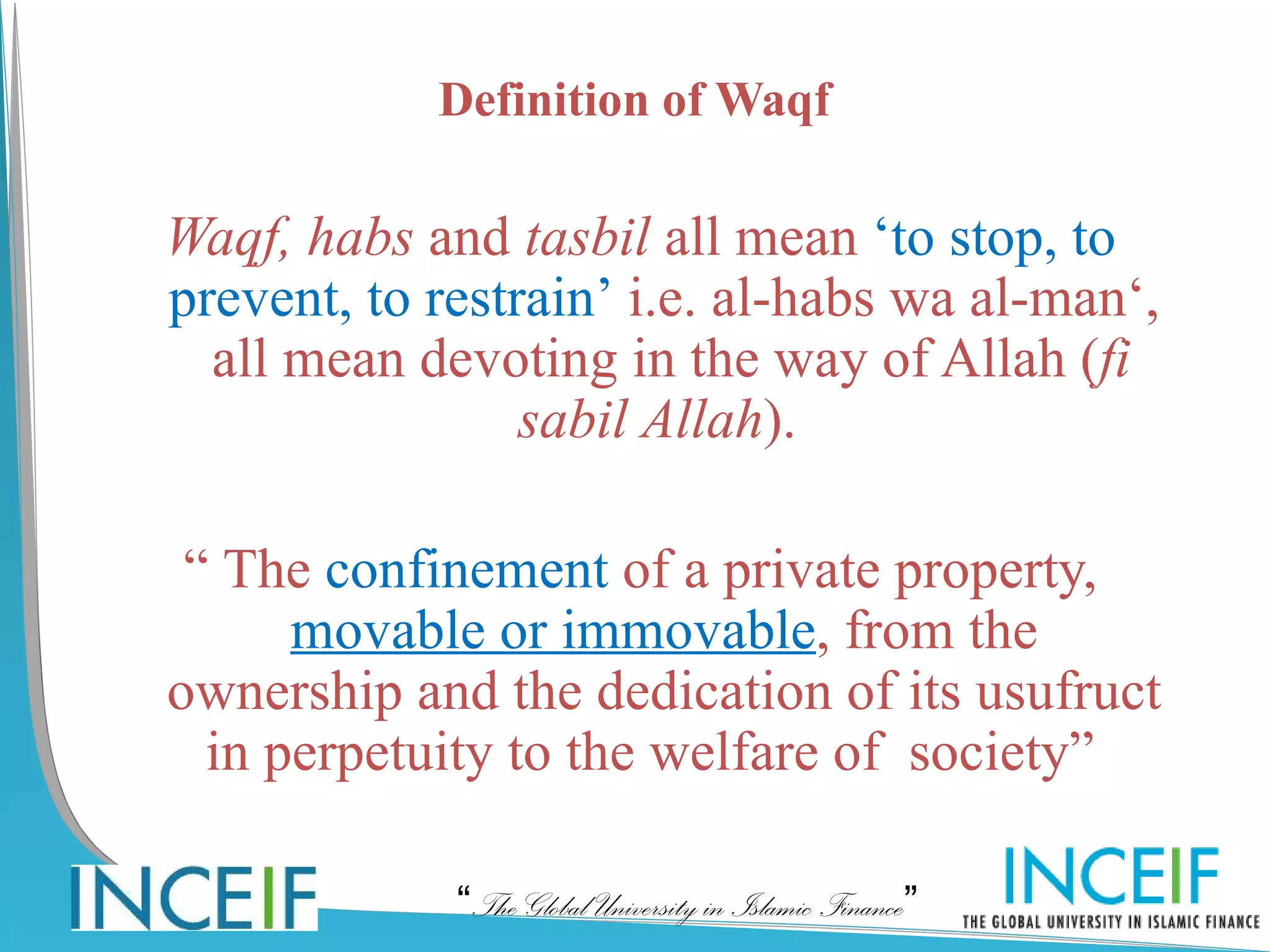

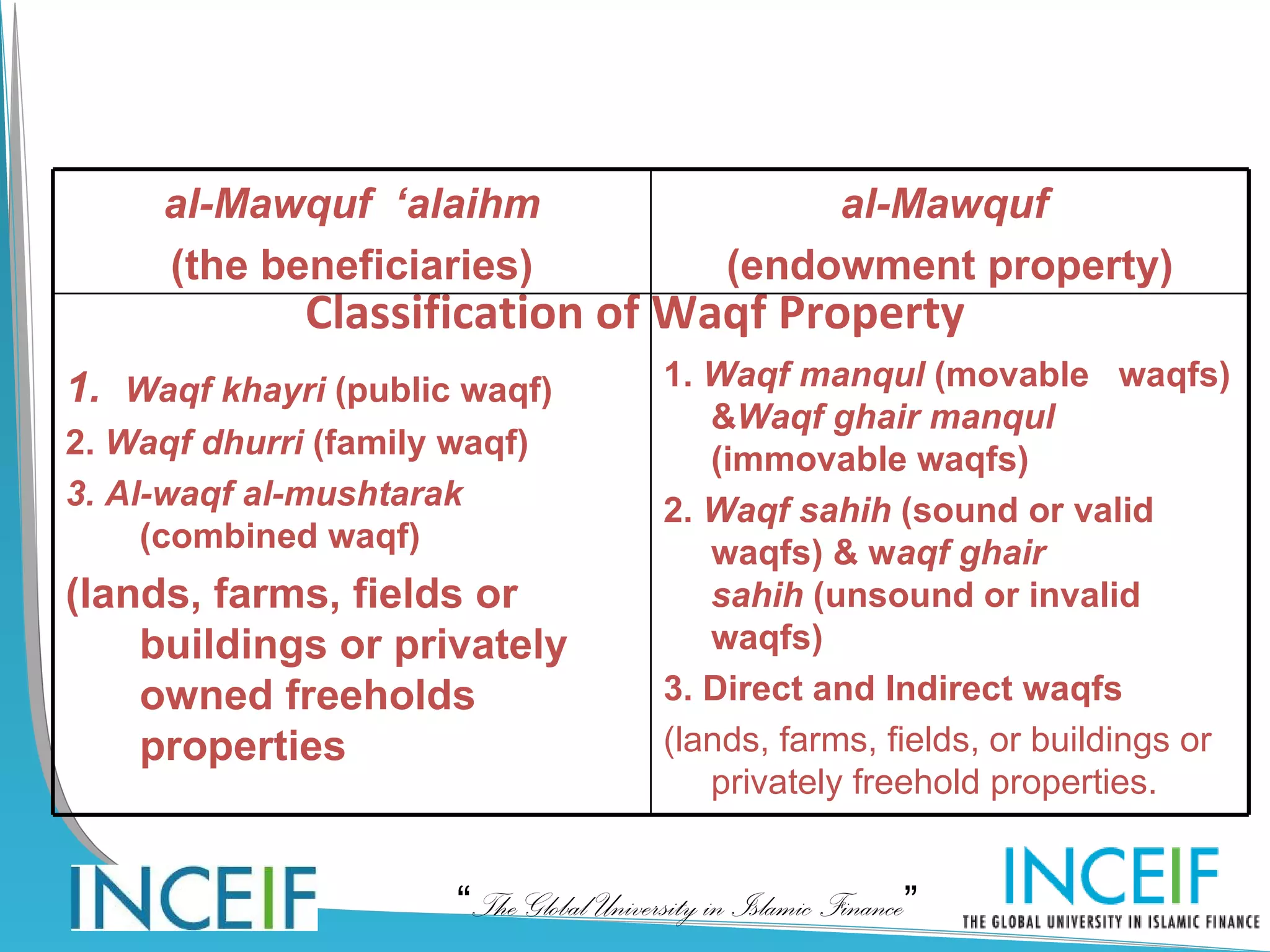

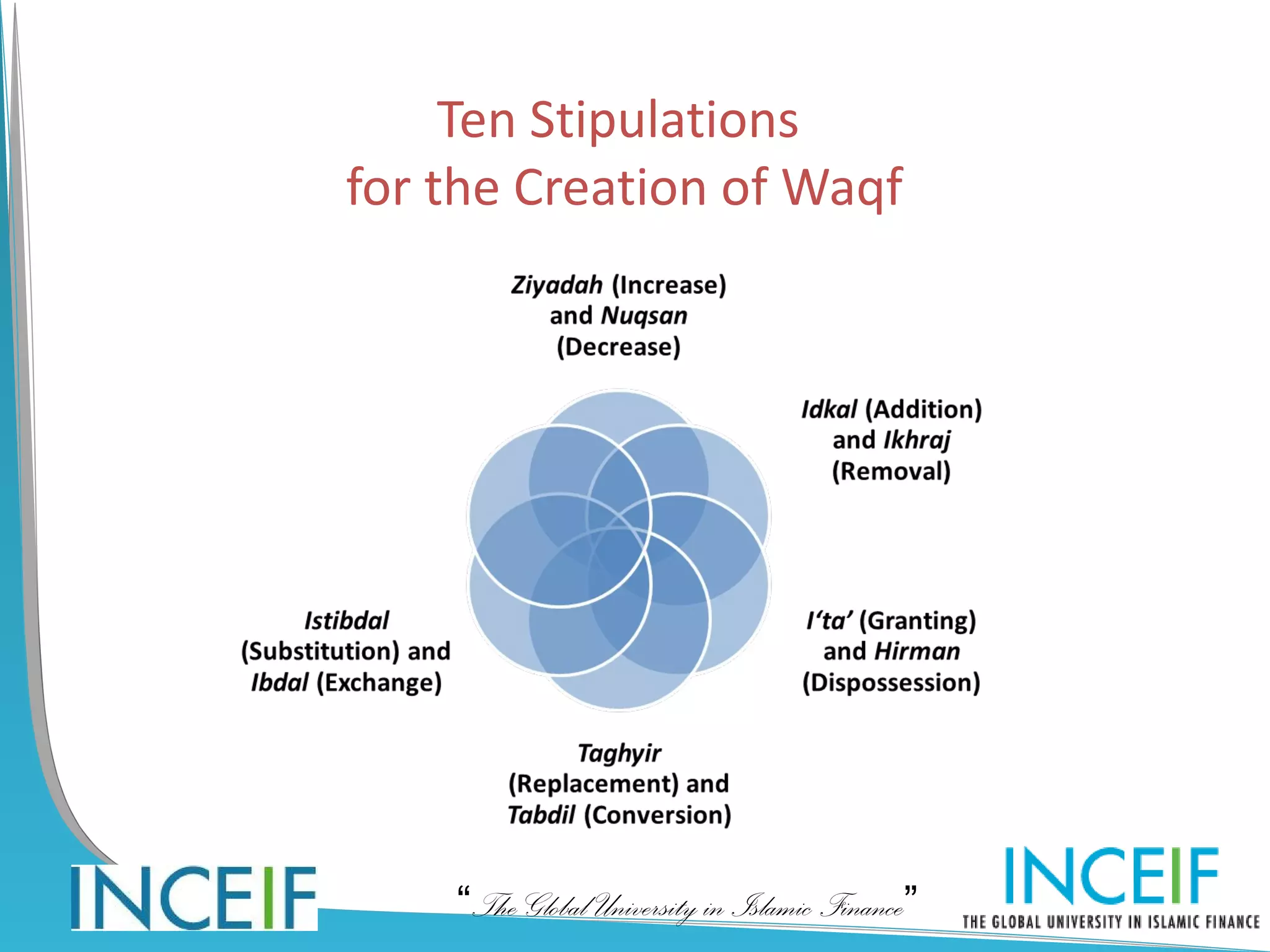

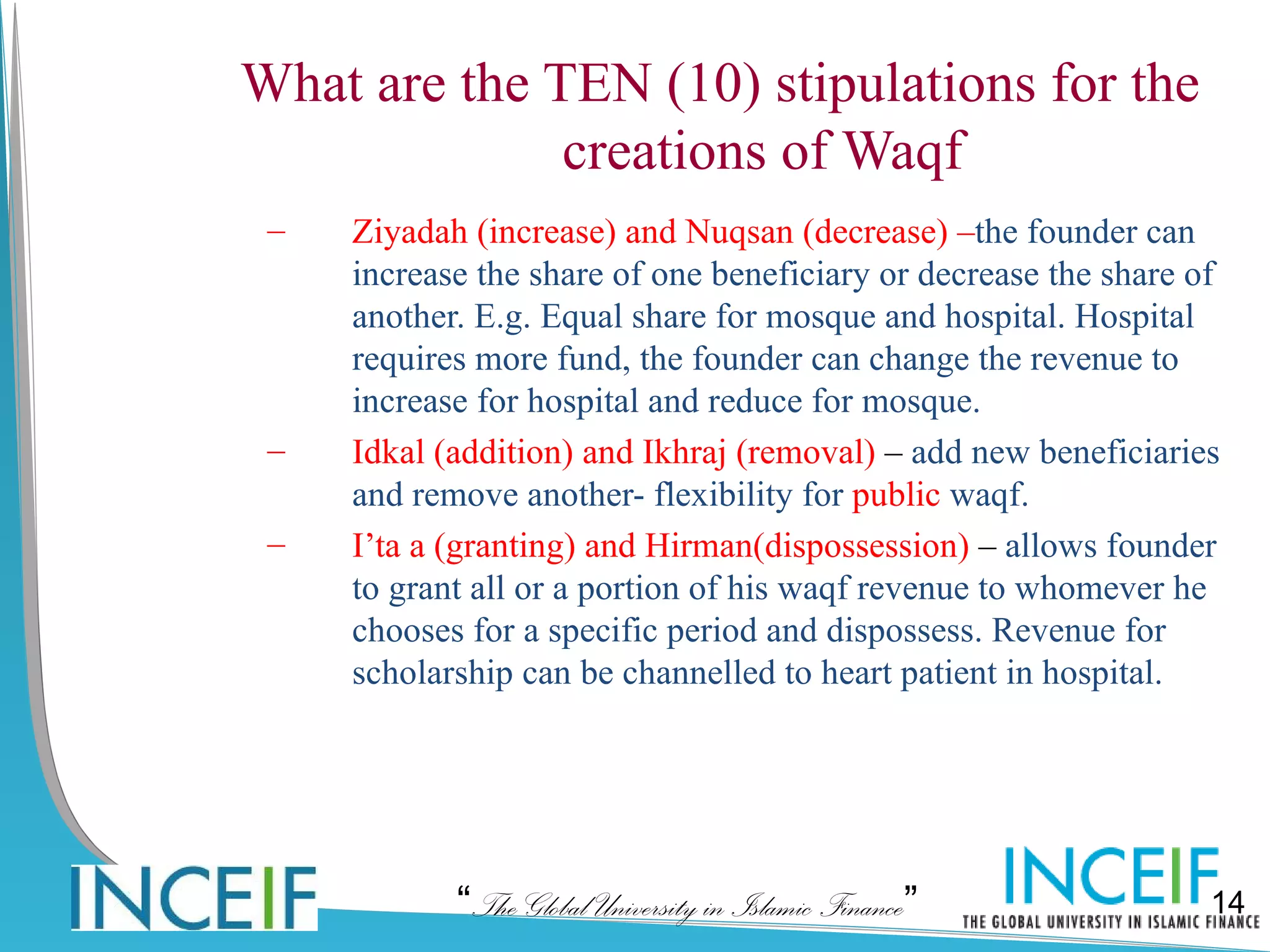

The document discusses wealth planning and management through the Islamic instrument of waqf (endowment). It begins by explaining the hadith about a person's good deeds continuing after death through recurring charity, beneficial knowledge, and righteous children. It then defines waqf and describes the three main types: public waqf, family waqf, and combined public-family waqf. The conditions for valid waqf creation and permissible waqf assets are also summarized.

