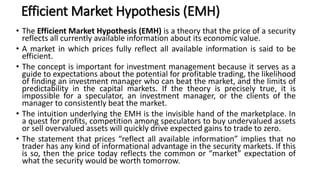

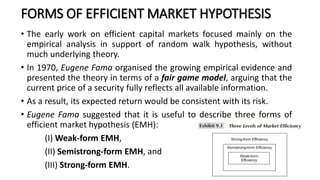

- Eugene Fama introduced the efficient market hypothesis in the 1960s, which states that intense competition in capital markets leads to fair pricing of securities.

- Fama suggested three forms of market efficiency - weak, semi-strong, and strong. Weak-form says prices reflect all past price and volume data. Semi-strong says prices rapidly reflect all public information. Strong-form says prices reflect all public and private information.

- Empirical evidence generally supports weak-form but is mixed for semi-strong. Strong-form is not supported. Overall, while anomalies exist, the efficient market hypothesis remains the best description of how stock markets work.