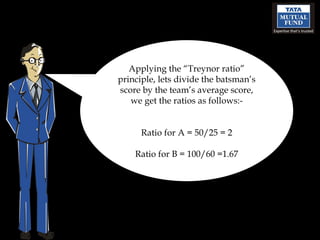

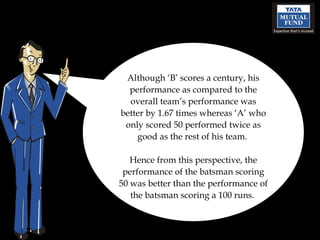

The Treynor Ratio measures the returns of a fund relative to its volatility or risk. It is calculated by dividing the fund's excess return over the risk-free rate by the fund's volatility. A higher Treynor Ratio indicates the fund has performed well with less risk compared to the overall market. The document provides an example comparing the performance of two batsmen to illustrate how the Treynor Ratio works.

![Hope this lesson has succeeded in further clarifying the concept of ‘Treynor Ratio’. Please give me your feedback at [email_address]](https://image.slidesharecdn.com/treynorratio-111110034123-phpapp01/85/Treynor-ratio-9-320.jpg)