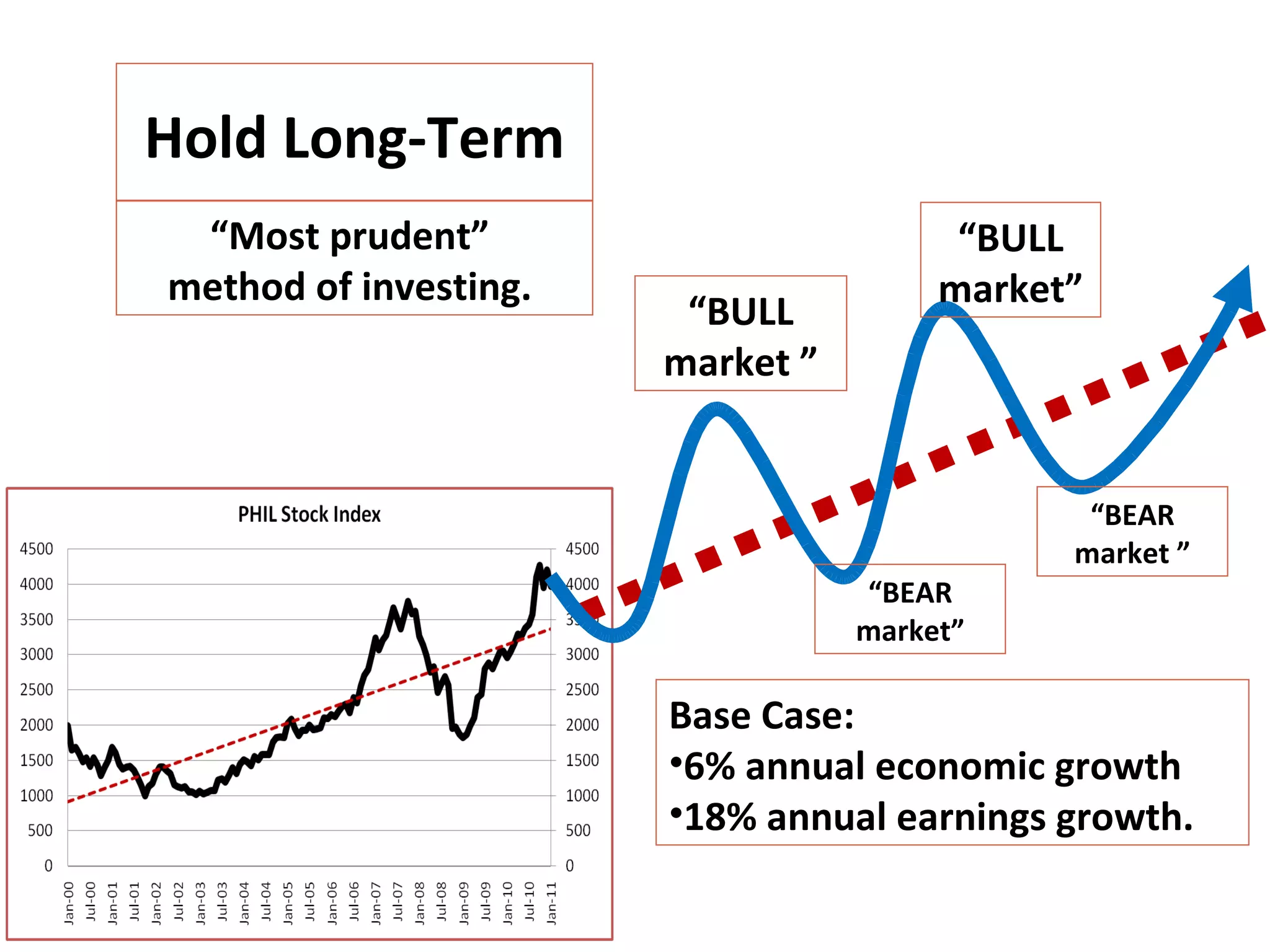

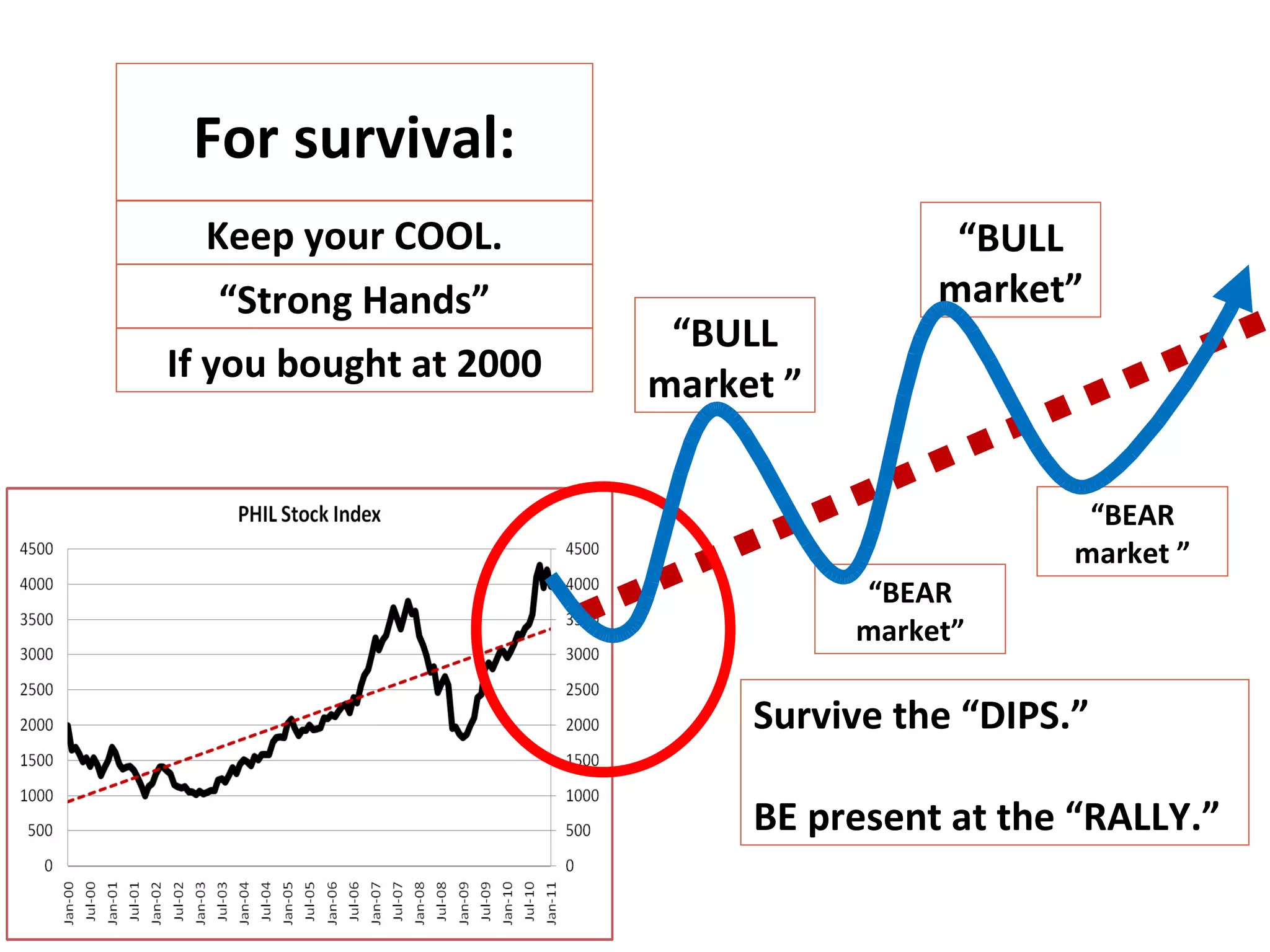

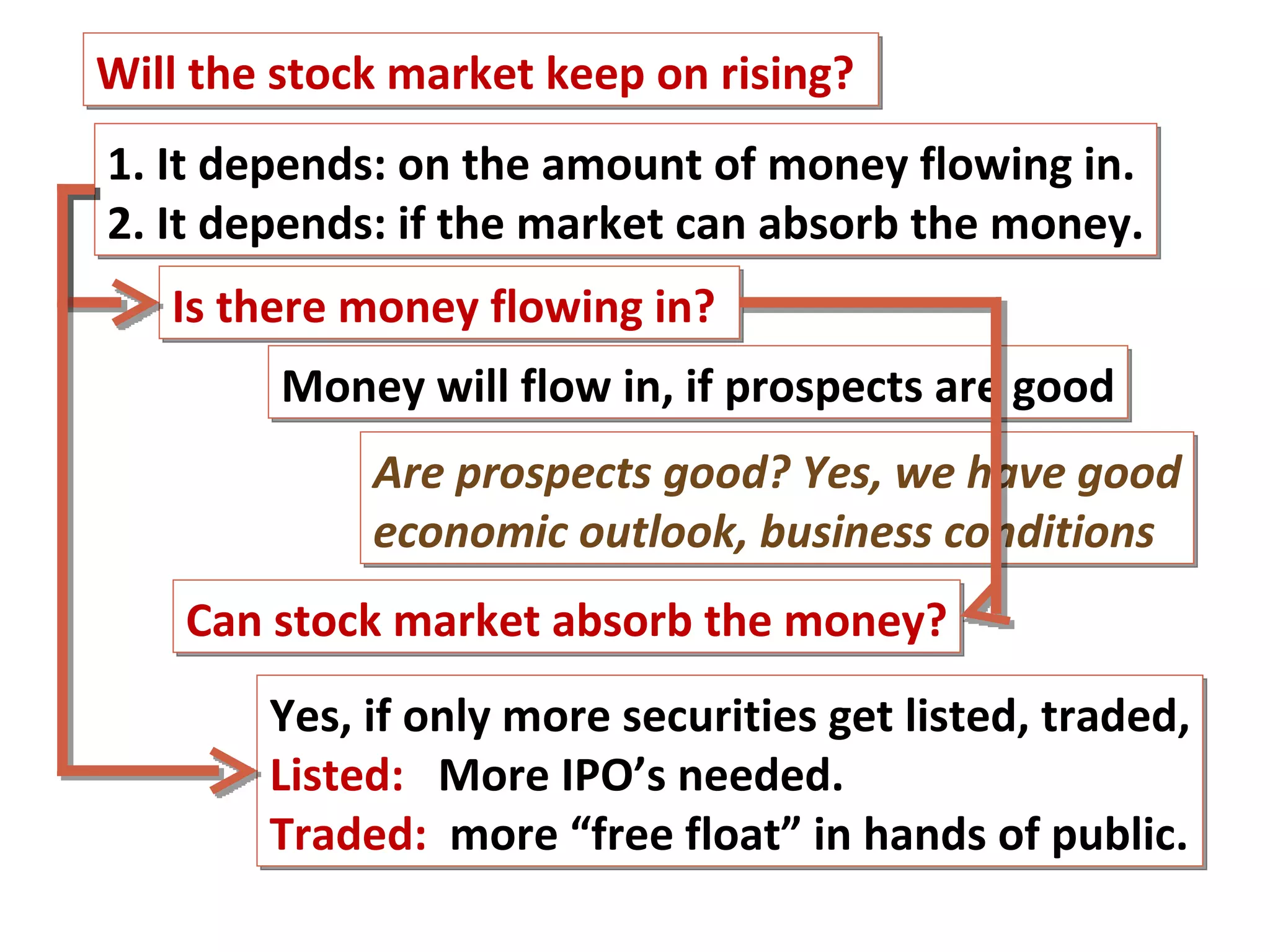

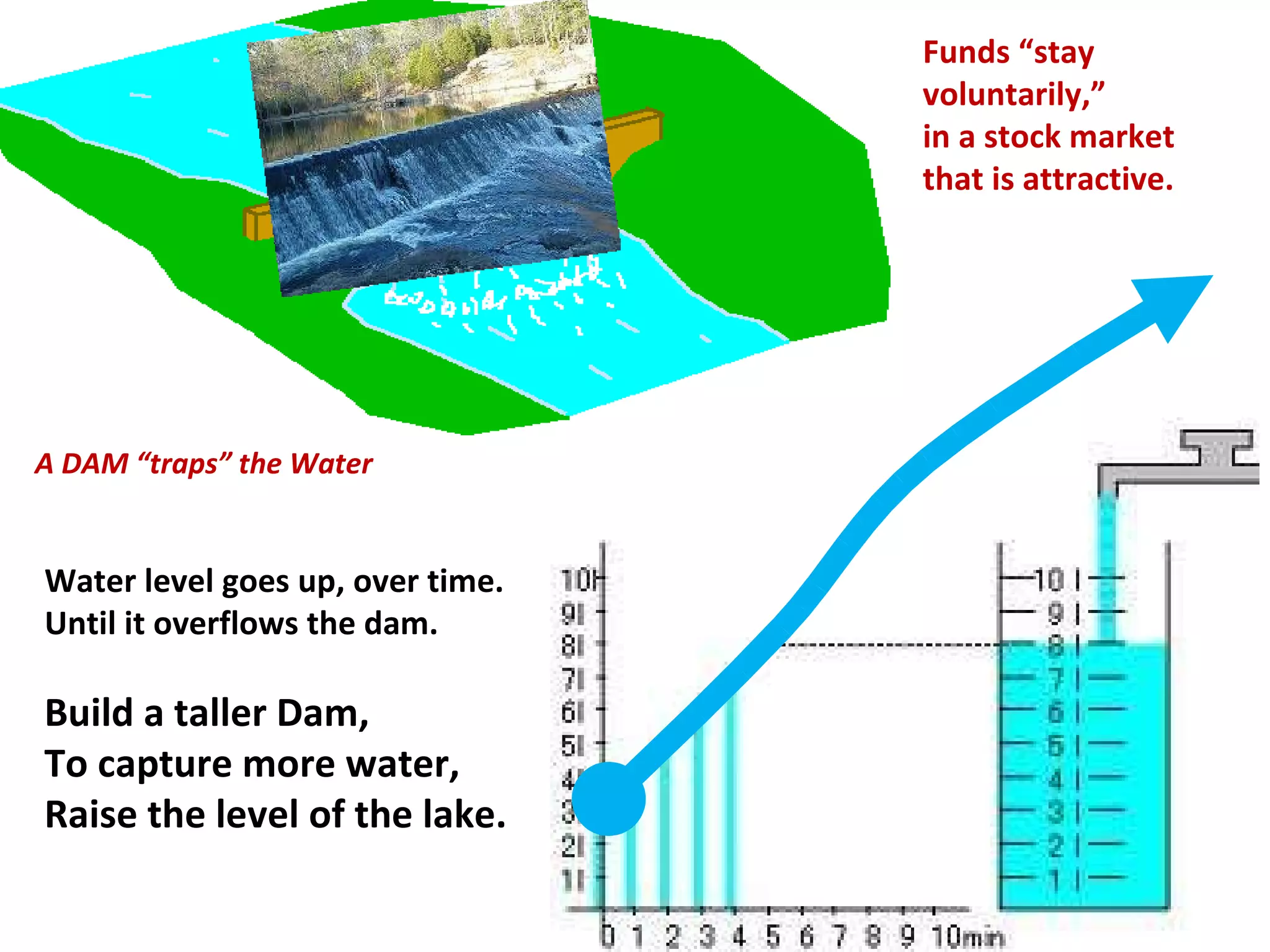