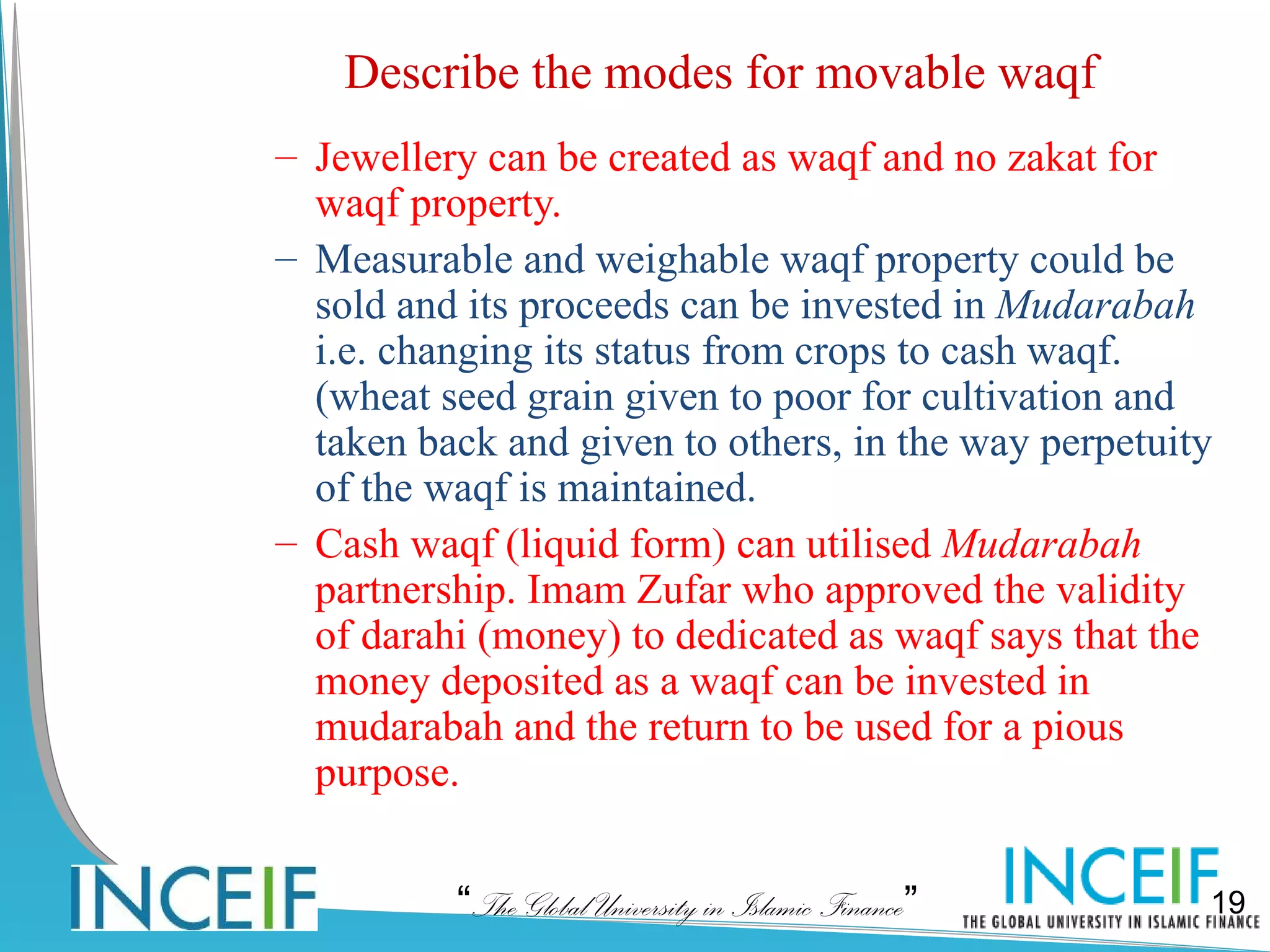

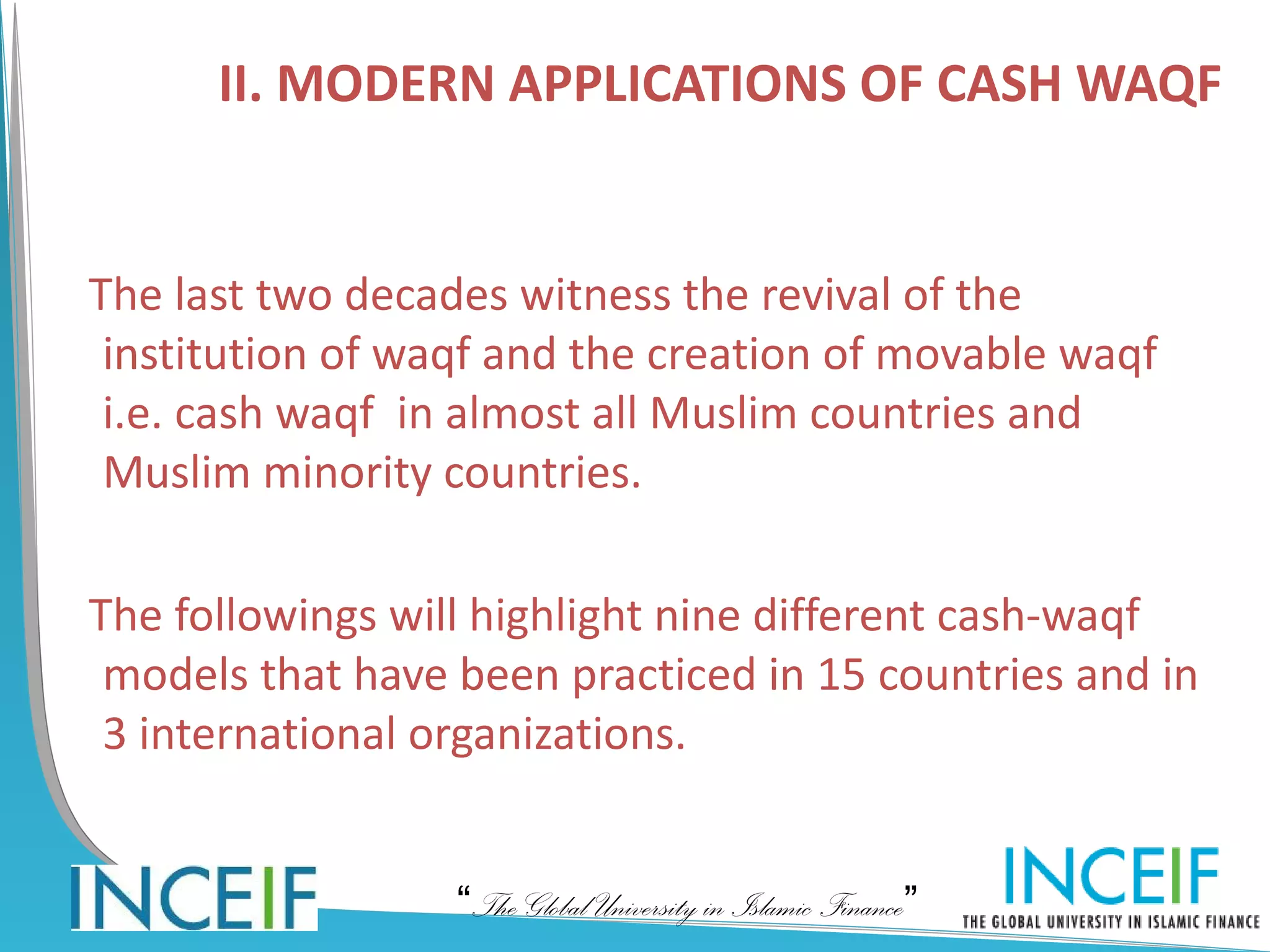

![ISLAMIC B A N K ( T R U S T E E )

ISLAMIC B A N K ( T R U S T E E )

CASH W AQF ( B A N K ) W I N D O W S

FUND A C C U M U L A T I O N INVESTMENT A N D P R O F IT

D IS T R IB U T IO N (C H A R IT Y ,

MNAGEMENT A N D C A P IT A L

ENDOW MENT OF SHARES ( I B AND OTHER E N H A N C E M E N T ) A N D

INSTITUTIONS) A S CASH W A Q F M A R K E T IN G .

CASH WAQF BY O T H E R S INSTITUTIONS FROM

THEIR P A R T S OF D I V I D E N D

WAQF LAND D E V E L O P M E N T S (MUDARABAH

AND M U S H A R A K A H )

WAQF CERTIFICATE (SPECIFIC OR G E N E R A L )

MICROFINANCE (GROUP B A S E D LENDING

OR S O C I A L COLLATERAL [E.G. P R A Y E R

WAQF INSURANE (SPECIFIC O R G E N E R A L ) LEADER], C O M P U L S O R Y SAVINGS AND

ASSETS INSURANCE FOR F A R M E R S

TEMPORARY W A Q F :

SME LOAN: M U S H A R A K A H (COLLATERRAL,

DEPOSIT W ITHOUT S H A R E O F P R O F I T

C O M P U L S O R Y SAVINGS, OPTIONAL

ASSETS I N S U R A N C E )

BUYING W AQF SHARES (50% O F DIVIDEND

POTFOLIO I N V E S T M E N T IN IFI’S

WILL BE D O N A T E D )

SECURI T I E S

E-WAQF (LUMP S U M A M O U N T ) EMERGENCY NEEDS F U L F I L L

OTHERS: SPECIFIC B Y DONOR AND

GENERAL (MOSQUE, MADRASH E T C . )

