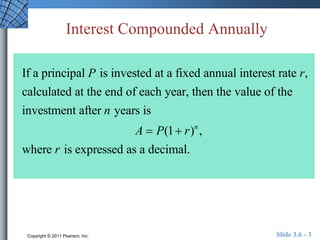

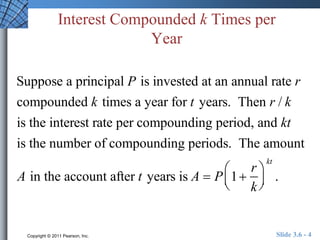

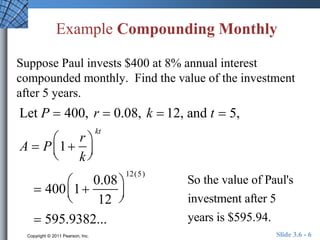

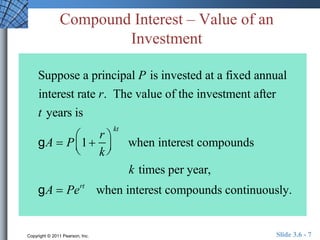

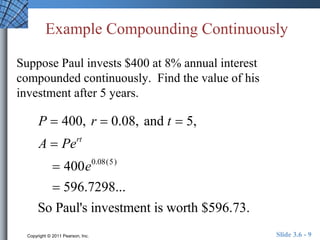

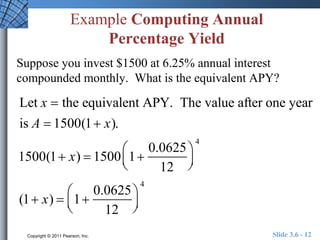

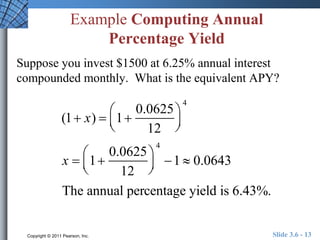

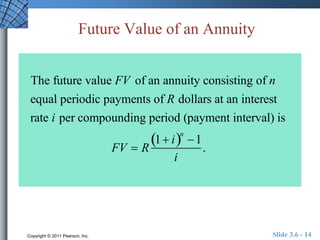

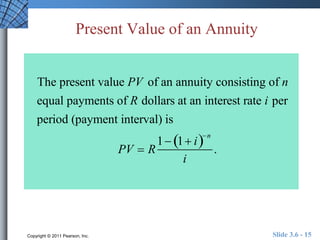

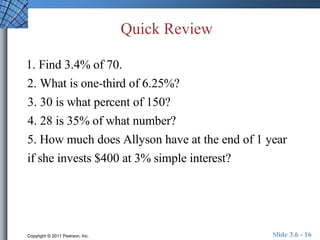

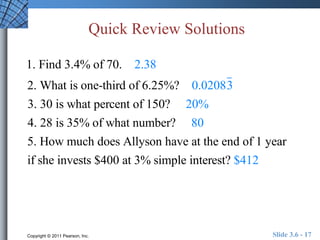

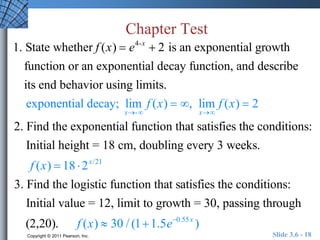

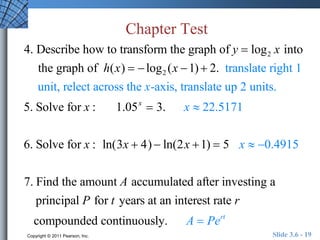

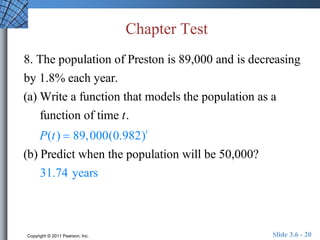

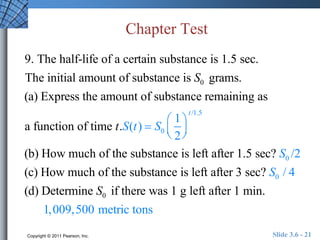

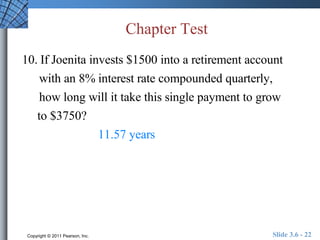

This document provides an overview of topics in mathematics of finance including compound interest, future and present value of annuities, and exponential and logistic functions. It includes examples of calculating interest compounded at different time periods, annual percentage yield, and using exponential functions to model growth. The document concludes with a sample chapter test covering these financial mathematics topics.