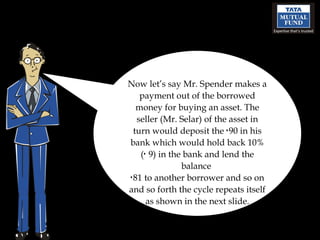

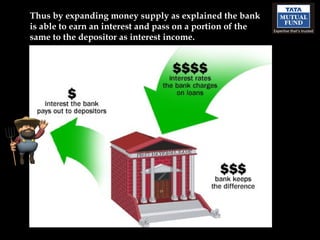

The document discusses money supply expansion by banks and runs on banks. It explains that when a customer deposits money in a bank, the bank lends out a portion while keeping a 10% reserve. This lending allows new money to enter circulation, expanding the money supply. However, if too many depositors withdraw funds due to economic uncertainty, it can cause a bank run where the bank lacks sufficient reserves to pay everyone.

![Hope this lesson has succeeded in further clarifying the concept of “Expansion of money supply” well as “ Run on a bank”. Please give us your feedback at [email_address]](https://image.slidesharecdn.com/runonabank-111110042704-phpapp01/85/Run-on-a-bank-21-320.jpg)