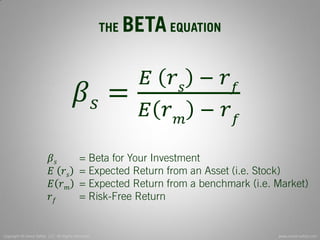

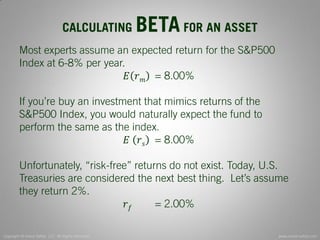

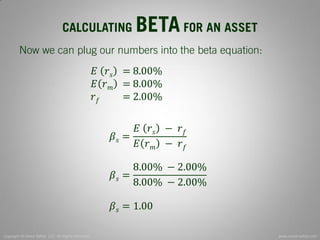

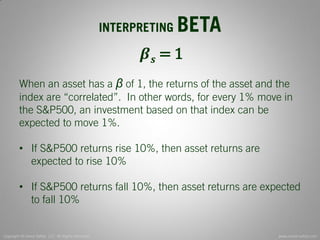

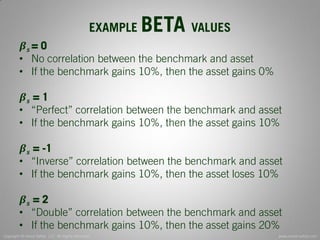

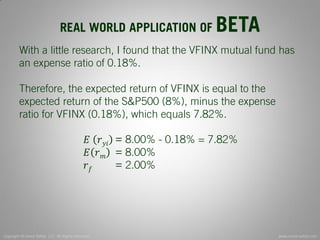

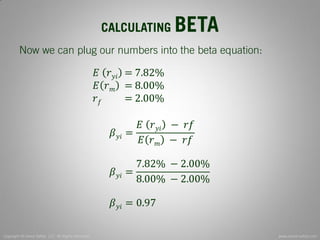

This document is a guide for investors on calculating and interpreting beta, a measure of correlation between an asset's returns and market returns, particularly the S&P 500. It outlines the beta equation, provides examples, and discusses the implications of different beta values for investment decisions. Additionally, the guide emphasizes the importance of understanding costs associated with investments and the significance of beta in evaluating mutual funds.