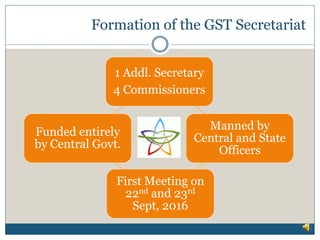

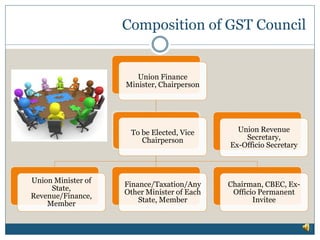

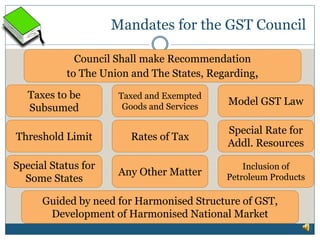

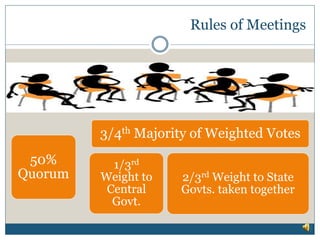

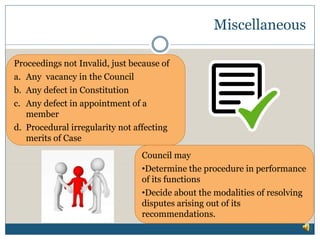

The document outlines the recent developments concerning the Goods and Services Tax (GST) Council, including the passage of a constitutional amendment bill and its ratification by various states. It details the formation and composition of the GST Council, which includes the Union Finance Minister and state finance ministers, among others, and mandates the council to recommend taxes to be subsumed and rates of taxation. Additionally, it describes the council's quorum, voting structure, and the procedures for handling disputes.