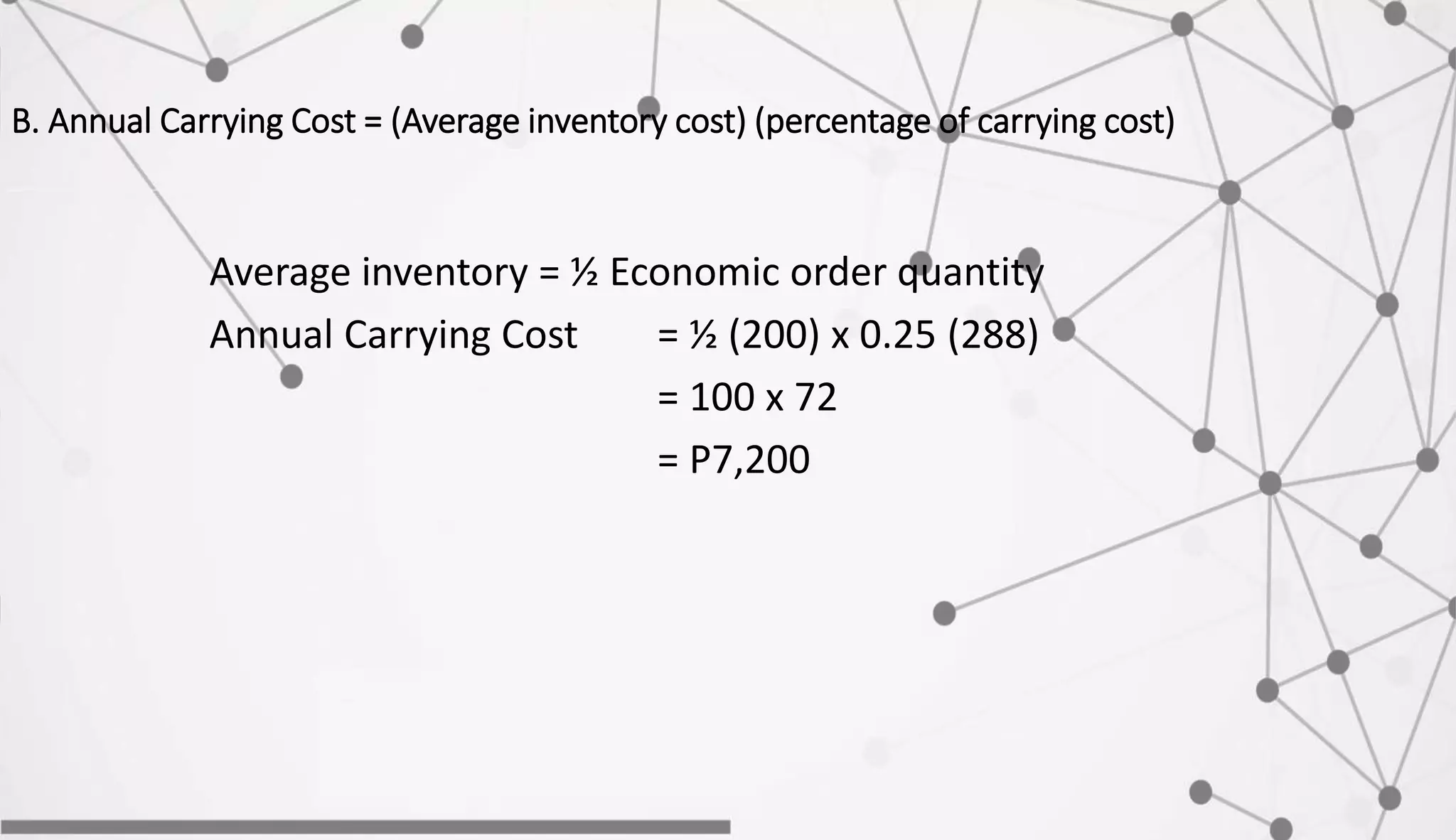

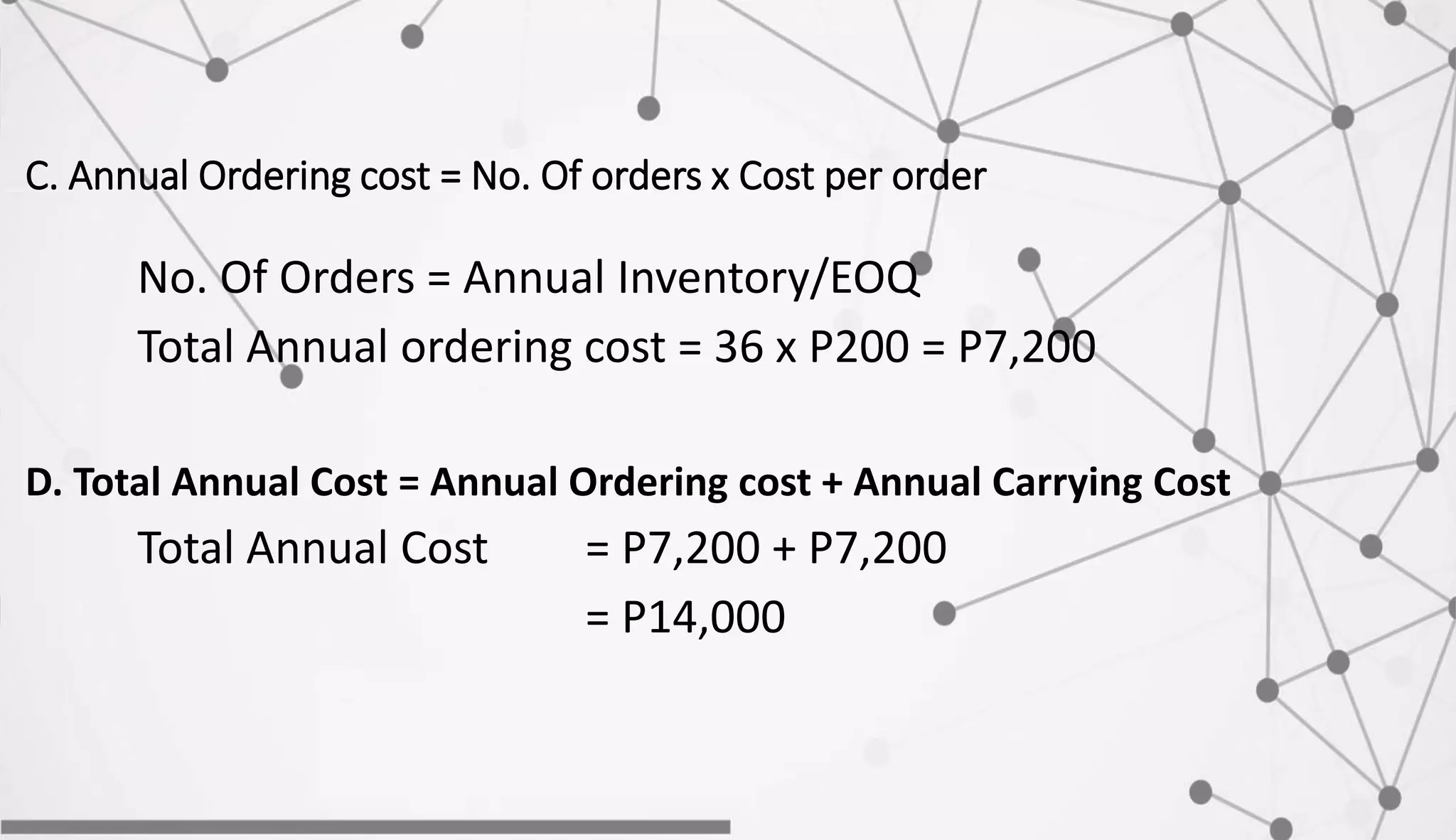

The document discusses inventory management concepts including economic order quantity (EOQ) models. It defines key inventory costs: ordering/setup costs, holding/carrying costs, shortage costs. The EOQ model balances ordering and carrying costs to determine the optimal order quantity. An example calculates the EOQ, annual carrying cost, ordering cost, and total annual cost for a company with constant demand and known costs and demand values. The optimal order quantity minimizes total annual inventory costs.