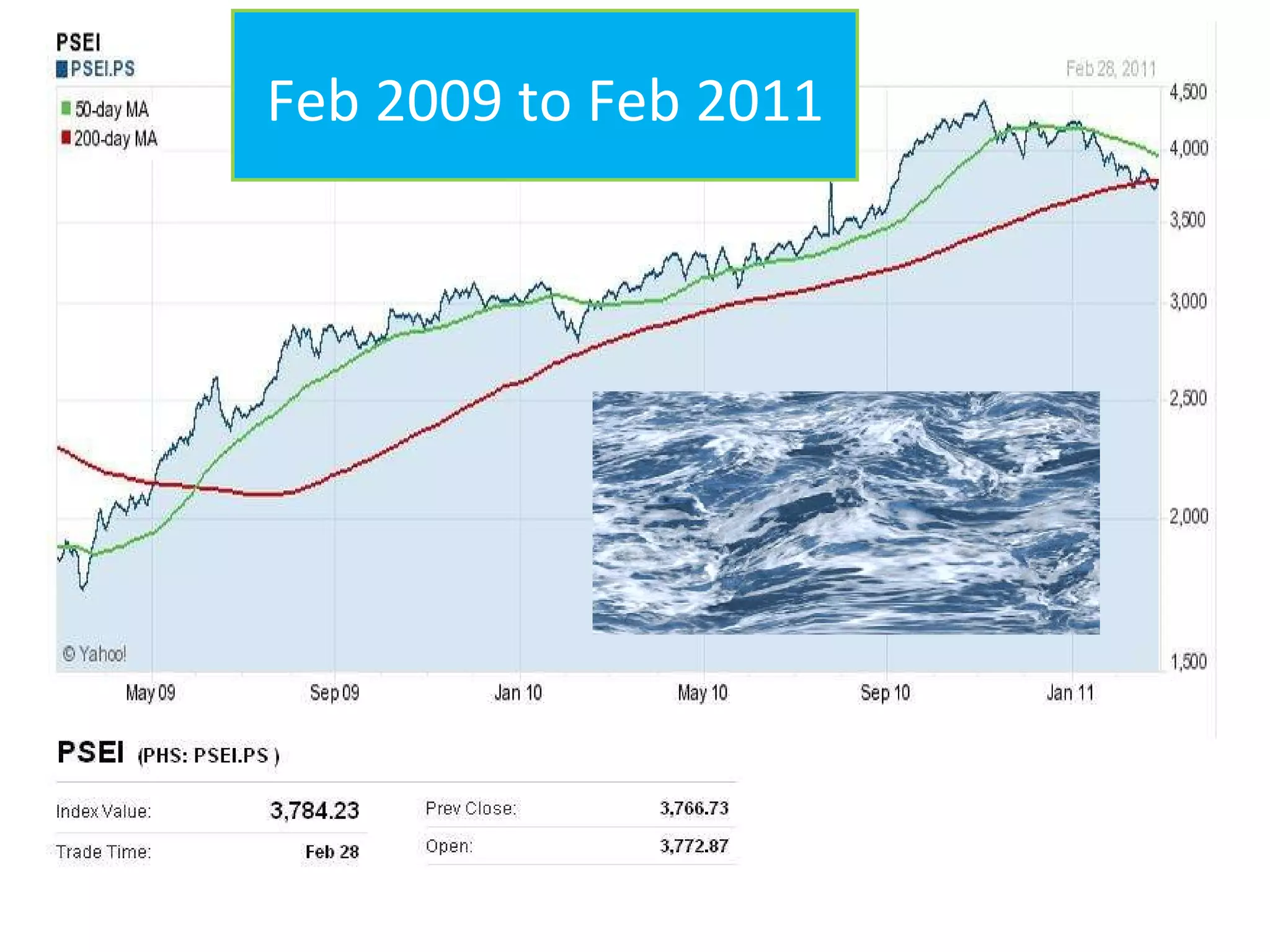

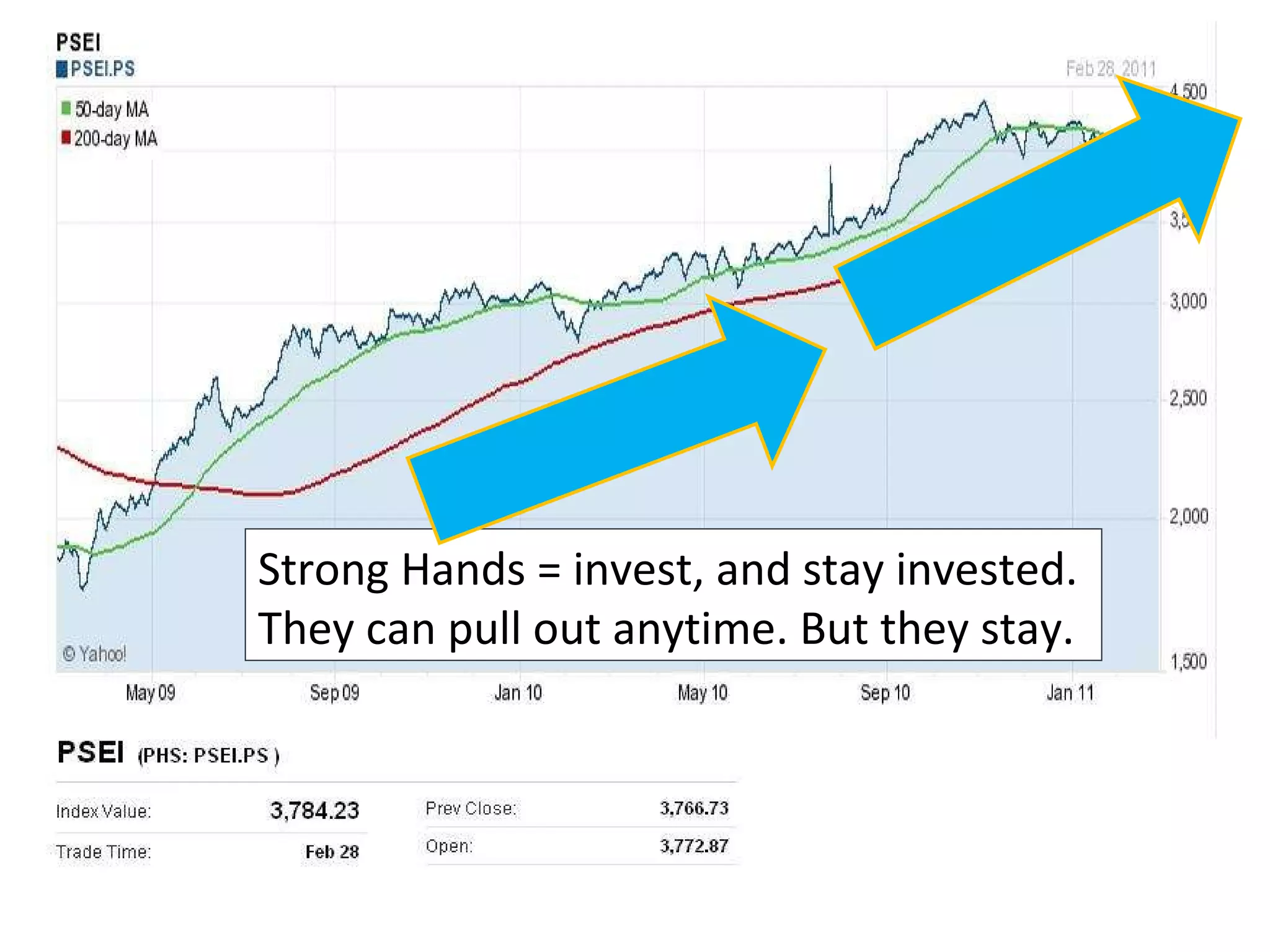

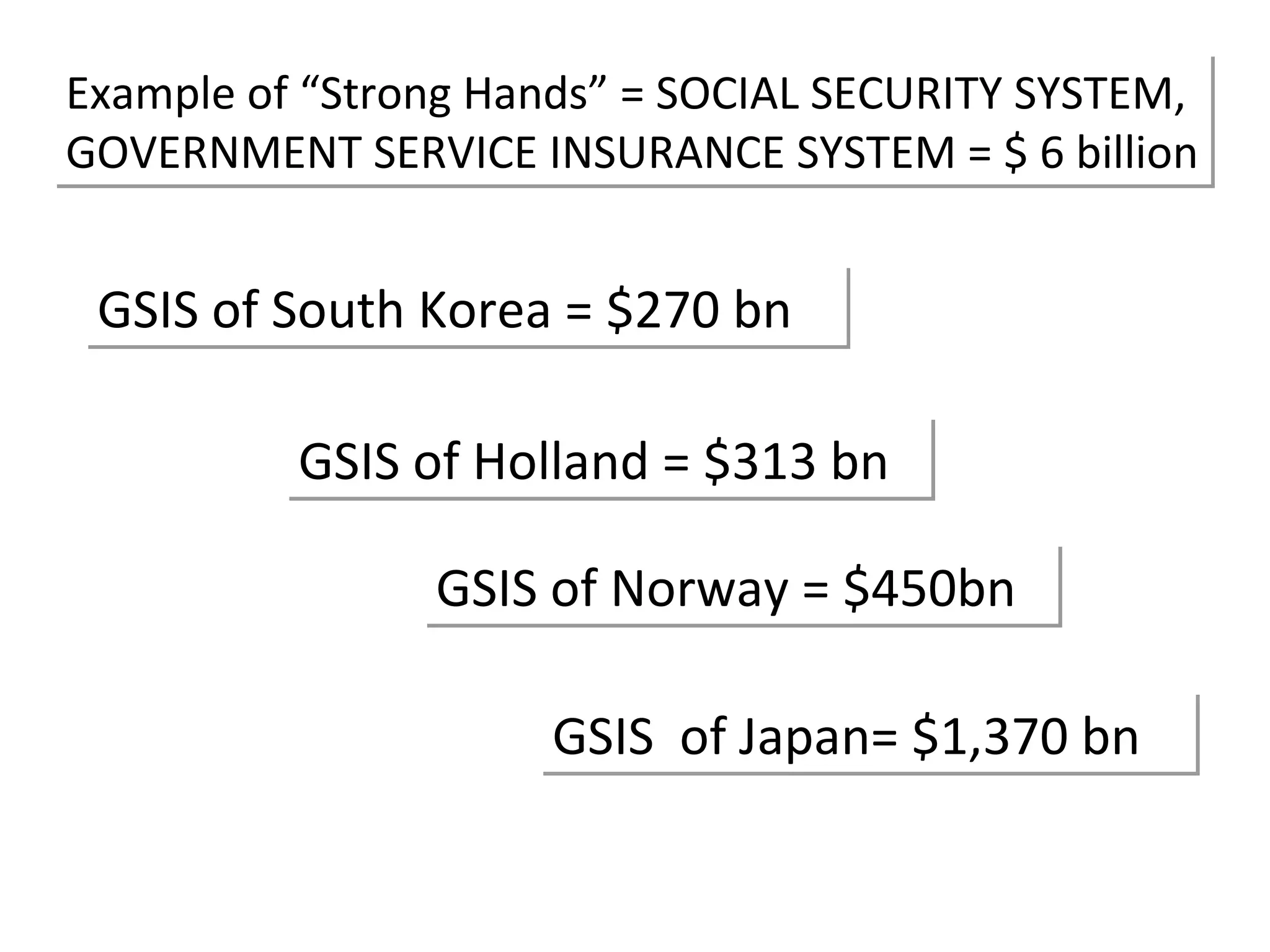

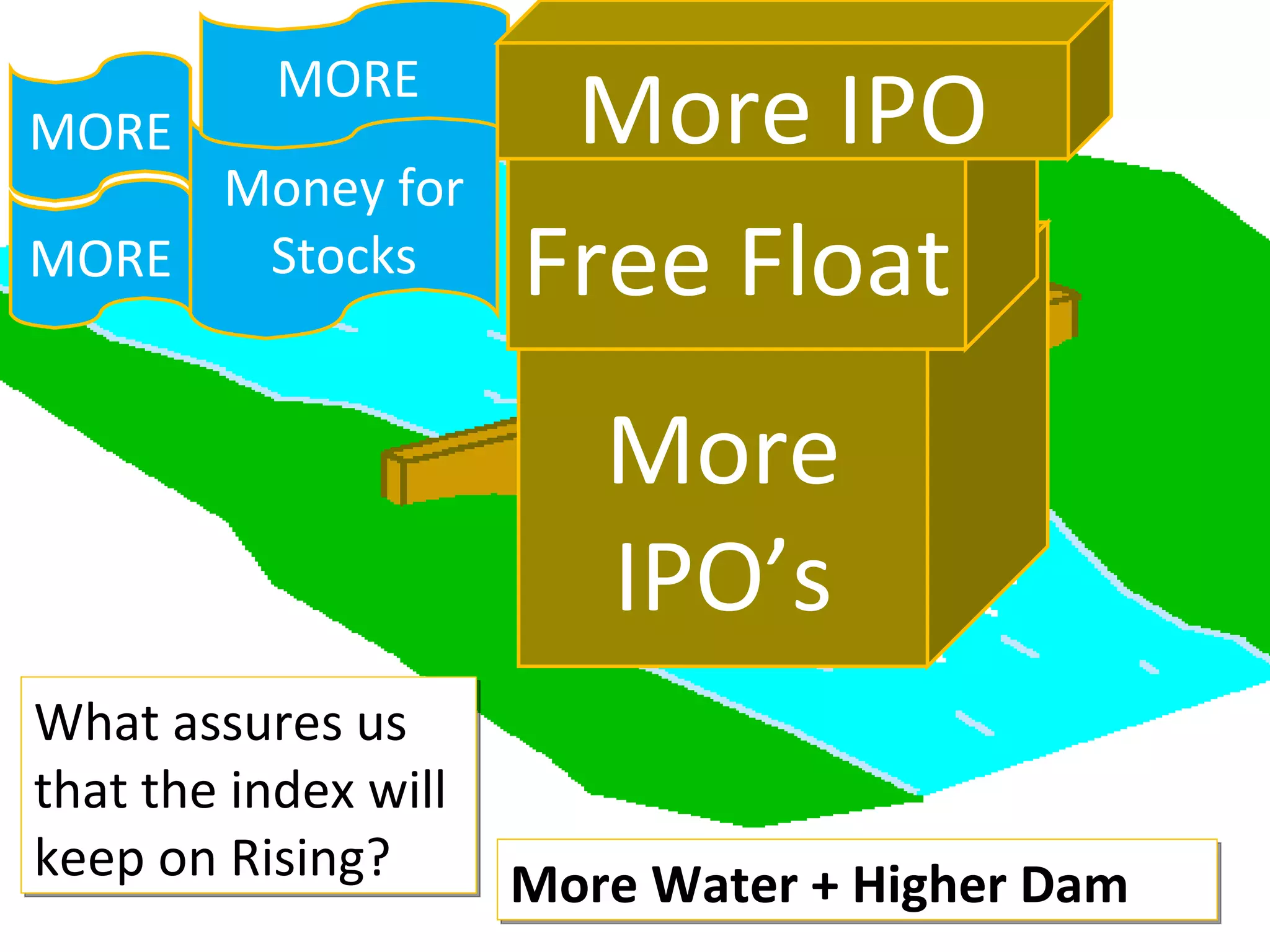