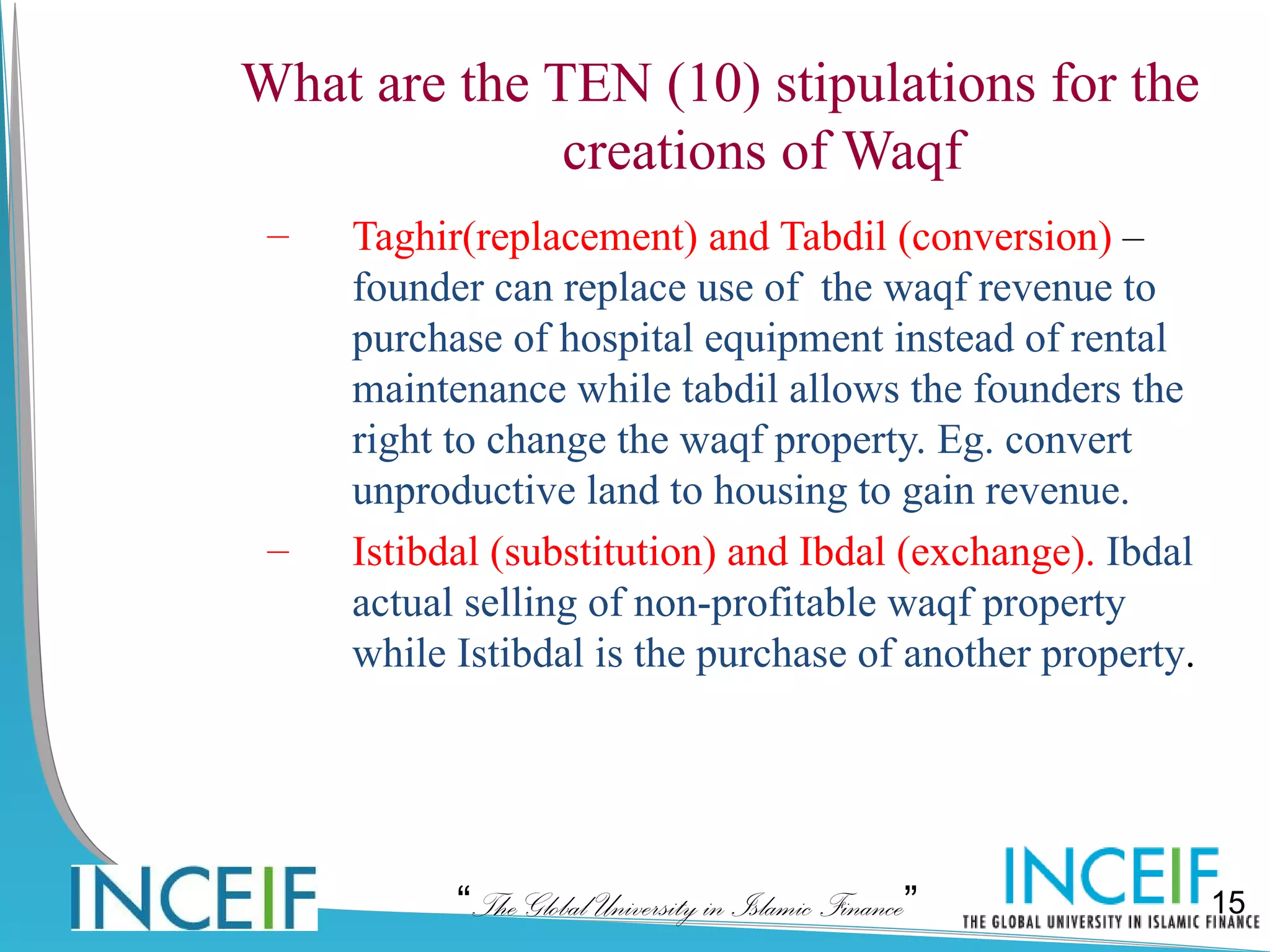

Figure 2. Cash WAQF model.

“The Global University in Islamic Finance”](https://image.slidesharecdn.com/lecture08finalupdated-120501001111-phpapp01/75/Lecture-08-final-updated-35-2048.jpg)