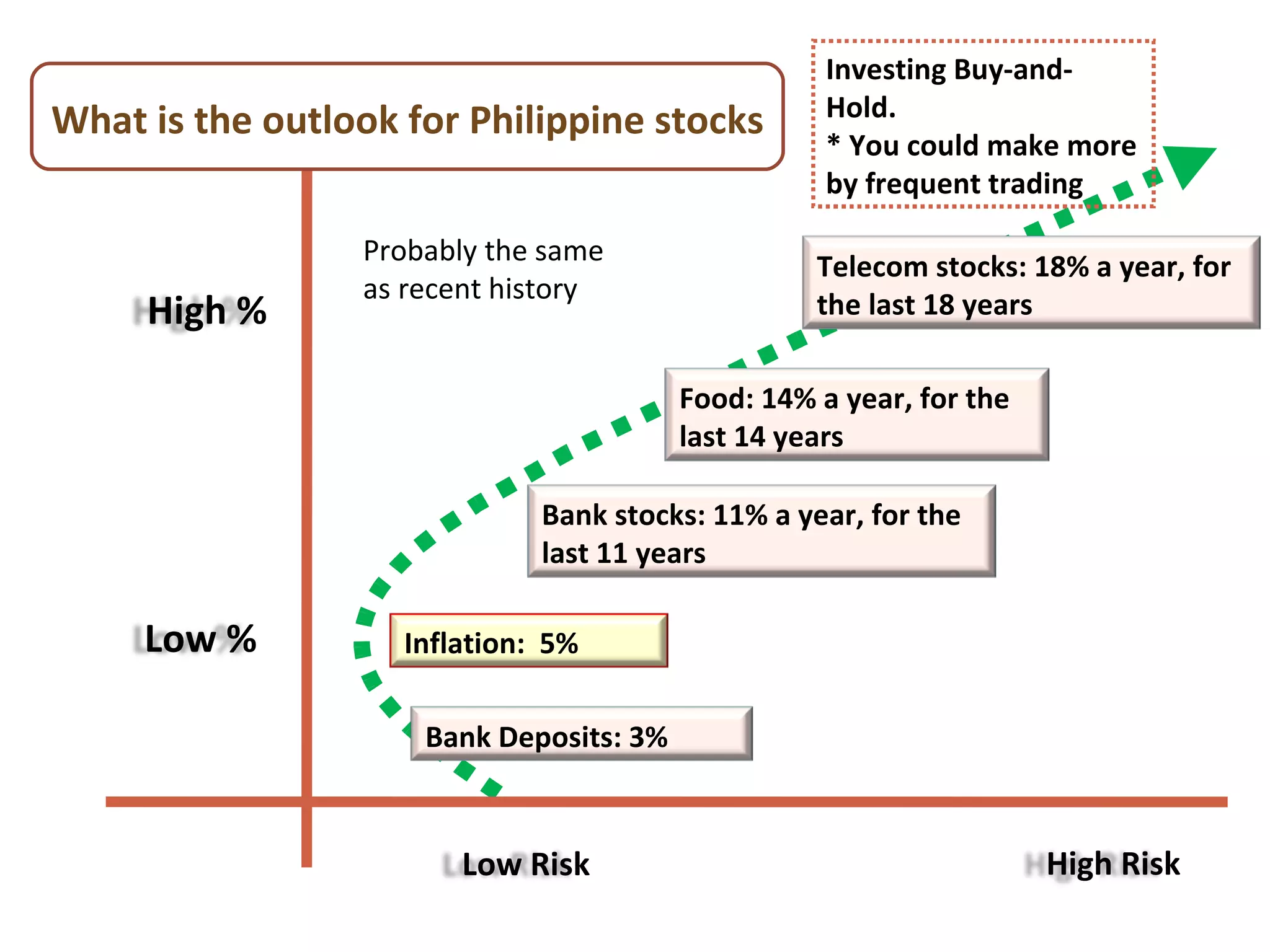

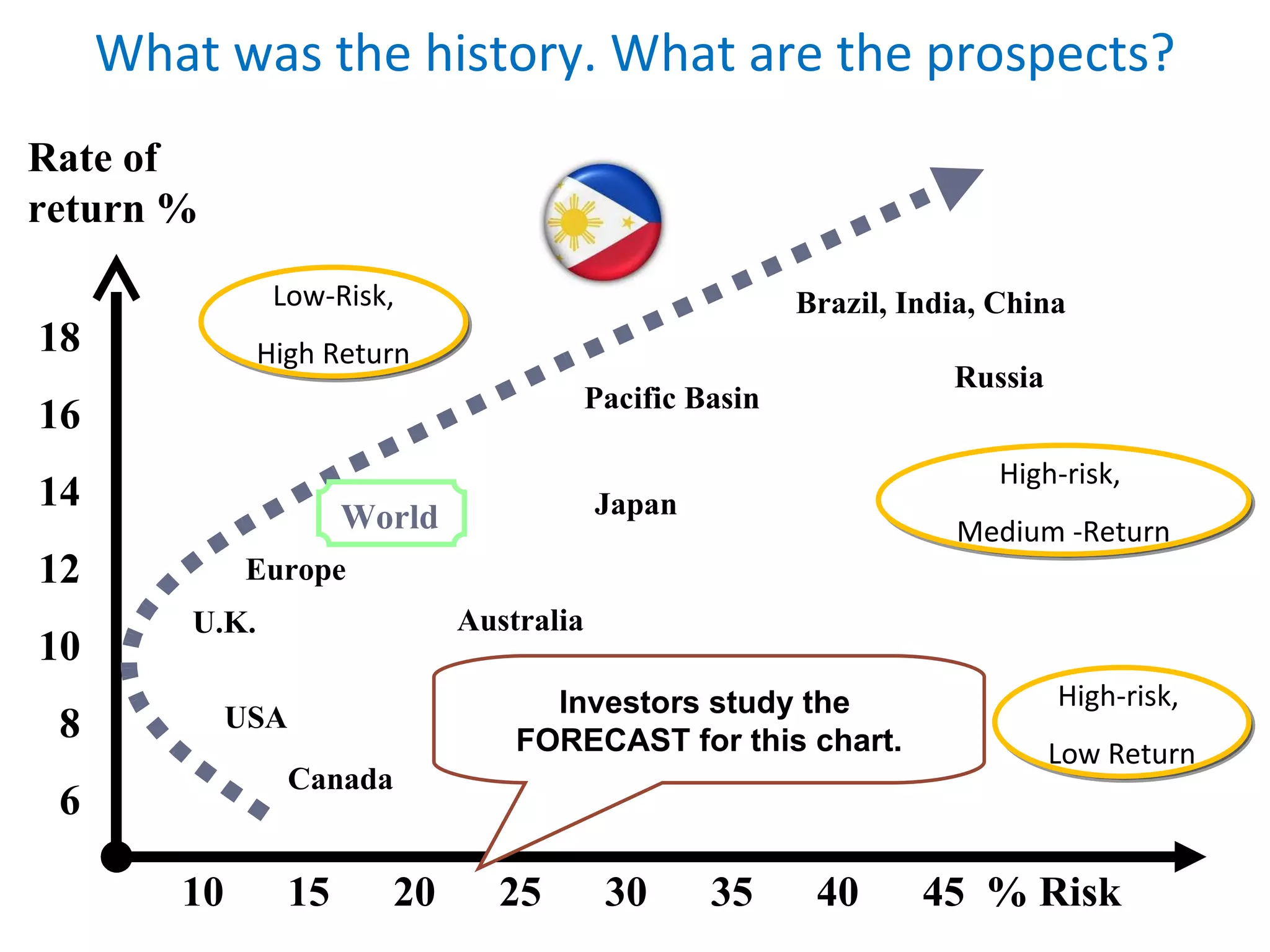

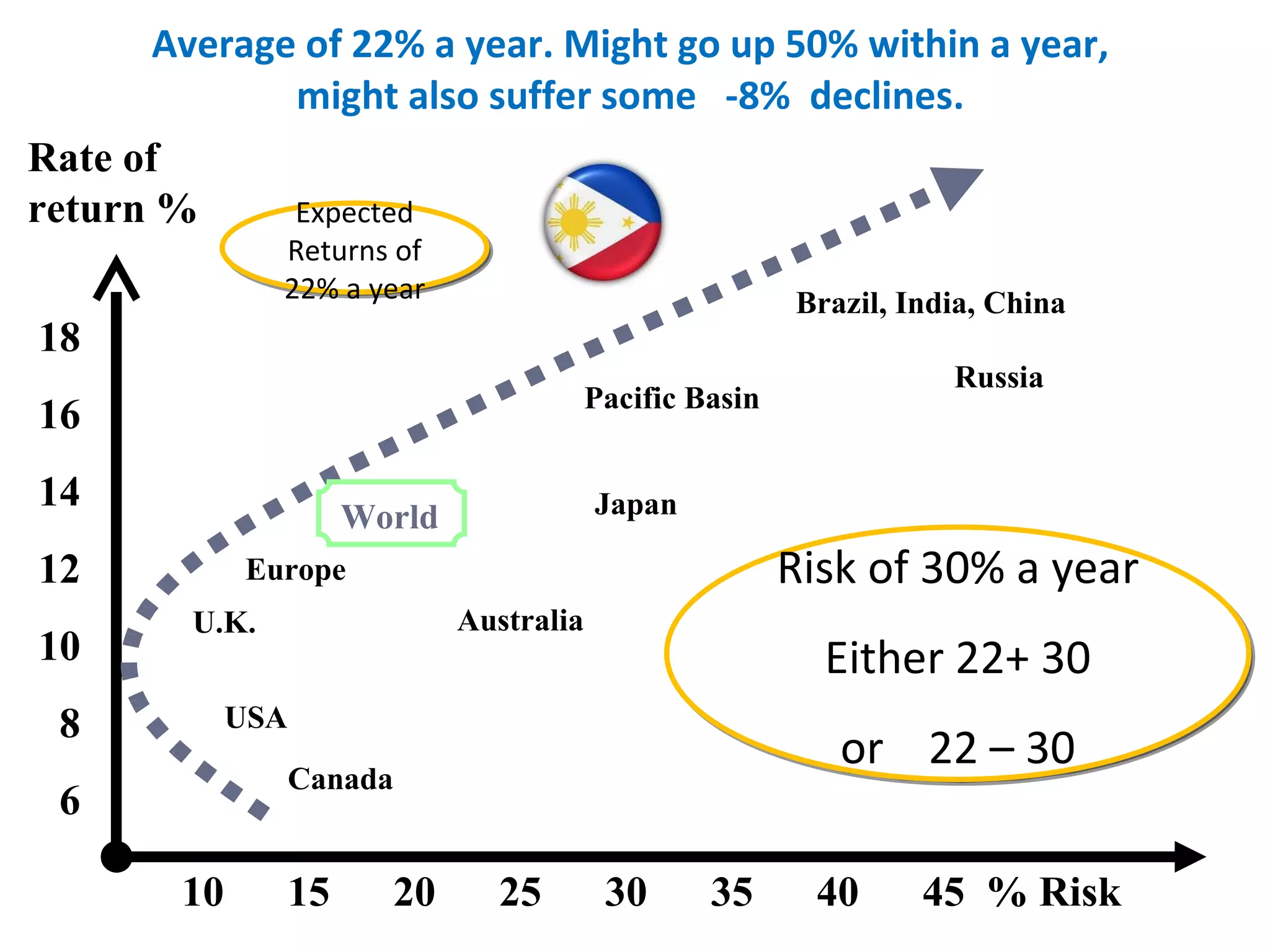

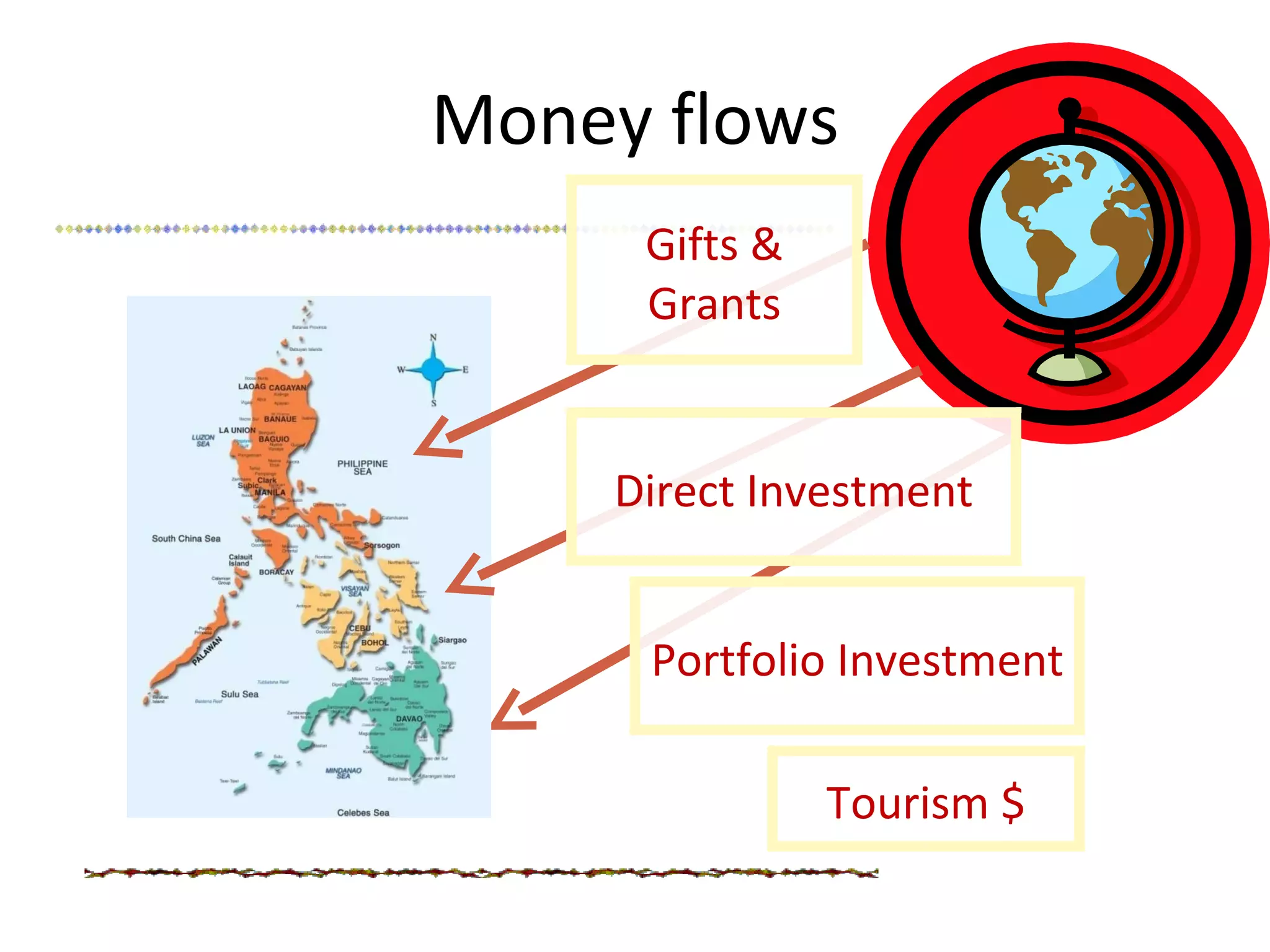

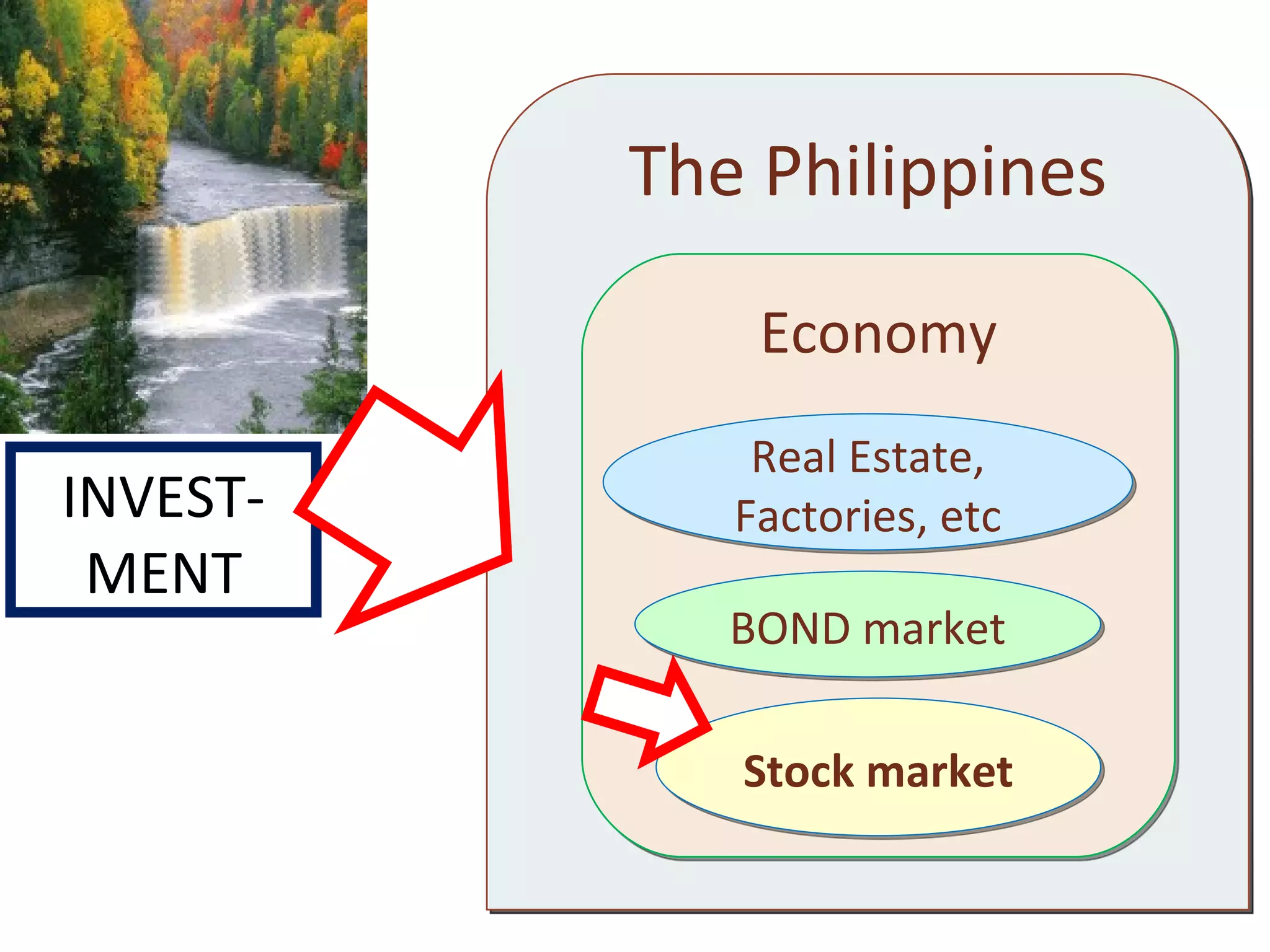

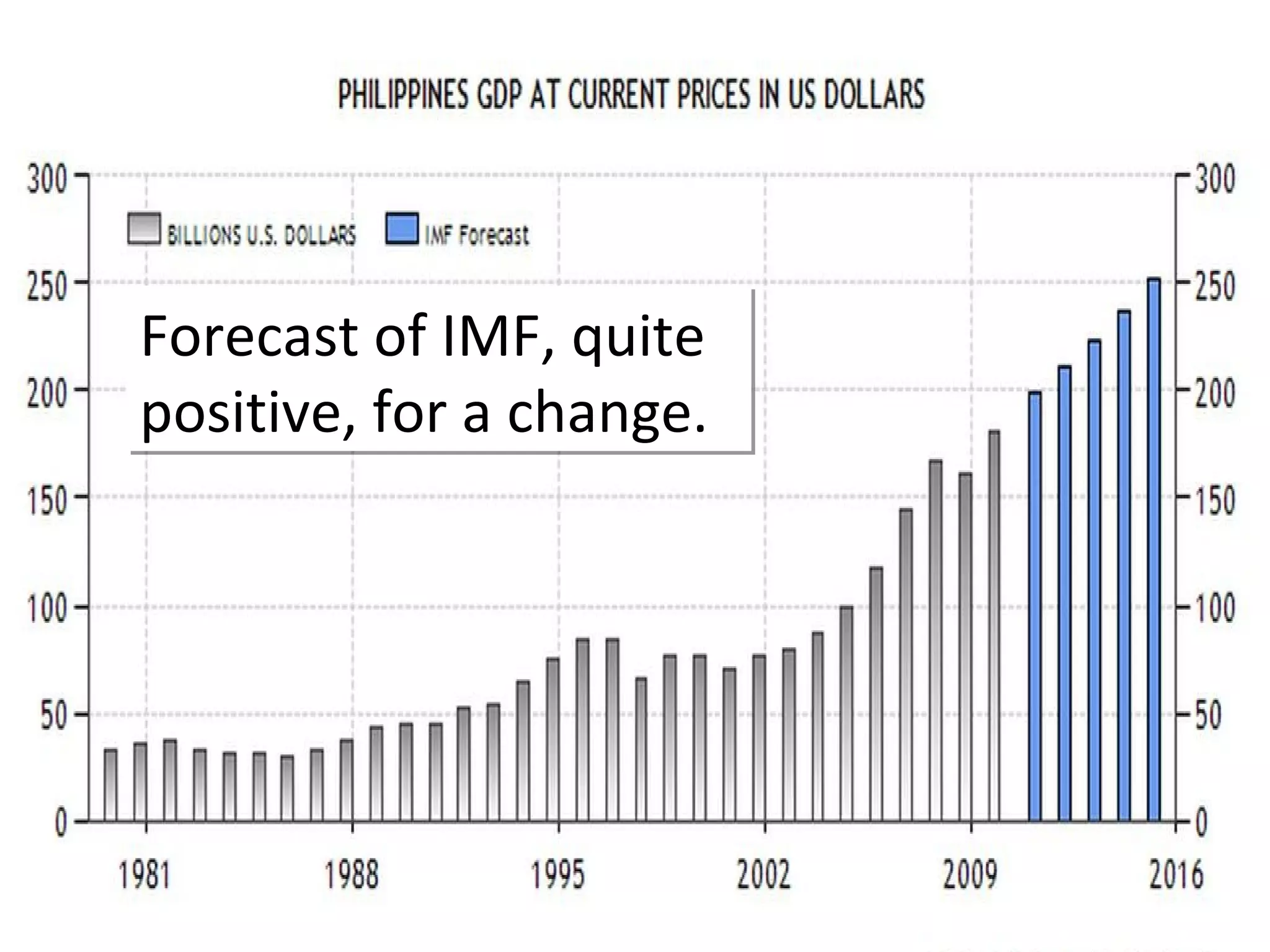

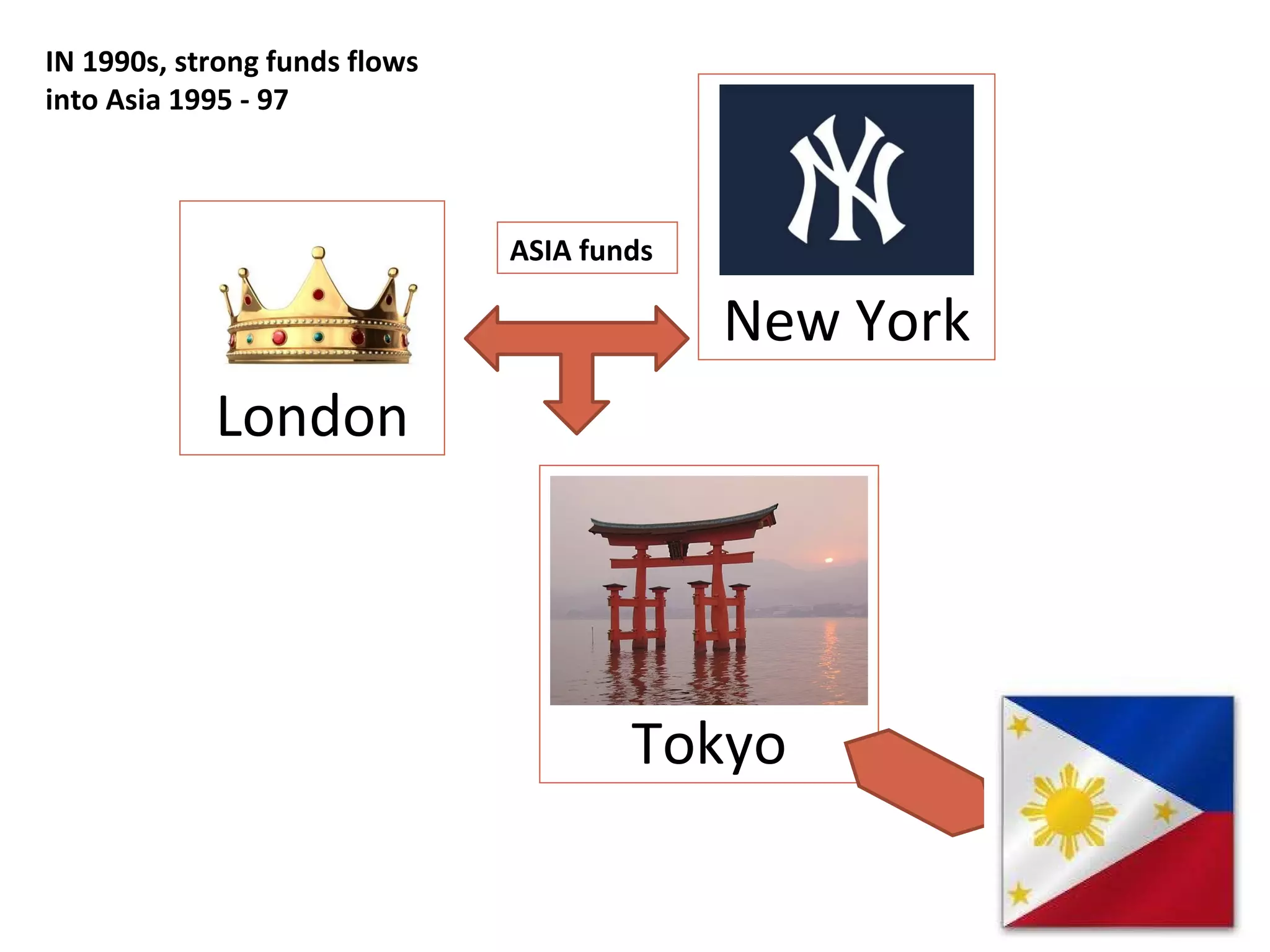

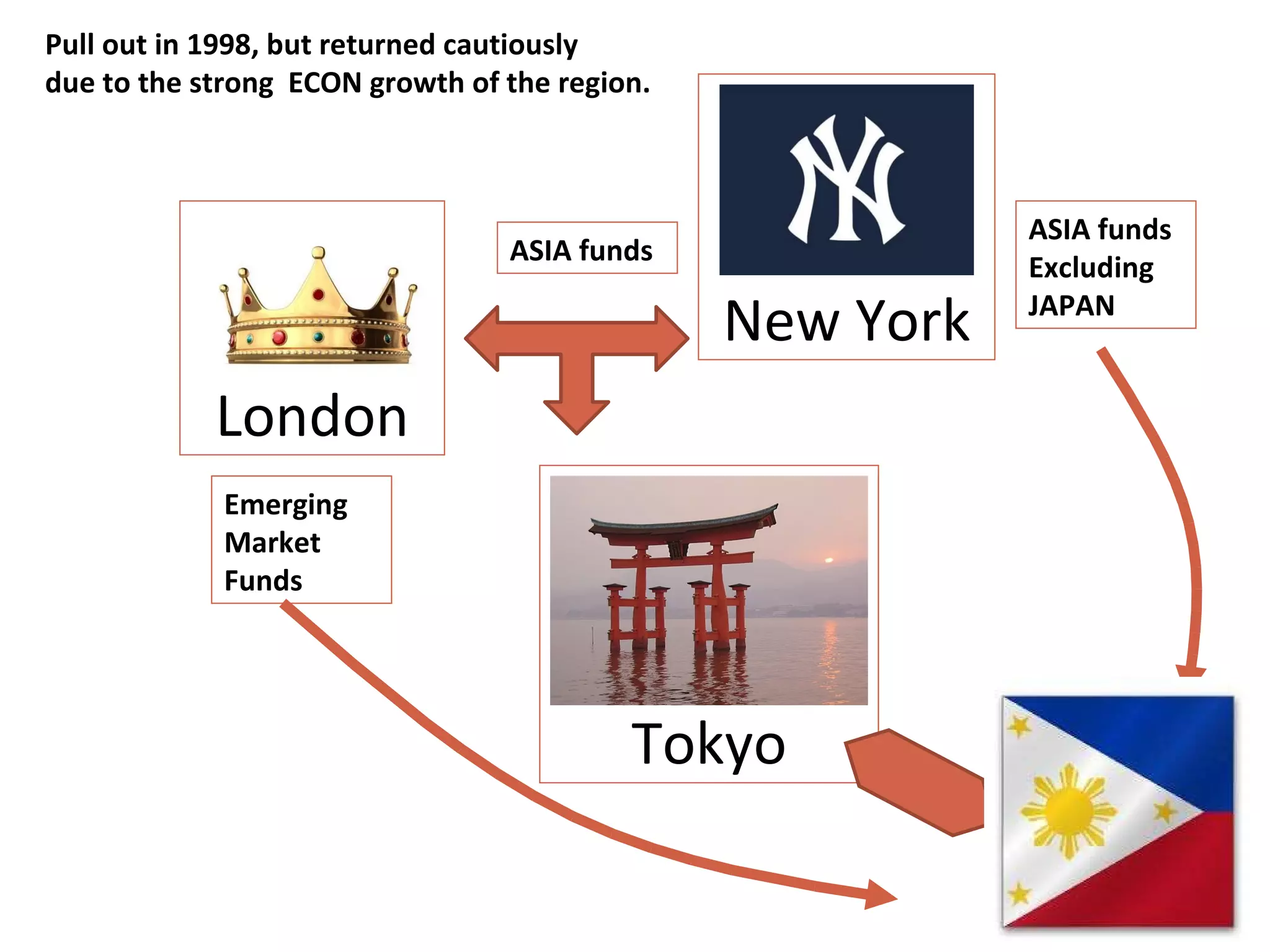

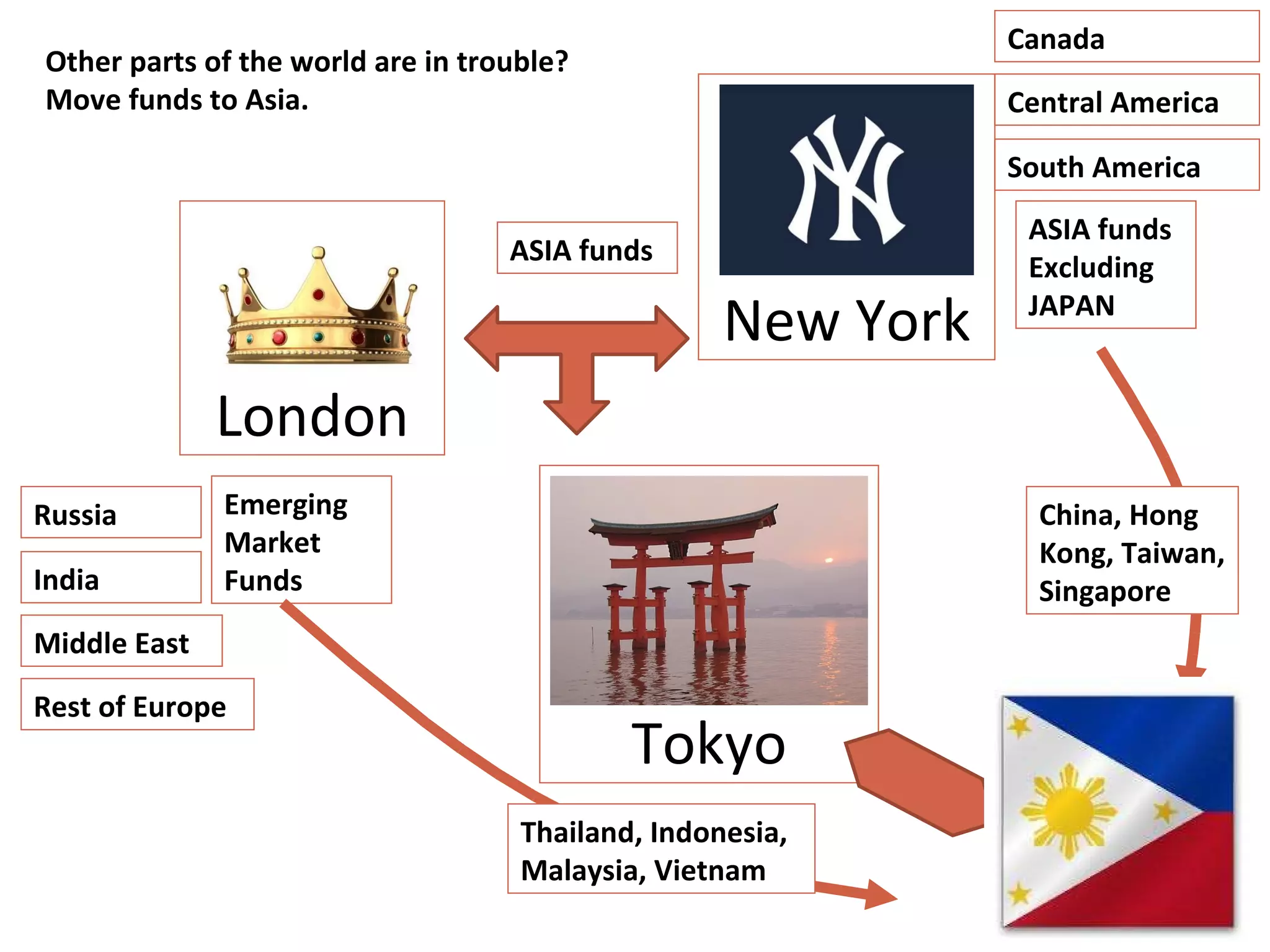

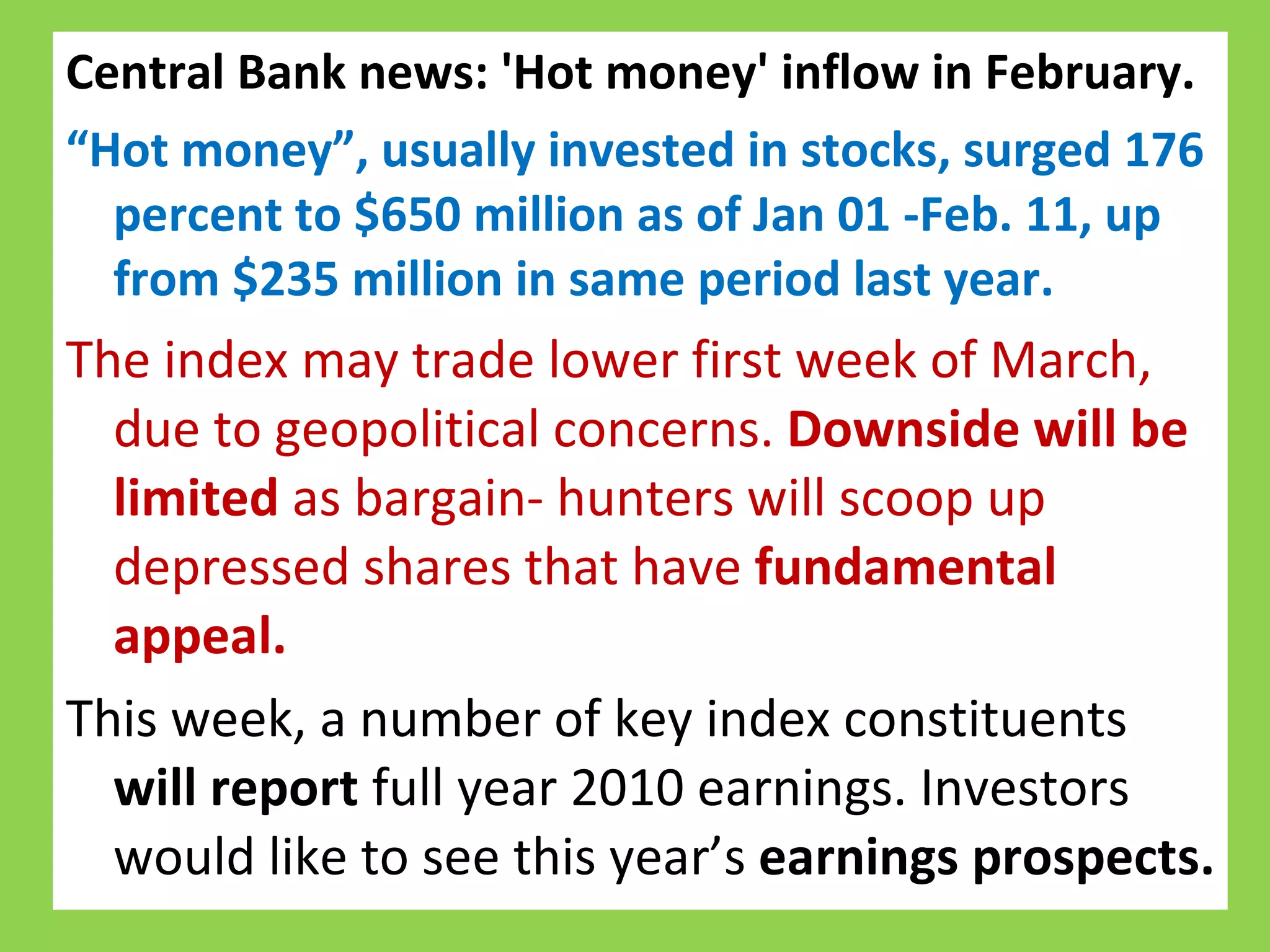

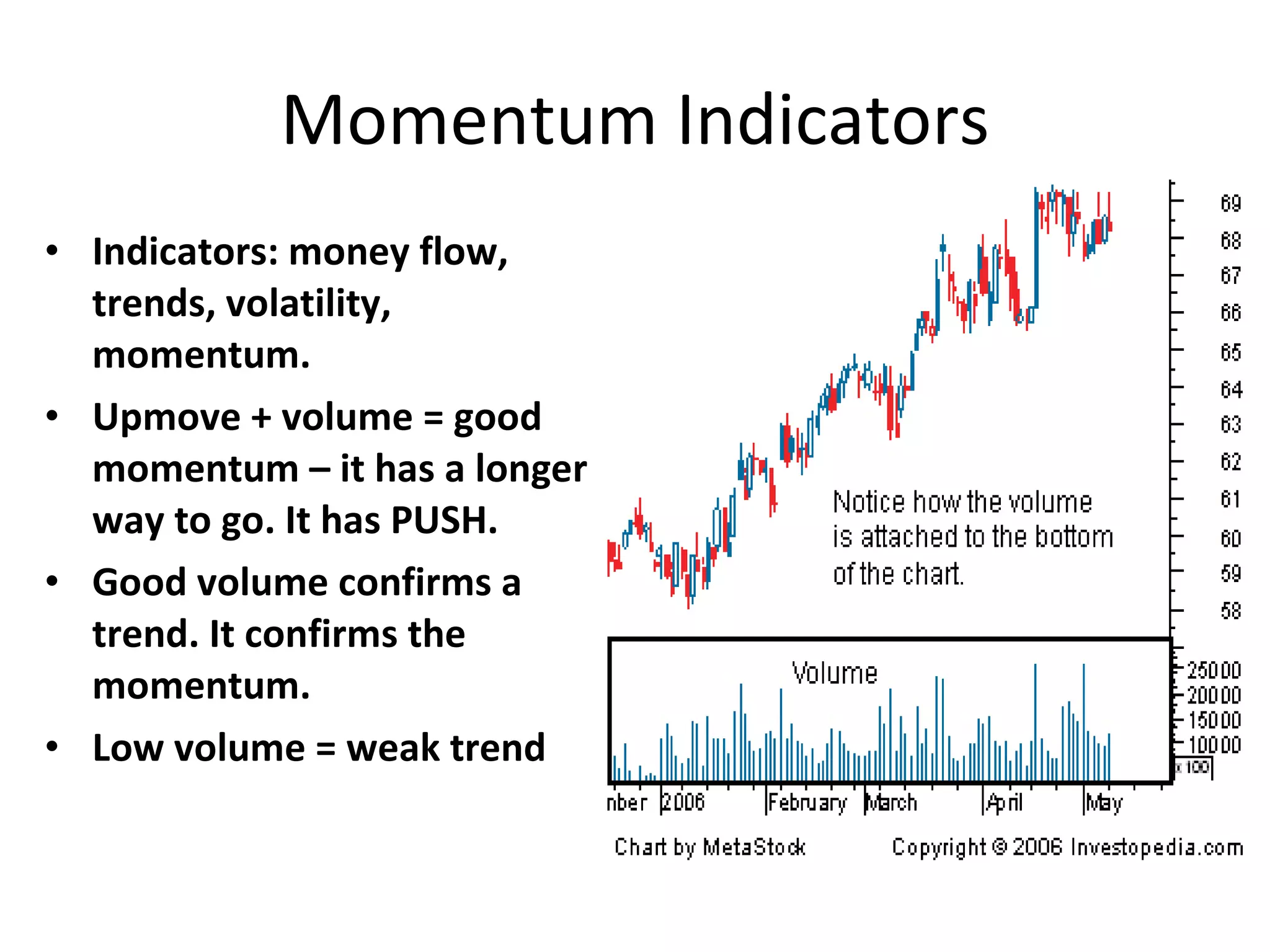

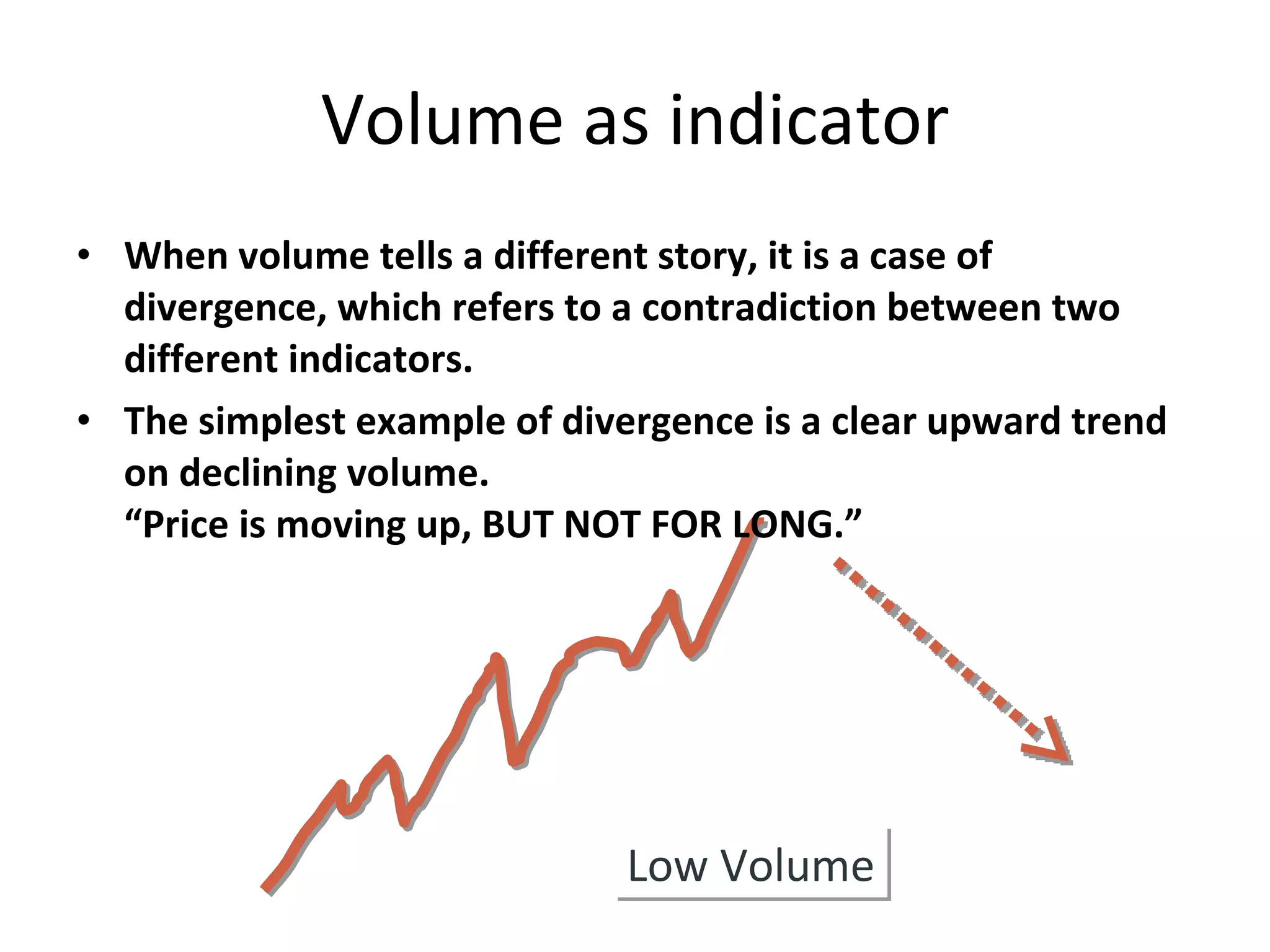

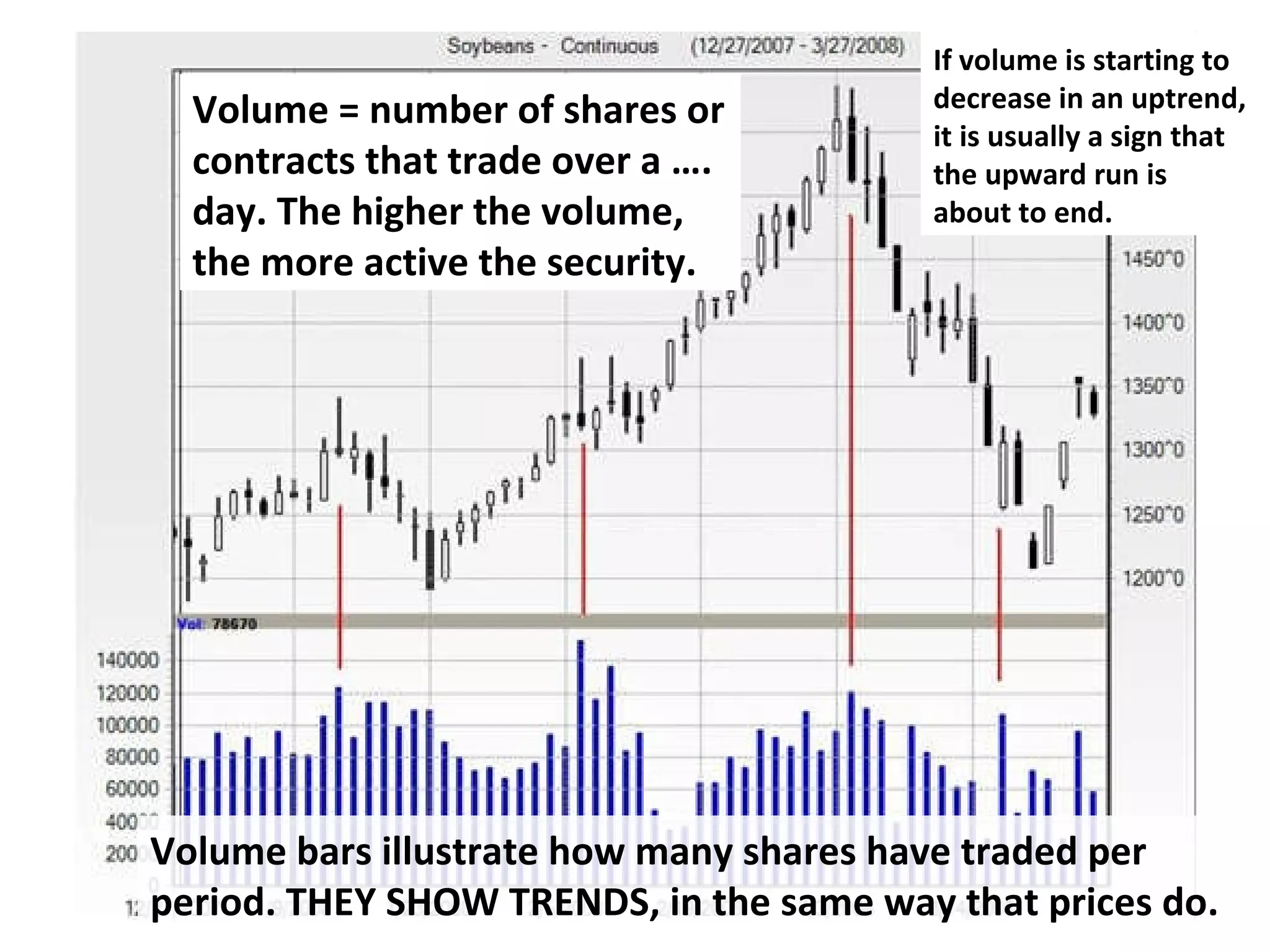

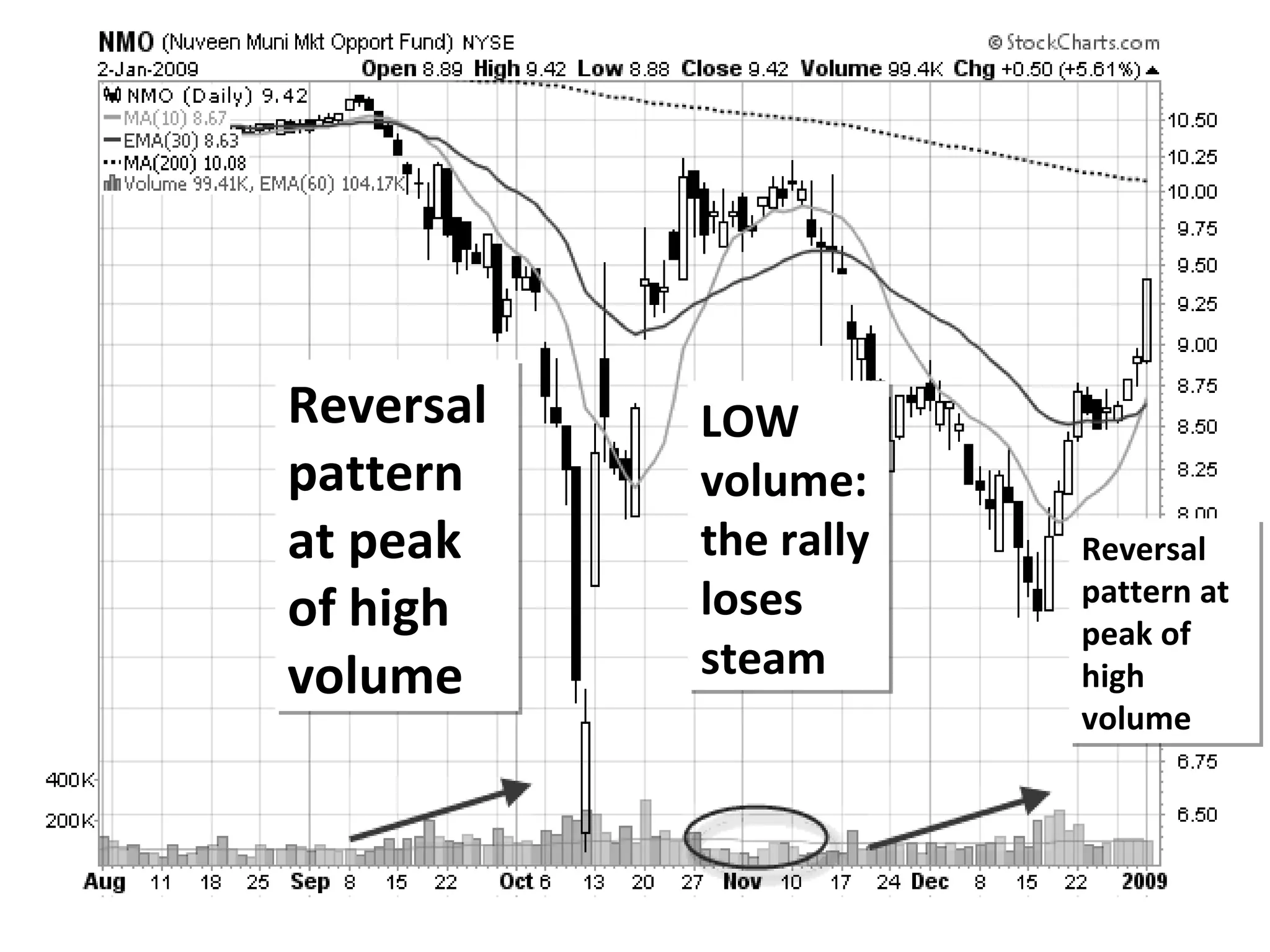

The document discusses various measures of investor sentiment in financial markets, including volume and liquidity. It notes that high trading volume confirms trends in prices and that divergences between rising prices and falling volume can signal a trend reversal. The document also examines factors that influence money flows into stock markets, such as economic growth, listings and float of new companies.